Welcome Legally India's 2019 InLegal 50 Issue

If you would like to receive future editions, please click here to register your interest.

Our 2019 print and digital edition of Legally India is a joint publication by Global Legal Media and Legally India. The issue introduces the InLegal 50, which is an annual fully-transparent tracking of India's corporate law firms. Other topics in the issue include updates on a number of vital practice areas and jurisdictions, as well as:

- Top 100 Dealmakers of the Year

- Marquee & Prestige Firms, Profiled

- 63+ Busiest Indian & Foreign Firms

- Cap Markets: Riding out the Lull

- Insolvency: The Boom of Busts

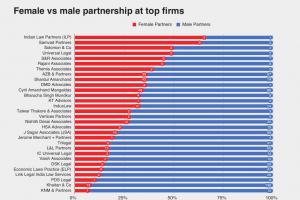

- Talk About Sex: Gender Ratios at Top Firms

Introducing the InLegal 50: Editor’s Note

A major part of Legally India’s core mission has always been transparency. When we first set up in 2009, the domestic legal market was largely shrouded in secrecy and could be understood only by tapping into an arcane flow of information and rumours spread via professional networks.

InLegal 50: The biggest M&A & insolvency deals in a year of plenty

“M&A is the mainstay of any small or large corporate firm’s practice,” states Shardul Amarchand Mangaldas Delhi corporate partner Amit Khansaheb, one of the InLegal 50’s top dealmakers of the financial year 2018-19. “M&A is always happening – bear or bull market – although valuations may differ, expectations may vary and people may put off plans from time to time,” he adds.

InLegal 50: The Legally India Corporate Dealmakers of the Year 2018-19

A law firm is only ever as good as the collection of its partners. And (nearly) all top transactional partners will be quick to tell you that they are only as good as their team. The analysis that follows is therefore a recognition not just of individual partners’ rainmaking and execution abilities, but also a testament to leadership and teamwork from everyone involved.

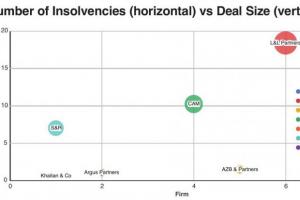

InLegal 50: The Insolvency Machine

At least 17 insolvency deals under the Insolvency and Bankruptcy Code brought significant work to Indian law firms in our tables in the 2018-19 financial year, with deal values of $20.5bn.

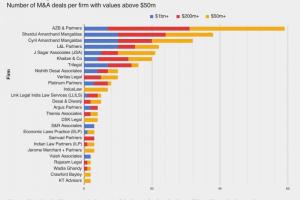

InLegal 50: The Busiest Corporate Law Firms

The proof of most things lies in the pudding, and for a good corporate lawyer, your pudding begins and ends with the kind of work that clients entrust you with.

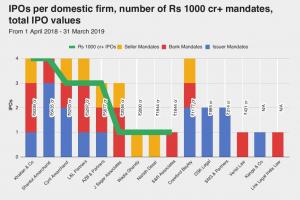

InLegal 50: Top of Equity Capital Markets

Equity capital markets (CM) can be a tough practice area for a law firm to manage. When the going is good and the markets are booming, it seems like there aren’t enough lawyers to handle the work; when the capital markets go to sleep, utilisation and profits plummet.

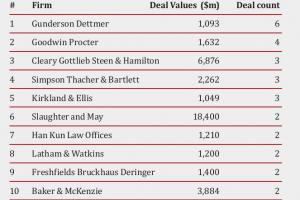

InLegal 50: Foreign corporate firms in India

Foreign law firms too have had a bumper year in India, with the vast majority of public instructions linked to their relationships with their marquee private equity clients, which were very hot on India this year. We have ranked the top 13 firms that had at least two India mandates with deal values attached, signifying transactions with a significant India element.

Women in Indian law firms: In a growing minority

To some extent it’s understandable: for years, the Indian legal profession – particularly litigation – has been dominated by men, and most of the new law firms that rose in the nineties and noughties were headed by men. The (generally) male managing partners would often be busy trying to capture market share and executing the work; worrying about whether female lawyers were given the same opportunities as the men was for many an afterthought, if that.

India-Israel Commercial Relations: The Opportunities, Challenges and the Way Ahead

Following the establishment of full diplomatic relations in 1992, India and Israel have enjoyed a fruitful partnership. Bilateral trade between the countries has been strengthened on the basis of mutual interests in defense, security, agriculture, IT and other sectors. Accordingly, the economic relations have steadily grown since, from $200m (diamonds and defense excluded) in 1992 to approximately $1.94bn in 2018.

Building a Two-Way Street: A Guide for Indian Companies Seeking to Conduct Business in the US

The United States and India should view one another as important strategic business partners regionally and globally. With a common legal system of British heritage, democratic governance and relatively free market economies, one would think the two countries would enjoy more trade and mutual direct investment in one another than in European and other Asian countries. But they do not.

Decoding the “Liquidation Preference” Clause in Investment Transactions

Most investors, whether private equity players or otherwise, prefer to have the protection of a liquidity preference clause in investment agreements to protect their investment in case of the happening of certain events.

The National Company Law Tribunal in India

Before the establishment of National Company Law Tribunals (“NCLTs”) under the Companies Act, 2013 (“2013 Act”), schemes of arrangement – being court approved arrangements or compromises between a company(ies) and its (their) creditors or members, fell within the purview of the High Courts under Sections 391-394 of the Companies Act, 1956 (“1956 Act”).

Insolvency and Bankruptcy Code, 2016 – Jurisprudence Bolsters and Aids Implementation

India has managed to significantly improve its ranking in World Bank’s ease of doing business report – from 130 in 2016 to 77. A major contributor to this is the enactment and implementation of a comprehensive insolvency resolution eco-system through the Insolvency and Bankruptcy Code, 2016 (IBC). Breaking the cumbersome, inefficient, subjective, debtor-in-possession model, the IBC ushered in a simple and modern framework which provides certainty of outcome, ensures value maximization for all stakeholders through a time bound process. IBC arguably has improved the credit culture in India.

Increasing Role of Forensics in Due Diligence

The famous contract law principle ‘caveat emptor’ – Buyer Beware – is often used in commercial transactions involving M&A and other financial and strategic investment deals. Information asymmetry between a buyer and seller necessitates robust due diligence exercise on targets and promoters pre and post such transactions. While traditional methods of due diligences help in uncovering broader business, financial and legal risks, recent times of increased liability of directors, calls for transparency, and reporting requirements have magnified the relevance of micro-level due diligence.

Turbulence in Global Trade: Effective Strategies for Navigating Through the Headwinds

Let us start with some statistics about India’s economy: (a) Starting from USD 452 billion in 1999, India’s GDP crossed USD 2.6 trillion by 2017 – a growth of almost 6 times1 during a period when global GDP increased by only 2.5 times; (b) Per capita income nearly trebled in the past two decades; and (c) Total exports from India (merchandise and services) have increased 8.73 per cent year-on-year in 2018-19 (up to February 2019) to reach USD 483.92 billion, while total imports have increased by 9.42 per cent year-on- year to USD 577.31 billion2.Increasing protectionism, the US-China trade dispute and uncertainty around Brexit have contributed to the lowest global trade volumes in 9 years.

Fundamental Tenets and Laws of Succession Planning

Succession planning for safeguarding and optimal transitioning of wealth and control are emerging as a critical consideration for businesses in India, many of which are family owned/controlled and are characterized by significant promoter family stakes. While wealth preservation, ring fencing key assets and tax-optimized transfer to the next generation were the guiding features of such exercises earlier on, modern businesses look at corporate succession planning with the added lens of ensuring business continuity and operational competitiveness. In this context, promoters and companies need to reflect upon additional factors such as choice of successors (who may not necessarily be only from the family), composition for the board post-transition and rights of the promoters (including their successors), amongst others.