Shearman & Sterling

Platinum Partners Mumbai partner Gautam Bhat with associate Abhik Ghosh and associate Ushma Marwah, and Sidley Austin led by partner Manoj Bhargava, of counsel Vivek Baid, and associate Rishabh Gupta, advised Essar on the sale of its BPO subsidiary Aegis to Capital Square partners.

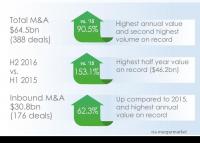

Freshfields Bruckhaus Deringer has topped the mergermarket value league table of international law firms that advised on M&A deals in the record 2016 calendar year.

Freshfields Bruckhaus Deringer has topped the mergermarket value league table of international law firms that advised on M&A deals in the record 2016 calendar year.

"Direct-to-home television operator Dish TV will merge with Videocon d2h, creating India’s largest media company by sales. Dish TV is the market leader in the DTH space while Videocon is the third largest by subscribers. Their combined sales in FY16 were Rs 5,920 crore, more than Zee Entertainment, which had sales of Rs 5,850 crore. Both Zee and Dish are part of Subhash Chandra’s Essel Group.

CX Partners (a PE firm focused on the Indian mid-market) and Capital Square Partners sold for $420m its stake in Minacs to Concentrix Global Holdings Inc., a subsidiary of Synnex Corporation, as reported by the Economic Times as one of the largest in the business process outsourcing (BPO) sector, and Concentrix’ second largest deal.

Shearman & Sterling, DLA Piper, White & Case and Allen & Overy had the largest number of recorded Indian M&A deals in the first six months of 2016, according to data intelligence provider mergermarket, each with five or four transactions.

Amarchand Mangaldas maintained its top spot in intelligence provider mergermarket’s M&A league rankings this quarter.

Amarchand Mangaldas maintained its top spot in intelligence provider mergermarket’s M&A league rankings this quarter.

Sun Pharma bought debt-ridden pharmaceutical giant Ranbaxy for $4bn from Daiichi Sankyo.

Sun Pharma bought debt-ridden pharmaceutical giant Ranbaxy for $4bn from Daiichi Sankyo.

Shearman & Sterling has promoted Hong Kong-based M&A counsel and India co-head Sidharth Bhasin to its partnership.

Shearman & Sterling has promoted Hong Kong-based M&A counsel and India co-head Sidharth Bhasin to its partnership.

AZB & Partners and international law firm Shearman & Sterling advised a Canadian financial holdings company’s investment subsidiary Fairbridge Capital in its purchase of 76.81 per cent equity for Rs 817 crore ($150m) in British holiday maker Thomas Cook Group’s (TCG) Indian subsidiary Thomas Cook India (TCIL). TCG was advised by Trilegal with international best friend law firm Allen & Overy.

AZB & Partners and international law firm Shearman & Sterling advised a Canadian financial holdings company’s investment subsidiary Fairbridge Capital in its purchase of 76.81 per cent equity for Rs 817 crore ($150m) in British holiday maker Thomas Cook Group’s (TCG) Indian subsidiary Thomas Cook India (TCIL). TCG was advised by Trilegal with international best friend law firm Allen & Overy.

Shearman & Sterling, DLA Piper, Freshfields Bruckhaus Deringer, Salans, Linklaters and Clifford Chance have advised on Tata Steel’s sale of Teesside Cast Products’s (TCP’s) assets to Thailand’s largest steel producer Sahaviriya Steel for $469m.

Shearman & Sterling, DLA Piper, Freshfields Bruckhaus Deringer, Salans, Linklaters and Clifford Chance have advised on Tata Steel’s sale of Teesside Cast Products’s (TCP’s) assets to Thailand’s largest steel producer Sahaviriya Steel for $469m.

The book-running lead managers are Kotak Mahindra, Enam Securities, JP Morgan India and Morgan Stanley India.

Amarchand, Luthra & Luthra and Khaitan & Co were leading in Legally India's Q3 2009-10 IPO rankings.

For the first time this year, Desai & Diwanji and Khaitan & Co are leading the third quarter Indian M&A rankings both by value and volume of deals, pushing Amarchand Mangaldas two places down mergermarket's value league table compared to three months ago.

For the first time this year, Desai & Diwanji and Khaitan & Co are leading the third quarter Indian M&A rankings both by value and volume of deals, pushing Amarchand Mangaldas two places down mergermarket's value league table compared to three months ago.

Luthra & Luthra and S&R Associates acted as Indian counsel in Indian mining company Sterlite Industries' $1.5bn (Rs 7,200 crore) equity fundraising, with Latham & Watkins and Shearman & Sterling handling the international advice.

Luthra & Luthra and S&R Associates acted as Indian counsel in Indian mining company Sterlite Industries' $1.5bn (Rs 7,200 crore) equity fundraising, with Latham & Watkins and Shearman & Sterling handling the international advice.

Despite meagre pickings, Desai & Diwanji, Khaitan & Co, AZB & Partners and Amarchand Mangaldas have topped an M&A league table, together advising on 30 Indian deals worth a total of $9.4bn in the last six months.

Despite meagre pickings, Desai & Diwanji, Khaitan & Co, AZB & Partners and Amarchand Mangaldas have topped an M&A league table, together advising on 30 Indian deals worth a total of $9.4bn in the last six months.

Amarchand and US firm Shearman & Sterling jointly advised the Californian venture capital fund Norwest Venture Partners in buying Rs250 crore ($51m) in the National Stock Exchange of India (NSE) under new foreign investment rules.

Amarchand and US firm Shearman & Sterling jointly advised the Californian venture capital fund Norwest Venture Partners in buying Rs250 crore ($51m) in the National Stock Exchange of India (NSE) under new foreign investment rules.