Deals Feed

The latest deals involving Indian companies and law firms.

Corporate M&A

Tags: J. Sagar Associates (JSA)PepsiCo India Holdings (PepsiCo) has sold its franchise rights for the State of Odisha and parts of Madhya Pradesh to Varun Beverages Limited (“VBL”), PepsiCo’s largest bottler in India and the flagship company of the R K Jaipuria Group, as reported by Money Control and Business Standard. VBL will now be a franchisee for PepsiCo products across 18 states and 2 union territories in the country.

Corporate M&A

Engineering giant, Larsen and Toubro Ltd (L&T) has entered into a definitive agreement with UK-based subsidiary of Colfax Group, ESAB Holdings, to sell 100% stake of its wholly owned unlisted subsidiary EWAC Alloys, for a total consideration of Rs. 522 crores ($80.6m) as reported by Livemint & Moneycontol. The transaction is a part of L&T group’s strategy to divest from their non-core business and is expected to be completed within 60 days from the date of execution of the share purchase agreement.

Capital Markets

“Cash management company CMS Info Systems has filed preliminary papers with markets regulator Sebi to raise about Rs1,000-1,200 crore through its initial share-sale offering. The company’s initial public offer (IPO) is a pure offer for sale.” reported Livemint and Moneycontrol. CMS Info Systems, fully owned by Baring Private Equity Asia, provides cash management services, which include ATM services, and cash delivery and pick-up. Existing shareholders would sell 44.4 million equity shares, resulting in a 30% stake dilution on a post-issue basis.

Corporate M&A

Auto-ancilliary major Precision Camshafts (PCL) has announced its acquisition of 95% stake in Nashik-based precision component maker MEMCO Engineering for an undisclosed amount, as reported by The Economic Times and VCCircle.

Corporate M&A

Rajaram Legal advised and acted for Lenskart Solutions and was led by Mumbai-based founding partner Archana Rajaram and senior associate Prasad Subramanyan.

Rajaram Legal advised and acted for Lenskart Solutions and was led by Mumbai-based founding partner Archana Rajaram and senior associate Prasad Subramanyan.

Capital Markets

Indiabulls Ventures Ltd, the financial services arm of the Indiabulls Group, approved raising Rs 2,000 crore (USD 305 million) either through rights issue of shares, to meet the funding requirements and to support future growth of consumer finance and assets reconstruction businesses carried out by the Company, through its subsidiary companies, as reported by The Economic Times and Livemint

Corporate M&A

Chemicals company BASF India has sold its leather chemicals business to Stahl India Private Limited for Rs. 197.63 crores (USD 30.35 million) through a slump sale, as reported by Livemint and Business Standard.

Corporate M&A

Realty firm Embassy Group has entered into a joint-venture of about Rs 900 crores with US-based Taurus Investment Holdings in an SPV called Winterfell Realty Private Limited, to develop commercial projects, including an IT/ITES SEZ, encompassing 2.5 million square feet on a 10-acre land parcel as part of Phase III of the Technopark SEZ in Thiruvananthapuram, Kerala as reported by Livemint and The Economic Times.

Capital Markets

“CMM Infraprojects is coming out with an initial public offering (IPO) of 45,45,000 equity shares of face value of Rs 10 each for cash at a fixed price of Rs 40.00 per equity share.The shares will be listed on Emerge Platform of NSE. The share is priced 4 times higher to its face value of Rs 10,” reported Finalaya. The issue opened on September 29th and closed on October 4th and it was a 100% book-built issue.

Private equity / VC

“Private equity firm IDFC Alternatives has invested Rs 75 crore ($11 million) for a minority stake in ASG Eye Hospitals,” reported VCCircle.

Litigation

The Supreme Court directed the Punjab State Power Corporation (PSPCL) to pay Rs 1100 crores as refund to L&T subsidiary Nabha Power (NPL), relieving NPL from a potential loss of Rs 8000 crore over the next 22 years.

Projects

AZB & Partners partner Gautam Saha and partner Pallavi Meena, with associates Pragya Sood and Ayan Das have acted for Overseas Private Investment Corporation (OPIC).

Corporate M&A

Zee Entertainment Enterprises Limited (ZEEL) aquired 100% in 9X Media Private Limited (and its subsidiaries) from Rivendell PE LLC / New Silk Route Partners and other shareholders of 9x Media Private Limited. The deal was valued at Rs 160 crore, reported VC Circle and others.

Corporate M&A

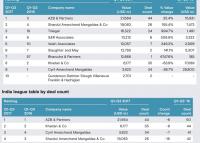

Massive Vodafone-IDEA merger continues causing quakes in league tables half a year after having been announced...

Massive Vodafone-IDEA merger continues causing quakes in league tables half a year after having been announced...

Corporate M&A

One does wonder whether all the Playboy publicity generated by Hefner’s death late last month would have positively affected valuations...

One does wonder whether all the Playboy publicity generated by Hefner’s death late last month would have positively affected valuations...

Corporate M&A

Hyderabad-based Itelligence India Software Solutions Private Limited, a subsidiary of Germany’s itelligence AG, acquired 100% of Hyderabad-based Vcentric Technologies Private Limited for an undisclosed amount. Vcentric had revenues of around Rs 72 crore and profits of Rs 1.59 crore in 2015-16, according to VCCircle.

Litigation

McDonald’s India has approached the Delhi high court seeking to enforce a 13 September London Court of International Arbitration (LCIA) partial award to appoint experts to value and sell estranged former managing director Vikram Bakshi's stake in the North and Eastern India local franchise of the fast food giant, reported Mint, the Economic Times and others.

McDonald’s India has approached the Delhi high court seeking to enforce a 13 September London Court of International Arbitration (LCIA) partial award to appoint experts to value and sell estranged former managing director Vikram Bakshi's stake in the North and Eastern India local franchise of the fast food giant, reported Mint, the Economic Times and others.

Private equity / VC

"Budget-hotel tech company Treebo has raised Series C funding of $34 million led by Hong-Kong based investment firms Ward Ferry Management and Karst Peak Capital. Existing investors SAIF Partners, Bertelsmann India Investments and Matrix Partners also participated in the round," reported Your Story.

Private equity / VC

"B9 Beverages Pvt. Ltd has raised around $8 million from venture capital fund Sequoia Capital India Advisors, said Ankur Jain, founder of the company that sells the popular Bira 91 craft beer. With the latest round of funding from Sequoia Capital, B9 Beverages has so far raised around $30 million," reported Mint.

Corporate M&A

Realty Major DLF Limited has entered into an agreement to sell a stake of 33.34% in its rental arm, DLF Cyber City Developers Limited (DCCDL) to Reco Diamond Private Limited, an affiliate of the Singapore sovereign wealth fund, GIC Group, in a multi-stage transaction for an aggregate value of US$ 1.9 billion, as reported by VCCircle and Business Standard.

Corporate M&A

"Monsanto is selling its branded cotton seeds business in India to Hyderabad-based Tierra Agrotech, although the US biotechnology major would remain invested in farming segments such as corn seeds, crop protection, vegetables and Bollgard II technologies," reported the Economic Times.

Corporate M&A

“A stake sale by DLF Ltd’s promoters to an affiliate of Singapore’s sovereign wealth fund GIC Pte Ltd will see capital infusion of nearly Rs 13,000 crore into India’s largest property developer,” reported Mint.

Corporate M&A

Smaaash Entertainment, a gaming and entertainment company co-owned by Sachin Tendulkar has entered into a definitive agreement to acquire a 100% stake in bluO entertainment, PVR's JV with Thailand-based Major Cineplex Group, B, through a cash acquisition deal for Rs 86 crores ($13.46 million), as reported by Livemint.

Corporate M&A

ASDA Media & Entertainment Private Limited (ASDA), an INDASDA Group entity, has acquired a significant stake in Moshe's Fine Foods Private Limited from South Asia Gastronomy (Mauritius) Enterprises LLC, a food and beverage portfolio company and platform of private equity firm, New Silk Route, as reported by The Economic Times and Deal Street Asia.

Litigation

NUJS Kolkata 2015 alumni Jay Sayta, who reports on India’s gambling laws on his website glaws.in, and The Wire, are facing E-Cool Gaming Solutions' criminal defamation case in far-flung Mizoram for Sayta's story reporting on a Comptroller and Auditor General (CAG) audit of the complainant, reported Medianama.

Corporate M&A

Engineering major, Larsen & Toubro (L&T) has entered into a definitive agreement for the divestment of its entire stake in its unlisted and wholly owned subsidiary L&T Cutting Tools, to IMC International Metalworking Companies BV, owned by the Warren Buffett-led Berkshire Hathaway Inc. for Rs. 174 cr ($27.18 million USD) as reported by Business Standard, Livemint and others

Corporate M&A

"International Finance Corp (IFC), the private-sector investment arm of the World Bank, will sell its entire 7.5% stake in Analjit Singh-led Max Group’s healthcare business for Rs 423 crore ($65.3 million)," reported VCCircle.

Litigation

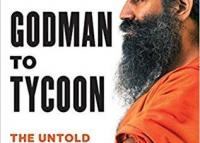

A Delhi district court today heard the appeal of publishing house Juggernaut against an order restraining it from publishing the book “Godman to Tycoon: The Untold Story of Baba Ramdev”.

A Delhi district court today heard the appeal of publishing house Juggernaut against an order restraining it from publishing the book “Godman to Tycoon: The Untold Story of Baba Ramdev”.

Corporate M&A

"Mars Food, part of Mars Inc said it has signed a definitive agreement to acquire Connecticut-based Preferred Brands International, known for its ready-to-heat Indian and Asian food products sold primarily under brand Tasty Bite," reported The Hindu Businessline.

Private equity / VC

"Non-banking finance company Five Star Business Finance has raised Rs 333 crores (about $50 million) in its Series C round led by Norwest Venture Partners and Sequoia Capital. Existing investors including a fund managed by Morgan Stanley Private Equity Asia and Matrix Partners also participated in the round. The round saw Five Star raising Rs 318 crores through primary infusion with about Rs 15 crores coming in via a secondary sale of shares," reported the Economic Times.

Capital Markets

“State-owned reinsurance company General Insurance Corp. of India (GIC) filed the draft red herring prospectus (DRHP) for its initial public offering (IPO). The IPO will see a total stake dilution of 14.22%, according to the DRHP available on the website of one of the investment banks managing the share sale,” reported Mint.

Corporate M&A

"Dollar Industries Limited announced an equal joint venture with Pepe Jeans Europe BV. Pepe London would pump in ₹36 crore worth of equity as its contribution over four years," reported The Hindu.

Private equity / VC

"Milestone Commercial Advantage Fund made its first investment in June in The Capital, a commercial building in Mumbai’s Bandra-Kurla Complex," reported the Economic Times.

Private equity / VC

"Green Visor Capital announces follow-on investments in Flutterwave and Simpl, two emerging payments companies targeting commerce in Africa and India, respectively," according to News Wire.

Megadeal: Khaitan Bgl helps Flipkart grow anti-Amazon war chest with $2.5bn from AZB-client SoftBank

Private equity / VC

Khaitan & Co Bangalore partner Ganesh Prasad with associate partner Vinay Joy, principal associate Arun Scaria and senior associate Sanjay Khan Nagra represented Indian Singapore-headquartered e-commerce Flipkart on the $2.5bn investment.

Private equity / VC

"Budget hotels chain FabHotels has raised $25 million in a Series B funding round led by Goldman Sachs, a top company executive said. Accel Partners, an existing investor in FabHotels, also participated in the round," reported Mint.

Corporate M&A

"Axis Bank Ltd on Thursday announced the acquisition of Snapdeal-owned mobile wallet FreeCharge in a Rs385 crore all-cash deal, strengthening its position in the payments space," reported Mint.

Corporate M&A

"Global private equity (PE) firm Carlyle Group has emerged as the front runner for GE Capital Corp’s stake in SBI Card, the credit card joint venture between the US-based company and India’s largest lender State Bank of India (SBI). Carlyle has emerged as the front runner for GE Capital’s stake in SBI Cards for somewhere around $325 million. The board of SBI settled upon the final bidder in a meeting. Carlyle has pipped Warburg Pincus and Credit Saison and emerged as the final bidder though the deal is not closed yet,” reported Mint.

Private equity / VC

"Online pharmacy and healthcare services start-up 1mg Technologies Pvt. Ltd has raised $15 million in a funding round led by global healthcare-focused fund HBM Healthcare Investments AG, to launch predictive healthcare and corporate wellness products. The series C round also saw participation from existing investors Maverick Capital Ventures, Sequoia India, Omidyar Network and Kae Capital," reported Mint.

Corporate M&A

Automotive insurtech company Roadzen Inc. has acquired the India operations of assistance services company AXA-Assistance India by acquiring 100% equity stake in AXA Assistance India Private Limited from its sole shareholder Inter Partner Assistance SA in a cross border transaction.

Corporate M&A

Indian insurance company Global Insurance Services Brokers Private Limited and its promoters Prabodh Thakker and Sunita Thakker have acquired the entire stake of 26% of Aon Holdings BV in their Indian insurance JV broking company, Aon Global Insurance Brokers Private Limited, for an undisclosed amount, as reported by The Economic Times and The Insurance Insider. Post the acquisition, the name of the company has been changed to Global Insurance Brokers Private Limited.

Capital Markets

"SBI Life Insurance Co. Ltd on Monday filed the draft red herring prospectus for its initial public offering (IPO), joining several other insurance companies headed for the stock market. In an offer for sale, SBI and BNP Paribas will sell 80 million and 40 million shares respectively, amounting to a combined 12% stake. SBI Life is not raising any primary capital. The IPO could see SBI Life raise more than $1 billion (about Rs6,500 crore), a Bloomberg story quoted bankers as saying," reported Mint.

Private equity / VC

"KKR, one of the largest PE investors in the world, signed a definitive agreement on Monday to invest $200 million for a 49% stake in Radiant Life Care," reported the Economic Times.

Private equity / VC

"Trade financing company Vayana Network, which recently split from parent company Vayana (VPL), has raised $4 Million (about Rs 26 crore) from venture capital firms IDG Ventures India and Jungle Ventures," reported Indian CEO.

Litigation

Service tax law firm JK Mittal & Co's founder JK Mittal won an order in the Delhi high court exempting lawyers from government action in case of non-observance of the Integrated Goods and Services Tax Act 2017, reported News18.

Litigation

“In a major setback to the US- based fast food chain McDonald's in India, the National Company Law Tribunal (NCLT) today restored its estranged partner Vikram Bakshi as the Managing Director of Connaught Plaza Restaurant Ltd. The tribunal has said the meeting of Connaught Plaza Restaurants Ltd (CPRL) of August 6, 2013 in which Bakshi was removed as MD of the company was illegal, unjust and malafide,” reported the PTI.

Finance

"GMR Goa International Airports Limited (GGIAL), subsdiary of GMR Airports has today, successfully executed a debt facility arrangement for the development of the greenfield project at Mopa in north Goa by signing a common loan agreement with Axis Bank. The bank will provide the company with Rs 1330 crore," reported the Economic Times.

Litigation

"After fighting for over three decades for a share in ancestral properties, three branches of the Singhania family told the Supreme Court on Wednesday that they had amicably settled the dispute by honouring and implementing the decision of the arbitrator who had in 2008 divided the assets in three parts.

Corporate M&A

The Vodafone-Idea mega-merger has gifted five Indian law firms a $10bn+ deal values in the first half of 2017 in league tables, according to data collated by analytics firm mergermarket.

The Vodafone-Idea mega-merger has gifted five Indian law firms a $10bn+ deal values in the first half of 2017 in league tables, according to data collated by analytics firm mergermarket.

Capital Markets

"The initial public offer (IPO) of Eris Lifesciences was subscribed 3.27 times on the last day of the public offer and book running lead managers to the offer are Axis Capital, Citigroup Global Markets India and Credit Suisse Securities (India)," reported Economic Times.

Corporate M&A

"Online tutoring firm BYJU’s has announced the acquisition of TutorVista and Edurite from Pearson. It said these acquisitions will help it expand in newer markets as well as create a diverse product portfolio," reported Your Story.

Litigation

“A Mumbai magistrate’s court on Tuesday admitted a Rs 500 crore criminal defamation suit, filed by R Venkataramanan, a trustee at Tata Trusts, against ousted Tata Sons Ltd chairman Cyrus Mistry and his family investment firms. Venkataramanan filed the defamation complaint in his personal capacity on 7 June through the law firm MZM Legal, citing allegations that Mistry made against him in an email he wrote to Tata Sons directors and Tata Trusts trustees on 25 October. The allegations pertained to some transactions at AirAsia India, Tata Sons’ joint venture with AirAsia Bhd,” reported Mint.

Capital Markets

"The initial public offering of Central Depository Services Ltd (CDSL) received bids for 170 times the number of shares on sale, making it the most attractive IPO in nearly 12 years. The public offering of 24.83 million shares – excluding the anchor investors’ portion – got bids for nearly 52 million shares, stock-exchange data showed at the end of bidding on Wednesday. This translates into bids worth Rs 62,653 crore ($9.7 billion)," reported VC Circle.

Litigation

The Prevention of Money Laundering appellate tribunal set aside penalties imposed on 15 banks, in 2013, by the Financial Intelligence Unit (FIU) for alleged failure to prevent money laundering as revealed in a purported expose by news media Cobrapost.

The Prevention of Money Laundering appellate tribunal set aside penalties imposed on 15 banks, in 2013, by the Financial Intelligence Unit (FIU) for alleged failure to prevent money laundering as revealed in a purported expose by news media Cobrapost.

Private equity / VC

"OneAssist Consumer Solutions – which provides protection for credit cards, smartphones and payment cards in case of loss or theft – has raised Rs 118 crore ($18 million) in its series-C round of financing, as per documents filed with the Registrar of Companies. The round was led by existing investors Sequoia Capital India along with participation from Lightspeed Venture Partners and New York-based insurance provider Assurant. The round also marks the entry of new investor, UK-based Moonstone Investments," reported the Economic Times.

Corporate M&A

Kirloskar Oil Engines Limited, manufacturers of diesel engines, gensets and agricultural pumpsets, have entered into an agreement to acquire a majority stake of 76% in La-Gajjar Machineries Pvt. Ltd., the maker of Varuna and Raindrop brands of electric pumps, as reported by Livemint.

Capital Markets

Tata Steel on Friday sold its entire 2.9 per cent stake in Tata Motors to Tata Sons through a block deal on the BSE. A block deal of 8.35 crore shares was executed at an average price of Rs 452.80 a share. At that price, the deal size stood at Rs 3,780.88 crore. Last week, the Tata group had said to reduce cross-holdings, Tata Sons, the holding company of the $103-billion Tata group, will acquire Tata Steel’s 2.85 per cent share in Tata Motors on or after June 23. After the stake buy, Tata Sons’ holding in Tata Motors will increase to 31.06 per cent from the current 28.2 per cent.

Private equity / VC

“Zee Entertainment Enterprises picked up about 12.5 % stake in Bengaluru-based Tagos Design Innovations,” reported Inc42.

Capital Markets

“The Pune Municipal Corporation (PMC) today raised Rs 200 crore by selling 10-year bonds, becoming the first civic body to tap money from this route in 14 years. Proceeds from the issue, raised at a coupon of 7.59 per cent and oversubscribed six times, will be used for a Rs 2,300-crore water project,” reported PTI.

Corporate M&A

Intertape, the Canadian packaging company with executive headquarters in Sarasota County, announced Thursday it is making a “greenfield” investment in Capstone Polyweave Private Limited, which plans to build a $30 million manufacturing facility in Karoli, India. Capstone’s shareholders also own and operate Delhi-based Airtrax Polymers Private Limited, which manufactures and sells woven products that are used in the building and construction industry. Airtrax posted $11 million in revenues for the year ended March 31.