At least 17 insolvency deals under the Insolvency and Bankruptcy Code brought significant work to Indian law firms in our tables in the 2018-19 financial year, with deal values of $20.5bn.

And although IBC sales are basically takeovers of one company by another, for lawyers the process can be very different from a vanilla M&A transaction.

For one, the IBC process has been fraught with huge delays, as an “entire ecosystem is getting used to the fact that people can lose money, that promoters can lose money,” explains one partner. In part, the issue can be about ego: a promoter doesn’t want to give up their company, and therefore interferes in the process with legal and other challenges, despite in most cases not even being allowed to regain control of the company.

L&L partner Bikash Jhawar explains that the system has responded well overall and would become more efficient, but it had not been “prepared to respond to the amount of cases or even legal argument that came up – bankers, lawyers, judicial systems – all were flooded with matters and a regular feast of arguments on technicalities”.

There are usually at least three meaty roles in an insolvency, and each of them generally pay well, though in very different ways. “Charging is similar to what you would for a complicated M&A transaction,” says one corporate partner, adding that bankruptcies will also draw in legal expertise in antitrust, litigation and lots of other practice areas.

The RP

“The resolution professional (RP) mandate is, from an earnings perspective, maybe the best mandate,” says one partner who has been active in the space.

An RP basically steps in as de facto interim CEO to run the bankrupt company while it’s being saved. Parachuting into a failing business, trying to keep it going and finding ways of giving creditors their dues is a tough job, and RP’s charge appropriately astronomical fees, dwarfing even lawyers’. However, the role is also largely a custodial one for the RP, and for lawyers this can be a gold mine of steady, predictable advisory work, explains the partner.

A law firm working for the RP could be advising the RP on a daily basis on nearly all company business and matters, on top of issues relating to the insolvency process itself. And so, the expected fees can be solid, predictable and keep teams occupied for a long time (more below).

As an added bonus, it is a very low-risk mandate: since RP’s decision-making power is limited, their appointment does not generally get challenged in courts.

But in the mega-insolvencies it can be hard for anything but the largest firms to play ball in that court, depending on how the RP likes to run their ship. “For RP [mandates], you need a large bench strength,” comments a partner at a small firm, but adds that work does exist for smaller players particularly in advising investors, the banks or on ensuing litigation.

The COC

The committee of creditors, also referred to as the CoC in IBC-speak, is also an interesting role for a law firm. If not generally as lucrative as the RP mandate, it can bring in significant work for other departments.

The COC is usually a committee of banks and other creditors of the insolvent company, who will need negotiate hard with any potential buyers, saviours and vultures about commercials, to ensure they get as much of their money back as possible without sinking the company and within the ambit of the insolvency framework policed by the court.

But, the role of the COC has also been exposed to numerous legal challenges. While law firms’ litigation partners may generally welcome such excursions to the bench, clients will be less excited.

The bidders

Acting for a bidder in an IBC resolution is much more akin to traditional M&A, with an edge. Seeing as it’s usually a competitive process, in the words of one partner, “sometimes you win, sometimes you lose”.

Besides the anti-climactic disappointment for a law firm that acts for a ‘loser’ in a bid, it can mean forgoing a chunk of billings. “The gap [in fees] is likely to be significant,” says AZB & Partners’ Ashwath Rau, who is also top of our Corporate Dealmakers of the Year. “Post bid acceptance, there is a lot of legal work to be done – not just the NCLT [National Company Law Tribunal] process, but working with the RP to ‘close’ under the bid, and typically there is also a lot of work to be done post-closing.”

There are only few companies or investors who will be able to stomach delaying their desserts – and earmarking the funds – for as long as many of the big resolutions have taken: nearly 700 days now in several cases.

“I am not sure how many [companies] are looking at [insolvency] as a great avenue to undertake M&A transactions because people don’t have full visibility on the time lines in such a process,” says one corporate partner at a large firm. “There are only a few buyers who will venture into such a process, rather than all of them. As time passes, people will get some more clarity.“

The law firm players

While nearly all law firms have been interested in capturing a piece of the insolvency pie, expertise and the accompanying adventuring spirit has been showcased the most by the large firms.

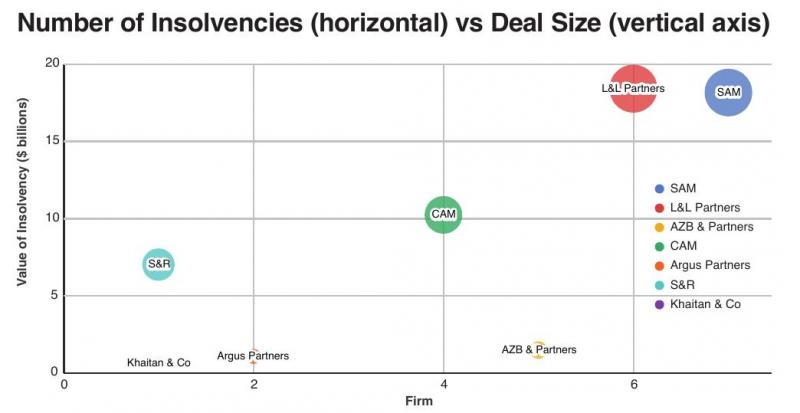

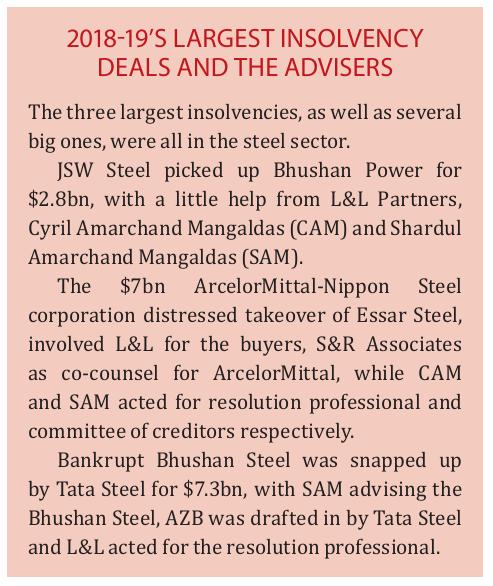

Shardul Amarchand Mangaldas has been present on pretty much all of the mega insolvencies with a total count of seven and aggregate values of $18bn. Two of those instructions were for the committee of creditors, and two for the resolution professional.

L&L Partners has been neck-to-neck with SAM, having acted on six insolvencies worth more than $18bn. Three of its mandates were for the resolution professional, while the other half were for steel majors that had been victorious in their bids (with two of these for the voracious JSW Steel, alone).

AZB & Partners, in its five insolvency mandates, acted for the resolution professional twice, and for its close clients Tata Steel and Reliance Industries in two others.

Cyril Amarchand Mangaldas, on the other hand, has thrown its hat in the ring for the committee of creditors in three of its four insolvency mandates, and once for the resolution professional.

{module 544}

threads most popular

thread most upvoted

comment newest

first oldest

first

threads most popular

thread most upvoted

comment newest

first oldest

first