The 70th anniversary of diplomatic relations between Brazil and India, which began with installation of the Brazilian embassy in New Delhi in the following year of India independence, is celebrated in 2018. The similarities of both countries may be a good perspective to explain the critical value of such partnership to Brazil, which has grown stronger through so many different times and contexts.

Both countries are democracies with a multi-ethnical, multi-cultural and multi-religious society, with a vast territory, heavily populated metropolis, sharing similar ambitions of economic and sustainable growth, but also struggling against social inequality, each one due to their particular reasons.

Such similarities may also explain the level of alignment between Brazil and India in foreign policies, representing a strategic partnership built on a common global vision, shared democratic values and a commitment to foster economic growth with social inclusion. Said cooperation is reflected in the intense and multifaceted relationship in larger multilateral bodies such as the United Nations (“UN”), World Trade Organization (“WTO”), United Nations Organization for Education, Science and Culture (“UNESCO”) and World Intellectual Property Organization (“WIPO”), as well as in several plurilateral fora such as the blocs Brazil, Russia, India and China (“BRICS”) as well as Brazil, South Africa, India and China (“BASIC”), the Group of Twenty (“G-20”), the G4 countries (“G-4”), the India-Brazil-South Africa Dialogue Forum (“IBSA”), International Solar Alliance (“ISA”), Biofuture Platform.

Another resemblance regards the economic opening of said countries, which took place in the ‘nineties (90s) upon several regulatory reforms aiming at making the economy more business-oriented, also pursuing their economic development through funding of private and foreign investments. Since then, the Brazilian-Indian relation has rapidly intensified resulting in several bilateral agreements, the creation of India-Brazil Joint Commission Meeting – which is the main mechanism of dialogue coordination of both parties - a strategic partnership commenced in 2006 and, more recently, an ongoing negotiation of an Investment Cooperation and Facilitation Treaty (ICFT) expected to boost direct foreign investments reciprocally.

The areas of cooperation are as broad as expected for countries with such importance and may play an important role in creating synergy in key areas, such as:

(a) Science, Technology and Innovation – with respect to which India may enormously contribute, being a well-established global producer, and which resulted in the creation of the Scientific Council Brazil-India, in 2005, which enables the financing of joint researches in IT, Geoscience, Engineering, Renewable Energy, Math, Health;

(b) Economic and Social Development – (i) the creation of IBSA in June 2003, which includes the IBSA Fund, aiming at supporting projects in several sectors and, more recently, resulting in the IBSA Facility for the Alleviation of Poverty and Hunger entered into on October 17, 2017; as well as (ii) the creation of the New Development Bank in 2014 purporting to mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging economies;

(c) Defense – an agreement entered into between India and Brazil in 2003 establishes the cooperation in defense-related matters, especially in the field of Research and Development, acquisition and logistic support;

(d) Agriculture – execution of memoranda of understanding between Brazilian Agriculture Research Corporation (EMBRAPA) and Indian Council of Agricultural Research (ICAR) – for cooperation in the fields of genetic resources, agriculture, animal husbandry, natural resources and fisheries – as well as Department of Animal Husbandry, Dairying & Fisheries (DADF) – for cooperation in the fields of zebu cattle genomics and assisted reproductive technologies;

(e) Health/Pharmaceutical – a memorandum of understanding was entered into between Brazilian Health Surveillance Agency (ANVISA) and Indian Central Drugs Standard Control Organization of the Directorate General of Health Services (CDSCO/DGHS), in 2016, for cooperation in pharmaceutical production regulation; and

(f) Foreign Trade – Preferential Trade Agreement between Common Market of the South (“MERCOSUR”) and the Republic of India of 2004, entered into force in 2009, establishing 450 tariff lines for each party, deemed to be a milestone towards the creation of a free trade area among the parties.

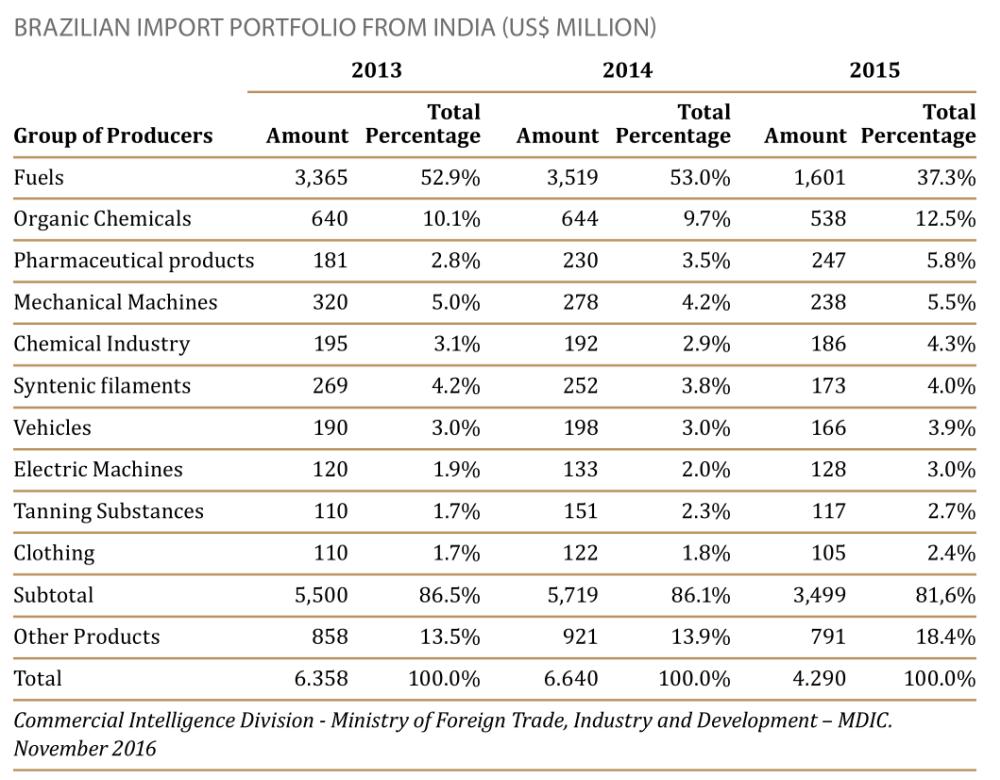

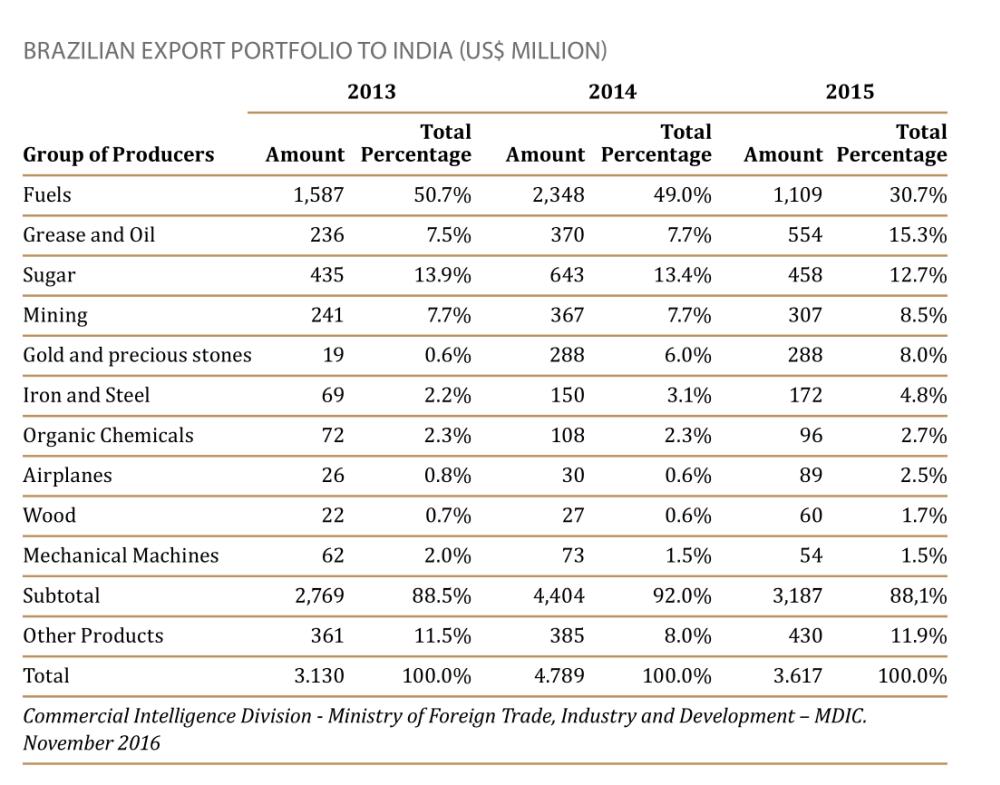

Within the Latin America and Caribbean region, Brazil is one of the most important trading partners of India, having substantially increased their bilateral trade over the past decades. However, with the global drop in commodity prices, the economic recession and political turmoil in Brazil, the overall bilateral trade in 2015 was severely affected. Such scenario resulted in a collapse of the overall bilateral trade, reducing from US$11.429 billion in 2014 to US$5.64 billion in 2016, representing a decrease of approximately 49%. The recovery of Brazilian economy is expected to increase again the flow of bilateral trade.

The products portfolio of import and export between both countries from 2013-2015 are summarized in the charts overleaf.

After a long period of optimism in Brazil and the commodity super-cycle, Brazilians have been facing for the last couple of years uncertain times. While attempting to handle an ongoing economic, political and fiscal crisis, business were definitely affected by such context and, consequently, key assets are being sold either as a result of financing and corporate restructure of major Brazilian players or to generate additional income for the Federal, State and Municipal Governments. There has been an increase in major M&A transactions as a result of divestment programs carried out by government-controlled companies, as well as by companies involved in corruption scandals or otherwise in need of cash availability to meet debt obligations or to for selected investment more focused on their core business.

Brazil – An overview

Brazil is the world’s fifth largest country (and the largest in South America) by geographical area. It extends over an area of more than 8.5 million square kilometers, and is divided into 26 states and one Federal District (Brasília). With its vast expanse of territory spanning three time zones, the country is crossed in the north by the Equator, and in the south by the Tropic of Capricorn. Its 200 million-plus population lives mostly in urban areas, according to the latest census carried out by Instituto Brasileiro de Geografia e Estatística (IBGE). The country’s population derives from a mix between European ancestors who migrated at different times in history, Africans brought to the country as slaves, and Amerindians. Black and multiracial citizens make up a majority of the country’s population (50.7%); whites account for 47.7% of the total.

The country has by far the largest economy in Latin America; the second in America (after the USA only); and the ninth in the world. The agricultural, mineral, manufacturing and services segments are the strongest in Brazil. The country’s major exports encompass electric equipment, aircraft, orange juice, automobiles, ethanol, textiles, iron ore, steel, coffee, soya and meat.

Brazil has teamed up with its neighbors Argentina, Uruguay, Paraguay and Venezuela (currently suspended) to form MERCOSUR, a customs union and trade bloc representing a potential 240 million-plus consumer market. The country has also increasingly expanded its presence in the international financial markets, and is also part of the BRICS.

Brazil is a federative presidential constitutional republic formed by the Federal Government, states and municipalities, where power is exercised by distinct and independent bodies. The head of state is democratically elected for a four-year term of office, one reelection being permitted. The president of the Republic acts as head of state and head of government cumulatively. Brazilian states have political autonomy, and a multi-party political system is in place. Brazil is a federative presidential constitutional republic formed by the Federal Government, states and municipalities, where power is exercised by distinct and independent bodies. The head of state is democratically elected for a four-year term of office, one reelection being permitted. The president of the Republic acts as head of state and head of government cumulatively. Brazilian states have political autonomy, and a multi-party political system is in place.

The three branches of Brazilian government are: the Executive, led by the president of the Republic at federal level; the Legislative, which at federal level comprises a bicameral Congress that is composed of the Senate and the House of Representatives (whose members are elected on a proportional representation basis, thus favoring less populous states); and the Judiciary, which is made of the Federal Supreme Court, the Superior Court of Justice, and lower federal and state courts.

The Constitution of the Federative Republic of Brazil, enacted in 1988, is the country’s fundamental law. Each of the 26 Brazilian states may pass its own state constitutions and laws, provided that they do not conflict with the principles enshrined in the Federal Constitution.

In the last couple of years, Brazil has been seen as a buyer’s market with several opportunities throughout the different segments of the economy. Many transactions related to divestment plans of private and mixed-capital companies, distressed assets, large-scale debt restructuring and reorganization, generally involves several stakeholders, such as creditors, courts, judicial administrator, regulatory agencies or granting authorities, in the particular case of projects subject to concession, authorization or permission regimen.

Within such context, not only the due diligence process becomes crucial to adequately identify the relevant risks of the transaction, but also negotiations pursuing appropriate protections for the buyer can be particularly challenging.

Compliance and corporate ethics of the target company and the seller’s group, as well as their financial soundness in the medium and long term may be key aspects to avoid being dragged into liability discussions at a later stage and also to effectively benefit from indemnification provisions in case of potential breaches or price adjustments.

Furthermore, several ongoing regulatory discussions are simultaneously being held purporting either to address specific market concerns or to promote broader reforms in many different sectors. Also as a result of the opening of specific segments, which were being maintained as monopolies operated by mixed-capital and government controlled companies, discussions on the new regulatory regimen are defining the legal framework for future operation by multiple private parties. Another reason for such regulatory reforms might also have occurred as a response to dysfunctions in certain sectors (such as, local content requirements in the Oil & Gas and discussions involving the generating scale factor in the energy sector), which resulted in an increase of lawsuits in such sectors, so as to adapt their rules to the current economic scenario.

For 2018, the market is expecting a scenario of controlled inflation rate and a better defined political environment upon election of new president of the Republic and State governors. Therefore, the preparation and follow-up on the ongoing discussions might give leverage to potential investors when making investment calls in the near future.

Just to name a few regulatory aspects currently being discussed in Brazil, which are expected to offer interesting business opportunities in different sectors:

(a) Infrastructure – created by Law No. 13334 of September 2016, the Investment Partnership Programme (the “PPI Programme”) purports to increase and strengthen the participation of the private sector in infrastructure projects, by means of public- private partnerships and privatization measures. Such law focuses on facilitating the early stages in the planning and development of infrastructure projects, as well as addresses relevant concerns of the market upon recognizing the need for securing and making stable policies. Accordingly, said law establishes that the federal government must define long-term policies and strategic guidelines for investment, privatization and public bids. It also sets forth the infrastructure projects considered of national priority by public authorities (in all levels), requiring an efficient and timely coordination of such public entities for the development and approval of PPI projects which includes, among others: (i) oil and gas bidding rounds; (ii) divestments of mixed capital companies in energy sector (generation and distribution of electric energy); (iii) mining assets; (iv) ports; (v) airports; (vi) roads;

(b) Oil & Gas – one of the most important measures recently adopted by the Brazilian Petroleum, Natural Gas and Biofuels Agency (“ANP”) and governmental authorities to heat the industry, is to give predictability of the bidding rounds and scheduled several bids for the next years, as follows: (a) 2018 – (i) 15th Bidding Round (May); (ii) 4th Production Sharing Bidding Round – Pre-Salt (May); (iii) 5th Marginal Fields Bidding Round (to be defined); (b) 2019 – (i) 16th Bidding Round (3rd Quarter ); (ii) 5th Production Sharing Bidding Round – Pre Salt (3rd Quarter); and (iii) 6th Marginal Fields Bidding Round (to be defined). The Brazilian local content requirement policy is also currently undergoing an intense debate by multiple public authorities and a specific regulation on the matter is expected to be enacted in the near future, as ANP carried out a Public Consultation and Hearing to discuss with the industry and civil society improvements on the local content policy aiming at elaborating a new specific resolution to regulate the matter, while there is also a bill of law currently being debated by the Brazilian House of Representatives purporting to regulate a local content requirement policy for oil, natural gas and other fluid hydrocarbons by virtue of law. As regards tax matters, the Brazilian Federal Revenue has recently issued a normative instruction regulating the tax treatment of exploration, development and production of oil and natural gas activities, as well as established a calculation formula for the purpose of withholding income tax applicable to cross-border charter/lease contracts of vessels operating in Brazil, subject to contractual split (whenever there is charter with rendering of services) applicable to charter hire above certain limits established in law. Such new regulation is expected to enhance the legal certainty for investors of the oil and gas industry;

(c) Electric Power – Ministry of Mines and Energy (“MME”) launched in 2017 a Public Consultation on changes to the electric power regulations, aiming at improving the legal framework and also to reduce the litigations involving agents of the electric power sector. There are also recent official announcements by the MME that the Federal Government is considering the privatization of Centrais Elétricas Brasileiras S.A. – Eletrobrás, which is a listed company controlled by the Brazilian government (mixed-capital company) with presence throughout the entire electric chain, such as generation, transmission and distribution segments. Eletrobrás is the largest company in the electricity sector in Latin America, participating either, directly through its subsidiaries, or together with the private sector in joint-venture arrangements. If such privatization is implemented, this transaction will certainly represent a game changer for the electricity sector in Brazil;

(d) Shipping – there is an ongoing controversy with respect to the validity of a foreign vessel mortgage in Brazil. Due to a decision rendered at the lower court in charge of an enforcement action, which considered a foreign mortgage as invalid in view of the absence of registration at Brazilian maritime authorities, several ship financing transactions were being restructured in Brazil, with migration of vessel ownership registration to countries that are party to certain international treaties entered into by Brazil (Bustamante Code and 1926 Brussels Convention). Fortunately, on November 2017, the Brazilian Superior Court of Justice reverted the original decision acknowledging the validity of the foreign mortgage based on international treaties, despite the fact that the country of origin where the vessel is registered is not a signatory of the relevant international treaty. Although such decision is still not final and unappealable, it seems that such leading case tends to consolidate the validity of foreign mortgages in Brazil, enhancing a standard ship financing practice widely adopted in the international market and providing additional comfort to lenders in Brazilian operations;

(e) Port – recent changes to port regulatory framework in Brazil improved the business environment for the private sector, enhancing the competitiveness and establishing a more stable legal regimen for private terminals. New rules have extended the duration of operating authorizations from 25 to 35 years, which may now be extended for successive periods for up to 70 years. The management of public ports may also negotiate the anticipation of tariff revenue with users aiming at performing immediate investments in infrastructure to be afforded by the tariff; and

(f) Aviation – Brazilian domestic airlines have currently a legal restriction on foreign capital which limits the corporate participation of foreign investors at 20 per cent of the total voting capital of the company. There are recent official announcements indicating that the Federal Government intends to gradually lift such restriction so as to enable foreigners to hold up to 100% (one hundred per cent) of equity interest in Brazilian airlines.

Brazil continues to be a solid and feasible option for those investors with medium and long term strategy. With a worldwide economy, a significant internal consumer market and assets distributed all over its vast territory, the country combines a deficit of infrastructure facilities with an enormous demand for such facilities in a variety of areas, including also transportation, sewage, biofuels, construction and energy, just to name a few. Brazil might also be the long awaited-chance to make the difference in selected investment portfolios, with a chance of return rates above the average business in the global market. There are a myriad of opportunities for Indian investments in Brazil and the strong, stable and friendly bilateral relationship between India and Brazil over the years is certainly an additional element to foster business between such great countries.

About The Authors

Ricardo E. Vieira Coelho is a Partner at Pinheiro Neto Advogados. He has significant experience in corporate law, project finance, asset financing, foreign trade financing, public-private partnerships, capital markets (equity and debt securities), credit facilities, joint ventures, M&A, leasing, oil and gas, energy, maritime law, ethanol & biofuels, transportation, and the aviation and insurance industries.

Caio Bernardes Vianna is an Associate at Pinheiro Neto Advogados. His practice covers corporate law, project finance and oil and gas.

RIO DE JANEIRO OFFICE

Pinheiro Neto Advogados

Rua Humaitá, 275 – 16º andar.

Rio De Janeiro 22261-005

Brazil

Tel: +55 (21) 2506-1600

Welcome Legally India's Spring 2018 Issue

If you would like to receive future editions, please click here to register your interest.

Our Spring 2018 print and digital edition of Legally India, a joint publication by Global Legal Media and Legally India, has a strong disputes flavour, and examines: AI, global litigation risk, GC wishlists and more than a dozen jurisdictions and practice areas.