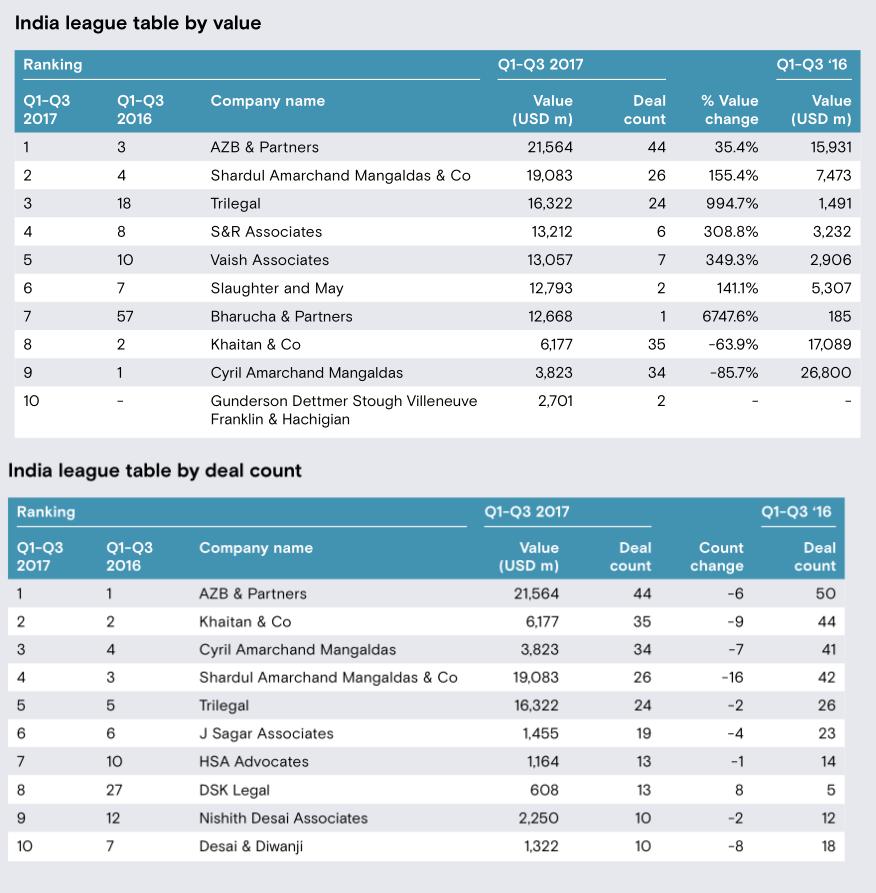

AZB & Partners recorded $21.6bn over 44 M&A deals in the first three quarters of 2017, according to data analytics service mergermarket, topping both value and volume league tables.

AZB added another $5bn with 12 deals in the last quarter, according to the mergermarket data.

Shardul Amarchand Mangaldas (SAM) came second with $19bn of deals - $3bn more than three months ago, when it ranked first ahead of AZB by value (and second by volume).

Last month AZB and SAM both acted on DLF’s $1.9bn Cyber City stake sale to GIC.

And in February, AZB had acted on both sides of the $1bn Airtel Telenor takeover.

However, the massive $12.2bn Vodafone Idea merger from March - Asia's second-largest deal this year - continued to heavily distort the tables, benefiting S&R Associates, SAM, Vaish Associates, Bharucha & Partners and AZB (as well as DMD Advocates, which was not listed by mergermarket).

As well as, now, Trilegal.

Trilegal was vaulted to third position of the value league tables at $16bn, adding nearly $14bn to its deal value tally with 8 additional deals since the 2017 half-year point mergermarket league table. The lion's share of that increase would be due to the competition work on the Vodafone Idea merger having transferred to the firm with AZB-to-Trilegal mover Nisha Kaur Uberoi and her team after May 2017.

Khaitan & Co added around $5bn to its deal values in the last quarter compared to June with 16 additional deals captured.

Cyril Amarchand Mangaldas added 8 deals to its tally, ending up third in the volume tables with 34 deals but only barely making the top 10 by value at $3.8bn (an increase of around $1bn on its rankings three months ago).

threads most popular

thread most upvoted

comment newest

first oldest

first

threads most popular

thread most upvoted

comment newest

first oldest

first