L&L Partners

L&L Partners - formerly known as Luthra & Luthra - Delhi corporate and M&A partner Anshul Jain has resigned from the firm and will leave later this month, we understand from sources.

L&L Partners - formerly known as Luthra & Luthra - Delhi corporate and M&A partner Anshul Jain has resigned from the firm and will leave later this month, we understand from sources.

Luthra & Luthra Law Offices, as its full official name has been, is now called L&L Partners Law Offices, we have learned from sources and Bar & Bench has reported.

Luthra & Luthra Law Offices, as its full official name has been, is now called L&L Partners Law Offices, we have learned from sources and Bar & Bench has reported.

Fortis Healthcare Limited was aquired by Malaysian-Singaporean healthcare group IHH Healthcare Berhad (through its wholly owned subsidiary, Northern TK Venture Pte Ltd), through a preferential issue of equity shares of Fortis for a consideration of Rs 4,000 crores at a price of Rs 170 per Equity Share amounting to 31.1% of Fortis’ share capital, as reported by Mint and others.

In what will be welcome to the firm’s corporate strength, Shardul Amarchand Mangaldas Mumbai corporate finance and M&A partner Jay Parikh is set to join Luthra & Luthra in Mumbai early next month, according to authoritative market sources.

In what will be welcome to the firm’s corporate strength, Shardul Amarchand Mangaldas Mumbai corporate finance and M&A partner Jay Parikh is set to join Luthra & Luthra in Mumbai early next month, according to authoritative market sources.

AZB & Partners acted on the biggest and greatest number of deals in the first quarter (Q1) of 2018, topping the charts across league tables published by mergermarket (MM) as well as by Bloomberg and Thomson Reuters (TR).

AZB & Partners acted on the biggest and greatest number of deals in the first quarter (Q1) of 2018, topping the charts across league tables published by mergermarket (MM) as well as by Bloomberg and Thomson Reuters (TR).

NLU Jodhpur has already placed 32 out of 103 students who will graduate the LLB degree next year, including three foreign firm vacation schemes.

NLU Jodhpur has already placed 32 out of 103 students who will graduate the LLB degree next year, including three foreign firm vacation schemes.

The 25 winners of the Delhi bar council election have been announced, with an unprecedented two law firm lawyers making the cut.

The 25 winners of the Delhi bar council election have been announced, with an unprecedented two law firm lawyers making the cut.

NLU Delhi has already placed 23 out of 78 students who will graduate LLB next year, including four foreign firm vacation schemes, with 10 of those jobs gained during the 24 March ‘Day Zero’ of recruitment at the law school.

NLU Delhi has already placed 23 out of 78 students who will graduate LLB next year, including four foreign firm vacation schemes, with 10 of those jobs gained during the 24 March ‘Day Zero’ of recruitment at the law school.

Khaitan & Co has filed more IPO drafts than any other firm in 2017 just ahead of Cyril Amarchand Mangaldas, in a market where downward pricing pressures have made it tough across the board.

Khaitan & Co has filed more IPO drafts than any other firm in 2017 just ahead of Cyril Amarchand Mangaldas, in a market where downward pricing pressures have made it tough across the board.

Luthra & Luthra managing associate Abhishek Singh has joined K Law in Delhi as partner in its litigation practice.

Luthra & Luthra managing associate Abhishek Singh has joined K Law in Delhi as partner in its litigation practice.

Luthra & Luthra partner Dipti Lavya Swain has joined Azure Power as general counsel (GC).

Luthra & Luthra partner Dipti Lavya Swain has joined Azure Power as general counsel (GC).

Trilegal Delhi corporate, M&A and private equity counsel Vishwanath Pratap Singh has left the firm several weeks ago and is understood to be joining Luthra & Luthra as a partner in Delhi.

Trilegal Delhi corporate, M&A and private equity counsel Vishwanath Pratap Singh has left the firm several weeks ago and is understood to be joining Luthra & Luthra as a partner in Delhi.

Senior advocate Kapil Sibal declared to the media that he had been proven right by the CBI court that acquitted all of the accused in the 2G Spectrum case yesterday after six years since the case was filed, reported The Wire.

Senior advocate Kapil Sibal declared to the media that he had been proven right by the CBI court that acquitted all of the accused in the 2G Spectrum case yesterday after six years since the case was filed, reported The Wire.

State-owned lender Union Bank of India (UBI) has proposed to raise up to Rs 2,000 crores (approximately $312.4 million) through qualified institutional placement (QIP) with an initial offer of Rs 1,000 crores followed by a green-shoe option for another Rs 1,000 crores, as reported by Financial Express. The placement document was filed with the Indian stock exchanges on 12 December 2017. As a part of the transaction, equity shares of face value of INR 10 each of UBI were placed with QIBs, aggregating to INR 2000 Crores.

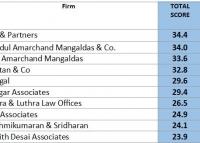

In the latest bi-annual rankings compiled by consultancy RSG India, AZB & Partners has topped the table ahead of Shardul Amarchand Mangaldas (SAM) and Cyril Amarchand Mangaldas (CAM), which had topped the table in 2015 when still united in one firm as Amarchand Mangaldas before their break-up (see full table below).

In the latest bi-annual rankings compiled by consultancy RSG India, AZB & Partners has topped the table ahead of Shardul Amarchand Mangaldas (SAM) and Cyril Amarchand Mangaldas (CAM), which had topped the table in 2015 when still united in one firm as Amarchand Mangaldas before their break-up (see full table below).

“The Rs 1,157-crore initial public offer (IPO) of Godrej Agrovet (GAVL) was subscribed 51.84 times times on the final day of bidding process”, reported The Economic Times. GAVL is a diversified, research & development focused agri-business company with operations across five business verticals of animal feed, crop protection, oil palm, dairy, and poultry and processed foods. The initial public offering opened for subscription on October 4th and closed on October 6th, with a price band of Rs 450-460 per share.