AZB & Partners was the busiest and fastest-growing law firm in India this year according to the number of deals law firms reported to Bloomberg (BB) and Thomson Reuters (TR) databases.

While we usually only cover the mergermarket M&A league tables, which are expected out shortly, this year we thought we’d also cast an eye over the other credible M&A league tables in the market to give some perspective on who captures what and who does well where.

One proviso with league tables, as ever, is that some firms that perform poorly in a given ranking may simply have less sophisticated public relations (PR) functions that disseminate deals, or may find themselves unable or unwilling to ask clients for permission to disclose deals. Of course, in some cases, they simply have fewer deals to report and in light of the large number of deals captured by many of the larger law firms in 2017, the figures seem a fairly useful indication of M&A strength.

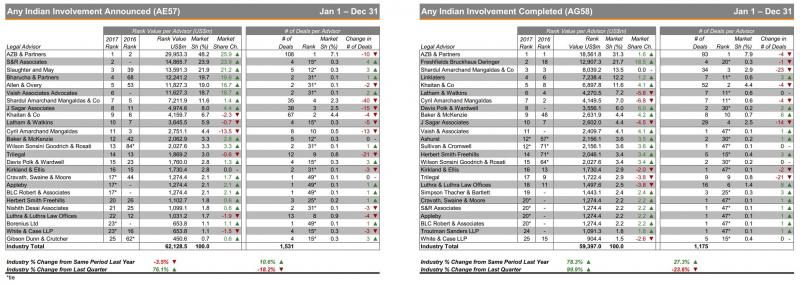

According to the Bloomberg figures...

Having closed 105 deals worth over $48bn, AZB grabbed a 54.5% market share of 2017 M&A in India, growing that market share by almost 33 percentage points vis-a-vis its 2016 Bloomberg total deal values.

Of Cyril Amarchand Mangaldas submissions, 83 were included by Bloomberg in 2017, which is nearly as many deals as AZB but a total deal sizes aggregating to less than 9% of the market share with $7.7bn in 8th position in the values league table.

Shardul Amarchand Mangaldas, reported the next-largest number of accepted deals to Bloomberg at 55 but raked in the second-highest total deal values at $20.3bn, grabbing 23% of the market. The firm's total market share according to Bloomberg grew by more than 12 percentage points vis-a-vis 2016.

Trilegal did better than J Sagar Associates (JSA) and Khaitan & Co in terms of deal value and better than JSA in terms of deal volume this year, tapping a 5.1% market share by Bloomberg's count, with its 39 deals worth $4.49bn.

J Sagar Associates (JSA) registered 37 deals worth $2.6bn behind five Indian firms in terms of deal count and behind nine firms in terms of deal value for a 2.9% market share.

S&R Associates acted on 16 big deals worth $16.4bn, according to Bloomberg, growing its market share of total values by 4 percentage points.

Bharucha & Partners acted on 3 big deals and raked in a value of almost $14bn while Vaish Associates raked in over $13bn through only 2 deals.

HSA Advocates acted on 27 deals amounting to $1.4bn in total value.

Former AZB partner Abhjit Joshi-founded firm Veritas Legal came 9th in BB with 13 deals but did not crack the top 20 by value.

According to Thomson Reuters...

Thomson Reuters generally accepted and/or captured fewer deals and lower aggregate deal sizes than Bloomberg in its 2017 league table, either by virtue of its research process, qualification criteria (see below), firms' preference in where they submit their deal reports, or quite possibly a mix of such factors.

And while AZB still topped the Thomson Reuters league table with 108 deals worth a total of $30bn, Shardul Amarchand came only seventh in the values league table with $7.2bn from 35 deals.

Cyril Amarchand came 11th in TR league tables by value, with 8 deals and a value of $2.8bn.

The one major exception was Khaitan & Co, which while having had 67 deals recognised by both TR and BB, had a greater deal value with TR of $4.2bn ranking it in 9th place there (as opposed to $2.5bn and 11th with BB).

Luthra & Luthra too performed marginally better with TR than BB: while BB tallied 9 of Luthra's deal at a total of only $668m (which was not enough to even make the top 20 by value), TR counted 13 of Luthra's deals, allowing the firm to just crack the $1bn mark in 22nd place in the value tables (dropping from 12th in TR's table the previous year), behind Nishith Desai Associates (which was not included in Bloomberg's tally at all).

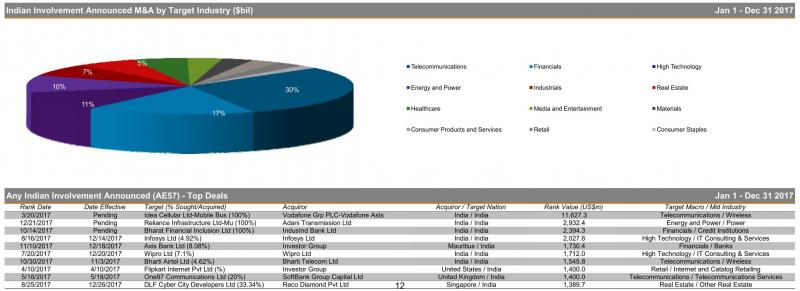

Top deals of 2017

The March 2017-announced Vodafone-IDEA merger on which at least 12 firms, including AZB and SAM, bagged roles, was the top rated deal done by Indian law firms this year, according to the Thomson Reuters rankings.

CAM and J Sagar Associates (JSA) had acted on the second-biggest Indian M&A - Adani Transmission’s buy in Reliance Infrastructure for $2.1bn - which snuck in just before the New Year.

Axis Bank's $1.78bn fundraising, on which AZB and SAM had roles, is also among TR's list of top deals.

Flipkart's funding from Softbank also finds a mention in the top 10, with roles bagged by AZB and Khaitan.

Bloomberg (BB) & Thomson Reuters (TR) 2017 M&A league tables combined (and sortable)

Click in the first row to sort by that column

| Firm | BB Value ($m) | BB Deal # | BB Value per Deal ($m) | TR Value ($m) | TR Deal # | TR Value per Deal ($m) | TR Change in Deal # vs 2016 |

| AZB & Partners | 48034 | 105 | 457 | 29953 | 108 | 277 | -10 |

| Shardul Amarchand Mangaldas & Co | 20260 | 55 | 368 | 7212 | 35 | 206 | -40 |

| S&R Associates | 16420 | 16 | 1026 | 14866 | 4 | 3716 | 4 |

| Slaughter and May | 13985 | 6 | 2331 | 13591 | 5 | 2718 | 3 |

| Bharucha & Partners | 13883 | 3 | 4628 | 12241 | 2 | 6121 | 1 |

| Allen & Overy LLP | 13472 | 5 | 2694 | 11827 | 2 | 5914 | -2 |

| Vaish Associates | 13272 | 2 | 6636 | 11627 | 2 | 5814 | 2 |

| Cyril Amarchand Mangaldas | 7717 | 83 | 93 | 2751 | 8 | 344 | -13 |

| Trilegal | 4492 | 39 | 115 | 1869 | 12 | 156 | -21 |

| J Sagar Associates | 2570 | 37 | 69 | 4975 | 38 | 131 | -15 |

| Khaitan & Co | 2549 | 67 | 38 | 4160 | 67 | 62 | -4 |

| Simpson Thacher & Bartlett LLP | 2221 | 3 | 740 | ||||

| Sullivan & Cromwell LLP | 2021 | 1 | 2021 | ||||

| Economic Laws Practice | 1859 | 1 | 1859 | ||||

| Davis Polk & Wardwell LLP | 1760 | 4 | 440 | 1760 | 4 | 440 | 3 |

| Allen & Gledhill LLP | 1626 | 3 | 542 | ||||

| HSA Advocates | 1445 | 27 | 54 | ||||

| Mayer Brown LLP | 1421 | 1 | 1421 | ||||

| Drinker Biddle & Reath LLP | 1421 | 1 | 1421 | ||||

| Cuatrecasas Goncalves Pereira SLP | 1421 | 1 | 1421 | ||||

| Luthra & Luthra Law Offices LLP | 668 | 9 | 74 | 1031 | 13 | 79 | -4 |

| Veritas Legal | 657 | 13 | 51 | ||||

| White & Case LLP | 609 | 4 | 152 | 654 | 4 | 163 | -3 |

| O'Melveny & Myers LLP | 570 | 7 | 81 | ||||

| Jones Day | 501 | 6 | 84 | ||||

| Gibson Dunn & Crutcher LLP | 231 | 4 | 58 | 451 | 4 | 113 | 3 |

| Freshfields Bruckhaus Deringer LLP | 136 | 6 | 23 | ||||

| Krishnamurthy & Co | 108 | 5 | 22 | ||||

| Goodwin Procter LLP | 85 | 4 | 21 | ||||

| Latham & Watkins | 3646 | 4 | 911 | -5 | |||

| Baker & McKenzie | 2063 | 5 | 413 | 0 | |||

| Wilson Sonsini Goodrich & Rosati | 2028 | 2 | 1014 | 1 | |||

| Kirkland & Ellis | 1730 | 2 | 865 | -3 | |||

| Cravath, Swaine & Moore | 1274 | 1 | 1274 | 0 | |||

| Appleby | 1274 | 1 | 1274 | 1 | |||

| BLC Robert & Associates | 1274 | 1 | 1274 | 1 | |||

| Herbert Smith Freehills | 1103 | 3 | 368 | 1 | |||

| Nishith Desai Associates | 1099 | 2 | 550 | -3 | |||

| Borenius Ltd | 654 | 1 | 654 | 1 |

Full league table from Bloomberg

Full league table from Thomson Reuters

Criteria & methodology

Thomson Reuters states the following as its criteria:

- Announced league tables include all deals that were announced between January 1, 2016 and December 29, 2017 and of which Thomson Reuters was made aware. All current data and previous year's data is as of 5:00pm EDT on December 29, 2017.

- League tables include rank eligible mergers, acquisitions, repurchases, spin-offs, self-tenders, minority stake purchases and debt restructurings.

- A tender/merger transaction is considered to be effective at the time of consummation of the merger or the date on which it is declared wholly unconditional.

- Deals with undisclosed dollar values are rank eligible but with no corresponding Rank Value. Non-US dollar denominated transactions are converted to the US dollar equivalent at the time of announcement of terms.

- Financial and legal advisors receive full credit for each deal on which they provide financial or legal advisory services, unless they represent minority sellers or advise on only a portion of the transaction or Thomson Reuters has not been made aware of their participation in that transaction. For pending transactions, advisors to targets of multiple bids receive credit for the transaction agreed to or, in the absence of an agreement, the value of the highest offer.

- Any Involvement league tables include deals where the target, acquiror, or either ultimate parent are domiciled (nation of headquarters) in the specified region or nation.

- League tables, commentary, and charts citing announced activity are based on Rank Date and include intended, pending, partially complete, completed, pending regulatory, and unconditional transactions. Rank Date is defined as the earliest public announcement of when a value can be applied to a transaction.

Bloomberg has noted the following for its listing criteria:

Announced Global League Tables are based upon announced total values, unless otherwise stated in the title. Non-US dollar values are converted to US dollars at the time of announcement.

Credit will be given to transactions in which Bloomberg classifies as mergers, acquisitions, divestitures, self-tenders, or spin-offs.

Regional and industry League Tables will be based on the country of risk and industry of the ultimate publicly traded parent of a privately held company where applicable.

Advisors to any member of an investor group, consortium, or joint venture are eligible for full credit.

Advisory fees hold no weight over advisory credit.

Announced Global League Tables are based upon announced total values, unless otherwise stated in the title. Non-US dollar values are converted to US dollars at the time of announcement.

Credit will be given to transactions in which Bloomberg classifies as mergers, acquisitions, divestitures, self-tenders, or spin-offs.

Regional and industry League Tables will be based on the country of risk and industry of the ultimate publicly traded parent of a privately held company where applicable.

Advisors to any member of an investor group, consortium, or joint venture are eligible for full credit.

Advisory fees hold no weight over advisory credit

threads most popular

thread most upvoted

comment newest

first oldest

first

One example of such firm is Luthra. Luthra has a really poor PR team which struggles to even copy paste deal descriptions from one publication submission to the other. Partners (who delegate this task to senior associates / managing associates) are overburdened with the task of drafting and vetting these deal submissions. Unfortunately even after that, the communications team has in the past goofed up in making timely submissions. One such example was the DLF GIC JV for residential projects which though almost a 2000 crore deal didn’t feature in any of the respectable rankings.

I guess one would write to assume that only the management has to be blamed for this, since no competence comes for cheap. However, it would be incorrect to assume that Luthra is in the dumps! One can’t deny that the team of Mr Dudeja / Kakkar are as good as any other regulatory teams of any of the Amarchand’s and AZB. Similarly Bikash’s and Manan’s have top quality lawyers well respected in the market. Look at any of the rankings like legal 500 and that would substantiate my argument.

All what luthra needs to do to top the ranking is to throw out the laggards of the communications team, expend a few more thousands of rupees and get competent people on board. Same would go for the HR team as well.

I also think that because of god knows what reason, LI tends being unfair to luthra.

Also the senior partners of it are famous for blowing their trumpet. There must have been no trumpet available for them to blow. The deals are many a times snatched because of botched up execution. The attempt to give the thumbs up to the regulatory practice means that it must be the source of botch ups. Some time back we saw AZB take away the credit for a transaction which Luthra claimed they were involved.

threads most popular

thread most upvoted

comment newest

first oldest

first