Most investors, whether private equity players or otherwise, prefer to have the protection of a liquidity preference clause in investment agreements to protect their investment in case of the happening of certain events.

Liquidation preference is the right of the investor, defined in an investment agreement, to receive its investment amount plus certain agreed percentage of the proceeds in the event of happening of a Liquidation Event. While liquidation in common law parlance is considered as winding up of a company, Liquidation Preference is triggered on the happening of events like sale of shares or substantial assets, an acquisition or merger of the company, consolidation, merger, amalgamation, demerger or where an arrangement is entered into with the creditors, etc. or in some cases even a ‘nonqualified’ IPO. Such events are generally defined as liquidation events in an investment agreement.

There are two types of liquidation preference: (i) non-participating liquidation preference and (ii) participating liquidation preference. Under non-participating liquidation preference, the investor will be entitled to receive its predetermined returns, but shall not be entitled to receive any portion of the surplus proceeds to be distributed to the equity shareholders. On the other hand, under participating liquidation preference, the investor, is entitled to pre-determined returns, and in the distribution of the surplus proceeds.

The need for a Liquidation Preference

An investor is keen to include a liquidation preference right in an investment agreement to ensure that it can get some return on its investment in case of the happening of a liquidation event as defined above. An investment agreement usually includes provisions that provide an assured exit to the investors at a fixed return post a specified period. However, the need for the liquidation preference protection arises in scenarios where a liquidation event takes place prior to the investor being provided an exit. In such a case it is essential that the investor receives return on its investment and such a clause finds its way in an investment agreement.

Legal Enforcement of Liquidation Preference:

There has been some debate on whether a liquidation preference clause is legally enforceable under Indian law. The confusion arises since by virtue of the provisions of the Companies Act, 2013 the preference shares and preference shareholders are entitled to preference upon liquidation of the company. However, equity shareholders have not been specifically provided with such rights under the Companies Act, 2013. Section 43 of the Companies Act, 2013 provides that preference share capital, on winding up, has a preferential right on payment of amounts and premium. This would in turn imply that investors who have been issued equity shares would perhaps not be in a position to enforce its liquidation preference over the preference shareholders. In the erstwhile Companies Act, 1956, provisions with respect to different types of share capital were not applicable to private companies and hence the general view was that a liquidation preference clause with respect to a private company was legally enforceable as the preference right given to preference shareholders was not applicable in case of private companies. Initially, the Companies Act 2013 did not provide such exemption to private companies. This position changed when the Ministry of Corporate Affairs vide notification dated June 5, 2015 provided that a private company may be exempted from Section 43 and Section 47 of the Companies Act 2013. However, in such a scenario, the articles of association of a private limited company shall reflect that such private company is exempted from the applicability of section 43 and section 47 of the Companies Act, 2013. In view of the above notification, it can now be said that a liquidation preference clause with respect to private companies may be enforceable provided that the articles of such a company exempt it from the applicability of section 43 of the Companies Act, 2013.

In case of public companies the situation is a bit more complex as sections with respect to different types of share capital is applicable to public companies and there is no clarity as to whether a contractual understanding with respect to distribution of proceeds will be considered legally valid in such a scenario.

Also, the law is unclear as to whether the liquidation preference in case of preference shares, can have a participating right as highlighted above, over and above the preference capital in the company. One view is that as long as the shareholders of a company agree to such preferred distribution and the same is captured in the terms of the preference shares and in the articles of the Company, then such provisions should be binding on the Company and its shareholders.

Structuring of the Liquidation Preference Clause

The investors, by virtue of the rights assigned to them vide the investment agreements, are generally referred to as preferred shareholders. The liquidation preference clause is outlined in such a manner so as to ensure that returns or proceeds from a liquidity event are credited to the investor in priority to the other shareholders. The manner and degree in which the same is done varies from deal to deal and primarily upon the parties. However, as the name suggests, in liquidation preference, it is the preferred shareholders i.e. the investors that receive proceeds prior to or in preference to the distribution of the same amongst common shareholders.

On the happening of a liquidation event, generally, the proceeds are distributed to the investor in the manner highlighted below:

Non-Participating Liquidation Preference or the Multiple:

A “multiple” of the investment amount is decided upon by the investor and in a liquidation event and the Company is obligated to provide to such multiple amount by attributing the proceeds to the investor. The multiple may be a 1x, 1.25x, 1.5x, 2x, 3x, etc of the investment amount. Generally, the investors either propose a non-participating liquidation preference with a higher multiple or else 1x coupled with participating liquidation/capped participation (explained below).

Participating Liquidation or Double Dip:

Participating liquidation preference goes a step ahead from the “multiple” mechanism to secure the interest of the investor. In such a scenario, post the investor receiving its guaranteed return, the investor will also be additionally entitled to participation rights to share the remaining proceeds in proportion to the shares held by the investor. This mechanism is commonly referred to ‘double dip’.

Capped Participation

In a scenario where the investor and the company cannot settle for a conclusion between participating and non-participating liquidation preference, it is the capped participating that comes to rescue. Where an investor invests in a company, there is an internal rate of return i.e. IRR that the investor expects i.e. by and large the percentage of return on investor. A capped participation liquidation preference is what we can call as a “Restricted Double Dip”. This is what can work for both for the investor and the company. Vide this mechanism, the investor receives his multiple, usually 1x of the investment amount, and has a further right to share the remaining proceeds in proportion to their ownership until it reaches a threshold amount which is generally the IRR or a multiple of investment (2x/3x).

Chosen Participation

Another kind of technique that the parties resort in a situation of deadlock is providing the investor with the option of choosing the liquidation preference upon the happening of a liquidation event subject to certain restrictions. The investor is given a choice to opt for the option that provides higher proceeds. The options provided to the investor are either the non-participating liquidation preference/multiple, which in the current scenario is generally limited to 1x, or to convert their preferred shareholding into common shareholding to participate in the distribution of proceeds on a pro rata basis with the other shareholders. In a situation where the company is able to generate higher proceeds, the investor would choose conversion of its preferred stock into common shareholding however, in a situation where limited proceeds are generated, the return would be limited to 1x for the investor. The terms of conversion of the instruments subscribed to by the investors shall be given due consideration when this mechanism is adopted.

Example:

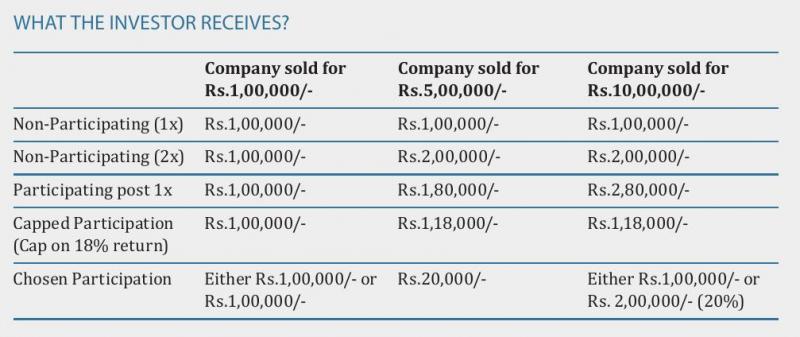

Where an investor invests Rs.1,00,000/- in lieu of 20% shareholding in a company and the said company is sold at valuations illustrated below, the table specifies the returns which the investor will be entitled to as per the opted liquidation preference:

Assuming that the other shareholders hold 80% shares of the company, the return that such other shareholders collectively receive, has been illustrated below:

Balancing Interest:

Prima facie, it seems that for an investor choosing the option promising the maximum return is a wise option. However, if the interest of both, the investor and the company, is not balanced, there is a possibility that the investor may be shooting its own foot. Many a times the promoters’ and small entrepreneurs give in the demands of the investors, however, what they lose in return is their motivation to strive for higher returns. Such a scenario adversely affects the company on a whole and in turn the investors are affected as well. Furthermore, the probability of future investors demanding the same preferential rights over the rights of previous investor increases which would adversely affect such previous investors.

Multiple Investors:

The complexities of the liquidation preference clause increase where in addition to the already existing investors, new investors step in the company. It is common to find series seed investment in a company followed by Series A, Series B, Series C and so on. The liquidation preference is rearranged in a company with new investments flowing in the company. However, the company and all investors collectively decide upon participating/non-participating/capped participation.

Seniority: Where the seniority structure is adopted, the investors from the latest rounds are given preference in terms of pay outs over and above the other investors i.e. Series A investors would be paid in priority over the Series Seed investor who would be paid in priority over the company. Continuing the above example, where a Series A investor invests Rs.1,00,000/- in a company post the investment by the Series Seed investor and the Company is sold for Rs.1,00,000/-, the Series A investor will receive its 1x i.e. Rs.1,00,000/- in priority whereas the Series Seed and Company would not be entitled to the proceeds.

Pari-passu or Pro Rata: This is the generally adopted mechanism where all investments received in a company, as on a particular date, are considered to be 100% and investors pro rata percentage is calculated depending upon the amount of their investments. For example, if the total investment raised by a company is Rs.50,000/- from Series Seed Investor, Rs.50,000/- from Series A Investor and Rs.1,00,000/- from Series C investor the respective pro rata investment ratio would be 25% for Series Seed and Series A and 50% for Series C investors. The liquidation proceeds received are then distributed amongst the investors, in proportion to their pro rata investment percentage.

Hybrid Pari-Passu: In a hybrid of pari-passu, some class of investors might be pari passu within themselves but senior to other classes. Such a scenario usually occurs where there are multiple funding rounds in a company of varied investment amounts.

Conclusion:

Liquidation preference continues to be used extensively by investors in investment agreements. Enforceability of the liquidation preference clause has not been extensively tested in Indian Courts. Most investors do insist on the inclusion of this clause in their investment agreements. While the enforcement aspect with respect to private companies appears to be fairly clear, until and unless we seek more clarity from courts or regulators, the enforcement of the liquidation preference clause in case of public companies will continue to be a matter of debate and discussion.

About the authors

Apurv Sardeshmukh is a partner with Legasis Partners, a law firm having its offices in Mumbai, Pune, Delhi and Hyderabad.

With over 10 years in the profession, Apurv has advised variety of private equity firms, venture capital firms, investors, foreign companies and domestic companies on various aspects of corporate laws, investment laws, foreign exchange regulations, commercial laws, IT laws and labour laws.

He has advised various companies and firms in relation to investment transactions and due diligences. Apurv also acted as the issuer’s counsel for the Pune Municipal Corporation in relation to their 200 Crore Municipal Bond Offering in 2017. Apurv has also advised companies on various aspects of competition laws, cyber laws and data protection laws.

Aanchal Lamba is an ILS Law College Graduate and is currently working as an associate with Legasis Partners, Pune. At Legasis Partners, she is involved in advising on number of investment transactions, conducting due diligence, reviewing and drafting related documents and advising a number of companies and firms on matters related to company law, investment law, foreign investments, data protection laws, etc.

Aanchal completed her BSL LLB in 2016 and secured an overall University Rank 10 in her final year post which she joined Legasis. She has also holds diplomas in human rights law and corporate law from ILS Law College. She is currently pursuing her Master’s in Business Law from NLSIU, Bangalore. She has authored a paper on Cyber Squatting and co-authored papers on Insolvency and Bankruptcy Ordinance and Corporate Criminal Liability which are published on legal portals and in legal magazine. While pursuing her BSL LLB, she had also interned with a number of law firms including Legasis Partners and participated in moots.

Legasis Partners

B-105, International Convention Center,

Senapati Bapat Road,

Pune 411016

Maharashtra, India

With offices in Mumbai – BKC, Mumbai – Nariman Point, New Delhi and Hyderabad

www.legasispartners.com

{module 544}