Print Edition

India Unleashed: Print Edition

Print Issue Editorials

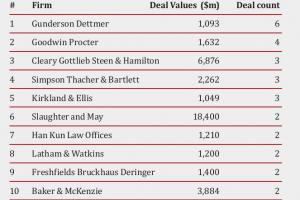

Foreign law firms too have had a bumper year in India, with the vast majority of public instructions linked to their relationships with their marquee private equity clients, which were very hot on India this year. We have ranked the top 13 firms that had at least two India mandates with deal values attached, signifying transactions with a significant India element.

Foreign law firms too have had a bumper year in India, with the vast majority of public instructions linked to their relationships with their marquee private equity clients, which were very hot on India this year. We have ranked the top 13 firms that had at least two India mandates with deal values attached, signifying transactions with a significant India element.

Print Issue Editorials

The proof of most things lies in the pudding, and for a good corporate lawyer, your pudding begins and ends with the kind of work that clients entrust you with.

The proof of most things lies in the pudding, and for a good corporate lawyer, your pudding begins and ends with the kind of work that clients entrust you with.

Print Issue Editorials

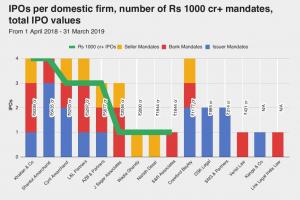

Equity capital markets (CM) can be a tough practice area for a law firm to manage. When the going is good and the markets are booming, it seems like there aren’t enough lawyers to handle the work; when the capital markets go to sleep, utilisation and profits plummet.

Equity capital markets (CM) can be a tough practice area for a law firm to manage. When the going is good and the markets are booming, it seems like there aren’t enough lawyers to handle the work; when the capital markets go to sleep, utilisation and profits plummet.

Print Issue Editorials

At least 17 insolvency deals under the Insolvency and Bankruptcy Code brought significant work to Indian law firms in our tables in the 2018-19 financial year, with deal values of $20.5bn.

At least 17 insolvency deals under the Insolvency and Bankruptcy Code brought significant work to Indian law firms in our tables in the 2018-19 financial year, with deal values of $20.5bn.

Print Issue Editorials

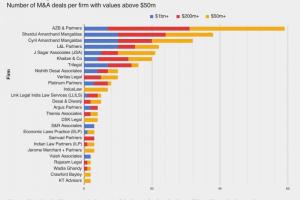

“M&A is the mainstay of any small or large corporate firm’s practice,” states Shardul Amarchand Mangaldas Delhi corporate partner Amit Khansaheb, one of the InLegal 50’s top dealmakers of the financial year 2018-19. “M&A is always happening – bear or bull market – although valuations may differ, expectations may vary and people may put off plans from time to time,” he adds.

“M&A is the mainstay of any small or large corporate firm’s practice,” states Shardul Amarchand Mangaldas Delhi corporate partner Amit Khansaheb, one of the InLegal 50’s top dealmakers of the financial year 2018-19. “M&A is always happening – bear or bull market – although valuations may differ, expectations may vary and people may put off plans from time to time,” he adds.

Print Issue Editorials

To some extent it’s understandable: for years, the Indian legal profession – particularly litigation – has been dominated by men, and most of the new law firms that rose in the nineties and noughties were headed by men. The (generally) male managing partners would often be busy trying to capture market share and executing the work; worrying about whether female lawyers were given the same opportunities as the men was for many an afterthought, if that.

To some extent it’s understandable: for years, the Indian legal profession – particularly litigation – has been dominated by men, and most of the new law firms that rose in the nineties and noughties were headed by men. The (generally) male managing partners would often be busy trying to capture market share and executing the work; worrying about whether female lawyers were given the same opportunities as the men was for many an afterthought, if that.

Print Issue Editorials

A law firm is only ever as good as the collection of its partners. And (nearly) all top transactional partners will be quick to tell you that they are only as good as their team. The analysis that follows is therefore a recognition not just of individual partners’ rainmaking and execution abilities, but also a testament to leadership and teamwork from everyone involved.

A law firm is only ever as good as the collection of its partners. And (nearly) all top transactional partners will be quick to tell you that they are only as good as their team. The analysis that follows is therefore a recognition not just of individual partners’ rainmaking and execution abilities, but also a testament to leadership and teamwork from everyone involved.

Print Issue Editorials

A major part of Legally India’s core mission has always been transparency. When we first set up in 2009, the domestic legal market was largely shrouded in secrecy and could be understood only by tapping into an arcane flow of information and rumours spread via professional networks.

A major part of Legally India’s core mission has always been transparency. When we first set up in 2009, the domestic legal market was largely shrouded in secrecy and could be understood only by tapping into an arcane flow of information and rumours spread via professional networks.

Energy

The Indian Government has set ambitious targets for renewable energy, yet must protect the existing portfolio and assure regulatory certainty.

The Indian Government has set ambitious targets for renewable energy, yet must protect the existing portfolio and assure regulatory certainty.

Insolvency

India has managed to significantly improve its ranking in World Bank’s ease of doing business report – from 130 in 2016 to 77. A major contributor to this is the enactment and implementation of a comprehensive insolvency resolution eco-system through the Insolvency and Bankruptcy Code, 2016 (IBC). Breaking the cumbersome, inefficient, subjective, debtor-in-possession model, the IBC ushered in a simple and modern framework which provides certainty of outcome, ensures value maximization for all stakeholders through a time bound process. IBC arguably has improved the credit culture in India.

India has managed to significantly improve its ranking in World Bank’s ease of doing business report – from 130 in 2016 to 77. A major contributor to this is the enactment and implementation of a comprehensive insolvency resolution eco-system through the Insolvency and Bankruptcy Code, 2016 (IBC). Breaking the cumbersome, inefficient, subjective, debtor-in-possession model, the IBC ushered in a simple and modern framework which provides certainty of outcome, ensures value maximization for all stakeholders through a time bound process. IBC arguably has improved the credit culture in India.

Israel

Following the establishment of full diplomatic relations in 1992, India and Israel have enjoyed a fruitful partnership. Bilateral trade between the countries has been strengthened on the basis of mutual interests in defense, security, agriculture, IT and other sectors. Accordingly, the economic relations have steadily grown since, from $200m (diamonds and defense excluded) in 1992 to approximately $1.94bn in 2018.

Following the establishment of full diplomatic relations in 1992, India and Israel have enjoyed a fruitful partnership. Bilateral trade between the countries has been strengthened on the basis of mutual interests in defense, security, agriculture, IT and other sectors. Accordingly, the economic relations have steadily grown since, from $200m (diamonds and defense excluded) in 1992 to approximately $1.94bn in 2018.

Ireland

Increasingly Ireland has proven to be the domicile of choice for asset managers seeking to establish investment funds investing in India which can be marketed to European and global investors.

Increasingly Ireland has proven to be the domicile of choice for asset managers seeking to establish investment funds investing in India which can be marketed to European and global investors.

USA

The United States and India should view one another as important strategic business partners regionally and globally. With a common legal system of British heritage, democratic governance and relatively free market economies, one would think the two countries would enjoy more trade and mutual direct investment in one another than in European and other Asian countries. But they do not.

The United States and India should view one another as important strategic business partners regionally and globally. With a common legal system of British heritage, democratic governance and relatively free market economies, one would think the two countries would enjoy more trade and mutual direct investment in one another than in European and other Asian countries. But they do not.

Due Diligence

The famous contract law principle ‘caveat emptor’ – Buyer Beware – is often used in commercial transactions involving M&A and other financial and strategic investment deals. Information asymmetry between a buyer and seller necessitates robust due diligence exercise on targets and promoters pre and post such transactions. While traditional methods of due diligences help in uncovering broader business, financial and legal risks, recent times of increased liability of directors, calls for transparency, and reporting requirements have magnified the relevance of micro-level due diligence.

The famous contract law principle ‘caveat emptor’ – Buyer Beware – is often used in commercial transactions involving M&A and other financial and strategic investment deals. Information asymmetry between a buyer and seller necessitates robust due diligence exercise on targets and promoters pre and post such transactions. While traditional methods of due diligences help in uncovering broader business, financial and legal risks, recent times of increased liability of directors, calls for transparency, and reporting requirements have magnified the relevance of micro-level due diligence.

Private Equity

Most investors, whether private equity players or otherwise, prefer to have the protection of a liquidity preference clause in investment agreements to protect their investment in case of the happening of certain events.

Most investors, whether private equity players or otherwise, prefer to have the protection of a liquidity preference clause in investment agreements to protect their investment in case of the happening of certain events.

Mergers & Acquisitions

Before the establishment of National Company Law Tribunals (“NCLTs”) under the Companies Act, 2013 (“2013 Act”), schemes of arrangement – being court approved arrangements or compromises between a company(ies) and its (their) creditors or members, fell within the purview of the High Courts under Sections 391-394 of the Companies Act, 1956 (“1956 Act”).

Before the establishment of National Company Law Tribunals (“NCLTs”) under the Companies Act, 2013 (“2013 Act”), schemes of arrangement – being court approved arrangements or compromises between a company(ies) and its (their) creditors or members, fell within the purview of the High Courts under Sections 391-394 of the Companies Act, 1956 (“1956 Act”).