Deals Feed

The latest deals involving Indian companies and law firms.

Corporate M&A

HDFC Standard Life Insurance, a joint venture between HDFC and Standard Life, will be absorbing Max Life Insurance and Max Financial Services, according to reports, in what is billed as the biggest ever consolidation in the private insurance space in India.

Litigation

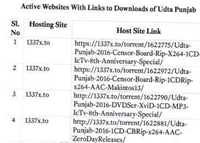

RM Partners won a John Doe order in the Bombay high court today, directing several websites to take down the downloadable copy of the yet unreleased Hindi film Udta Punjab, and temporarily restraining cable operators from telecasting the film.

RM Partners won a John Doe order in the Bombay high court today, directing several websites to take down the downloadable copy of the yet unreleased Hindi film Udta Punjab, and temporarily restraining cable operators from telecasting the film.

Private equity / VC

Clove Legal advised queue management app Sminq on raising $1m from various venture funds led by Saama Capital and Blume Ventures. Saama was advised by Samvad.

Corporate M&A

Cyril Amarchand Mangaldas Mumbai projects partner L Viswanathan and corporate partner Jaya Singhania advised Welspun Energy on selling the assets of Welspun Renewable Energy to Tata Power, which was advised by AZB & Partners partner Shameek Chaudhuri.

Private equity / VC

Economic Laws Practice advised Edelweiss’ private equity arm Ecap Equities on its investment in BRIDGEi2i Analytics Solutions (BAS) which was advised by Nuvo Juris.

Corporate M&A

Nanavati & Nanavati Advocates advised gas industry components maker Siddha Gas Technik on its joint venture with Norwegian company Hexagon Composites which was advised by The Law and Options.

Corporate M&A

Cyril Amarchand Mangaldas (CAM) and Dr Behrooz Akhlaghi & Associates advised India Ports Global and India’s shipping ministry on setting up a company in Iran to run the Chabahar port.

Corporate M&A

Shardul Amarchand Mangaldas (SAM) advised Japanese conglomerate Sumitomo Corp on its Rs 623.44 crore ($93m) buy of 44.98 per cent stake in Excel Crop Care which was advised by AZB & Partners.

Private equity / VC

Link Legal advised digital healthcare platform 1MG Technologies on raising Rs 100 crore ($15m) from Maverick Capital Ventures which was advised by Shardul Amarchand Mangaldas (SAM) and Jones Day. Existing investors also participating in the round were Sequoia Capital which was advised by Themis Associates, Omidyar Network which was advised by Trilegal, and Dumac.

Corporate M&A

Khaitan & Co advised Mumbai-based RPG Life Sciences on the Rs 25 crore ($3.7m) sale of its biotech unit to Intas Pharmaceuticals which was advised by J Sagar Associates (JSA).

Litigation

Saikrishna & Associates won today for Micromax in the Delhihigh court against Ericsson, which had challenged the validity of a CCIinvestigation into its grant of patents contemporaneously with otherlegal challenges against it.

Saikrishna & Associates won today for Micromax in the Delhihigh court against Ericsson, which had challenged the validity of a CCIinvestigation into its grant of patents contemporaneously with otherlegal challenges against it.

Corporate M&A

Verus advised refrigerated container-operator ColdEX on its fundraising from Asia Climate Partners which was advised by AZB & Partners.

Litigation

The Supreme Court issued notice today on a challenge to the Muslim custom of immediate divorce for husbands on uttering the word “Talaq” thrice.

The Supreme Court issued notice today on a challenge to the Muslim custom of immediate divorce for husbands on uttering the word “Talaq” thrice.

Corporate M&A

Tatva Legal advised the Bangalore Elevated Tollway and NCC Infrastructure Holdings on the Rs 750 crore sale of stake in the tollway to India Infrastructure Fund II which was advised by Trilegal.

Tatva Hyderabad partner Ekta Bahl and manager Pratyush Singh acted for the Tollway and NCC

Trilegal Delhi partners Yogesh Singh and Saurabh Bhasin, counsel Ravi Mahto, senior associates Amar Narula and Tanya Mehta and associate Astha Srivastava acted for the fund.

NCC and Soma hold 38 per cent stake each in BETL, while Infrastructure Leasing and Financial Services holds 24 per cent, according to Mint.

Private equity / VC

Vaish Associates advised luxury merchandise e-tailer Radiant Hues on the $2m (Rs 13.8 crore) sale of stake in it to the Anil-Ambani controlled Reliance Capital which was advised by Bharucha & Partners.

Vaish Delhi partner Satwinder Singh and senior associate Varnika Sharma acted for Radiant.

Bharucha Mumbai partner Justin Bharucha and associate Gunmeher Juneja acted for Reliance.

Reliance will end up with 14.07 per cent stake in Radiant, through investment in various tranches, by May 2017, reported VC Circle.

Corporate M&A

Alpha Partners advised online grocery service Mera Grocer on its acquisition by the hypermarket chain Spencer’s Retail which was advised by Khaitan & Co.

Alpha Delhi partner Akshat Pande acted for the Omnipresent Retail-owned Mera Grocer which currently operates in Gurgaon and some Delhi neighbourhoods.

Khaitan Mumbai partner Ashish Razdan, executive director Daksha Baxi, senior associates Alok Sonker, Shabnam Shaikh and Surajkumar Shetty, principal associate Shailendra Bhandare and associates Sunayana Bose, Abir Sarkar and Alisha Ganjawala acted for the RP-Sanjiv Goenka Group-owned multi-format retailer Spencer’s Retail.

Mera Grocer earns only Rs 5 crore in annual revenue but Spencer’s bought it less for its size and more for its robust information technology platform, reported Mint.

Corporate M&A

Shardul Amarchand Mangaldas advised Red Fort India Real Estate on its Rs 600 crore ($89m) exit from Exora Business Parks, selling its stake to Valdel Extent Outsourcing Solutions which was advised by Cyril Amarchand Mangaldas. CAM also advised Exora and the promoter Prestige Estate Projects

SAM Delhi partners Jatin Aneja and VR Neelakantan, principal associate Siddhartha Sen and senior associate Varun Nair acted for Red Fort India is a fund managed by Red Fort Capital.

CAM Bangalore partner Nagavalli Gopalakrishna acted for Valdel, Exora and Prestige.

Prestige Estates, through its subsidiary Valdel, bought 62.54 per cent of Red Fort’s stake in the special purpose vehicle (SPV) Exora that owns the villa project Silver Oak, reported the Times of India adding that Rs 250 crore worth residential stock was also part of the buyout.

Corporate M&A

Linklaters advised Banca Regionale Europea and 14 other Italian banks on Tech Mahindra and Mahindra & Mahindra’s buy of majority stake in Italian automotive brand Pinifarina. Gianni, Origoni, Grippo, Cappelli & Partners advised the Mahindra Group entities and Pavesio and Associates advised Pinifarina’s owner Pincar.

Linklaters Italy partner Francesco Faldi, managing associate Ettore Consalvi and associate Valentina Armaroli acted for the banks: Banca Regionale Europea, Intesa Sanpaolo, Banca Nazionale del Lavoro, UniCredit, Banca Monte dei Paschi di Siena, Banco Popolare Società Cooperativa, UBI Leasing, Monte dei Paschi di Siena Leasing & Factoring, Banca per i Servizi Finanziari alle Imprese, Selmabipiemme Leasing, UniCredit Leasing, BNP Paribas Leasing Solution, Release, Mediocredito Italiano and Banca IM

Gianni senior partner Francesco Gianni acted for IT, Networks and Engineering solutions and BPO services provider Tech Mahindra and Mahindra & Mahindra.

Pavesio founder Carlo Pavesio acted for Pincar on the sale of its automotive and industrial design brand which will continue to remain an independent company, listed on the Milan Stock Exchange, according to Linklaters’ press release.

As part of the agreement, Tech Mahindra and M&M will form a joint venture (JV), with 60 per cent stake held by Tech Mahindra. This JV will purchase 76.06 per cent stake in Pininfarina at a price of Euro 1.1 per share, followed by an open offer for all the remaining ordinary shares of Pininfarina, also at Euro 1.1 per share. A rights issue to infuse funds into Pinifarina will also be executed before the end of 2016, added the release.

The 85-year-old Pinifarina is an iconic design brand and has relationships with the best in the automobile industry including with Ferrari, Alfa Romeo, Maserati and Peugeot. But it has remained unprofitable for 10 of the last 11 years, with a consolidated revenue of 86.6 million Euros in 2014, reported The Hindu.