Deals Feed

The latest deals involving Indian companies and law firms.

Corporate M&A

Ostro Energy is in the process of acquiring a 49% stake in a 60 MW NTPC Project in the state of Rajasthan. Suzlon will be responsible for the project commissioning, expectedly by September 2017.

Private equity / VC

Fast food chain Wow! Momo today said it has raised Rs 44 crore in Series B funding from venture capital firm Lighthouse Funds and angel investor group Indian Angel Network (IAN). The latest round of funding led by Lighthouse Funds, which invests in mid-market consumer-driven firms, values the company at Rs 230 crore, the Kolkata-based firm said in a statement. Besides, it also provided “a highly profitable” exit to the tune of Rs 10 crore to some of the IAN investors who decided to sell their shares partly/completely to Lighthouse, it added.

Private equity / VC

“Awfis Space Solutions, a start-up that provides shared workspaces, has raised $20 million from Sequoia Capital India to fund its expansion plans.” reported Mint.

Corporate M&A

“Paint manufacturer Berger Paints India Ltd has completed the acquisition of specialty coatings maker Saboo Coatings Pvt. Ltd, it said in a stock-exchange filing on Tuesday. It acquired Saboo Coatings’ shares for Rs 81.77 crore”, reported VCCircle.

Corporate M&A

“Drug firm Strides Shasun today said it has inked a pact with Vivimed Labs to set up two joint venture firms,” reported PTI.

Capital Markets

The CLIENT:: State Bank of India (SBI);; is planning to raise Rs 15,000 crore in capital through a qualified institutional placement (QIP) of 54.4 crore equity shares, reported Bloomberg Quint.

Corporate M&A

Otsuka Pharmaceutical Factory, Inc, a leading Japanese pharmaceuticals manufacturing company, has announced a proposal to acquire an additional 20% stake from its joint venture partner, Claris Lifesciences Limited for a consideration of about Rs 128.9 crores (US$20 million) in its existing Indian joint venture, Otsuka Pharmaceutical India Private Limited, as reported by Business Standard.

Private equity / VC

Angel Investors, The Chennai Angels and Lets Venture have made an investment of Rs. 3 crores in Pre Series A Funding in Netree E-services Pvt. Ltd, engaged in creating a retailer oriented networking platform, as reported by Business Standard.

Litigation

“Police will book five men including a tourist guide for alleged gang-rape of an American woman at a five-star hotel in Delhi in March,” reported the Hindustan Times in December adding, “The woman has said the tourist guide befriended her while showing her tourist spots in Delhi and adjoining states. The woman said on the night of the incident, he entered her room with four of his friends, also related to the travel agency, on the pretext of discussing their next day’s journey route plan. They had drinks in the room after which the tourist guide forced himself on her, she said. The others also took turns to rape her before leaving the room, said a source familiar with the complaint. The traumatised woman went back to the US shortly after the alleged gang-rape, the complaint read.”

Corporate M&A

VPC GmbH has acquired 50% controlling stake in Encotec Energy (India) Pvt. Ltd for an approximate value of Rs. 14.43 crores (€2 million). Encotec offers operation management for power plants, supply of photovoltaic systems and trading of Chinese power plant spare parts.

Litigation

“Producer Allu Arvind of Geetha Arts on Thursday sought the injunction against the release of Sushant Singh Rajput starrer ‘Raabta’, which is slated to hit the screens on June 9, over copyright infringement. Arvind claims the story of ‘Raabta’ is very similar to his Telugu film ‘Magadheera’,” reported Zoom TV.

Private equity / VC

“Private equity firm Warburg Pincus LLC part-exited Capital First Ltd by selling a 25% stake in the non-banking financial company (NBFC) through open market transactions on Wednesday, according to a stock exchange filing. Cloverdell Investment Ltd, an affiliate of Warburg Pincus, sold the stake to marquee global and domestic investors, including Singapore’s sovereign wealth fund GIC,” reported Mint.

Capital Markets

The President of India recently sold 10.19% of shares in HUDCO for Rs 1,209 crores ($188m) in an IPO in India and concurrent private placements outside the country (including a Rule 144A offering in the United States), as reported by The Times of India.

Corporate M&A

Mswipe Technologies Private Limited, a mobile point of sale (POS) service provider, is to acquire the offline merchant-acquisition point-of-sale (POS) vertical business of PayU Payments Private Limited, as reported by Medianama and others.

Litigation

Phoenix Legal and senior counsel Ramji Srinivasan won for Arnab Goswami’s new TV news venture Republic in the Delhi high court, after the India Today Group withdrew its writ that we had first reported yesterday, which challenged Republic for allegedly violating the telecom law to gain unprecedented TV ratings (TRP).

Phoenix Legal and senior counsel Ramji Srinivasan won for Arnab Goswami’s new TV news venture Republic in the Delhi high court, after the India Today Group withdrew its writ that we had first reported yesterday, which challenged Republic for allegedly violating the telecom law to gain unprecedented TV ratings (TRP).

Private equity / VC

“Domestic air-conditioning major Voltas today said it has formed an equal joint venture with Turkish company Ardutch BV to introduce the Beko brand of home appliances in the Indian market. The joint venture will have an equity capital of USD 100 million and will set up a manufacturing plant in the country, it said in a statement,” reported DNA.

Litigation

We understand that law firm Phoenix Legal is defending journalist Arnab Goswami’s freshly launched news channel Republic TV in the Delhi high court, against news channel TV Today’s writ that alleges that Republic is violating telecom law to gain unprecedented television ratings (TRP).

We understand that law firm Phoenix Legal is defending journalist Arnab Goswami’s freshly launched news channel Republic TV in the Delhi high court, against news channel TV Today’s writ that alleges that Republic is violating telecom law to gain unprecedented television ratings (TRP).

Private equity / VC

“Paytm has raised $1.4 billion from SoftBank Group Corp. in the largest funding round by a single investor in India, making the digital payments firm the Japanese company’s biggest bet in India’s start-up ecosystem. The deal includes $400 million worth of shares that SoftBank will buy largely from Paytm’s early investor SAIF Partners in a secondary transaction, and a minor stake from founder Vijay Shekhar Sharma, according to two persons close to the development,” reported Mint.

Private equity / VC

“E-commerce logistics services provider Delhivery has raised $30 million from Chinese conglomerate Fosun International. This additional investment is a part of the $100 Mn funding the company raised in March from The Carlyle Group, as indicated by ETTech. The company currently services 800 cities, 9000 pin codes with a network of 12 fulfilment centres. Delhivery claims it fulfils 10 million shipments a month,” reported Medianama.

Private equity / VC

“In the largest private equity deal in the logistics space, the Canadian pension fund manager Canada Pension Plan Investment Board (CPPIB) and IndoSpace, promoted by PE firm Everstone and US-based Realterm, have entered into a three-step deal which would entail an investment of $1.3 billion (Rs 8,320 crore), most of which will come from the CPPIB,” reported Business Standard

Corporate M&A

“Media baron Subash Chandra-led Zee Entertainment Enterprises Ltd has decided to acquire an 80% stake in tech startup Margo Networks Pvt. Ltd for Rs 75 crore ($11.5 million),” reported VC Circle.

Litigation

Advocate Kartik Seth warned the Hindustan Times (HT) of criminal defamation charges that he would press against the newspaper for reporting that a battery of expensive senior advocates had been briefed in the case of Seth’s client, who is a government employee.

Litigation

Amity Law School Noida student Paras Jain’s November 2015 win against cosmetic company Emami was turned around by the Delhi state consumer commission, which has sent his case back to the lower rung for fresh hearing.

Amity Law School Noida student Paras Jain’s November 2015 win against cosmetic company Emami was turned around by the Delhi state consumer commission, which has sent his case back to the lower rung for fresh hearing.

Corporate M&A

dated: now“Kia Motors, a minority-owned subsidiary of Korean auto major Hyundai Motor Company, is likely to set up a manufacturing facilty in Andhra Pradesh with an investment worth Rs 10,300 crore. The car manufacturing facility, a first for Andhra Pradesh, will involve two phases with a cumulative investment of $1.6 billion, or Rs 10,300 crore, with first phase of investment amounting to about Rs 6,000 crore,” reported the Hindustan Times.

Litigation

Pamasis Law Chambers won for the producers of Hindi movie Sarkar 3 in the Bombay high court under Justice Gautam Patel, who ruled against granting an injunction over the movie’s release.

Corporate M&A

“Canadian Private equity firm Clairvest Group and a consortium of investors have officially announced that they have acquired a majority stake in Head Infotech, the company that operates leading rummy website Ace2three for around $73.7 million (approximately Rs. 474 crores),” reported Glaws.

Litigation

“The Delhi High Court on Tuesday asked the Centre and Hindustan Aeronautics Limited to pay Rs 55 lakh as compensation to an Indian Air Force pilot who was injured in a MiG-21 crash in 2005. While the government will pay Rs 5 lakh, the state-run aeronautics firm will have to shell out Rs 50 lakh to Wing Commander Sanjeet Singh Kaila within four weeks,” reported PTI.

Litigation

“Arms dealer Abhishek Verma, his wife and others were discharged by special court on Wednesday in a CBI case involving alleged payments to some officials to influence the defence ministry to keep a German firm out of the government’s blacklist. Special CBI Judge Anju Bajaj Chandna also discharged Verma and his Romanian wife Anca Verma in a money laundering case filed by Enforcement Directorate (ED) in the matter.” reported the Times of India.

Corporate M&A

“Everest Kanto Cylinder has entered into an asset purchase agreement with SNF Flopam India to sell its Land, Building and Electric Installations in Gandhidham, Gujarat for consideration of $29 million. The expected date of completion of sale would be April 30, 2017,” reported Mint.

Litigation

Mason & Associates is defending Google in the Delhi high court against a writ claiming the “right to be forgotten” on the internet, in the second instance of such a claim before an Indian court.

Litigation

“The fresher MBBS candidates for PG courses took out a march on Monday evening to express their resentment over the merit list. “My all Rajasthan rank is 123 in NEET from which I can get a descent branch of my choice for PG course. But, as the in-service doctors get incentive marks, my rank has gone above 700,” said Dr Manoj Bheri, an MBBS doctor, who is not an in-service doctor,” reported the Times of India.

Private equity / VC

“BlackBuck, the B2B intercity logistics startup, has raised Series C funding of $70 million in a round led by Sands Capital. Among existing investors, Accel and Flipkart participated in this round, while Tiger Global and Apoletto did not.

Private equity / VC

“Private equity firm Multiples has acquired a majority stake in HR technology and solutions provider PeopleStrong with an investment of around Rs 400 crore. Multiples, has made a “controlling investment” in PeopleStrong through a combination of primary and secondary investments, and sources close to the development said the deal value is around Rs 400 crore,” reported PTI.

Private equity / VC

“Mumbai-based non-banking financial company (NBFC) InCred Finance, founded by former Deutsche Bank senior executive Bhupinder Singh, has secured $75 million in a funding round led by Deutsche Bank’s former co-CEO Anshu Jain. The latest investment is one of the largest fintech deals in India this year. The startup focusses on providing SME loans, home loans and education loans,” reported In Shorts.

Corporate M&A

“Terex Corporation is selling its India-based compact construction business to Manitou BF (Manitou). Manitou is a leader in all terrain material handling products. Terex Equipment Private Limited (TEPL) manufactures and sells backhoe loaders, engages in the sale of wheel loaders and contract manufactures and sells skid steer loaders,” reported Business Wire.

Corporate M&A

Platinum Partners Mumbai partner Gautam Bhat with associate Abhik Ghosh and associate Ushma Marwah, and Sidley Austin led by partner Manoj Bhargava, of counsel Vivek Baid, and associate Rishabh Gupta, advised Essar on the sale of its BPO subsidiary Aegis to Capital Square partners.

Corporate M&A

Nishith Desai Associates Huzefa Tavawalla along with Kartik Maheshwari and Poonam Sharma acted as Indian and transaction counsel for CLIENT:: Zensar ;;.

Capital Markets

Cyril Amarchand Mangaldas acted for Avenue Supermarts on one of the largest (Rs 1800 crore) and most oversubscribed (106 times) initial public offerings (IPOs) ever, alongside Luthra & Luthra and Herbert Smith Freehills Singapore for the banks, listing with a valuation of Rs 39,998 crore - the 67th largest Bombay Stock Exchange-listed company.

Private equity / VC

Samvad Partners acted for Delhivery Private Limited on its Rs 650 crore ($100m) investment by private equity giant Carlyle Group along with Tiger Global.

Corporate M&A

According to several sources, S&R Associates partner Rajat Sethi and UK firm Slaughter and May partner Susannah Macknay have been advising Vodafone on its long-awaited Rs 80,000 crore ($12.2bn) merger with Idea, which was formally announced today.

Private equity / VC

“Bangalore-based Catbus Infolabs Pvt. Ltd, which operates intra-city logistics startup Blowhorn, has raised Rs 25 crore ($3.65 million) in Series A funding from IDG Ventures India, Michael & Susan Dell Foundation, and existing investors Draper Associates and Unitus Seed Fund, it said in a statement,” reported Techcircle. “Blowhorn, whose tech-enabled platform connects customers with mini truck owners for intra-city, sub 2-tonne deliveries, will use the funds to expand operations to eight cities over the next two years.”

Finance

Juris Corp partner Veena Sivaramakrishnan , senior associate Saurabh Sharma and associate Vedika Lakhotia acted for Standard Chartered in a mixed fund-non-fund $20m loan.

Corporate M&A

Dua Associates acted for Canara Bank in the sale of its 13.45% stake in Can Fin Homes, which was bought by Singapore’s sovereign wealth fund GIC for Rs 753.77 crore in an off-market deal on 10 March 2017.

Corporate M&A

Bharti Airtel is buying the Indian telecoms assets of Norwegian telecoms major Telenor in a deal that’s estimated at Rs 6,800 to Rs 7,000 crore, including debts of Rs 1,500 crore, according to Moneycontrol.

Corporate M&A

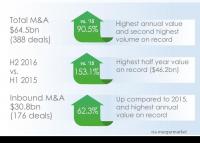

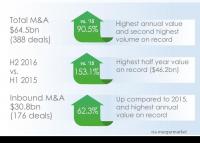

Freshfields Bruckhaus Deringer has topped the mergermarket value league table of international law firms that advised on M&A deals in the record 2016 calendar year.

Freshfields Bruckhaus Deringer has topped the mergermarket value league table of international law firms that advised on M&A deals in the record 2016 calendar year.

Corporate M&A

"Paris-based global toll roads concession and construction company Vinci has taken an unspecified strategic stake in TollPlus, the Phoenix-based developer of electronic toll collection systems, through its Vinci Highways US subsidiary,” reported ITS International.

Corporate M&A

“Private equity (PE) firm Warburg Pincus said in a statement that it has bought a 14% stake in PVR Ltd, Indias largest multiplex chain, for Rs820 crore through an open market transaction.

Litigation

Kochhar & Co has forced the makers of the Jolly LLB 2 to partially back down over its allegedly disparaging use of Bata in a trailer and scene, which we had first reported on 22 December 2016.

Kochhar & Co has forced the makers of the Jolly LLB 2 to partially back down over its allegedly disparaging use of Bata in a trailer and scene, which we had first reported on 22 December 2016.

Corporate M&A

“On 21 December, RCom signed a binding agreement with Brookfield to sell a 51% stake in Reliance Infratel for Rs11,000 crore. RCom currently owns close to a 96% stake in the company, while the remaining ownership is with minority investors,” reported Mint on 29 December 2016.

Corporate M&A

I-Nurture Education Solutions Private Limited, a higher educational services company, has entered into a joint venture agreement with Galileo Global Education France Sas, which is the largest higher education company in France and Europe.

Private equity / VC

Thermal Energy Solutions Pvt Ltd (TESSOL), a company engaged in providing next-generation clean technology cold chain solutions, has raised an undisclosed amount from Infuse Ventures and Ankur Capital. TESSOL, founded by Mr. Rajat Gupta, had raised seed investment from Infuse Ventures in 2014.

Corporate M&A

Cyril Amarchand Mangaldas has acted on $40.4bn worth of mergers and acquisition in the 2016 calendar year, according to researcher mergermarket, with AZB & Partners having recorded $30.1bn of M&A deals in the same period.

Cyril Amarchand Mangaldas has acted on $40.4bn worth of mergers and acquisition in the 2016 calendar year, according to researcher mergermarket, with AZB & Partners having recorded $30.1bn of M&A deals in the same period.

Private equity / VC

"Gurgaon-based developer Vatika Group on Friday secured Rs 700 crore funding from Altico Capital and has closed the first tranche of Rs 475 crore,” reported Mint.

Corporate M&A

News Corp-backed real estate portal PropTiger said on Tuesday that Mumbai-based Housing.com will merge with it in an all stock deal, and that it will receive $50 million in fresh funds from News Corp.’s REA Group Ltd and $5 million from SoftBank Group.

Private equity / VC

"EcoCentric Management Pvt Ltd (ECMPL), a Mumbai-based e-waste management firm, has raised its first round of growth capital from a couple of high net worth individuals (HNIs). The funding will be utilized to increase capacity and expand its reach pan-India,” reported Enablers Investment.

Private equity / VC

"International Finance Corp (IFC), the private sector investment arm of World Bank, on Thursday said it has invested $125m in Hero Future Energies, the renewable energy arm of the Hero Group, for an undisclosed equity stake.

Corporate M&A

"IDFC Bank has signed a share purchase agreement with Grama Vidiyal Micro Finance (GVMFL) for acquisition of 100 percent equity share capital of GVMFL,” according to IDFC’s filing as reported by Money Control. AZB & Partners partner Srinath Dasari and senior associate Gautam Rego acted for IDFC.

Kochhar sends Jolly LLB sequel notice for trailer making ‘impeccable’ Bata shoes look ‘lower strata’

Litigation

Kochhar & Co has sent a legal notice to the makers of Bollywood sequel The State vs Jolly LLB 2 on behalf of footwear empire Bata, asking them to remove and apologise for an allegedly disparaging trailer of the movie in which the reputation of Bata as a brand is allegedly damaged.

Kochhar & Co has sent a legal notice to the makers of Bollywood sequel The State vs Jolly LLB 2 on behalf of footwear empire Bata, asking them to remove and apologise for an allegedly disparaging trailer of the movie in which the reputation of Bata as a brand is allegedly damaged.

Private equity / VC

"HR Food Processing, which manufactures and markets dairy products under the brand name Osam, has raised Rs 45 crore (around $6.7m) in its Series B round of funding, it said in a statement. The round was led by Lok Capital-advised Growth Catalyst Partners. HR Food’s existing investor Aavishkaar also participated in this round,” reported VC Circle.

Private equity / VC

"American Express Ventures, the corporate venture investment arm of American Express Co, has led a $4m (Rs 26.6 crore) funding round in fintech startup IndiaLends, its second transaction in the country in as many months,” reported the Economic Times.

Corporate M&A

“Hero MotoCorp, India’s largest two-wheeler manufacturer, is investing up to Rs 205 crore in electric automotive startup Ather Energy for a 26-30% stake in one of the biggest deals in the nascent sector. Ather has received Rs 180 crore of the total investment with the rest due to be released in tranches. The deal values the three-year-old company at Rs 680 - Rs 790 crore.” reported The Economic Times.

Private equity / VC

Silicon Valley-based venture capital firm Lightspeed Venture Partners has invested $10m in Hiveloop Technology, which provides a B2B e-commerce marketplace platform under the brand ‘Udaan’. The company is founded by three former top executives of Flipkart, namely Sujeet Kumar, who led WS Retail at Flipkart, Amod Malviya, ex-CTO of Flipkart, and Vaibhav Gupta, former Senior VP who was leading product management and finance functions at Flipkart.

Corporate M&A

"Direct-to-home television operator Dish TV will merge with Videocon d2h, creating India’s largest media company by sales. Dish TV is the market leader in the DTH space while Videocon is the third largest by subscribers. Their combined sales in FY16 were Rs 5,920 crore, more than Zee Entertainment, which had sales of Rs 5,850 crore. Both Zee and Dish are part of Subhash Chandra’s Essel Group.

Corporate M&A

"[Quess Corp] entered into a definitive agreement to acquire a 49 per cent stake in Terrier Security Services (India) (Terrier), marking its entry into the manned guarding and security solutions business. With a track record of over 27 years, Terrier is among the leading providers of manned guarding services in India. In addition, Terrier also provides training services for security personnel and electronic security solutions to clients,” reported the Financial Express.