India and Israel doing business – background

Following the establishment of full diplomatic relations in 1992, India and Israel have enjoyed a fruitful partnership. Bilateral trade between the countries has been strengthened on the basis of mutual interests in defense, security, agriculture, IT and other sectors. Accordingly, the economic relations have steadily grown since, from $200m (diamonds and defense excluded) in 1992 to approximately $1.94bn in 2018.

The relationships between authorities have also strengthened over the last decade, as witnessed by a series of formal high profile visits: President Mukherjee in October 2015, Israeli president Rivlin in November 2016, Prime Minister Narendra Modi in 2017, and Prime Minister Netanyahu in 2018. Moreover, the two Prime Ministers initiated a joint CEO forum to encourage the development of the industrial collaboration between the countries. The forum assembled leading CEOs and took place in Tel Aviv in July 2017 during Prime Minister Modi’s visit, and in Delhi in January 2018, during Netanyahu’s visit.

These intensified diplomatic-economic relations eased the accessibility between the two countries in the forms of facilitating a business visa policy and an increase in the frequency of direct flights, which has multiplied threefold since the launch of Air India’s Israel-India route.

India made a giant leap in the World Bank’s Ease of Doing Business 2018 survey, having had increased to a rank of 77 from 132 in only two consecutive years, while Israel is rated as the third most innovative economy in the world in the Global Competitiveness Index, 2018.

Prospects and Challenges

Prospects

The promising future of Indo-Israeli economic relations is clear when considering Israel and India’s respective characters and achievements.

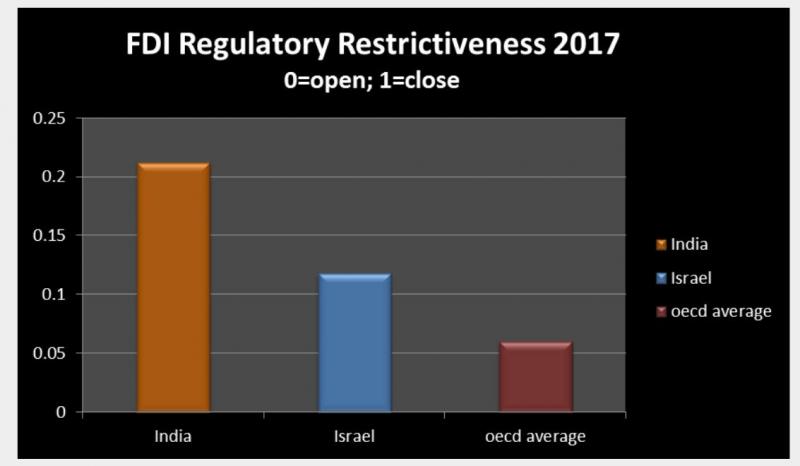

Israel has gained the reputation as the world’s “start-up nation” with over 4000 start-ups, the largest amount per capita, and is ranked 3rd amongst the top start-up hubs in the world. In addition, Israel operates a welcoming FDI policy and bestows tax benefits and exemptions for foreign investors. Accordingly, there are no restrictions regarding non-residents holding shares in Israeli companies. Israel has been rated 0.118 in the “FDI Regulatory Restrictiveness” index in 2017, placing it as an open FDI economy, quite adjacent to the average of the OECD countries.

India is considered to have exceptional economic potential, with a huge population of 1.3bn people and a growing consumer market with a unique demographic distribution (median age of 28 years). India aspires to increase its international trading scope and make a name for itself as a R&D and Innovation economy. For that purpose, the government has established a number of targeted initiatives, such as:

- • “Make in India”- which has been devised to transform India into a global design and manufacturing hub.

- • “Digital India”- the flagship program with a vision to transform India into a digitally empowered society and knowledge economy. As part of this initiative, India has experienced major growth with 1,200 new start-up companies amongst 7,200 start-ups overall in 2018.

- • “Start-up India”- which is intended to build a strong ecosystem that is conducive to the growth of start-up businesses, and to generate large scale employment opportunities for the R&D professionals. As part of this initiative, India has experienced major growth with 1,200 new start-up companies amongst 7,200 start-ups overall in 2018.

These initiatives encourage cross-border inbound investments in early stage high-tech innovative ventures to increase their efforts in India; thus, aiming to move India from a services oriented economy to an innovation and technology driven economy, providing good opportunities for Israeli-based technology companies to expand to India and benefit from this growing market.

Challenges

Nevertheless, Israel and India’s industrial collaboration faces a few challenges that are important to be acquainted with, before the countries do business together.

Differences between Indian and Israeli regulations

In spite of the Indian government’s “ease of doing business” efforts, India still maintains some level of regulations that, to some extent, may harden the access for foreign investors to do business in the country. One of these regulations is the policy on restricting foreign investment by the supervisory FIFP regulator and the RBI by the authority of the Foreign Exchange Management Act, 1999 (FEMA).

India’s rating in the “FDI Regulatory Restrictiveness” (2017) index is 0.212, characterizing India as a relatively closed economy; while Israel‘s rating is 0.118, close to the OECD average. Recently, from February 1st, many actions and transactions under the Indian “Company Act 2013” as well as Insolvency and “Bankruptcy Code 2016” and certain regulations of SEBI require that the valuation will be carried out by Registered Value only.

Israel holds a liberal approach towards foreign investments in all sectors. Foreign investors are not required to gain authorization from the government to conduct business, except if the business being done falls under the regulated sectors.

Differences in legal instruments and establishments

India and Israel’s legal foundations have both been developed from the British legal system and the common law. However, in the past 70 years each legal system has developed in different directions, creating some differences in legal institutes and establishments, and some legal practices.

For example, there are differences in labor law, types of incorporated entities, perception of some legal instruments and more. All are important to become acquainted with, before doing business overseas.

While in India there is a wide variety of incorporated legal entities which differ in their legal capabilities, in Israel there are two common types of legal entities whose main purpose is to gain profits for their owners: “Company” and “Partnership”. Company can be either “Private Company” or a “Public Company” with securities registered on a Stock Exchange and held by the public.

Immigration and visa policies

Both Israel and India require an adequate visa for visitors and employees. Although the policies are different in some aspects, in the last few years both countries are making an effort to ease the visa process. For example, recently India launched a one year business e-visa. Still in some cases the requirements for the particular type of visa may be found to be challenging.

Differences in tax laws and rules

Naturally, there are distinctions between the taxation policies of the countries. For instance, the broad Permanent Establishment (“P.E”) definition in India is wider than the Israeli one, and exposes foreign firms to P.E exposure such as extent taxation even going back 6 years retroactively.

However, Indian companies are exposed as well to P.E in Israel. The profits of an Indian enterprise will be taxed in Israel if the enterprise carries out business through an Israeli P.E that is situated in Israel. If the enterprise carries out business as aforesaid, the profits of the enterprise may be taxed in Israel, only if so much of them are attributable to that P.E.

In addition, Israel-India trade relations are still lacking a Free Trade Agreement (“FTA”), which has been under negotiation for more than a decade. There are also challenges in the field of offset requirements, GST implications and other issues.

How to overcome the challenges and meet the prospects

Despite the challenges above, we are witnessing an improvement in some areas. Driven by the proven economic benefits of the industrial collaboration, both the governments of India and Israel are making efforts to increase and encourage joint initiatives and co-operation between the markets.

Since 2016 India has initiated some reforms that have eased foreign investment (FDI) and encouraged non-resident investments and enterprises in the country. Many of the sectors had been excluded from FDI restrictions, and the others have been eased substantially.

Moreover in the taxation aspect, Israel and India have been engaged since 1996 in a bilateral tax treaty: the Avoidance of Double Taxation Agreement (“ADTA”), the same having been amended in 2017 by the Amending Protocol. The “ADTA” designated for the Prevention of Fiscal Evasion with respect to taxes on Income and on Capital gains. As per the Treaty, gains derived by an Israeli entity from the alienation of shares or similar rights in an Indian company, are taxable both in Israel and India. The same rule applies to gains from alienation of partnership interests, trust units and estates. In this context, it is important to note that the Treaty makes no other distinction for the purposes of capital gains, between listed and unlisted shares, or otherwise.

Nonetheless, for the purpose of avoiding double taxation on the same income, the Treaty provides that Indian tax paid in respect of capital gains arising from sources in India shall be allowed to be credited against Israeli tax payable in respect of such capital gain. The Treaty therefore follows the tax credit method, as opposed to the tax exemption method, under which a head of income taxable in one State is exempt from taxation in the other State. In no circumstances however, will the credit given exceed the net Israeli tax chargeable on such gains. Gains from the alienation of any other property (other than gains from immovable property) are taxable only in the State of which the alienator is a resident.

The Israeli government encourages investments in R&D and innovation, and driven by liberal values rewards foreign investments by a series of laws:

Law for the Encouragement of Capital Investments, 5719-1959

The Law for the Encouragement of Capital Investments, 5719-1959, generally referred to as the Investment Law, provides certain incentives for capital investments in production facilities (or other eligible assets) by “Industrial Enterprises” (as defined under the Investment Law). The incentives may be in the form of grants or tax benefits.

Tax Benefits for Preferred Technological Enterprise

A Preferred Technological Enterprise (as defined under the Law) shall be taxed at a rate of 7.5% if located in “Area A” (certain areas in Israel defined by the government) and 12% if located elsewhere. If this is a “Special Preferred Technology Enterprise”, corporate tax will be imposed at a rate of 6%.

The rate of tax on dividends paid by a Preferred Technological Enterprise is 20%, whereas a foreign resident will be taxed at a rate of 4%.

Capital gains tax for a Preferred Technological Enterprise and for a Special Preferred Technological Enterprise for a foreign resident company shall be 12% or 6%, depending on certain circumstances.

Law for the Encouragement of Industry (Taxes), 5729-1969

The Law generally referred to as the Industry Encouragement Law, provides several tax benefits for “Industrial Companies.”

The following corporate tax benefits, among others, are available to Industrial Companies:

- Amortization over an eight-year period of the cost of purchased know-how and patents and rights to use a patent and know-how which are used for the development or advancement of the Industrial Enterprise.

- Under limited conditions, an election to file consolidated tax returns with related Israeli Industrial Companies.

- Expenses related to a public offering are deductible in equal amounts over three years.

Tax Benefits and Grants for Research and Development

Israeli tax law allows, under certain conditions, a tax deduction for expenditures, including capital expenditures, for the year in which they are incurred. Expenditures are deemed related to scientific research and development projects.

Foreign investments tax exemption – Section 97(B3) of the ITO grants any foreign resident an exemption from capital gains tax upon the sale of securities of an Israeli company (or a foreign company whose assets are mostly in Israel), upon fulfillment of the following conditions: (i) the capital gain is not derived in a permanent establishment in Israel; (ii) the security was not purchased from a relative and the provisions of Section E2 or the provisions of Section 70 of the Real Estate Taxation Law did not apply to it; and (iii) the security is not traded on the stock exchange in Israel on the date of the sale.

As witnessed, Israel encourages foreign investments through tax benefits, exemptions and other incentives. An example for a company that benefits from this policy is Intel. Motivated by Israeli tax benefit plans, Intel has invested $17 billion in Israel since 1974 and recently announced that it is making an additional investment of $10 billion in Israel. In addition to the tax benefits, this investment is predicted to profit the company a grant by the Israeli government, which is valued between $880m to $1.1bn.

Specifically, in the Indo-Israeli arena both governments have founded bilateral frameworks providing financial support for collaborative industrial R&D ventures between Israeli and Indian companies. As part of this initiative, Israel demonstrates good will and openness to share information and industrial knowledge. “The Israel Innovation Authority” initiated the I4Rd, India-Israel Industrial Cooperation Program, in collaboration with its Indian counterparts at the federal and state level, as well as with stakeholders in the private sector, in order to facilitate and implement access to funding schemes dedicated to the development of R&D-driven partnerships between Israeli and Indian companies.

Another program is “The India–Israel Innovation Bridge”, a joint initiative of the Israel Innovation Authority and its Indian counterparts, in order to enhance the collaboration between start-ups from both countries’ start-up ecosystems.

Latest Trends

The improvement of India’s ease of doing business (by 23 places in the World Bank’s 2018 survey) is one of the causes of India’s increasing economic growth rate, with an estimated growth rate of 7.2% in 2018-19.

The improvement of commercial relations is backed by the leaders of both countries. For example, the visit of Prime Minister Modi to Israel in January 2017 was followed by Prime Minister Netanyahu’s directive to coordinate a cross ministries effort to strengthen the political, economic, scientific and cultural ties with India.

All the above efforts and initiatives have led to an increase of 24.5% of exports from Israel to India in 2018.

In addition, in January 2018 the Prime Ministers signed several MOUs covering the following fields:

- Energy agreement in the gas and oil sector

- Cinema Cooperation Agreement

- Aviation agreement

- Cyber Agreement

- Mutual Investment Agreement – a statement of both governments reflecting the intentions to promote direct investments between the countries.

These MOUs join a number of bilateral agreements and institutional arrangements that veteran diplomatic relations have yielded over the years, such as: The Agreement for Cooperation in Agriculture (1993), The Agreement for Promotion and Protection of Investments (Jan 1996], Bilateral Agreement regarding Mutual Assistance and Cooperation in Customs Matters (1996), and MOU on India-Israel Research and Development Fund Initiative (2005).

Recently, we have witnessed a rise in the number of Indian companies engaged with Israeli companies, and vice versa, in a variety of fields. Among those engagements:

- Infosys investment in the Israeli analytics and optimization of cloud servers company “CloudYn” and in “Cloudendure”, a Cloud Migration and Cloud Disaster Recovery company.

- Mahindra group’s JV transaction with Israeli Top Green House in the field of protected agriculture.

- The acquisition of the Israeli NaanDan Irrigation company by the Indian company Jain Irrigation Systems.

- Indian Sun Pharmaceutical Industries acquisition of the Israeli-American company Taro Pharmaceuticals.

- The acquisition of Givon, a manufacturer of parts and assemblies for the aerospace industry, by Wipro Infrastructure Engineering.

- The acquisition of Israel-based Upstream Commerce by Flipkart, India’s largest e-commerce marketplace.

Future prospects and conclusions

Assuming that the encouraging policies by both countries will be maintained and even enhanced, the sentiment between the economies will get even better as well. The scope of trade is predicted to rise, due to potential growth in the range of business sectors and the number of players.

Hence, we suggest to businesses that are considering involvement or are already involved in the flourishing Israeli-Indian economic system, to recognize and reach their potentials, while taking advantage of the incentives at their disposals. While doing so, it is important to learn about the differences and challenges that may accrue along the way, and the methods to overcome them.

About The Author

Benjamin Grossman, a partner at APM & Co., manages the firm’s Indian Legal Practice.

For over 18 years, Mr. Grossman has developed expertise and acquired in-depth knowledge of Indian law and regulations as well as of Indian business culture and practices.

Over the years, Mr. Grossman has advised on a wide array of complex transactions and activities, including, the establishment of joint ventures, technological collaborations and joint production ventures, procurement and offset transactions and tender processes, and has led negotiations with various entities in India. Mr. Grossman also specializes in Transfer of Technology agreements, technological collaborations and licensing agreements, as well as investment, procurement and offset transactions.

Mr. Grossman has been instrumental in the initiation of fruitful collaborations between Israeli, Indian and other global companies.

CONTACT

Benjamin Grossman

www.apm-law.com

{module 544}