India and Japan share a long history. Buddhism, which was born in India, travelled to Japan around the 6th century. The first major interaction between Japan and India seems to have been Japanese assistance to Shri Subhash Chandra Bose in the fight for Indian independence (1943-45). Post WWII, Japan and India signed a peace treaty and established diplomatic relations on 28th April, 1952. Since then, there have been interactions between Japan and India at various levels, which have increased in the last couple of decades.

Japanese investment into India

For the third consecutive year, India has been ranked as the most attractive investment destination in the latest survey of Japanese manufacturing companies, conducted by Japan Bank for International Cooperation (“JBIC”). The top response for India being considered as promising was “Future growth potential of local market”.

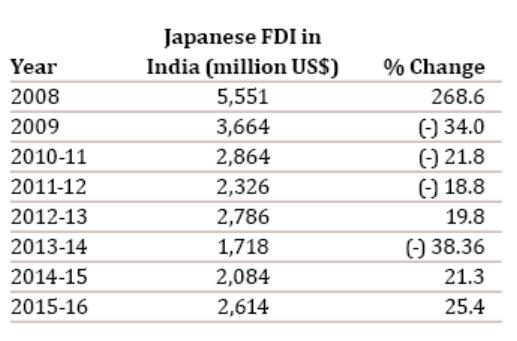

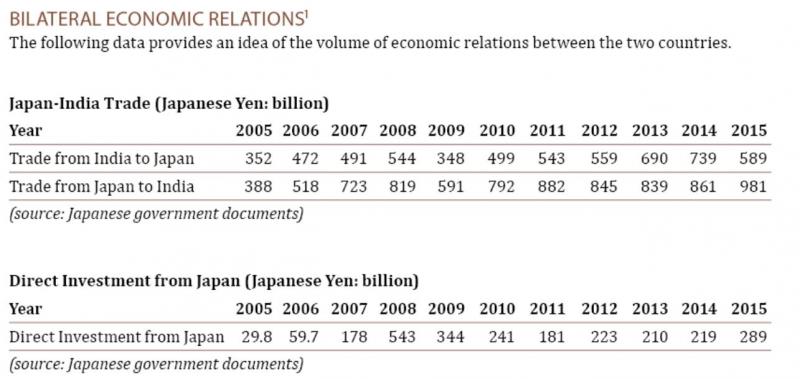

According to information available on the web page of the Embassy of India, Tokyo, Japan, Japanese FDI in India has increased in recent years. In terms of cumulative FDI inflows into India, Japan is India’s fourth largest source of FDI. Japanese FDI in India grew exponentially from US$139 million in 2004 to an all time high of US$5,551 million in 2008 due to mega deals, particularly the acquisition of Ranbaxy by Daiichi Sankyo. In the last two years, Japanese FDI into India increased from US$ 1.72 billion in 2013-14 to US$2.61 billion in 2015-16. The amount of Japan’s cumulative investment in India since April 2000 to March 2016 has been US$ 20.966 billion, which is nearly 7 per cent of India’s overall FDI during this period. Japanese FDI into India has mainly been in the automobile, electrical equipment, telecommunications, chemical and pharmaceutical sectors.

According to information available on the web page of the Embassy of India, Tokyo, Japan, the number of Japanese affiliated companies in India has grown significantly in recent years. As of March 2016, there were 1,209 Japanese companies that are registered in India, an increase of 137 companies (13%) compared to 2013. These companies had 3,961 business establishments that are operating in India, which is an increase of 1,419 establishments (56%) compared to 2013.

According to JETRO’s press release: the total number of Japanese companies registered in India, as of October 2016, is 1,305; the total number of Japanese business establishments in India, as of October 2016, is 4,590; over the last one year, the number of companies has increased by 76 (6% growth) as compared to 1,229, as of October 2015; and, similarly, the number of establishments has increased by 173 (3% growth) as compared to 4,417, as of October 2015.

India: An attractive destination

India is one of the most attractive investment destinations because of various reasons including stable government, rule of law (albeit slow), big consumer class coupled with a rapidly growing middle income class, and a large literate young population. There could not be a better source to confirm this than the United Nations Commission on Trade and Development (“UNCTAD”) World Investment Report 2016, wherein India ranks as the 3rd most prospective top destination (after the United States of America and China) by multinational corporations. Thus, the attractiveness of India is beyond doubt.

The interaction between Japan and India on the social-political as well as the economic front is, one may say, recent, unlike India’s long interaction with Russia, UK (and other parts of Europe) and the United States. However, the amiable relationship between the two countries and the past economic and cultural association are strong points in the Japan-India relationship. Both countries complement and supplement each other. Japan is a technology rich country with superior management and other techniques, but is concerned about the issues of availability of manpower and is facing a population decline. Japan needs to invest outside in order to maintain its growth momentum. India is rich with natural resources but short of technology, management techniques and lastly, capital. This presents a unique opportunity for both countries to come together for mutual benefit not only in the economic field but also for geo-political reasons.

Japanese investments into India

If one were to consider the sectors where Japanese investment has happened in India it is apparent that investment is spread across traditional brick and mortar businesses to new age industries comprising IT based and E-commerce. Not only have Suzuki and SoftBank made investments into India, but there have been other successful Japanese investments such as those by Honda, Hitachi, Nissan, Toyota, Daikin, Eisai, Meiji Seika Pharma, Nippon Life, Sompo Japan Nipponkoa, Bank of Tokyo Mitsubishi UFJ, Mizuho, Sumitomo Mitsui, Mitsui & Co., Sumitomo Chemicals, Zuken Inc. and BANDAI NAMCO, to name a few.

The share of Japan in overall foreign investment in India is 7% as per the Government of India statistics for the period April 2013 to March 2016. According to the same statistics, Mauritius is the front runner with a 33% share. Much of the investment from the United States of America is routed through Mauritius for tax efficiency. Consider this with the fact that Japanese investors are allocating more capital to Southeast Asia. FDI flows to the ASEAN-6 countries (Singapore, Thailand, Malaysia, Indonesia, Philippines and Vietnam) have averaged US$20 billion per year for the past five years (except for 2012 when investment in Thailand fell sharply after severe floods). Compare this with the US$2.61 billion that Japan invested in India in 2015-16. This means that there is still a huge potential for increasing Japan’s investments in India, which needs to be utilized fully.

Can India attract more Japanese investment and what needs to be done?

India can attract a sizeable Japanese investment. An individual Japanese investment is more sizeable compared to other country investments. Further, the investment outlook tends to be more long term. Apart from technology, investment by Japanese companies brings the famous Japanese work culture, way of living and other aspects of Japanese culture. In a nutshell, it is a win-win situation for India.

The question one often hears back in India is what can be done to increase the flow of Japanese investment into India. It is a difficult question and the authors feel that there is no one answer. Before attempting to answer the question, it would be useful to have a broad understanding of Japan and how it compares with India. Unlike Europe and the United States of America, Indian interaction has been less with Japan.

A brief comparison of the Indian and Japanese environment follows (see chart on next page.) (Some may feel that the following chart is, to some extent, very broad. We believe that, for the purpose of comparison, the chart would be useful – however, at the same time, please bear in mind that this chart may not always be applicable to any and all cases.)

Thus, there is wide diversity in India. India is a diverse nation in many respects. When compared to this, Japan is not diverse.

It would be useful to understand some of the key focus areas for Indian parties to work upon to attract an even higher number of Japanese investments. The readers may note that the following is a high-level summary and may not necessarily apply to every case.

1. Time management

Two aspects immediately come to mind, first the unrealistic business expectations of Indian promoters, and second is lack of detailed planning and lengthy negotiations. The general view outside India is that a lot of time is spent on avoidable negotiations. To provide an example to help people back in India to understand the Japanese sensitivity one can consider the fact that the annual average delay for the Shinkansen (bullet train) is 0.9 minutes per operational train (FY2013, including delays due to uncontrollable causes such as natural disasters)13. Thus, time is money and not understanding the way business is done in matured markets like Japan can be a serious hindrance to business growth. At the same time, readers may note that the players from matured markets like Japan are understanding of the difficulties/bottlenecks faced by an emerging market player like India. Therefore, a realistic and fair understanding about the entire process provided to the Japanese counterparty in the initial stage would help the counterparty to anticipate and plan for it.

2. Predictable regulatory framework and time bound approval mechanism

The Indian regulatory framework is evolving and at times has been a bit ambivalent. Be it the constant clarifications to the Consolidated Foreign Direct Investment Policy (some of which are retrospective in effect) by both the Government of India and the Reserve Bank of India, or the amendments/clarifications to the Income Tax Act, these make the international sophisticated investor like the Japanese investor uncomfortable. From an administration of policy perspective, if something has not been included or is not clear, then the risk should not be passed on to the business community by making the clarifications effective retrospectively. Also, there is a general perception that the administration of the regulatory and legal framework by various governmental authorities has not been uniform. We would like to add here that recently there have been lot of efforts by the Central and State Governments for addressing this issue, which is a good development and hope that the efforts are accelerated.

3. Predictable tax system

The Indian direct and indirect tax system needs overhaul. Aggressive tax policing by the authorities have led to delays and litigation. The enforcement of the GST (replacing the Central and State Sales Tax and Value Added Tax) later this year would alleviate the concerns to an extent. But without a proper and efficient administration of the laws the exercise would not be complete.

4. Fast and effective dispute redressal mechanism

The courts and alternative dispute redressal mechanism also needs overhaul. Making massive investment in the soft and hard infrastructure by the Central and State Governments coupled with initiating stringent action against parties or their advisors who cause delays (like imposing exemplary costs) would be required.

5. Ease of obtaining and maintaining business licenses

The Central and State Governments need to have a re-look at the laws and the rules with a view to ensuring that there is clarity on the documentation process whilst applying for licenses as well as expedite the approval process. During the tenure of the license compliance requirements and processes need to be made business friendly. Recently, there have been some measures by the central government followed by some State Governments; however, we feel that this process needs to be accelerated.

6. Awareness about India in Japan

Lastly, the authors would like to suggest a massive initiative from the Central Government (with active participation from the State Governments) to make people in India aware of Japan, its culture, ways of doing business, climate and the general way of life in Japan. Simultaneously, they should also initiate programs with the Japanese Government to increase awareness in Japan of India and the Indian way of life. Some of the developing countries like China do have such awareness programs for their citizens, which have proven to be quite helpful.

We feel that this article would be incomplete if we were not to acknowledge the various good aspects about India like the English speaking literate population, hunger amongst the youngsters to excel and imbibe good foreign values, various inherent soft skills and many others, which have led to India being ranked as the 3rd most prospective top destination (after the United States of America and China) by multinational corporations14.

On the eve of the 70th anniversary since India became independent on 15th August 1947, there is a huge opportunity for India to lead and become the engine of growth in the world. Japan and the business community in Japan would be extremely happy to partner India in this progress.

A brief comparison of the Indian and Japanese environment

| India | Japan |

| India is a subcontinent. | Japan is an archipelago, an island nation. |

| The Indian subcontinent has been subject to repeated invasion and foreign rule. | Japan has never been under foreign rule except the Allied occupation during 1945-1952. |

| The current population of India is approximately 1.33 billion based on the latest United Nations estimates. This population is equivalent to 17.86% of the total world population. 32.8 % of the population is urban. The median age in India is 26.9 years10. | The current population of Japan is approximately 126 million based on the latest United Nations estimates. It is equivalent to 1.68% of the total world population. The median age in Japan is 46.9 years11. |

| Adult literacy rate is 74.04% with male literacy at 82.14% and female literacy at 65.46% as per the 2011 Census12. | Adult literacy rate is almost 100%. |

| India is a federal union comprising 29 states and 7 union territories. The states and union territories are further subdivided into districts and further into smaller administrative divisions. There is a parliament at the Centre in Delhi and similar parliaments for each state, which are further sub-divided in to smaller administrative structures called Districts. Each District has their administrative capital. As of 2016 there are a total of 707 districts in India. Distributed and decentralized administration. | There is no concept of states in Japan, and therefore there are only the central Japanese government and local or municipal governments (such as Tokyo metropolitan governments and other prefectures, and cities, wards, towns and villages). Some of the local and municipal governments such as Tokyo metropolitan government are important, and local or municipal governments have their governors/mayors and Assembly or council; however, the central Japanese government and the Diet are quite important. Although local governments’ autonomy has been paid attention to, relatively, there is unified administrative structure. |

| The Indian Constitution lists 22 languages with numerous dialects. | The Japanese Constitution is described in Japanese only. |

| The Indian subcontinent has different climate and topography depending upon the region, ranging from desert, snow, tropical and dry climate. | Japan has four seasons which are relatively uniform. |

| Indian business culture (and to an extent social culture) is relatively informal. The business culture, recently, is developing to be much closer to the American business culture. | Relatively formal and hierarchical culture, both social as well as business; however, depending on the time and place, this may be informal. Formality is observed by persons in Japan according to the relevant situation. |

| Leadership or top driven. | Said to be consensus driven; however, depending on the place or situation, leadership or top driven. |

About the authors

Hiroyuki Sanbe, Attorney-at-law admitted in Japan, is a Partner with Atsumi & Sakai. Hiroyuki has represented foreign and Japanese companies in numerous domestic and cross-border M&A and other investments including ones involving Indian companies. His experience includes advice on various corporate and financial regulatory compliance matters. Hiroyuki is a core member of the Innovation Practice Group of Atsumi & Sakai which supports businesses related to recent innovations such as IoT, AI and Fintech. He is a Member of the subcommittee on AI R&D Principles of the “Conference toward AI Network Society” of the Ministry of Internal Affairs and Communications of Japan, and Atsumi & Sakai acts as a secretariat of the FinTech Association Japan. Hiroyuki is the co-manager of the India Team.

Ashish Jejurkar, Advocate & Solicitor, is currently an Of Counsel with Atsumi & Sakai. Ashish is admitted as an Advocate & Solicitor in India. Ashish has worked in Mumbai, India for 16 years and earlier had been the Partner with Cyril Amarchand Mangaldas, which is the largest law firm in India, and was the Corporate, M&A, Regulatory and Compliance Partner before joining Atsumi & Sakai. He has advised on various cross border deals and has interacted regularly with various regulators in India. Ashish has been consistently rated for his client facing and solution oriented skills by the RSG India Report which is considered as the primer on Indian lawyers and law firms. Ashish is the co-manager of the India Team.

Footnotes

10 Worldometers, India Population (www.worldometers.info/world-population/india-population). Data was shown at this website as of 30 March 2017.

11 Worldometers, Japan Population (www.worldometers.info/world-population/japan-population). Data was shown at this website as of 30 March 2017.

12 Office of the Registrar General & Census Commissioner, “Provisional Population Totals : India : Census 2011” (www.censusindia.gov.in/2011-prov-results/indiaatglance.html).

13 english.jr-central.co.jp/about/punctuality.html

14 UNCTAD, World Investment Report 2016 (unctad.org/en/PublicationsLibrary/wir2016_en.pdf), at pages 27 and 28

Firm profile

Atsumi & Sakai is a multi-award-winning, full-service Tokyo law firm, and is the only independent Japanese law firm with overseas offices in both London and Frankfurt. The firm operates as a foreign law joint venture, which enables it to admit foreign partners and so offer its clients the quality of service that the modern international business community demands. Expanding from its highly regarded finance practice, the firm now acts for a wide range of international and domestic companies, banks, financial institutions and other businesses, offering a comprehensive range of legal expertise.

An International Practice

Atsumi & Sakai has an outward-looking approach to its international practice, and has several foreign lawyers and consultants with extensive experience from leading international law firms, so providing its clients with the benefit of both Japanese law expertise and real international experience.

As a member of a number of global legal networks, and having had many years’ experience in working with international law firms, the firm is able to assist clients in the selection of overseas counsel and to work on cross-border transactions with foreign lawyers it is familiar with.

Innovation & Value

The firm constantly seeks to anticipate its clients’ needs for new legal services, most recently by bringing together lawyers from various areas of expertise across the firm as a practice group to address issues arising from the rapid technological developments in the financial services industry, the Internet of Things (IoT), big data, artificial intelligence (AI) and cloud computing.

We are also conscious that, in a very commercially-focused business environment, clients look to their legal advisers not only for expertise, but also for value-for-money, and we are happy to discuss both constructive fee arrangements and added-value services, such as secondments, helplines and legal updates.

This article is brought to you by India Unleashed

India Unleashed is a print and online publication by Global Legal Media and Legally India, providing country-by-country insights and sector-specific analysis from leading law firms and writers around the world.