a. Foreign Businesses in Germany

Germany’s attractiveness as a place to invest and as a trading partner is unbroken.

The same is true for Germany’s great openness to foreign investments. Despite a recent tightening of the foreign investment regime, Germany remains one of the most open economies in the world. German law generally treats Germans and foreign nationals equally regarding investments or the establishment of companies. Basically, foreign investors are not subject to significant restrictions, specific administrative approvals, formal review procedures, as well as permanent import/export- or currency controls.

According to the German Foreign Trade Act (Außenwirtschaftsgesetz – AWG) restrictions on inbound investments may only be imposed in order to protect public security.

However, under the new AWG rules, the German Federal Ministry of Economic Affairs and Energy can check whether a specific foreign investment of 25 % or more poses a threat to German public security or public order. In this context the new AWG rules also provide specific examples for potential threats to the German public security or public order.

b. Intellectual property rights (IP rights) protection

Germany offers a comprehensive and robust legal environment to protect intellectual property rights, such as patents, utility models, design patents, trademarks or copyrights, just to name only the most important. Furthermore, Germany is a party to all major international intellectual property protection agreements.

In addition, many of the recent changes in German intellectual property laws derived from European Union (EU) legislation to further enhance not only national, but European IP protection.

Application procedures for IP rights at the German Patent and Trademark Office or the European Patent Office, both based in Munich (Germany) are of highest international standard. Foreign investors must decide whether to register f.e. a trademark in Germany individually or to go for an EU-wide trademark- or design protection by applying for a Community Trademark and/or a registered Community Design.

German law grants a protection period for patents for 20 years, but also offers the possibility to protect technical inventions by registering a utility model which provides low-cost protection for such inventions with the exception of processes. Utility model protection starts on the filing date and ends 10 years after the month of filing.

A registered trademark also grants protection for a period of 10 years, which, however, can then be extended indefinitely by 10 years at a time.

Trade secrets, both technical and commercial, are protected by the German Law Against Unfair Competition.

c. Corporate Law and Laws in Daily Business

I. Company Forms

Foreign investors can choose freely between various legal forms for German companies.

1. Corporations

Corporations are usually the best option for larger and established companies.

A corporation is a legal entity, i.e. the company itself – and not the shareholder – is the holder of assets and liabilities, rights and obligations. Once the share capital has been contributed, the shareholders’ liability is limited to the corporation’s business assets.

Table 1 gives a brief overview of German corporations and the minimum share capital required.

A corporation implies more extensive accounting obligations (compared with partnerships) and liablity to corporate income tax, trade tax and solidarity surcharge. The average tax burden is less than 30 percent. In some regions, due to a locally variable rate of trade tax, it is below 23 percent.

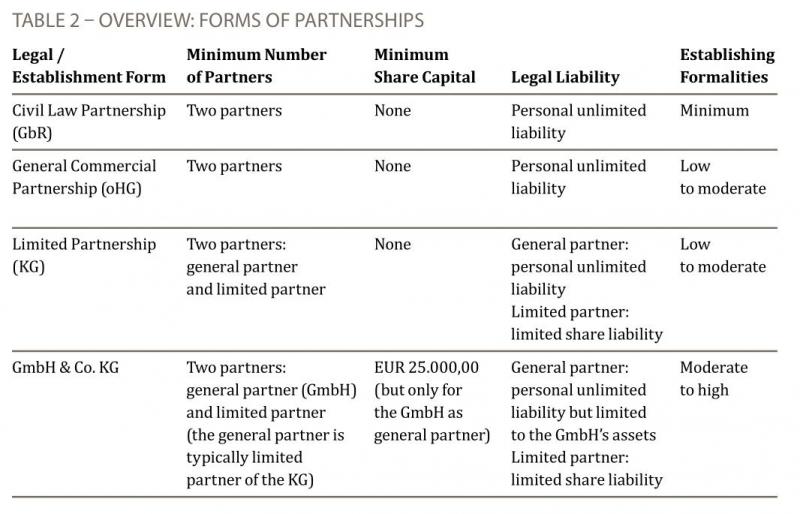

2. Partnerships

Partnerships are not independent legal entities but associations of partners. Generally, each partner is responsible for the liabilities of the company (including private assets), except limited partners in a limited partnership (KG or GmbH & Co. KG). Generally, there is no minimum share capital required, and accounting obligations and publication requirements are less extensive than those for corporations.

Basically, the management of a partnership may – with a few exceptions – only be carried out by partners only.

Table 2 gives a brief overview of German partnerships.

There is another form of partnership (Partnergesellschaft or PartG) specifically designed for the joint exercise of professional freelance activities, such as architects, doctors or attorneys. This company form is not further explained in this article.

Contrary to corporations, partnerships themselves are not subject to corporate tax, but only the individual partners; partnerships are only subject to trade tax.

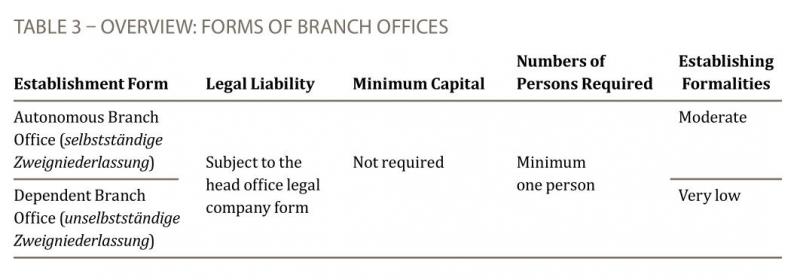

3. Branch Offices

A foreign company with head office and registered business operations outside of Germany may establish a German branch office. Table 3 shows how two kinds of branches are possible in Germany.

A branch office is subject to taxation in Germany if it is considered as a permanent establishment according to the applicable double taxation agreement (DTA).

II. Company Foundation; Company and Business Registration

Anyone – i.e. irrespective of nationality or place of residence – can establish a business in Germany.

1. Establishing of a Partnership

Establishing a partnership is comparably easy and basically requires the conclusion of a partnership agreement between the partners without any form requirements.

A registration of the partnership with the German commercial register is required for the general commercial partnership (oHG) and the limited partnership (KG and GmbH & Co. KG) which requires involvement of a German notary public. For business activities the competent local trade office (Gewerbe-/Ordnungsamt) must be notified accordingly.

With respect to the special but very common form of the limited partnership where a limited liability company (GmbH) acts as generalpartner (GmbH & Co. KG), also the GmbH is required to be founded as described below under lit. b). However, the GmbH & Co. KG is a very popular form of a partnership since no (natural) person is generally liable without a limit and the company form benefits from tax advantages and lower form requirements compared with the GmbH.

2. Establishment of a Corporation

A corporation can be established by any number of different partners by agreeing in the articles of association. In case of the limited liability company (GmbH), the articles of association require notarial form. In any case the establishment procedure is completed with registration in the German commercial register (Handelsregister).

The most common form of a corporation used for businesses in Germany is the limited liability company (GmbH) which can be founded by the conclusion of the company’s articles of association in notarial form and its registration with the German commercial register. Since the registration of the company requires that the share capital of EUR 25,000 (at least to the half amount of EUR 12,500) is contributed to the company, a bank account at a German bank is to be opened (for which the KYC rules for a bank a required to be met in each single case). Costs for foundation and registration of a GmbH vary in a range between approx. EUR 700 and EUR 800 for the notary and the court (plus bank fees and plus lawyer’s fees when required).

Anyone can be appointed as a managing director of a GmbH also with place of residence in a foreign country. However, the GmbH strictly requires a business address in Germany. Declarations of a managing director vis-à-vis the commercial register require to be authenticated in front a German notary public or require authentication in form of legalization in India.

It is also possible to acquire a shelf company (Vorratsgesellschaft) as a GmbH. Such acquisition generally costs around EUR 3,000 plus notarial and court fees of approx. EUR 700 to EUR 800.

3. Commercial Register Display

Documents and information registered with the German commercial register are open to public and can be downloaded online at minor charges.

4. Trade Office

Before starting business operations, each business operator is required to notify the local trade office (Gewerbe-/ Ordnungsamt) where the business operation is located regardless of the company form (except freelancers and professionals).

Specific business licenses are required in some sectors (e.g. pharmacies, property developers, real estate agents, brokers, security firms, pubs and hotels or banks).

The trade office automatically sends a copy of the business registration to the responsible tax office (Finanzamt). The tax office will then send a registration form to the company for tax registration purposes. Further, the trade office will also inform other relevant institutions such as the respective Employer’s Liability Insurance Association (Berufsgenossenschaft), the competent Chamber of Industry and Commerce (IHK) and, if applicable, the Chamber of Crafts (Handwerkskammer).

5. Chambers of Industry and Commerce (IHKs) and Chambers of Crafts

In Germany, the Chambers of Industry and Commerce (IHK) and the Chambers of Crafts (Handwerkskammer) represent the interests of local groups of business operators.

Membership in such the Chamber of Industry and Commerce or the Chamber of Crafts is mandatory and occurs automatically on registration in the trade office without special registration. The fees for the membership depend on the turnover of the respective company.

III. Labour Law

Besides relatively high employment costs and complex tax regulations, it is mostly the relatively rigid German labour law which may impede foreign investments into Germany. However, foreign investors, working with German labour laws on a daily basis, cope with it particularly well.

German labour law is not laid down in one uniform act, but in a multitude of legal sources. Even if employer and employee are generally free to agree on the terms of an employment contract, the rights of both parties are limited by mandatory laws and ordinances, and sometimes also by collective bargaining agreements as well as company-specific works agreements.

The German social security system consists of pension insurance, health insurance, unemployment insurance, accident insurance and nursing insurance. In principle, social insurance coverage is mandatory for all employees, working in Germany, regardless of their citizenship. If a foreign investor transfers a foreign employee only for a certain period of time to a German branch, exceptions may apply.

Many foreign managers, acting – officially registered – as a managing director of a German branch, underestimate the latent risks to infringe respective laws and obligations, rendering himself/herself to prosecution.

In particular, the strict laws of manager liability should be known to foreign managers heading German companies.

The responsibilty of a Managing Director of a GmbH not only encompasses the operating business, but also specific legal terms of office being an adressee of legal obligations. Examples include the strict and complex capital maintenance rules for German companies and the various managerial duties of compliance in this regard. Furthermore, particularly serious obligations for Managing Directors exist under the German Insolvency Code (Insolvenzordnung) if the German branch falls into a severe economic crisis or if the company risk to become insolvent. In case of illiquidity or over-indebtedness, the Company’s managing director has to file for insolvency within three weeks or else he/she will not only commit a criminal offence, but also be personally liable to Company creditors for damages caused by delayed filing for insolvency (Insolvenzverschleppung).

IV. Contract Law; Commercial Law; Sales and Purchase Law

1. Contract Law / Law of Contract

German commercial and contract law gives a reliable operational framework to foreign investors. The principle of contractual freedom and the low level of formal requirements enables companies to freely choose contractual partners and to freely determine the subject matter of an agreement within the wide limits of the law. However, strict and mandatory German law on general terms and conditions (T&C) limit the possibility of one party to impose discriminating terms and conditions to the other party if not individually agreed in the single case.

The key types of contracts are governed by the German Civil Code (BGB). Contractual stipulations are standardized to a high degree. Also, the EU and UN law provides for the general possibility to agree on the application of German law between the parties of a contract.

Contracts under German law usually follow a short and simple structure. Applicable legal stipulations apply unless agreed otherwise in the contract. This is a basis for time and cost efficient drafting of German law contracts.

2. Commercial Law

German commercial law is in line with international standards and an excellent basis for fast forward-moving businesses and markets (Automotive & Mobility; Real Estate “Smart City”; Industry 4.0). Global trading standards such as “Incoterms” (International Commercial Terms) are well recognized.

Standard financial tools for international trade such as letters of credit and payment guarantees are also commonly used in Germany.

3. Sales and Purchase Law

A purchase contract is the most frequent type of contract. German law considerably simplifies the conclusion of purchase contracts in daily business.

The UN Convention on Contracts for the International Sale of Goods (CISG) applies to international delivery of good contracts with German business partners.

V. Product Liability

Besides the general liability under German contractual or tort law, under strict and mandatory German product liability law a manufacturer or importer is liable for personal injuries and property damages in Germany which arise in connection with the use of a defective product regardless of the manufacturer’s or importer’s fault.

This strict liability vis-à-vis contractual partners and any third party cannot be waived by way of agreements between individuals.

VI. Credit Security

In connection with granting of loans German banks usually require the provision of corresponding and reasonable securities. German law provides for a number of recognized credit securities such as e.g. retention of title (Eigentumsvorbehalt), ownership transferred by way of security only (Sicherungsübereignung), assignment of claims (Forderungsabtretung), mortgages (Hypothek) and land charges (Grundschuld), or bonds (Pfandbrief).

Moreover, there are a number of other options like e.g. suretyships (Bürgschaft) or personal guarantee (Garantie) which offer suitable solutions for individual security needs.

D. Planning; Building and Real Estate Law

I. Construction Laws

Public construction law in Germany is governed by federal and state law, in particular zoning law (Bauplanungsrecht) and building regulations law (Bauordnungsrecht).

Zoning law (Bauplanungsrecht) as a German federal law determines the purpose for which a property may be used and whether a building project fits into its surroundings.

Building regulations law (Bauordnungsrecht) as state law determines how buildings may be designed and constructed in order to meet the planning law requirements. Most German states have adopted sample building regulations which provide for standards within this field.

II. Building Permits

Construction, alteration, demolition, and/or change in use of a building require a building permit (Baugenehmigung) approving that the project complies with the zoning and building regulation law as well as with all other applicable laws (such as e.g. environmental laws). The local building authority and the building supervisory authority (Bauamt) are competent for issuing building permits.

The application for a building permit must include detailed documentation on the building project, such as inter alia a detailed plan of the project, accompanied by necessary supporting documentation such as site plan, construction drawings, building specifications (heating, noise prevention, fire protection plans). The documentation required for the application is also to be presented to adjacent property owners.

In order to simplify and coordinate the permit procedure, the emission control permit application procedure (see below III.) also includes the building permit process.

III. Emission Control Permits

Environmental protection is a general state goal in the German Constitution (Grundgesetz). A number of different laws and regulations strictlyprotect the environment.

Investors in large industrial facilities should focus their attention to the emission control permit, which is required prior to construction in order to prove that facilities and projects comply with the requirements of environmental law and other regulations aimed at protecting the common good.

Facilities and projects subject to this approval procedure are emitting industrial plants, waste management plants, nuclear (power) plants, highways and railroad tracks, airports, navigable waterways and plants subject to the law on genetic engineering.

The emission control approval procedure is governed by the German Federal Emission Control Act (Bundesimmissionsschutzgesetz, BImSchG) and related ordinances. The competent environmental agency of the respective federal state (Landesumweltamt) is responsible for the emission control permit procedure.

IV. Real Estate Commercial Law

Insurance companies, banks, investment companies, funds, and real estate holding companies own most of commercially used German real estate.

The German local courts (Amtsgerichte) maintain the German land registers (Grundbücher) which contain records of the entire German territory and provide information on ownership in land and apartments as well as any existing encumbrances. The German land register ensures good faith in its completeness and correctness.

Real estate purchase contracts in Germany require notarization in front of a German notary in order to be legally effective. Any transfer of ownership of real estate requires application and registration with the German land register. Due to the time gap between the conclusion of the real estate purchase and transfer agreement and the final registration of the purchaser in the land register, the purchaser may register a so called priority notice (Vormerkung) in order to secure the preliminary rights of ownership. Such priority notice protects the purchaser from dispositions made by the seller after its entry.

Generally, an acquisition of real estate in Germany does not require permits (except with respect to real estate intended for agricultural of forestry usage).

German rental law is (equally to purchase law) governed by the BGB and more or less tenant-friendly.

E. Legal Proceedings

I. Attorneys at Law

All German attorneys at law are members of the regional bar council (Rechtsanwaltskammer). The Federal Bar Council (Bundesrechtsanwaltskammer) is the professional umbrella association of the regional bar councils. The professional practice of German lawyers is regulated by comprehensive professional laws.

II. Civil Courts

In Germany, ordinary courts are organized at different levels: local courts (Amtsgericht), regional courts (Landgericht), higher regional courts (Oberlandesgericht) and the Federal Court of Justice (Bundesgerichtshof). A right of appeal is usually permitted against initial decisions to a court of a higher level.

The costs for court proceedings in Germany depend on the value in dispute and are comparably low. Generally, the unsuccessful party has to bear the costs of the dispute; costs will be shared between the parties in the event of a partial success.

III. Jurisdiction in civil law disputes

Basically, a German local court is only competent by law if the monetary value of the dispute does not exceed EUR 5,000. In other cases, the regional courts are competent

Generally, entrepreneurs may agree to regional courts being the competent forum. Furthermore, contractual parties may agree to an exclusive place of jurisdiction. In legal proceedings on regional court or a higher regional court level, both parties are required to be represented by an attorney at law. Representation in front of the German Federal Court of Justice (Bundesgerichtshof) requires attorneys at law with special permission.

IV. Order of payment procedure (Mahnbescheid)

In principle, a judicial order for payment procedure (Mahnbescheidsverfahren) is applicable to all payment claims. A small upfront court fee will be charged for this procedure and assuming the claim does not require a formal reasoning of the preconditions for the claim. A formal legal dispute will be initiated only if the defendant formally challenges the claim (during a period of one month) and the claimant (i) has either applied for an automatic initiation at the time of filing or (ii) the claimant applies for such initiation upon receipt of the defendent’s declaration of challenge.

If the defendant does not challenge the claim within the deadline set by the court the claimant may apply for an enforcement order from the court for the claimed amount and the court and legal fees. An order for payment (Mahnbescheid) is often a time and cost efficient way to realize an undisputed claim against an debtor who is in default of payment (Zahlungsverzug).

V. Alternative Dispute Resolution

Arbitration is becoming more and more important in Germany, in particular in the business sector. Different international arbitration institutions are recognized in Germany, such as the German institution for arbitration (Deutsche Institution für Schiedsgerichtsbarkeit – DIS) or the International Chamber of Commerce (ICC). Arbitration procedures are non-bureaucratic and confidential.

ABOUT THE AUTHORS

Dr. Andreas Bauer

Lawyer and Partner

Tel: +49 89 288174-0

Practice Areas: Corporate/M&A, Private Equity, Corporate Finance

Dr. Marcel Vietor

Lawyer and Local Partner

Tel: + 49 89 288174-0

Practice Areas: Corporate/M&A, Commercial Contracts, Corporate Litigation

Barbara Scharrer

Lawyer and Of Counsel

Tel: +49 89 288174-0

Practice Areas: Specialist for Corporate & Investment Laws in Asia, especially in the PR China and India; Specialist for Asian Inbound Investments to Germany, especially from the PR China and India

GSK Stockmann – Munich office

Karl-Scharnagl-Ring 8

80539 Munich

Germany

Welcome Legally India's Spring 2018 Issue

If you would like to receive future editions, please click here to register your interest.

Our Spring 2018 print and digital edition of Legally India, a joint publication by Global Legal Media and Legally India, has a strong disputes flavour, and examines: AI, global litigation risk, GC wishlists and more than a dozen jurisdictions and practice areas.

threads most popular

thread most upvoted

comment newest

first oldest

first

threads most popular

thread most upvoted

comment newest

first oldest

first