Law firms

Law firms

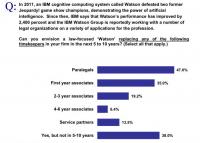

Around 35 percent of 320 large US law firm leaders think it’s realistic that within a decade junior lawyers could be replaced by sophisticated artificial intelligence (AI) computer systems, according to a survey.

Around 35 percent of 320 large US law firm leaders think it’s realistic that within a decade junior lawyers could be replaced by sophisticated artificial intelligence (AI) computer systems, according to a survey.

Capital Markets

Khaitan & Co advised computer security software company Quick Heal Technologies on its $38.5m (Rs 250 crore) Initial Public Offering of fresh issue of equity shares and and an offer for sale of 6,814,736 equity shares by existing shareholders, consisting of Kailash Sahebrao Katkar, Sanjay Sahebrao Katkar, Sequoia Capital India Investment Holdings III, and Sequoia Capital India Investments III

The investors were advised by _Cyril Amarchand Mangaldas _partner Arjun Lall. Luthra & Luthra Mumbai partner Manan Lahoty acted for the book running lead managers which were also advised by Sidley Austin Singapore partner Prabhat K Mehta.

Khaitan Mumbai executive director Sudhir Bassi, partner Abhimanyu Bhattacharya, principal associates Thomas George and Ashwinee Oturkar, associates Oishik Bagchi, Abir Sarkar and Manasi Gandhi acted for Quick Heal.

The company has filed its Draft Red Herring Prospectus (DRHP) with market regulator Securities and Exchange Board of India (SEBI) reported on 29 September and ICICI Securities, Jefferies India and JPMorgan India are the book running lead managers to the issue reported Times.

Corporate M&A

Khaitan & Co advised IT and software outsourcing company HCL Technologies on its acquisition of Swedish multinational group Volvo’s external IT business for $138m (Rs 895 crore) in an all cash deal. London based law firm Greenberg Traurig Maher LLP represented Volvo.

Khaitan Delhi partner Joyjyoti Misra, senior associate Shruti Singh and associate Sanchit Agarwal acted for HCL

The two companies have also signed a letter of intent under which the Volvo Group will also outsource its IT infrastructure operations to HCL Technologies for an undisclosed amount for five years. Around 2600 Volvo personnel affected by the transaction would be offered to move to HCL according to report by Firstpost.

The transaction will be closed during the second quarter of 2016 and will provide both cost savings and a capital gain, Volvo said.

Corporate M&A

J Sagar Associates (JSA) advised Reliance Capital (RCAP) on the Rs 1200 crore ($180m) sale of 14 per cent stake in Reliance Capital Asset Management (RCAM) to Japan’s largest life insurance company Nippon Life Insurance (NLI). NLI was advised by Khaitan & Co and Anderson Mori & Tomotsune.

JSA Mumbai partners Dina Wadia and Gautam Gandotra, senior associate Gagan Sharma and associate Upamanyu Talukdar acted for RCAP

Khaitan partner Niren Patel, senior associates Aravind Venugopal and Ritwik Kulkarni and associate Vidur Sinha and Anderson partner Ryo Kotoura and associate Masahiko Yasui acted for NLI

According to the press release, the stake sale would lead to change in controlling interest in RCAM according to mutual fund rules of the Securities and Exchange Board of India (SEBI) as NLI already had 35 per cent stake in RCAM This deal will trigger the exit option for various unit holders of various mutual fund schemes of Reliance Mutual Fund.

According to the report by TOI, this is the largest foreign investment in the mutual fund industry in India. Post the stake sale, Reliance MF will be renamed as Reliance Nippon MF

Private equity / VC

Indus Law advised Qualcomm Ventures and Themis Law Associates advised Norwest Venture Partners on infusing $10m (Rs 65 crore) in Chennai based health tech start-up, Attune Technologies. Attune Technologies was advised by Universal Legal Chennai.

Universal partner Sameena Chatrapathy and associates Shreya Deora and Vidisha Pulimood acted for Attune in the deal which, according to Business Standard was valued at Rs 65

Bangalore partner Suneeth Katarki and senior associate Pallavi Kanakagiri acted for Qualcomm Ventures in their reportedly first investment from their India focused fund worth $150m (973 Crore).

Corporate M&A

J Sagar Associates (JSA) advised Union Bank of India on its acquisition of 49 per cent shareholding in its joint ventures, Union KBC Asset Management Company (KBC-AMC) and Union KBC Trustee Company (KBC-TC) from KBC Participation Renta. KBC Participation Renta was advised by BMR Legal.

JSA Mumbai partner Dina Wadia, senior associate Manav Raheja and associate Viraj Bathe acted for Union Bank of India.

BMR Legal partner Souvik Ganguly, managing associate Vishruta Kaul and associate Deep Jain acted for KBC Participations Renta which a group company of Luxembourg based KBC Asset Management NV

The acquisition will be complete subject to regulatory approvals from the Securities and Exchange Board of India (SEBi) and the Competition Commission of India (CCI). After this acquisition, both Union KBC Asset Management and Union KBC Trustee Company will become wholly-owned subsidiaries of Union Bank of India reported Business Standard.

Law firms

Almost two years to the day after having announced their merger, Mumbai headquartered Rajani & Co and Delhi’s Singhania & Partners have split into two firms again.

Corporate M&A

Veritas Legal advised Recipharm AB, a Swedish pharmaceutical company on investing $103m (Rs 671.2 crore) in Nitin Lifesciences, an Indian pharma company which was advised by Khaitan & Co.

Veritas partner Partner Nandish Vyas and Associates Natasha Sethna and Tejasvi Saxena acted for Recipharm.

Khaitan Mumbai partner Kalpana Unadkat, senior associate Shweta Dwivedi and associate Bidya Mohanty acted for Nitin Lifesciences.

Recipharm, will buy 74 per cent in Nitin Lifesciences, reported Livemint

Law firms

Hammurabi and Solomon has absorbed Bangalore lawyer Bharath Babu’s firm Seagull Law in Bangalore to expand its South India operations, with Babu joining the firm as a partner.

Hammurabi and Solomon has absorbed Bangalore lawyer Bharath Babu’s firm Seagull Law in Bangalore to expand its South India operations, with Babu joining the firm as a partner.

Law firms

Kolkata start-up Aquilaw has partnered with Supreme Court advocate on record (AOR) Vikas Mehta and advocate Vikram Mehta, for a presence in Delhi.

Corporate M&A

Themis Partners advised Sequioa on its $34m (Rs 220.39 crore) co-infusion in ethnic handicrafts website Craftsvilla. The other investors in this round were Lightspeed Venture Partners advised by Luthra & Luthra, Global Founders Capital advised by Tamara Thompson , Nexus and Apolleto which was advised by US based firms Tamara Thompson and DST Global services.

Themis principal associate Ashwani Verma, senior associate Dheeraj Khanna and associates Rayan Azmi and Abhishek Dwivedi acted for Sequoia.

Luthra partners Deepak Joyce and Shinoj Koshy with managing associate Neha Sinha and associate Akansha Dalal advised Lightspeed.

Earlier this year Craftsvilla had rasied $1.5m from Lightspeed and Nexus, as reported by Medianama.

Law firms

Kochhar & Co Hyderabad head and partner VVSN Raju, who had merged his firm Juris Prime Law Services with Kochhar in July 2011, demerged from Kochhar in September.

Kochhar & Co Hyderabad head and partner VVSN Raju, who had merged his firm Juris Prime Law Services with Kochhar in July 2011, demerged from Kochhar in September.

Law firms

AZB & Partners former Mumbai partner Kalpana Merchant, who resigned from the firm in early September, has joined P&C Legal, the Mumbai arm of Bangalore headquartered firm Poovayya & Co that was started headed by AZB alum Vishnu Jerome.

AZB & Partners former Mumbai partner Kalpana Merchant, who resigned from the firm in early September, has joined P&C Legal, the Mumbai arm of Bangalore headquartered firm Poovayya & Co that was started headed by AZB alum Vishnu Jerome.

Corporate M&A

Khaitan & Co and _Skadden, Arps, Slate, Meagher & Flom_ acted for clinical trial service provider Bioclinica in its aqcuisition of global pharmacovigilance, regulatory affairs and IT services provider Synowledge. Synowledge was advised by Goodwin Procter and Nishith Desai Associates (NDA).

Khaitan partner Rajat Mukherjee, executive director Daksha Baxi, associate partner Kabir Bogra, principal associates Monika Srivastava, Ritu Shaktawat and Sameer Sah, associates Nidhi Killawala, Sanchit Agarwal and Shreya Shree and Skadden Arps partner Robert Pincus, counsel Faiz Ahmad and associate Vincent J Cannizzaro acted for Bioclinica.

NDA partners Mansi Seth and Nishchal Joshipura and Goodwin partner Stuart Rosenthal and associate Oreste Cipolla acted for Synowledge.

Synowledge employs around 500 persons in North America, Europe, India and Japan. The founder of Synowledge, Sankesh Abbhi would serve as senior vice president and head of global safety and regulatory solutions at the merged entity reported Outsourcing Pharma.

Corporate M&A

J Sagar Associates (JSA) advised renewable energy company BLP Energy on its $33.8m (Rs 220 crore) acquisition by Italy’s Enel Green Power which was advised by Khaitan & Co and Ashurst Singapore and Italy.

JSA partner Sidharrth Shankar and associates Prakriti Jaiswal and CV Srikant acted for BLP

Khaitan Mumbai partner Joy Jacob and Ashurst Singapore partner Keith McGuire acted for Enel.

This year US-based SunEdison and First Solar, Russia’s OAO Rosneft, China’s Trina Solar, Japan’s SoftBank and Taiwan’s Foxconn Technology have either invested or evaluated investing in the Indian renewables sector, reported Mint.