Current Macroeconomic Environment In Russia

Russia is a vast, resource-rich country with immense diversity and a lot of potential. After the turbulent 90s, Russia experienced over a decade of high economic growth. In the last few years, however, economic growth has stagnated: mainly due to the dramatic drop in the world market price for oil, sanctions imposed against Russia following the onset of the conflict with Ukraine and lack of structural reforms in the economy. According to the International Monetary Fund (IMF), Russia’s GDP decreased 2.8% in 2015 and 0.2% in 2016. Beginning this year, a gradual economic recovery is expected: IMF projects that the Russian economy will expand by 1.4% in each of 2017 and 2018. As the economy in Russia is returning to growth, foreign investors are taking a fresh look at the opportunities in the Russian market.

Overview Of Russian M&A Market

The Russian M&A market is recovering. According to Mergermarket, the aggregate deal value of Russian M&A equaled USD35 billion in 2016: there were 172 deals and the average deal size was USD203.5 million. The largest M&A deals involving foreign investors were:

- USD10.8 billion privatization of Rosneft by Glencore Plc (Switzerland) and Qatar Investment Authority (Qatar); and

- USD2 billion acquisition of a minority stake in Vankorneft by Indian Oil Corporation Ltd, Oil India Ltd and Bharat Petroleum Corp Ltd (all – India).

Russia’s energy, mining and utilities sectors were the dominant sectors in Russian M&A over the last few years. Other sectors that exhibited strong investor interest included consumer, TMT, pharma, Internet, industrials and chemicals.

India – Russia M&A

Over the recent years, there has been an increase of inbound M&A deals with India:

- India has become one of the most notable investors in Russia: ONGC Videsh, a subsidiary of India’s NOC, paid Rosneft USD1.3 billion for a 15% stake in Vankorneft, owner of the Vankor oil and gas deposit in eastern-Siberia, and Lupin, an Indian pharmaceutical company, acquired the Russian generic drug manufacturer Biocom for an undisclosed amount;

- In 2016, India was the 2nd largest foreign bidder on the Russian M&A market.

Overview Of Business Relations Between Russia And India

Russia has always enjoyed a special relationship with India, with close ties going back to the 1950s. The Russian Government is interested today in closer cooperation with India as one of its most prospective business partners in the Asia-Pacific region.

Potential for bilateral trade and investment is not fully unlocked: in 2016 the bilateral trade was USD7.7 billion. In a way to re-establish “the special and privileged nature” of the strategic partnership, Russia and India have set the goal of boosting bilateral trade to USD30 billion by 2025.

Overview Of Foreign Investment Regime In Russia

Over the recent years, the Russian Government has taken a number of measures aimed at the liberalization of the business environment, in particular: implementation of fundamental legal reform and introduction of greater transparency of Russian business.

Selected key legal developments

Recent legal developments have been primarily aimed at modernizing the legal system, improving corporate governance and strengthening compliance:

- introduction of explicit general obligation to act in good faith (applicable to all civil law relations, including corporate governance);

- introduction of new legal concepts into Russian civil law (e.g., representations, indemnities, option agreements, conditions precedent, guarantees, framework agreements, break fees, and rules for conducting negotiations);

- acknowledgement and regulation of shareholders’ agreements, which may provide for, inter alia, concerted voting by shareholders, put/call options, transfer restrictions, etc.;

- more flexible corporate governance in non-public joint stock companies: corporate charters may now expand the authority of shareholders’ meetings, delegate matters from shareholders to the supervisory board or executive bodies;

- amendments to ‘interested party transaction’ regulation: introduction of the concept of ‘controlling person’, elimination of mandatory preliminary approval, and expansion of the list of transactions exempted from the approval requirement;

- improvement of anticorruption and antitrust compliance: requirement that all companies operating in Russia adopt measures aimed at preventing corruption; antitrust compliance is promoted by the Russian antitrust authorities;

- improvement of commercial (‘arbitraj’) court system: increase of accountability of judges, measures to improve transparency of court hearings and decisions, random assignment of cases, focus on quality of the written decisions and an aggressive anticorruption campaign.

Structuring And Evaluating Acquisition Of A Russian Private Company

A Russian private company is formed either as:

- Joint Stock Company (JSC), which issues shares; or

- Limited Liability Company (LLC), which has participation interests.

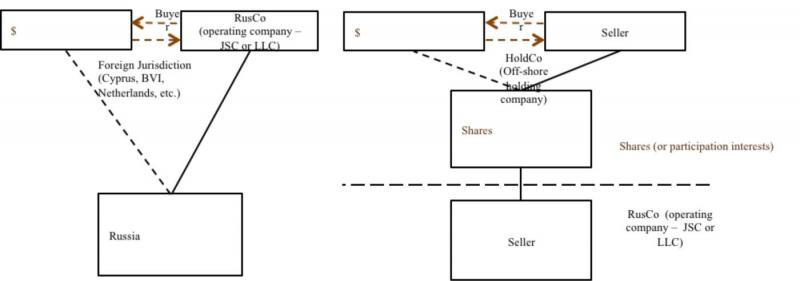

A Russian private company may be acquired directly, as an acquisition of shares (or participation interests), or indirectly, via acquisition of an off-shore holding company (see diagram on next page).

Statutory reorganization (combination or merger) is also possible, but is rarely used.

Due Diligence

Due diligence is one of the key ways to identify risks and past violations and ensure compliance with laws after the closing of the acquisition. General legal due diligence review of a Russian target company must be tailored to:

- industry-specific issues: licensing, industry regulations and market restrictions, environmental, workers’ safety, etc.; and

- specifics of the target company: legal form of the company, history of privatization or reorganization, shareholding structure, subsidiaries and intra-group relations, market position and governmental relations.

Due diligence review of a Russian company requires a thorough assessment of the company’s compliance with anti-corruption laws: Russian anti-corruption laws, and if applicable, U.S. Foreign Corrupt Practices Act (“FCPA”) or U.K. Bribery Act (“UKBA”).

It may be prudent to conduct background checks of shareholders, affiliates, managers and service providers. Foreign investors should also assess whether the target and its shareholders are subject to any sanctions imposed by U.S. and E.U. and many other countries following the emergence of hostilities in Ukraine, and whether the target is conducting any business in violations of such sanctions or is involved in transactions that may expose it to such sanctions.

Ownership and control

The success of a business in Russia is often directly related to the owner/founder, and established relationships, the value of which could be lost in any sale of a controlling stake. In such circumstances, a foreign investor may acquire a non-controlling stake, perhaps with an option to acquire control later. Alternatively, the investor may acquire majority control but require the seller to retain a minority interest in the company.

Certain regulatory restrictions on foreign ownership may apply, particularly if the target company operates in one of several “strategic” sectors.

Anticorruption compliance

Despite efforts to strengthen anticorruption legislation and enforcement in Russia, the country still receives low rankings in global corruption surveys. Foreign investors should implement robust compliance programs post-closing to ensure full compliance with FCPA, UKBA (as applicable) and Russian legislation. Russian anti-corruption laws currently provide for substantial liability for companies and there is increased drive to prosecute corruption cases in all types of Russian companies.

Key Deal Terms In Russian Private M&A

Preliminary non-binding documentation

Before starting negotiation of definitive agreements, the parties may want to set out their preliminary understanding of the proposed deal in a non-binding letter of intent (“LOI”) or memorandum of understanding (“MOU”).

Even if the LOI or MOU is described as non-binding, to avoid dispute it should also specify the governing law (usually the same as the definitive agreements). Under Russian law, a purportedly non-binding LOI or MOU may be deemed a “preliminary agreement”. To the extent the terms are sufficiently specific to be legally actionable, a Russian court may hold the parties bound by such preliminary agreement.

Choice of law

English law is common for Russian private M&A deals involving foreign investors for the following reasons:

- better availability of buyer protections (representations and warranties, indemnities, etc.);

- familiar to most foreign investors;

- a long history of judicial interpretation; and

- large pool of quality English law arbitrators.

However, Russian law is mandatory in certain transactions, such as the acquisition of Russian real estate or any interest in a Russian LLC (which requires a notarized agreement). Where necessary, the parties may use both Russian and English law by entering into Russian law-governed transfer agreements and separate English law-governed off-shore “transaction agreements” or other arrangements.

If an M&A transaction contains a “foreign element”, such as an off-shore holding company and/or guarantor, parties may choose a foreign governing law.

Dispute resolution

Foreign arbitration is common for Russian private M&A deals with foreign investors:

- typical venues: London Court of International Arbitration (LCIA); International Commercial Court (ICC) and Arbitration Court of the Stockholm Chamber of Commerce; recent trends suggest a growing preference for Asian arbitration centers (e.g., HKIAC, SIAC);

- preferred seats: London, Paris, Geneva, Zurich, Vienna, and Stockholm.

Significant changes to the Russian arbitration rules came into force on September 1, 2016, which clarified that share purchase agreements related to acquisition of shares or interests in Russian companies can be subject to foreign arbitration, while shareholders agreement with respect to shares or interests in Russian companies must be subject to arbitration (to the extent such disputes are arbitreable under Russian law) or litigation in Russia.

Agreements to submit disputes to foreign courts are generally recognized by Russian courts, but it may be difficult to enforce foreign court judgments in Russia if no international treaty applies and judicial reciprocity is unlikely. Foreign arbitral awards are generally enforceable in Russia in accordance and subject to the terms of the 1958 New York Convention.

Closing conditions

In Russian private M&A, it is common to have relatively few closing conditions, but the extent of conditionality can vary greatly from one deal to another, depending on the parties’ respective concerns and relative negotiating strengths. Regulatory approval is almost always included as a closing condition:

- may be limited to Russian antimonopoly approval (necessitating prior determination of applicable regulatory requirements);

- the buyer may be required to give specific undertakings to obtain approval in a timely manner.

Financing conditions are rare, even if the deal will be financed. Material adverse effect conditions, if included, are usually heavily negotiated. Longstop dates are common, reflecting the parties’ mutual interests in certainty and closing the deal as soon as practicable. Reverse termination fees may apply, if negotiated as part of the deal.

Representations and warranties

Determining appropriate representations and warranties is best accomplished as part of the due diligence process.

In Russian private M&A, it is advisable to get coverage of anti-corruption, sanctions and other compliance issues, but these can be contentious.

Buyer should scrutinize the seller’s authority to execute the transaction documents and perform their obligations in relation to the transaction and demand detailed representations and warranties to back this up.

Post-closing

Specific indemnities are relatively common, although determining the scope can be a particularly challenging aspect of negotiations. Whilst in a 100% sale it is typically appropriate for the seller to provide some indemnity coverage, this is less apparent in a minority investment.

Purchase price adjustments are a more straight-forward way of sharing valuation risk. In Russian private M&A, escrow arrangements are not common, as they are difficult to set up on acceptable terms, and agreeing those terms can delay or disrupt the deal. It is more common to have holdback amounts, but this depends on the type of deal and the parties’ relative negotiating strengths.

Shareholders’ agreements

Shareholders’ agreements in respect of Russian private companies tend to contain provisions similar to those found in a typical international M&A deal:

- governance, both in terms of governance bodies and management appointments, as well as veto rights and dead-lock resolution provisions;

- accounting and other reporting requirements and information access rights;

- non-compete / non-solicit provisions;

- share transfer restrictions: preemptive rights, tag-along rights and drag-along rights;

- put/call options; and

- exit arrangements, particularly in shareholders’ agreements with private equity investors.

While agreements among shareholders of a Russian company may be subject to foreign law, depending on the scope of rights covered by such agreement, Russian law may require that disputes under such agreements are resolved in Russian courts or arbitral tribunals in Russia. Foreign investors often prefer to establish an offshore company to hold shares in the Russian company and enter into a shareholders’ agreement under foreign law subject to arbitration outside Russia.

Russian Regulatory Regime

A transaction involving a direct or indirect acquisition of a Russian company may require the following regulatory approvals:

- competition clearance for most acquisitions of more than 25% interest in a Russian company;

- strategic investment clearance for acquisition of control if the target is engaged in any “strategic activity”, with lower threshold (more than 25% interest) if the target is a “strategic subsoil user”, and even lower threshold (more than 5% interest) where the acquirer of “strategic subsoil user” is controlled by a foreign government or international organization; and/or

- other industry specific M&A regulatory approvals depending on the industry sector of the target (e.g., banking).

FAS is responsible for issuing competition clearance: it must issue its decision within 30 days but it can extend the review period by up to 2 months.

The Governmental Commission for Control over Foreign Investments in the Russian Federation is responsible for issuing strategic approvals; applications are submitted via FAS. It typically takes from 3 to 6 months to obtain approval.

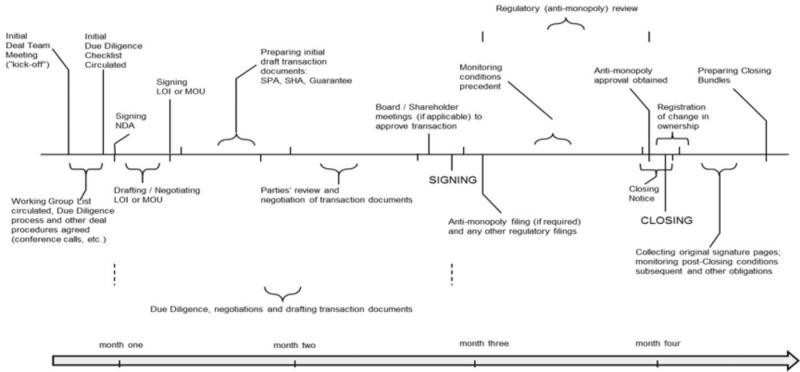

Typical Deal Timeline

Typical deal timeline in Russian M&A looks as below:

Authors

Alan Kartashkin (Moscow office)

Partner

Alan Kartashkin is a partner based in the Moscow office. His practice focuses on M&A, securities and corporate finance.

Geoffrey Burgess (London office)

Partner

Geoffrey Burgess is a corporate partner in London with a broad international practice, particularly in emerging markets and aviation. Mr. Burgess speaks Russian and leads Debevoise’s corporate practices in India and Africa. He is recommended by various legal guides for his work in Russia and India.

Debevoise & Plimpton LLP

www.debevoise.com

This article is brought to you by India Unleashed

India Unleashed is a print and online publication by Global Legal Media and Legally India, providing country-by-country insights and sector-specific analysis from leading law firms and writers around the world.