Welcome to India Unleashed

India Unleashed is a print and online publication by Global Legal Media and Legally India, providing country-by-country insights and sector-specific analysis from leading law firms and writers around the world.

You can view the full digital edition of the print magazine below.

Reading Between the Lines: How India’s Lawyers are the Key to Unleashing India

India makes it really difficult to maintain perspective sometimes when gung-ho headlines, government statements and statistics only ever tell part of its story. Yes, at give-or-take around 7%, India’s GDP is growing faster than most other countries and this is predicted to continue increasing next year. But is this enough? And, importantly, are India’s lawyers ready to keep pace?

India Unleashed: A View from In-House

I would like to congratulate Legally India for having established itself as a progressive, galvanizing force for the Indian legal fraternity, against many odds. This publication represents an incremental step in Legally India’s journey and a timely reminder of India’s economic potential. These days, I am more confident (but not complacent) that India will not simply fritter away its demographic dividend as the narrative shifts from that of a tiger caged to a tiger on the tail of a dragon.

Cutting Through the Clutter: India Takes First Steps to Unleash More Effective Commercial Litigation

No country can attract foreign trade and investment without a modicum of rule of law and stability in governance. Rule of law requires not only a set of easily understood norms and procedures, but also independent institutions where such norms are enforced without fear or favour. It is no coincidence that Shakespeare’s Merchant of Venice features a trial scene: Venice’s wealth as a trading nation was built on its institutions’ ability to impartially and rigorously enforce contracts in accordance with the law. Hubs of commerce in the modern world such as London, Singapore, Hong Kong and Dubai all boast of excellent institutions designed to resolve commercial disputes in an impartial, effective, and efficient manner.

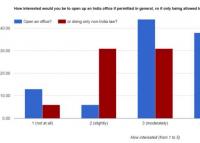

This is how foreign firms could see themselves coming to India, if a very old joke were to become history

One of the oldest jokes told by foreign law firm lawyers who often visit India begins with a question about when they think the market will liberalise. “Two years,” the answer will be. “It’s always been two years.”

Welcome to the Spring 2018 print issue of Legally India

In this second issue of Legally India, co-published with the team at Global Legal Media, we take a closer look at the world of disputes. In what can be the most exciting (as well as the most nerve-wracking) part of the job, we examine disputes of all shapes, colours and sizes and provide Indian lawyers, foreign lawyers and multinational companies with a closer understanding of Indian dispute resolution in a global context.

Has India Legal Inc Missed the Bus on Artificial Intelligence, or is it Just the Right Time to Get on Board?

Artificial intelligence (AI) and machine learning (ML) have been making inroads into nearly all walks of life. Much of what’s visible in the mainstream has been restricted to headline-dominating stunts such as Google’s DeepMind systems beating humans at ultra-complex board games like Go or Chess or the IBM Watson system besting champions of the TV game show Jeopardy (way back in 2011). There have been rapid improvements in self-driving car technology by several companies. And on the consumer software side, facial and photo recognition, real-time text, voice and image translation and other useful tools from the major tech giants often seem like magic, or at least eerily, almost-humanly intelligent.

Introducing the InLegal 50: Editor’s Note

A major part of Legally India’s core mission has always been transparency. When we first set up in 2009, the domestic legal market was largely shrouded in secrecy and could be understood only by tapping into an arcane flow of information and rumours spread via professional networks.

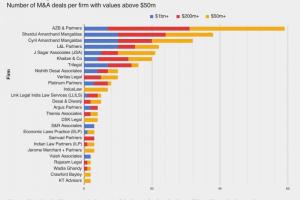

InLegal 50: The biggest M&A & insolvency deals in a year of plenty

“M&A is the mainstay of any small or large corporate firm’s practice,” states Shardul Amarchand Mangaldas Delhi corporate partner Amit Khansaheb, one of the InLegal 50’s top dealmakers of the financial year 2018-19. “M&A is always happening – bear or bull market – although valuations may differ, expectations may vary and people may put off plans from time to time,” he adds.

InLegal 50: The Legally India Corporate Dealmakers of the Year 2018-19

A law firm is only ever as good as the collection of its partners. And (nearly) all top transactional partners will be quick to tell you that they are only as good as their team. The analysis that follows is therefore a recognition not just of individual partners’ rainmaking and execution abilities, but also a testament to leadership and teamwork from everyone involved.

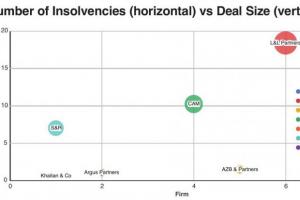

InLegal 50: The Insolvency Machine

At least 17 insolvency deals under the Insolvency and Bankruptcy Code brought significant work to Indian law firms in our tables in the 2018-19 financial year, with deal values of $20.5bn.

InLegal 50: The Busiest Corporate Law Firms

The proof of most things lies in the pudding, and for a good corporate lawyer, your pudding begins and ends with the kind of work that clients entrust you with.

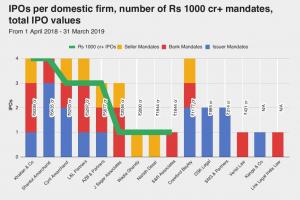

InLegal 50: Top of Equity Capital Markets

Equity capital markets (CM) can be a tough practice area for a law firm to manage. When the going is good and the markets are booming, it seems like there aren’t enough lawyers to handle the work; when the capital markets go to sleep, utilisation and profits plummet.

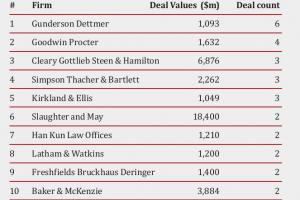

InLegal 50: Foreign corporate firms in India

Foreign law firms too have had a bumper year in India, with the vast majority of public instructions linked to their relationships with their marquee private equity clients, which were very hot on India this year. We have ranked the top 13 firms that had at least two India mandates with deal values attached, signifying transactions with a significant India element.

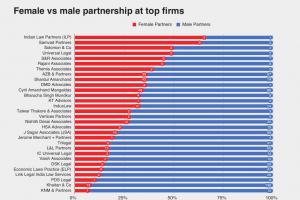

Women in Indian law firms: In a growing minority

To some extent it’s understandable: for years, the Indian legal profession – particularly litigation – has been dominated by men, and most of the new law firms that rose in the nineties and noughties were headed by men. The (generally) male managing partners would often be busy trying to capture market share and executing the work; worrying about whether female lawyers were given the same opportunities as the men was for many an afterthought, if that.

Time to be Bullish to Buy Brazilian Businesses?

On April 12, 2017, the Brazilian Central Bank cut the SELIC benchmark interest rate by 1% as inflation for the twelve months ended March 2017 slowed to 4.57% from a high of 10.71% for the twelve month period ended January 2016. Although GDP declined by almost 3.5% in 2016 over the prior year, foreign direct investment into Brazil increased by 6 per cent over the same period to 78.9 billion dollars. Anectodal evidence suggests that M&A activity has increased in Brazil as Brazil`s third largest airline Azul successfully sold 645 million dollars of shares in an initial public offering listing its shares on the New York Stock Exchange and the Sao Paulo BM&F Bovespa.

Business Opportunities in Brazil

The 70th anniversary of diplomatic relations between Brazil and India, which began with installation of the Brazilian embassy in New Delhi in the following year of India independence, is celebrated in 2018. The similarities of both countries may be a good perspective to explain the critical value of such partnership to Brazil, which has grown stronger through so many different times and contexts.

Cross Border Mergers and Acquisitions in Germany

Generally, there are no restrictions on foreign investors establishing companies in Germany or acquiring an interest in German companies. However, the articles of association of a company may individually restrict the transfer of shares in that company.

Israel: Startup Nation Open to India and the World

Established in 1948, Israel is the world’s only Jewish state, and the sole democracy in its vicinity. Israel has a diverse open market economy. Being a relatively young state, Israel is recognized as a developed market by many major indices. Israel has been a member of the high-income sector of the OECD since 2010.

India-Israel Commercial Relations: The Opportunities, Challenges and the Way Ahead

Following the establishment of full diplomatic relations in 1992, India and Israel have enjoyed a fruitful partnership. Bilateral trade between the countries has been strengthened on the basis of mutual interests in defense, security, agriculture, IT and other sectors. Accordingly, the economic relations have steadily grown since, from $200m (diamonds and defense excluded) in 1992 to approximately $1.94bn in 2018.

Doing Business in India – A Perspective from Japan

India and Japan share a long history. Buddhism, which was born in India, travelled to Japan around the 6th century. The first major interaction between Japan and India seems to have been Japanese assistance to Shri Subhash Chandra Bose in the fight for Indian independence (1943-45). Post WWII, Japan and India signed a peace treaty and established diplomatic relations on 28th April, 1952. Since then, there have been interactions between Japan and India at various levels, which have increased in the last couple of decades.

Public M&A in Switzerland

Cross-border transactions make up the majority of Swiss M&A transactions. Besides the above mentioned mega deals, recent cross-border transactions included Lonza’s USD 5.5 billion acquisition of US-based Capsugel, the acquisition of a 20% stake in Russia-based Rosneft by a consortium led by Glencore and the Qatar Investment Authority for USD 11 billion as well as the takeover by HNA Group of gategroup (USD 2 billion) and private equity fund EQT Partners’ takeover of travel company Kuoni (USD 1.4 billion).

M&A in Russia: Opportunities and Risks in the Current Environment

The Russian M&A market is recovering. According to Mergermarket, the aggregate deal value of Russian M&A equaled USD35 billion in 2016: there were 172 deals and the average deal size was USD203.5 million. The largest M&A deals involving foreign investors were:

Legal Considerations for Asian Investors in the Russian Market

Russia is both a European and an Asian country, but has often appeared to pay more attention to relations with Europe. That is changing, as shown by major energy deals between Russia and China; robust bilateral trade and political discussions with Japan, South Korea, India and Vietnam; and Russia’s hosting of regional conferences, including the Eastern Economic Forum in September 2017. Among other goals, Russia seeks to attract substantial foreign investments from its Asian and Indian partners. For both geographical and practical reasons, foreign investors may wish to focus on the Russian Far East, a historically neglected region which has the potential to become a significant player in Asian-Pacific trade. This is a vast area with a population of more than 7 million people that includes the ports of Vladivostok, Khabarovsk and Nakhodka and extensive natural resources.

The Singapore-India Joint Venture: Truly Symbiotic

Singapore has proved to be the destination of choice for many Indian corporates doing business overseas, though historically other markets such as London and New York have also had close ties with India. With its highly developed and successful free market economy, low taxation, proximity to the Indian subcontinent, numerous direct flights and sizable Indian population, Singapore’s trade ties with India have flourished.

Key Issues Facing UK-Indian Businesses: Brexit, new data protection challenges, M&A

In March this year, the UK government served formal notice under Article 50 of The Treaty on European Union (‘EU’) to terminate the UK’s membership of the EU. This starts a two year notice period, which means the UK’s exit (or ‘Brexit’) will most take effect in March 2019. In the meantime, the UK will seek to negotiate the terms of exit and future trading relationships.

Recent Developments in the UK Dispute Resolution Landscape

The dispute resolution landscape in the UK is in the midst of significant change. Many consider the reforms to be the most far-reaching civil justice transformations since the 1870’s1 and this is not even taking into account what may happen with Brexit (which we will discuss below).

US-India Dealmaking: A Look Ahead at M&A, labour and IP laws

Despite these positive signals, India suffers from a legacy perception of the license Raj. Investors face a host of legal and regulatory risks, including foreign exchange, foreign investment restrictions, and corruption. Foreign investments into India are subject to the FDI Policy of the Government of India and the provisions of the Foreign Exchange Management Act (FEMA).

Dispute Resolution for USA and Indian Businesses

Indian arbitration has been viewed by USA businesses as unpredictable and slow. Few USA businesses have agreed to arbitration conducted in India by an Indian arbitration forum. The 2015 Arbitration and Conciliation (Amendment) Act aimed to address concerns of the international business community about arbitration in India. It expressly limits the duration of on-shore arbitration to twelve months, with a possible six-month extension. After the prescribed period, the panel’s mandate automatically expires unless the parties appeal to the courts for a further extension. While theoretically sound, these time limits are yet to be tested in practice. It will take time for USA businesses to come to view Indian arbitration as a fair or preferred choice.

Building a Two-Way Street: A Guide for Indian Companies Seeking to Conduct Business in the US

The United States and India should view one another as important strategic business partners regionally and globally. With a common legal system of British heritage, democratic governance and relatively free market economies, one would think the two countries would enjoy more trade and mutual direct investment in one another than in European and other Asian countries. But they do not.

India and the Gulf: A Gateway into the GCC

United Arab Emirates United Arab Emirates (“UAE”) is a federation of seven Emirates, which were formed on 2 December 1971. The country has emerged as a global trading hub and as a gateway to the Gulf Co-operation Council countries (“GCC”) with which it enjoys legal and commercial agreements and treaties. It also leads the GCC countries in providing access to one of the leading financial markets in the region based out of the Dubai International Financial Center (“DIFC”).

India and the Gulf States: A Bright Future for Cross-Border Investments

The Gulf countries have always had strong trade relations with India and we see this bond strengthening over the coming years. With bilateral trade projected to reach US$ 100 billion by the year 2020 between India and the UAE alone, avenues for business and cross border investments between the Indian subcontinent and the Gulf look bigger and brighter than ever before.

Litigation: Enforcement of Foreign Judgments in Hong Kong

A foreign judgment can be enforced in Hong Kong by one of two means – first, through the statutory registration scheme based on reciprocity under the Foreign Judgments (Reciprocal Enforcement) Ordinance (Cap 319) or, second, under common law.

Ireland: Gateway to Europe

Ireland has recently introduced purpose-specific domestic legislation that enables two or more Irish companies to merge into a single company. This form of domestic merger enables one or more companies to transfer by operation of law all its assets and liabilities to another Irish company, upon which the transferor company is dissolved without going into liquidation. It mirrors aspects of the EU cross-border merger regime, which has been available to EEA companies, including Irish companies, since 2008.

Disputes in Global Business: Managing Risk, Expectations and the Future

In my view a global dispute involves various parties, from a number of different countries, litigating or arbitrating issues that frequently span multiple jurisdictions. This could range from parallel proceedings going on in different jurisdictions or substantive proceedings in one jurisdiction with interim relief applications in other jurisdictions or, as is common in international arbitration, where the parties are from different jurisdictions and have chosen a neutral seat and neutral governing law.

How much is legal talent worth? Corporate and firm pay, notice & demand across practice areas

The Indian legal talent market remains buoyant as we move through 2017 and we see strong hiring activity continuing across both private practice firms and in-house legal teams. This positivity can be attributed to the fact that Indian industry has witnessed a steady rise over the past few years in terms of productivity, expansion and revenue.

Benchmark your compensation across the Indian legal sector • Plus 24 key partner, 42 GC moves of the year

In 2017, we witnessed high levels of hiring activity in general corporate and M&A space across levels. Other transactional areas such as banking, capital markets and structured finance were busier than the previous years, but hiring at the mid-level especially was limited to replacing leavers rather than growing that practice area. The litigation market remained steady and so did other practice areas like IPR, taxation and competition law.