The Indian legal talent market remains buoyant as we move through 2017 and we see strong hiring activity continuing across both private practice firms and in-house legal teams. This positivity can be attributed to the fact that Indian industry has witnessed a steady rise over the past few years in terms of productivity, expansion and revenue.

The Modi regime has brought about many positive changes (like the Make in India campaign) to help promote India as a global player and to attract inward investment, and we have seen the macro level rise of the legal industry in consonance with the economy as a whole. It is estimated that Indian GDP will grow around 7.1% and India will remain one of the most attractive destinations for investment and other economic activities. India has been one of the most sought-after places to do business since 2009/10; FDI inflows into India in 2016 jumped 18% to USD46.4 billion at a time when Global FDI fell. New liberalization steps by the government contributed to attracting FDI in all quarters last year and India was the 10th largest recipient.

This is a clear indication of the bullish market sentiment towards investing, thus increasing the need for lawyers and legal professionals on both the in-house as well as private practice side.

Legal talent requirements have expanded and the market, albeit being a little saturated per global cues, remains open for strong and proactive talent.

In-house legal

From being an internal support function, the in-house counsel of today has transformed to being an important business partner. We have been witnessing in-house legal teams expanding their scope of work to backing and sometimes spearheading growing business needs. With more and more MNCs setting up shop in India, there is a clear and obvious need for legal professionals who can assist these corporations in the day-to-day running of their operations and hence, there is demand for lawyers with good pedigree and experience.

Some of these MNCs are strategically moving on to have diverse teams and this year we saw demand for women lawyers increase for specific roles at companies in the FMCG and financial services space. Business strategies call for lean resourcing so most hiring has been at senior (GC) and mid-levels. From being ‘one of the many employees’, GCs are now being viewed as a key employee and are considered part of leadership teams at most corporate houses. Companies are also realizing the importance of having separate legal and compliance functions, especially in circumstances where companies are in a highly regulated sector such as financial services, insurance, telecom, and pharmaceuticals such as lifesciences, healthcare and medical devices. We are also progressively seeing mid and senior level private practice lawyers wanting to move in-house to avoid increasing pressures like book building, client generation and business development.

Until now, the usual protocol has been to delegate work to law firms that are involved in high profile advisory and transaction related work, however, we are seeing a shift to get most of the work done in-house. Whilst the role of law firms can never be ruled out, it is essential that there is a strong base within an organization’s own structure. As a result productivity has increased, efforts are streamlined and costs have been reduced, which was the original purpose in the first place.

Major Sectors in the in-house market

The major players in the market have been investing in various sectors across the country. Whilst working independently, they form an integral part of this ecosystem. Here, we take a closer look at what seem to be the most dominant sectors in the market and how their growth has impacted the economy.

Pharmaceuticals & Healthcare

The pharmaceuticals sector is expected to continue its growth phase with the government allowing 100% FDI under the automatic route for greenfield projects and unveiling the Pharma Vision 2020, which seeks to make India a global leader in the production of end-to-end drug manufacturing. The healthcare sector is also seeing impressive growth and was valued at USD 37 Billion in 2016. Once again, the need for legal talent has been diverse in this sector. In addition to demand for commercial lawyers and contract specialists, the pharmaceutical and healthcare industries also have a regular demand for experts in IPR laws, especially Trademark and Patent specialists.

Information Technology (IT)

As a hub of all things IT, India is one of the big players in this sector. With initiatives like Startup India, the government has been encouraging more investment in IT projects. As we move towards building and sustaining a digital economy, there is a dire need for constant growth in this already flourishing industry which is presently estimated at a total worth of USD 155 Billion. Whilst the growth rate is predicted to be around 5%, less than previous years, the sector continues to command confidence year on year. The IT industry has always been looking at IT / IPR based contracts specialists and contract managers at the junior and mid level. At the senior level, the industry still prefers professionals who have a well-rounded corporate commercial experience with sectoral knowledge.

Manufacturing

The Modi government has ambitious plans to boost India’s image as a global manufacturing hub through the Make-In-India campaign. Its objective is to ensure that the manufacturing sector which currently contributes around 15% of India’s GDP is increased to 25% in the next few years. The lower cost of production means more and more organizations are choosing to start their ventures in India. The hunt for quality legal talent has been diverse, spread over multiple practice areas. Along with corporate lawyers, we have also seen an increased demand for disputes lawyers and labor law specialists. The general trend in this sector is a preference for professionals with a similar industry background, rather than those from private practice.

Infrastructure/Energy

Infrastructure has been one of the top priorities for the government to build and maintain and hence, the government announced a target of around INR 25 trillion for investment in the sector over the next 3 years. With India coming up to 35th place in global rankings of the World Bank’s Logistics performance index, we can be confident that the infrastructure sector will continue to grow at an encouraging pace for years to come. Given the same, more and more companies are investing in quality legal talent who have been well versed with the industry. Private practice lawyers who have worked on infrastructure based transactions and even dispute matters, have been able to build a sizeable and dedicated clientele and are making the transition to in-house to help companies build a stable structure.

E-Commerce

The past few years have seen some very interesting moves (including some large acquisitions) in this market. One of the prime reasons being that this is a consumer-based industry and there has been a significant shift of the market towards online consumption. This trend was highlighted further during the demonetisation days and more and more people took to the internet for their purchases. However, the flipside showed that due to the failure of a few prominent startups, the investment in the sector slowed down by a slight margin over the last year. Interestingly, given the number of investments, mergers and acquisitions in this industry, we have seen an increase in demand for corporate / M&A lawyers. After a lacklustre 2016, we are seeing comparatively positive movement and are expecting the sector to be revived this year.

Financial Institutions

In the day and age of startups, we have seen more and more financing happen in all areas of business. Not restricted to new-age corporations, the financial sector is an ever-growing part and what can easily be defined as the backbone of this economy. Hefty investments are coming through day by day to support organizations in their growth. A definite increase in PE / VC funds operating in the country and their level of interest in India has been a significant factor of growth. With notable growth in avenues like Investment Funds, AMCs and ARCs, the industry has seen several banking & finance lawyers make lateral moves or the transition from private practice firms. Also, with newer and heavier public investment coming through, we have seen a rise in demand for strong capital markets lawyers to help regulate the business.

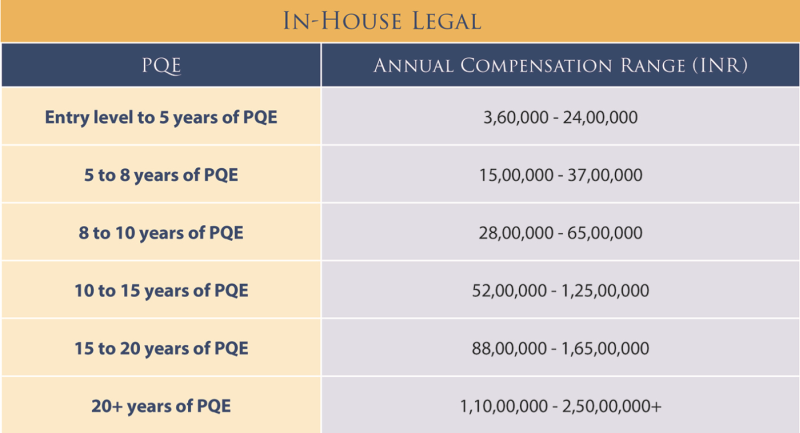

In-house Salary Scales

We have given salaries below in terms of PQE for different levels of experience at prominent corporate houses that have legal teams in Delhi NCR and Mumbai. Compensation at financial institutions may differ widely depending on the role and organization.

Key determinants of compensation:

- Nature of the company: Multinational companies (especially if they are listed) tend to offer better salaries and benefits than their Indian counterparts.

- Location: Salaries offered in Mumbai are generally higher than Delhi NCR and Bangalore.

- The reporting matrix and size of the legal team.

- Market reputation of the organization.

- Pedigree of the professional and additional qualifications (LLM/CS).

Key highlights:

- Businesses and regional counsel have realized that they need more sophisticated in-house legal teams in India and thus, we have been witnessing stricter interviewing processes that range anywhere between 4 to 8 rounds at the senior level.

- In light of becoming more efficient internally and coupled with tightening of the external counsel budget, in-house legal teams are expanding and we are seeing more specialized roles such as disputes counsel, transactions counsel, regulatory and government affairs counsel emerge.

- To attract and retain legal talent internally, structural changes are being brought in where clear progression paths are being laid down for in-house legal teams and competence models are being developed. There has been emphasis on continuous learning and development and we have seen initiatives like executive/refresher courses, soft skills training and internal training being willingly adopted.

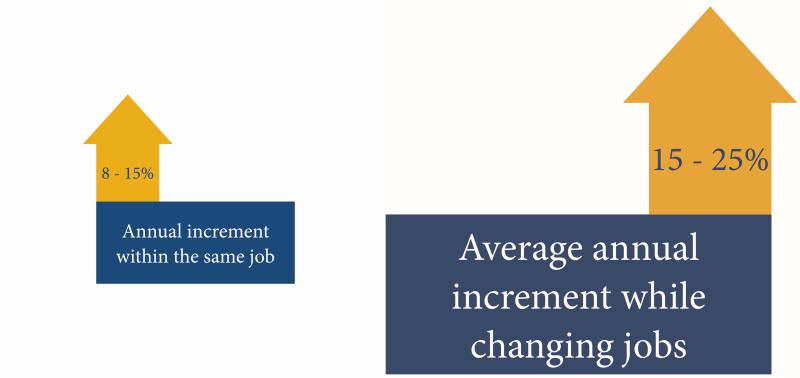

- Average annual increments have remained in the general range of 8-15% so far this year and are between 18-33% when moving jobs.

Private practice firms

The legal talent market has become extremely competitive in the last few years and candidates are more informed about their options. Candidates don’t just rely on a firm’s reputation, they delve deeper to understand the reputation of the partner concerned, internal and external branding of a specific practice, compensation levels, growth path, learning and development or mentorship programs and flexibility to work remotely. The market has become candidate-driven and the hiring mantra has evolved from ‘selecting’ the best lawyers to ‘attracting’ the best lawyers in the market. Candidates are considering firms in terms of the wider benefits and future progression and not just base salary. They are also concerned with the level of mentoring they are likely to receive, and are looking for an open door culture with senior management so they can understand and participate in wider business issues.

The Indian private practice market has had an extremely exciting year. In terms of personnel moves there have been surprises, but the fundamental dynamics have remained stable. With the market considerably open, there is an environment for increased competition and candidates will likely benefit.

A brief overview of the key private practice areas:

Mergers & Acquisitions / Private Equity

The constant flow of work on both the transaction and advisory side has ensured demand for proficient lawyers who can deliver in these sectors. With the inflow of FDI and major M&A deals happening in the country, lawyers with specific corporate and transactional skill sets have been kept busy. In the first quarter of 2017, many transactions have seen multiple firms now act and advise on a single deal rather than just one, as a wide range of skills are needed to consider the complexities involved.

Securities and Capital Markets

Hiring and demand for Indian capital markets lawyers has increased not only within India, but also in other jurisdictions where transactions happen with Indian companies, especially with international private practice firms based in Singapore and Hong Kong. Many professionals have returned to India to work in the capital markets practice area. Indian companies raised almost $3 billion through initial public offerings (IPOs) in the first nine months of 2016, the most since 2007 and hence, the demand for capital market lawyers went up last year and the sentiment this year remains positive.

Competition Law

As the economic forecast has brightened there have been more and more competition cases (on the behavioral and structural side) giving an equal number of opportunities to legal professionals. A testimony to the rising importance of the sector is the fact that in 2016 close to 1,000 cases were filed before the Competition Commission of India (CCI) out of which they had disposed of more than 80% of the matters. There has been a trend for many litigation lawyers to solely concentrate on the behavioral side while corporate lawyers lend their expertise to matters of merger control as well. The role of the CCI in ensuring proper surveillance and effective implementation has ensured that demand for specialized lawyers will remain.

Infrastructure, Projects & Energy

As new government policies have come into place, the need for subject expert lawyers who can deliver real time results in the sector has been relatively high. Boutique and mid-size firms, specialising in infrastructure and projects, have been doing brisk business and attracting talent from large-size firms.

Dispute Resolution

India is famed for its litigatious nature and with the courts being burdened more than ever before, it is not surprising that the country will continue to see more and more disputes being taken to courts or arbitrations. A shot in the arm has been recent judicial pronouncements by the apex court in India that have validated the cross-border arbitration clauses and narrowed the scope of interference in execution of arbitral awards coming from foreign seated arbitrations. Disputes in sectors like tax, construction, energy and the regulatory sector are snowballing and becoming more and more complicated. There has been an increase in demand for lawyers with experience in regulatory disputes, tax and compliance. The prominence of the sector is second to none and in a developing economy like India, disputes will always go hand in hand with the function of the law. The well-known disparity in the pay scales of disputes lawyers and corporate lawyers has lessened significantly as firms are starting to adopt similar pay structures.

Banking & Finance

As a complete practice area, banking & finance has risen to become a force in the past decade considering the post-recession hits on financial institutions across the globe. Due to the banking & finance sector being relatively stable in India and increase in the financing deals last year, specialist banking and finance lawyers have been in greater demand.

IP and TMT

As in previous years, Indian legal industry witnessed good growth in the field of IP, technology, data storage, analytics and data security. As data mining leads to targeted advertising, product development and the ability to provide products and services that are closely tailored to customer’s needs, sectors like financial services, e-health and retail have invested in this field over the last year. Disputes in relation to trademarks, copyrights, patents, trade dress and domain name issues have set new precedents with the Indian courts adopting international principles and ruling to protect IP rights to deter infringers. This has led to the need for specialist TMT and IP lawyers, creating opportunities for law firms to increase their legal expertise in these areas. The full-service law firms are now no longer looking at IP teams as a support function, but are rather focusing on this specialisation as one of their core areas of expertise.

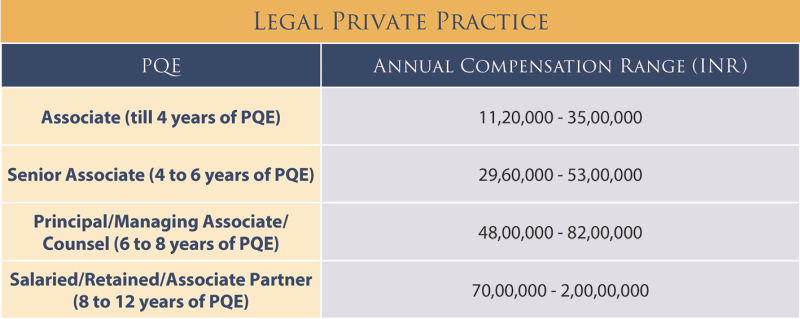

Private Practice Salary Scales

We have given salary figures below in terms of seniority and PQE at reputable law firms across Delhi NCR and Mumbai.

Key Notes:

- We saw some disparity between a couple of prominent law firms on the compensation ranges for corporate and litigation lawyers and hence, the litigation compensation numbers (where different from their corporate counterparts) have not been considered.

- The figures include variable components which could range from 10 - 50% of the total compensation depending on the level of the professional or 1 – 3 months of the fixed monthly retainer at the junior and mid-levels and/or percentage of receipts.

- These numbers do highly depend on the background / pedigree of the professional. Apart from the reputation within the ecosystem of a professional (especially at a senior level), law school, previous firm and years of experience are the major defining factors.

- At the mid and senior level, figures are usually 10 - 15% higher in Mumbai than Delhi.

- Most firms start the process of reviews in the month of January and announce their respective increments with effect from April of the new financial year. Some firms are yet to announce the increments for the current financial year.

- The average increments this year so far have been in the range of 7% - 12% at the top and prominent private practice firms. Some exceptional super performers have been able to attract an increment close to 20% and above as well.

OTHER INTERESTING TRENDS

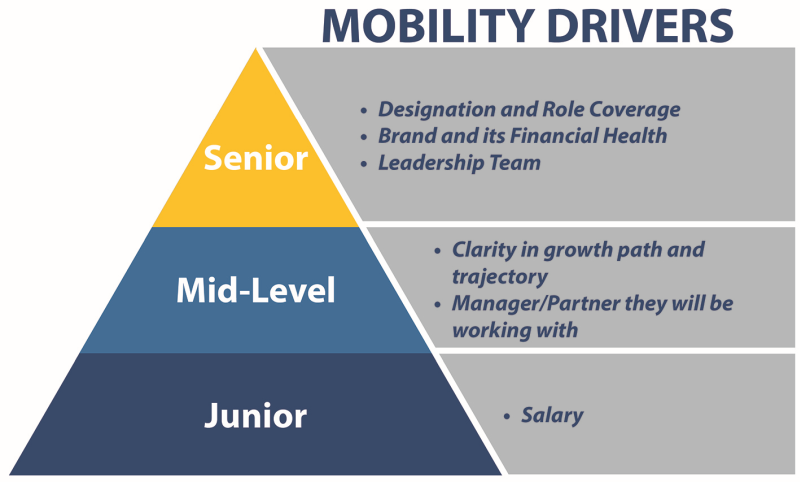

A. Mobility drivers:

When looking for the next career move, the motivating factors for prospective candidates can be multifold: better salary and benefits, designation, job security, work culture, brand of the organization and its financial health, manager or leadership team.

- At the junior level, we typically see better salary as a key motivator to take up the new role.

- Professionals at mid-level are more concerned about (a) clarity in the growth path and trajectory and (b) the manager/partner they would be working with.

- For senior level professionals, (a) designation and role coverage, (b) brand and its financial health and (c) leadership team, are the key motivators.

B. Key barriers to acceptance and onboarding:

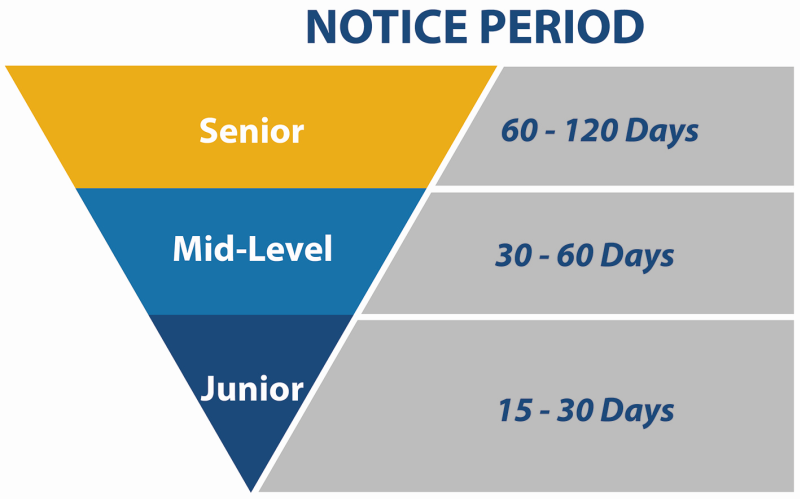

Apart from compensation, competing/multiple offers and long notice periods have been common hurdles in onboarding the right legal talent.

- Multiple offers: Clients that move quickly and confidently throughout the recruitment process without any delays are the most successful. A fast (even if it’s strict) process helps in sending out the right message about the seriousness of the organization in respecting the time of every individual involved in the process which in turn has made candidates take up the offer over others more often.

- Long notice periods: Organizations are becoming increasingly cognizant of the fact that getting the right talent on board is not magic per se - candidates are bound by their professional commitments and employment/ retainer agreements and hence, can have varying notice periods.

As mentioned above, these are heavily dependent on the candidate’s employment/ retainer agreements and the organization’s ability to buy-out the notice period.

C. Demand for Indian private practice lawyers overseas:

As with previous years, there has been demand for Indian qualified lawyers in foreign firms too as firms in Singapore, Hong Kong, Dubai and Tokyo have been ramping up their India-related business. In capital markets, banking & finance and disputes we are seeing the rising need for Indian lawyers, especially those with a New York / California Bar qualification.

This article is brought to you by India Unleashed

India Unleashed is a print and online publication by Global Legal Media and Legally India, providing country-by-country insights and sector-specific analysis from leading law firms and writers around the world.

threads most popular

thread most upvoted

comment newest

first oldest

first

Now corrected!

12, may be yes, but 35.. you must be kidding me !

May I request that the figures displayed in an image form be presented in a table / text form for the benefit of lawyers with blindness? While I chave read the entire article, the salary figures have been not readable (being in an image form)) with a software called screen reader, which reads out the textual information displayed on screen for people with blindness.

Much appreciate your understanding. Feel free to reach out to me, should you have any questions.

Regards,

Amar Jain

Website: www.amarjain.com

I have included below the text of the salary tables.

For private practice, these are the figures.

Until 4 years of PQE: Associate: 11.2 lakh - 35 lakh

SA: 4 - 6 years PQE: 29.6 lakh - 53 lakh

PA/MA/Counsel: 48 lakh - 82 lakh

Salaried / retained / associate partner: 70 lakh - 2 crores

In-house salaries

0-5 years PQE: 3.6 - 24 L

5-8: 15 - 37 lakh

8-10: 28 - 65 lakh

10-15: 52 lakh -1.25 crore

15-20: 88 lakh - 1.65 crore

20+: 1.1 - 2.5 crores

Hope that helps - I wasn't sure how to include this in the main copy. Is there some easy way of including this in the main copy so it's just visible on screen readers?

Best regards,

Kian

Anyways, can’t wait for foreign law firms to come. Not because we need more salary (thought don’t mind that too) but because we need more professionalism. Law firms have started taking its lawyers for granted! Otherwise why would they delay bonus and increments for 2 quarters. Aren’t the promoters answerable to anyone? Isn’t it a legitimate expectation to get bonus and increments on time? Kian - I seriously think an article should be written on law firm work culture and ethics.

First bonus, then increments, then arrears, promotion, diwali bonus and end of year bonus.

Unfortunately there is also a lot of deadwood in the law firms or people who are not confident of taking a leap, after arguably being too comfortable or too scared.

Things need to be done right, and the attrition rate of each law firm clearly potrays the same.

Kian, can someone do a piece on attrition in law firms, I mean obviously the Amarchands have no competition therein, but just to get a feel of how other firms fare.

Good stuff Rishab.

if you dont mind, can you plz share the names of such firms.. i m preparing my updated resume and shooting letters right away !

The firms are KCO Bombay, Trilegal, S&R and TTA.

My HR also comes up with these benchmarks every other year based on consultation with external executive hiring firms/HR Firms and their benchmarks are always are in line with what HR wants to pay. It's simply a function of who are you selling your product to -someone who is looking to hire (in which case you are going to get a % of CTC or a fixed slab rate - so higher the CTC the better) or your customer is HR who is looking at payroll revisions (someone who is looking at keeping employee cost as flat as possible).

threads most popular

thread most upvoted

comment newest

first oldest

first