AZB & Partners acted on the biggest and greatest number of deals in the first quarter (Q1) of 2018, topping the charts across league tables published by mergermarket (MM) as well as by Bloomberg and Thomson Reuters (TR).

It was chased on both fronts by Shardul Amarchand Mangaldas in MM as well as TR, while in Bloomberg Khaitan & Co trumped SAM only in terms of deal counts.

Cyril Amarchand Mangaldas came third in both Bloomberg league tables, and in mergermarket value tables, but did not have much presence (or perhaps submissions to Thomson Reuters).

While JSA, Trilegal made it on the charts of all three, Luthra & Luthra slipped off every chart after having lagged at the bottom of all independent M&A league tables by the end of last year.

Mergermarket

MM captured far fewer deals than both Bloomberg and Thomson Reuters databases in part due to its different deal eligibility criteria.

AZB led both in terms of value and volume amongst domestic firms, with 22 deals worth almost $13bn, chased by SAM’s 17 deals worth $10.2bn.

In terms of growth, compared to Q1 of 2017 both AZB and SAM deal values shrunk, by almost 13% for AZB and more than 36% for SAM even though AZB acted on 6 ore deals than last year’s Q1, but SAM acted on one deal less.

Cyril Amarchand Mangaldas, on the other hand, grew both in terms of deal value and volume with its 9 deals worth $7.3bn marking a value growth of almost 780% compared to Q1 2017.

CAM followed AZB and SAM in terms of overall value but in terms of volume it fell behind Khaitan which took the third spot with 16 deals worth $996m and an improvement of over 572% from the five extra deals it acted on compared to Q1 2017.

Bloomberg

Bloomberg captured smaller sized deals, although greater in number than MM.

AZB acted on 35 deals worth $9.5bn which was less by $4.5bn than the overall value of the deals captured by MM.

It was chased by SAM’s 13 deals worth $5.6bn.

AZB’s share accounted for almost half of the market.

CAM ranked third in terms of value with 15 deals worth $4.2bn, but it lagged behind Khaitan (23) and J Sagar Associates (JSA) (17) in terms of deal count.

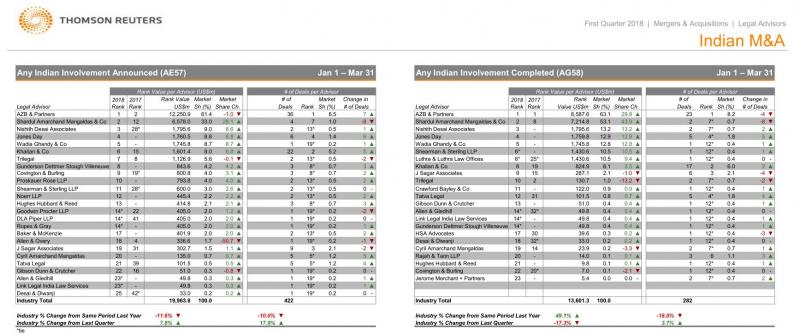

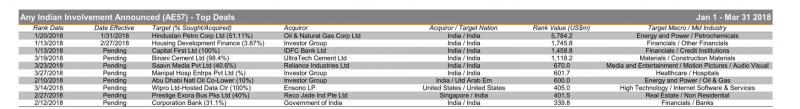

Thomson Reuters

Thomson Reuters had AZB leading on the value and volume charts with 36 deals worth $12.25bn.

SAM submitted only 4 deals worth a combined total of $6.57bn to TR and came in behind AZB.

Nishith Desai Associates (NDA) which didn’t make the charts in Bloomberg but was chasing CAM on deal counts in MM, chased SAM in TR both by deal value and volume having submitted only 2 deals worth a combined total of $1.79bn.

threads most popular

thread most upvoted

comment newest

first oldest

first

threads most popular

thread most upvoted

comment newest

first oldest

first