Year in review:

2017 saw another healthy year for legal recruitment in India, and it remains the most exciting function for career opportunities in the corporate governance space. Hiring across the legal sector (private practice firms and in-house legal teams of corporations and financial institutions) remained steady throughout 2017 with key trends continuing to reflect both global and regional influences. This piece provides an overview of key movements across the legal sector (divided into three segments- (i) private practice firms, (ii) In-House legal teams (BFSI), and (iii) In-House legal teams (commerce & industry) and then does a mid-market review of compensation and hiring trends in the organised Indian legal sector.

Key Legal Industry Movements in 2017:

Compensation and Hiring trends: a mid-term review (2017-18)

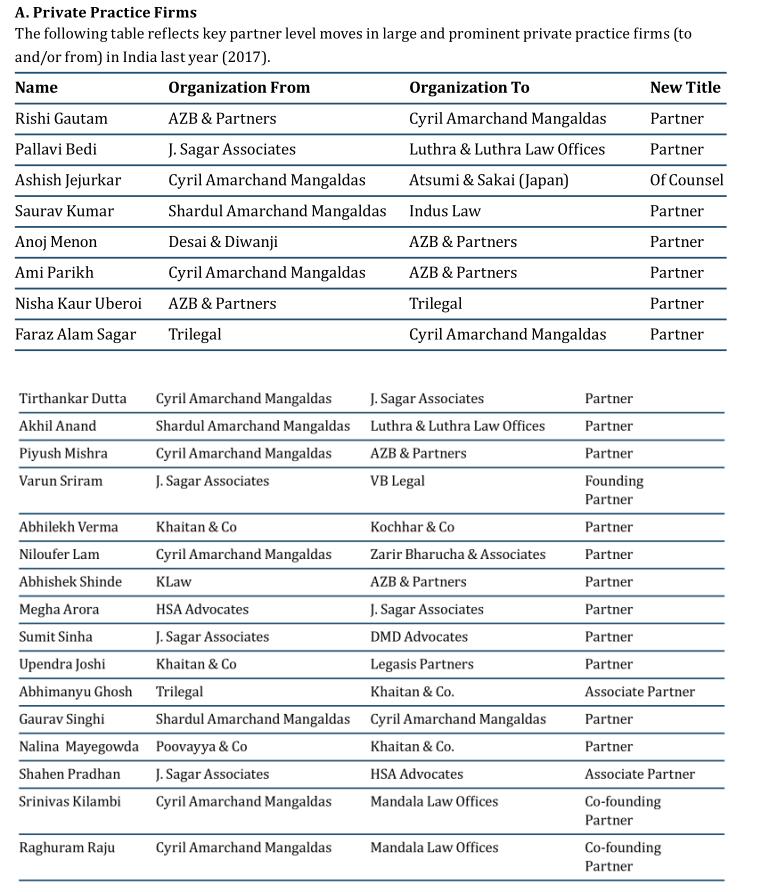

A. Private Practice Firms

In 2017, we witnessed high levels of hiring activity in general corporate and M&A space across levels. Other transactional areas such as banking, capital markets and structured finance were busier than the previous years, but hiring at the mid-level especially was limited to replacing leavers rather than growing that practice area. The litigation market remained steady and so did other practice areas like IPR, taxation and competition law.

Overall the 2017 private practice market was balanced but the firms and candidates remained cautious. At large-sized and prominent private practice firms- excellent communication skills, top law school and law firm pedigree have been a must for most hires. On the candidate side, few lawyers are moving for financial gain alone as was earlier the case, but are now placing equal (if not more) emphasis on work/life balance, the quality of the work on offer and the reputation of the hiring partners.

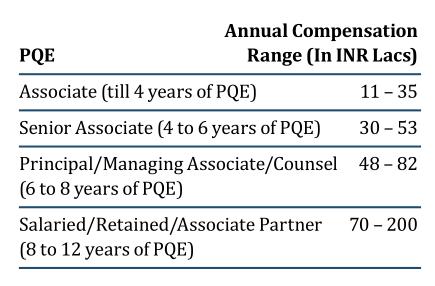

Below are the salary figures for 2017-18 in terms of seniority and PQE at reputable private practice firms across New Delhi NCR and Mumbai. These are due to be revised later this year for 2018-19.

Key Notes:

- Compensation numbers for lawyers working in litigation teams of these private practice firms (where benchmarks are different from their colleagues working in corporate teams) have not been considered

- Bonuses have been considered in these figures. Bonuses could range from 10% - 50% of the total compensation depending on the level of the professional or 1 – 3 months of the fixed monthly retainer at the junior and mid-levels and/or percentage of receipts.

- Background / pedigree of the professional also impacts the compensation figures. Apart from the reputation within the ecosystem of a professional (especially at a senior level), law school, previous firm and years of experience are some of the major defining factors.

- Compensation is usually 10 - 15% higher in Mumbai than Delhi especially at the mid and senior levels.

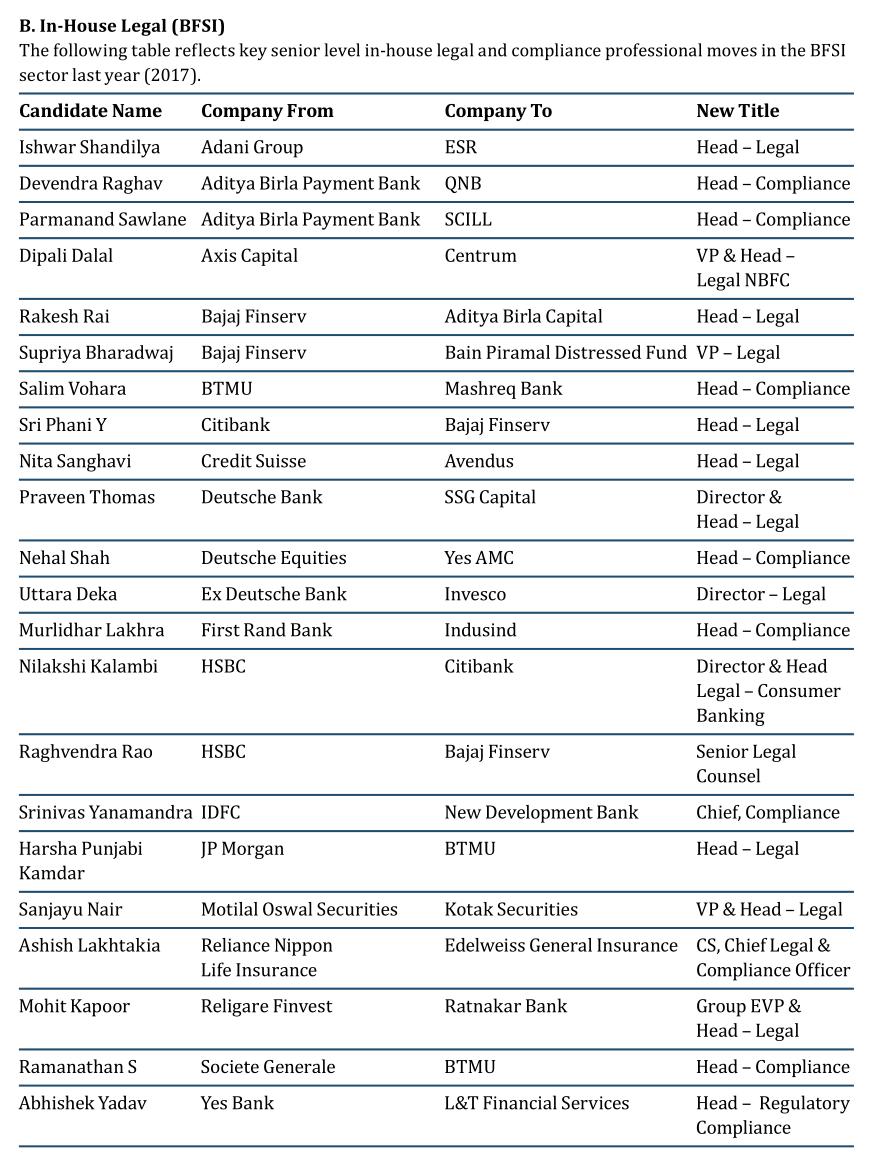

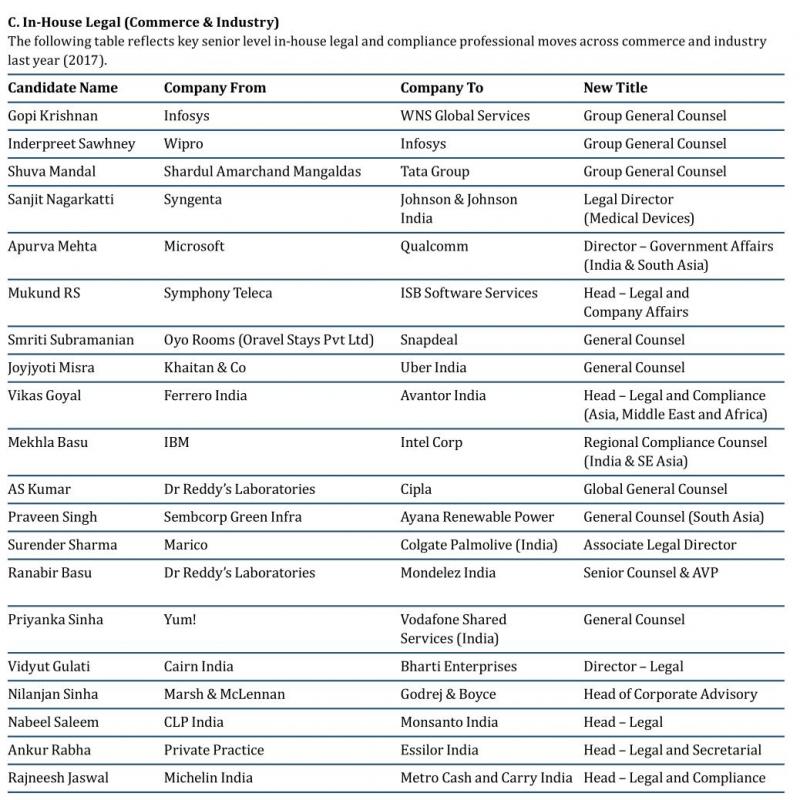

B. In-House Legal

The market produced a number of opportunities as in-house lawyers moved around and looked for better opportunities. In addition, employers sought replacements predominantly from within the in-house market. Lawyers with about six to ten years of PQE were typically sought after, as they were often perceived to be a safe pair of hands and who could manage internal clients. These counsel were commonly groomed into a deputy head or head of position (depending on the team size) within the team. Specialist skill-sets, including compliance, remain in demand and many lawyers filled these newly created roles. Company secretarial professionals remained relatively busy, especially those with legal qualification, and high-quality individuals sometimes had multiple opportunities when considering a move. Apart from observing stricter interviewing processes that range anywhere between 4 to 8 rounds at the senior level, we are seeing emergence of specialized roles such as disputes counsel, transactions counsel, regulatory and government affairs counsel.

With the overall expanse of financial services sector widening in the last 2 years, 2017 saw an aggressive demand for legal and compliance talent spanning across New financial sponsor led platforms within wholesale NBFC, Housing Finance Companies, Distress Funds, Payment Banks, Retail NBFCs and Fintech. Key deputy head talent from leading banks and established NBFCs were enticed by emerging Indian NBFCs and global single bank branches to spearhead the legal function. Lawyers with Compliance/Secretarial function experience were preferred over a single function lead as they offered holistic solutions and control which is key for any start-up. Apart from being a cost effective measure for these firms, candidates were offered a bigger portfolio and wealth-creating opportunities in form of ESOPs versus the standard declining bonus pay outs in banks.

In the commerce and industry space, we observed Pharma & Healthcare, IT & ITeS, Energy & Infrastructure as the top sectors; e-commerce slowed down a bit and so did the FMCG and manufacturing sectors (though there were a few senior level hires in these sectors but they were not comparable to the number of hires made in the previous years). Talent from within the industry (preferably same sector) was mostly required when hiring a counsel, and hence, we saw another year of the ‘musical chairs’ effect within the industry.

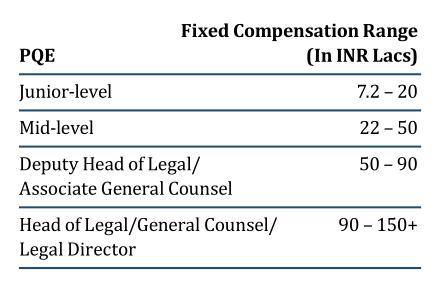

Below are the fixed salary figures for 2017-18 in terms of experience levels at top global banking and financial services institutions having legal teams in India. These are due to be revised later this year for 2018-19.

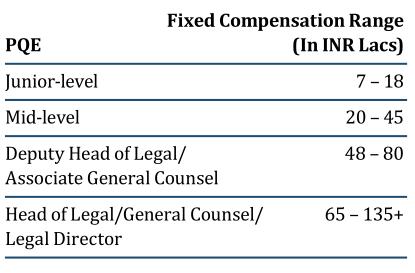

Below are the fixed salary figures for 2017-18 in terms of experience levels at prominent corporations having strong legal teams in New Delhi NCR and Mumbai. These are due to be revised later this year for 2018-19.

This data is for your general reading purpose only. ALL data that has been published is based on aggregation of information curated through placements done by Vito India, news “heard on street” and aggregation of news from public domains / proprietary research of Vito India.

Unless placed by Vito India, the information has NOT been verified directly with either the candidate or company mentioned in this data and no communication in any form has been received from ANY of the companies and/ or their employees directly or indirectly to either confirm or not confirm ANY of the information published in this data. Vito India reserves the right to amend or delete any of this information subsequently. Vito India is not responsible for any loss of damage that may arise of action taken by any one based on the contents of this data.

Key Notes:

- In-house legal salary scales above for BFSI and commerce and industry do not include the variable payouts.

- Only top global BFSI companies have been taken into account while preparing the salary scales for the BFSI sector. Other global and domestic companies have not been considered.

- Bonuses can vary from 20% to 50% of the total fixed compensation depending on various levels of seniority.

- Total compensation can vary according to the location of the where the role is based- salaries in Mumbai are generally slightly higher than the ones offered in Delhi NCR.

- Some of the other key factors impacting compensation are- (a) pedigree of the professional (law school and organisational background), (b) additional qualifications such as CS and/or LLM, (c) market reputation of the organisation and (d) the reporting matrix and size of the legal team.

- Apart from the above, we also observed that MNCs (especially if they are listed) tend to offer better salaries and benefits than their Indian counterparts.

About the Author:

Rishabh Chopra is Head – Legal and Compliance practice at Vito India Advisors. He is an experienced lawyer turned legal search specialist. He started his career by working as an associate in the structured finance team and then in the general corporate and M&A team of Amarchand Mangaldas in Mumbai and New Delhi. Prior to joining Vito India Advisors, he headed the India offices of Aquis Search.

Tel: +91 8130868625 (M)

The author would like to acknowledge the contrbution of Chaitra Desai (Principal) and Yamini Malhotra (Consultant) along with the research team at Vito India Advisors.

Vito India Advisors

302, 3rd Floor, Altrade Business Centre, Platina Building, MG Road, Near Sikanderpur Metro Station

Gurugram, Haryana-122002, India

www.vitoindia.com

Welcome Legally India's Spring 2018 Issue

If you would like to receive future editions, please click here to register your interest.

Our Spring 2018 print and digital edition of Legally India, a joint publication by Global Legal Media and Legally India, has a strong disputes flavour, and examines: AI, global litigation risk, GC wishlists and more than a dozen jurisdictions and practice areas.

threads most popular

thread most upvoted

comment newest

first oldest

first

Most/majority firms don't pay anywhere near that. Heck, even after working for few years in a firm most people don't make 12 lacs p.a.

All those ridiculous figures that you see are for a chosen few firms & only a minuscule percentage of people get such amounts. As long as you are happy with that, its fine!

1. CAM, SAM: around 15 lakhs (possibly 15.5 at SAM, unsure of exact amount, might be off by a few thousand)

2. Trilegal: 15.4 lakhs

3. Luthra: 15.5 lakhs (approx, unsure of exact amount, might be off by a few thousand)

4. Khaitan: mid-15 lakhs

5. S&R: around 14 lakhs (excluding bonus, which can push up the annual take home by 2 lakhs at least)

6. AZB:

So, gti going on about people not making 12 lakhs pa is clearly an attempt at trolling OR grossly misguided.

If an A0 is making that much, I'm sure there is at least some exponential increase across senior levels.

Trilegal paid 14 5 years ago, so definitely closer to 16 now

Of course these numbers should include bonus, as most of these firms give a large portion of the bonus pretty much automatically.

SAM pays 14/15 but none of it is bonus

CAM pays about the same, slightly higher

threads most popular

thread most upvoted

comment newest

first oldest

first