Deals Feed

The latest deals involving Indian companies and law firms.

Corporate M&A

Verus Advocates Mumbai partner Jay Parikh, assisted by associates Aastha Khurana, Rashna Jehani and Priyanka Devgan, acted for Hyderabad-based Sagar Cements which sold 47 per cent of its Vicat Sagar Cement to an affiliate of its French joint-venture partner Vicat Group for Rs 435 crore. MNK Law Delhi partner Probal Bhaduri and associate Kamalika Bhattacharjee acted for Vicat.

Real estate

Khaitan & Co partner Siddharth Shah has been included on the Bombay Stock Exchange’s (BSE) advisory group on real estate investment trusts (REIT) alongside 10 representatives of various banks, real estate and financial services companies, according to the PTI.

REITs are aimed at attracting long-term funds to the cash-strapped realty sector from both foreign as well as domestic investors.

It is hoped that after the newly announced budget’s exemption from capital gains tax to popularise REITs, they will bring in around $10bn of foreign funds into the realty sector by the end of this fiscal.

Corporate M&A

Mergermarket Q1 M&A value leader AZB & Partners slipped to seventh spot in 2014’s half-yearly rankings, while Q1 ninth-ranked Amarchand made up the lag to top spot.

Mergermarket Q1 M&A value leader AZB & Partners slipped to seventh spot in 2014’s half-yearly rankings, while Q1 ninth-ranked Amarchand made up the lag to top spot.

Private equity / VC

BMR Legal has continued advising online ticketing website BookMyShow in its latest fundraising round of Rs 150 crore by existing venture capital investors SAIF Partners and Accel Partners, who have continued relying on Indus Law.

BMR Legal has continued advising online ticketing website BookMyShow in its latest fundraising round of Rs 150 crore by existing venture capital investors SAIF Partners and Accel Partners, who have continued relying on Indus Law.

Capital Markets

Amarchand Mangaldas advised realty giant DLF on India’s first commercial mortgage backed securities (CMBS) issue to raise Rs 3,500 crore this fiscal.

Corporate M&A

Nishith Desai Associates (NDA) advised India’s largest e-commerce player Flipkart on buying out online fashion retailer Myntra which was advised by Indus Law. One of the existing investors IDG Ventures India I LLC which was advised by Samvad Partners

Private equity / VC

Desai & Diwanji advised Fidelity Capital in the sale of its equity in Laurus Labs, which was advised by Amarchand Mangaldas, to Warburg Pincus which was advised by AZB & partners.

Private equity / VC

Indus Law advised old client and online marketplace Snapdeal’s parent Jasper Infotech in its $100m (Rs 590 crore) second round of funding from US-based BlackRock Financial Management, Singapore’s sovereign wealth fund Temasek, Hong Kong-based Myriad Asset Management and Tybourne Capital Management, and Azim Premji’s Premji invest

Indus Law advised old client and online marketplace Snapdeal’s parent Jasper Infotech in its $100m (Rs 590 crore) second round of funding from US-based BlackRock Financial Management, Singapore’s sovereign wealth fund Temasek, Hong Kong-based Myriad Asset Management and Tybourne Capital Management, and Azim Premji’s Premji invest

Private equity / VC

Desai & Diwanji, DSK Legal and Universal Legal reprised their roles in Aster DM Healthcare's second fundraising round.

Universal Legal Chennai partners Kavitha Vijay and Sameena Chatrapatty acted for DM.

On the repeat investor side, DSK partner Narendra Dingankar and associate Mayank Mehta acted for India Value Fund and Desai & Diwanji partner Siddharth Mody and associates Ashraf Lala, Manav Shah and Ankesh Jain acted for Olympus.

DM Healthcare raised a further $65m from Olympus and IVF, reported the Economic Times.

The same firms had also acted on the initial $100m investment in 2012, as reported by Legally India at the time.

Corporate M&A

Nishith Desai Associates acted as Indian legal and tax counsel for Cognizant, which bought Atlanta-based digital video solutions company itaas, which was represented by P&A Associates.

Nishith Desai's Munich-based European operations head Ruchi Biyani, with partner Nishchal Joshipura and Singapore-based international tax head Mahesh Kumar, acted for the Indian IT giant, alongside US law firm Venable.

P&A, which used to have a best friend relationship with Jones Day several years ago, acted for itaas led by managing partner Anand Pathak, together with US law firm Morris Manning & Martin.

The deal value was not disclosed but itaas is estimated to have revenues of around $30-50m annually, wrote Mint in a detailed report, and is hoped to help Cognizant increase its US work from US telecoms and media companies.

Capital Markets

Axon Partners LLP and Milbank Tweed Hadley & McCloy jointly advised the lead book runners and lead managers in Bharti Airtel International (Netherlands) BV issuing $1bn and €750m of notes, with Allen & Overy (A&O) advised Bharti Airtel and the Dutch issue on Dutch and US laws.

Axon co-founding partner Abhimanyu Bhandari with associates Kajal Bhimani and Prashant Kumar advised on Indian law with Milbank Singapore partner Naomi Ishikawa with senior associate Adrian Yeo and associate Leroy Langeveld.

A&O Hong Kong partner Amit Singh with associates Garrick Merlo and Vivian Chow acted for the issuer.

The book runners were Barclays Bank PLC, BNP Paribas, The Hongkong and Shanghai Banking Corporation Limited, Standard Chartered Bank, JP Morgan Securities PLC and Bank of America-Merril Lynch, reported Mint and others.

The same firms had also acted on Bharti's Dutch $1bn dollar bond issue one year ago, followed by a €750m bond in December 2013.

Private equity / VC

IndusLaw partner Avimukt Dar with associates Aakriti Shakdher and Kriti Tannan acted for AM Marketplaces, which runs "social shopping platform" LimeRoad.com and received $15m in Series B funding from Tiger Global, Lightspeed Venture Partners and Matrix Partners VCCircle.

Luthra & Luthra partner Deepak Joyce acted for Matrix and Lightspeed, while Tiger Global drafted in Gunderson Dettmer New York partner Steven L Baglio and associate Eric Cheung.

Finance

Khaitan & Co and Clifford Chance Hong Kong advised HSBC's Hong Kong branch on its $30m term loan facility to the State Bank of India's Shanghai branch for general corporate purposes.

Khaitan banking partner Devidas Banerji (who joined the firm from CC in 2010) and Clifford Chance partner Matthew Truman acted for HSBC.

Deals in brief

The markets are picking up it looks like – here’s the round-up of what firms have been getting up to.

The markets are picking up it looks like – here’s the round-up of what firms have been getting up to.

Litigation

In India’s first judgement on medical aid for rare diseases, the Delhi high court today directed the Delhi government to provide monthly medical treatment, free of cost, to a minor child afflicted with a rare disease (gaucher).

In India’s first judgement on medical aid for rare diseases, the Delhi high court today directed the Delhi government to provide monthly medical treatment, free of cost, to a minor child afflicted with a rare disease (gaucher).

Corporate M&A

AZB, Trilegal and Luthra had the biggest reported deals in the first quarter of the year, which was a bit of a let down compared to the first quarter of 2014 but is looking up.

AZB, Trilegal and Luthra had the biggest reported deals in the first quarter of the year, which was a bit of a let down compared to the first quarter of 2014 but is looking up.

Corporate M&A

At least three domestic law firms acted on Vodafone UK’s buyout of Vodafone India shareholders to take full control over its Indian subsidiary for more than $1.6bn.

At least three domestic law firms acted on Vodafone UK’s buyout of Vodafone India shareholders to take full control over its Indian subsidiary for more than $1.6bn.

Corporate M&A

Indian Law Partners (ILP) and Ashurst acted for Japanese Toshiba in its investment in Delhi-based clean water solutions provider company UEM India.

Indian Law Partners (ILP) and Ashurst acted for Japanese Toshiba in its investment in Delhi-based clean water solutions provider company UEM India.

Corporate M&A

Sun Pharma bought debt-ridden pharmaceutical giant Ranbaxy for $4bn from Daiichi Sankyo.

Sun Pharma bought debt-ridden pharmaceutical giant Ranbaxy for $4bn from Daiichi Sankyo.

Corporate M&A

Indus Law advised textile and apparel retailer Arvind Brands, which bought 49 per cent of the Indian licensee of global fashion giant Calvin Klein (CK) for Rs 100 crore. J Sagar Associates (JSA) advised the previous licensee Premium Garments and Wholesale Trading.

Indus Law advised textile and apparel retailer Arvind Brands, which bought 49 per cent of the Indian licensee of global fashion giant Calvin Klein (CK) for Rs 100 crore. J Sagar Associates (JSA) advised the previous licensee Premium Garments and Wholesale Trading.

Litigation

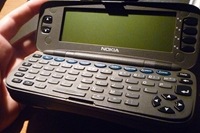

Luthra & Luthra is defending Finnish cellular giant Nokia’s Indian subsidiary Nokia India in its Madras high court writ contesting the Tamil Nadu VAT department’s claim and in the Supreme Court against a Rs 2,250 crore sales tax guarantee.

Luthra & Luthra is defending Finnish cellular giant Nokia’s Indian subsidiary Nokia India in its Madras high court writ contesting the Tamil Nadu VAT department’s claim and in the Supreme Court against a Rs 2,250 crore sales tax guarantee.

Capital Markets

Luthra & Luthra and Perkins Coie acted for the Government of India in the first-of-its-kind central public sector enterprise (CPSE) exchange traded fund (ETF), which offered stakes in 10 public sector undertakings (PSUs) through a mutual fund structure.

Corporate M&A

AZB & Partners acted for Tata’s subsidiaries Trent and Trent Hypermarket that entered into a joint venture with Anglo-global supermarket retail behemoth Tesco, which drafted in Trilegal.

AZB & Partners acted for Tata’s subsidiaries Trent and Trent Hypermarket that entered into a joint venture with Anglo-global supermarket retail behemoth Tesco, which drafted in Trilegal.

Corporate M&A

Leapfrog Investment bought a Rs 174 crore ($29m) stake in IFMR Capital Finance, advised by Desai & Diwanji and Trilegal.

Corporate M&A

Trilegal and Japanese firm Mori Hamada & Matsumoto (MHM) advised Japanese metal giant Hitachi Metals in buying a majority stake in two Vikas Group entities.

Capital Markets

Khaitan & Co advised Indian online fashion shop Koovs on its Rs 224.5 cr listing on the London Stock Exchange’s smaller cousin, with English law firms Osborne Clarke, Foot Anstey and Macfarlanes.

Khaitan & Co advised Indian online fashion shop Koovs on its Rs 224.5 cr listing on the London Stock Exchange’s smaller cousin, with English law firms Osborne Clarke, Foot Anstey and Macfarlanes.

Deals in brief

Litigation, corporate, M&A, capital markets and private equity deals in brief from a cross-section of India’s top law firms.

Litigation, corporate, M&A, capital markets and private equity deals in brief from a cross-section of India’s top law firms.

Corporate M&A

AZB & Partners Mumbai is advising Loop Telecom, which is being acquired by Bharti Airtel that is handling the legal work in-house.

AZB & Partners Mumbai is advising Loop Telecom, which is being acquired by Bharti Airtel that is handling the legal work in-house.

Corporate M&A

J Sagar Associates (JSA) Bangalore has bagged the mandate for global e-auction giant eBay, which took a $133.7m stake in Indian online marketplace Snapdeal, advised by IndusLaw.

J Sagar Associates (JSA) Bangalore has bagged the mandate for global e-auction giant eBay, which took a $133.7m stake in Indian online marketplace Snapdeal, advised by IndusLaw.

Litigation

Economic Laws Practice (ELP) won for Bharti Airtel, PDS Legal for Ernst & Young (E&Y), Lakshmikumaran & Sridharan (LKS) for Ultratech Concrete, and Global Legal Associates for ITC Welcome Group in the Delhi high court on Tuesday against the Service Tax Department.

Corporate M&A

Economic Laws Practice advised watches and jewellery retailer Titan in hatching a joint venture with luxury goods maker Montblanc International for single brand retail in India.

Economic Laws Practice advised watches and jewellery retailer Titan in hatching a joint venture with luxury goods maker Montblanc International for single brand retail in India.

Private equity / VC

J Sagar Asssociates (JSA), Nishith Desai Associates and Trilegal acted on Goldman Sachs’ and Mitsui Global Investment’s Rs 315 crore ($50m) investment in Global Beverages & Foods.

Corporate M&A

A law firm started seven months ago by a Kerala advocate and two ex-senior associates from Amarchand Mangaldas and Trilegal, have acted opposite J Sagar Associates (JSA) and DLA Piper to advise on the takeover of a Kerala-based vocational training company by a German services giant.

A law firm started seven months ago by a Kerala advocate and two ex-senior associates from Amarchand Mangaldas and Trilegal, have acted opposite J Sagar Associates (JSA) and DLA Piper to advise on the takeover of a Kerala-based vocational training company by a German services giant.

Corporate M&A

Seven years after advising India’s largest realtor DLF in its $250m buy of Aman resorts, Luthra & Luthra advised DLF in selling Aman back to its owner Adrian Zecha for $358m (Rs 1,600 crore).

Seven years after advising India’s largest realtor DLF in its $250m buy of Aman resorts, Luthra & Luthra advised DLF in selling Aman back to its owner Adrian Zecha for $358m (Rs 1,600 crore).

Khaitan capitalises on Morgan Stanley hire alongside Amarchand, Luthra in $930m Cairn India buy-back

Capital Markets

Amarchand Mangaldas Delhi office is acting for exploration giant Cairn India, which is buying back up to 14.98% of its equity share capital for $930m (Rs 5,725 crore) from the open market through stock exchanges.

Amarchand Mangaldas Delhi office is acting for exploration giant Cairn India, which is buying back up to 14.98% of its equity share capital for $930m (Rs 5,725 crore) from the open market through stock exchanges.

Projects

Amarchand Mangaldas maintained status quo as project finance leader for the third year running and reported a greater overall deal revenue since last year, according to data provider dealogic’s year end table for 2013.

Amarchand Mangaldas maintained status quo as project finance leader for the third year running and reported a greater overall deal revenue since last year, according to data provider dealogic’s year end table for 2013.

Corporate M&A

The four firms advised on the National Stock Exchange’s acquisition of Computer Age Management Services, which is valued at up to Rs 1,500 crore.

Deals round-up of more than a dozen recent instructions.

Deals round-up of more than a dozen recent instructions.