Experts & Views

Live Blog: 5th GNLU Moot on Securities and Investment Law, 12-15th September 2019

GNLU brings to you the 5th edition of the GNLU Moot on Securities and Investment Law. In keeping with tradition, the media team will provide you with updates in real time about moot related developments.

This edition has a whopping 46 teams battling it out over three days for the following prizes - Best Speaker (Preliminary Rounds), Best Speaker (Finals), Best Memorial, Runners Up, and the coveted position of Winners of the Competition.

Registrations begin at 4:30 p.m. on 12th September, with the competition unfolding over the three following days, culminating in finals on 15th September, 2019. We will bring you exclusive, live updates beginning with the opening ceremony. Don't forget to follow us on Twitter, Facebook and Instagram.

Day 1: 12th September, 2019

Registration

16:30 The teams have arrived and they wait in palpable excitement as their team codes are called out for registration.

16:45 As the teams register, they are given their folders, really cool GNLUMSIL T-shirts and delicious pastries.

17:00 A tangible glimpse of the Prizes!

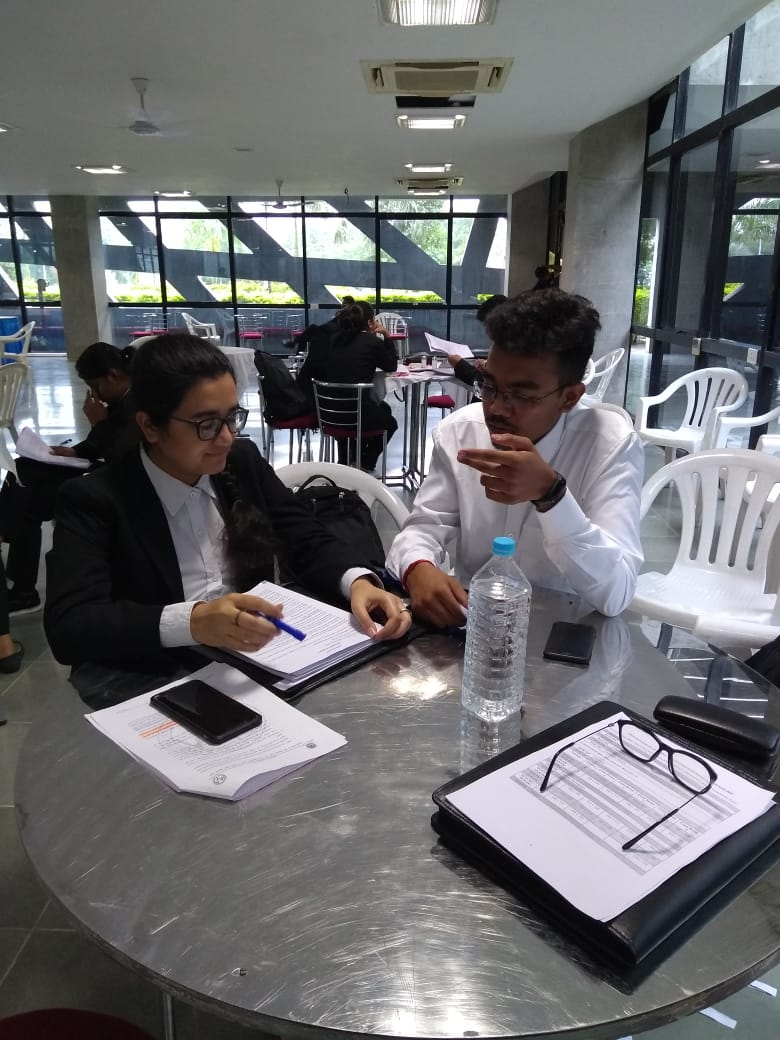

17:15 As registrations proceed, the participants delve into revisions and discussions. Weeks of hard work have led to this day - not a moment to lose!

17:30 The inaugration has begun!

17:33 Prof. (Dr.) S. Shanthakumar welcomes the participants, and offers words of encouragement and assurances of fairness and transparency in the moot.

17:33 Prof. (Dr.) S. Shanthakumar welcomes the participants, and offers words of encouragement and assurances of fairness and transparency in the moot.

17:37 Dr. Mamata Biswal, Dean of Academic Affairs, addresses the audience on the importance of Securities and Investment Law today, drawing on contemporary examples, and also underlining the importance of this moot in offering an opportunity to examine and apply the law in a critical manner.

17:45 GNLU Registrar, Dr. Jagadeesh Chandra explains to the gathering, the history of GNLU's engagement with specialised moot court competitions, and its forays into new areas over the years.

17:49 Dr. Girish R., Faculty Convenor of the Organising Committee shares with the participants how GNLUMSIL came into being.

17:54 Dr. Girish R. also declares the awards for the moot court competition:

Winners: Trophy, Rs. 50,000 cash prize, Internships at Shardul Amarchand Mangaldas & Co., Books sponsored by Corporate Law Adviser, Subscription to Manupatra for 6 months, Merit Certificates.

Runners Up: Trophy, Rs. 25,000 cash prize, Books sponsored by Corporate Law Adviser, Subscription to Manupatra for 3 months, Merit Certificates.

Best Memorial: Trophy, Rs. 10,000 cash prize, Merit Certificates.

Best Speaker - Finals: Trophy, Rs. 5,000 cash prize, Merit Certificates.

Best Speaker - Preliminary Rounds: Trophy, Rs. 5,000 cash prize, Merit Certificates.

Best Researcher: Trophy, Rs. 5,000 cash prize, Merit Certificates.

Semi-Finalists: Merit Certificates.

Quarter-Finalists: Merit Certificates.

17:56 Dr. Girish R. thanks our sponsors and supporters -

1. Bombay Stock Exchange

2. National Securities Depository Limited

3. Finsec Law Advisors

4. Shardul Amarchand Mangaldas & Co.

5. RegStreet Law Advisors

6. Lex Witness

7. Manupatra & Lawskills

8. Corporate Law Adviser (CLAOnline)

9. Lawctopus

He also thanks the organising committee consisting of 90 students and headed by the student convenors and coordinators.

18:00 Mr. Parag Jain makes a presentation on the NSDL, speaking about the role of the NSDL, the importance of saving and investment, and projects of the NSDL.

18:32 Mr. Manish Vibhandik and Mr. Chintansinh Jadeja commenced a presentation on Manupatra - how it works, the extensive coverage of the database, the possibility of accessing judgements from a diversity of courts and tribunals, as well as the ability to access judgements from different countries.

18:55 The participants are oriented on the rules of the competition.

Researchers' Test

19:15 The researchers' test has begun!

Day 2: 13th September, 2019

09:45 Armed with arguments and arguendos, the participants are ready to take on the day.

12:00 As the day and rounds progress, the pace quickens, and rebuttals volley across the courtroom.

14:00 The Judges, Core Committee, and participants.

15:00 Unrelenting discussing, prepping and honing.

19:00 Ending the last round of the day with unstaggering gusto.

Day 3: 14th September, 2019

08:00 The second day of Preliminary Rounds holds great promise for battles of legal prowess, sharp wits and smooth rebuttals. Who will win the day?

11:00 Rounds proceed with pointed questions, quick answers and a deft dispensation of authority and logic.

20:00 A moot is nothing without its participants, and to honour our brilliant participants in this edition, our Director Sir is now handing out the participation certificates.

20:30 We put the lock on the last courtroom of the day! These rounds were surely gruelling, but now participants have some time to wait before the results are out. Albeit, quite an anxious wait!

21:15 The most awaited moment is here! The teams who have qualified for quarters have been announced. The ones who made it (in alphabetical order) are:

Lloyd Law College

National Academy of Legal Studies and Research, Hyderabad

National Law University, Delhi

National Law University, Jodhpur

Rajiv Gandhi School of Intellectual Property Law, IIT Kharagpur

Sastra University School of Law

School of Excellence in Law, Tamil Nadu Dr. Ambedkar Law University

University of Petroleum and Energy Studies, Dehradun

We congratulate the qualifying teams! Tomorrow shall be another crucial day, with the quarters, semis and the finals. Stay tuned for updates!

Day 4: 15th September, 2019

QUARTERFINAL ROUNDS

09:00 Quarterfinal rounds have begun and the right teams are divvied up among four courtrooms.

The judges for quarters are:

1. Aashima Johur, Advocate, New Delhi

2. Aayush Mohata, Principal Associate, Khaitan & Co., Mumbai

3. Harish S., Principal Associate, Cyril Amarchand Mangaldas, Bangalore

4. Oishik Bagchi, Principal Associate, Khaitan & Co., Mumbai

5. Sanjay Khan, Partner, Khaitan & Co., Bangalore

6. Shailendera Singh, Junior Standing Counsel, IT Department, Delhi

7. Shaswata Dutta, Executive Director (Legal), Goldman Sachs, Mumbai

8. Varun Shivhare, Assistant Legal Advisor, SEBI, Mumbai

12:30 The results of breaks to semis have been announced! The four teams making it to the next round (in alphabetical order) are:

National Law University, Delhi

Rajiv Gandhi School of Intellectual Property Law, IIT Kharagpur

Sastra University, School of Law

Schol of Excellence in Law, Tamil Nadu Dr. Ambedkar Law University

13:02 The semi-final rounds have commenced! The judges for these rounds are:

1. Anil Choudhary, Partner, Finsec Law Advisors, Mumbai

2. Robin J. Baby, Division Chief, Enforcement Department, SEBI, Mumbai

3. Sumit Agrawal, Founder, RegStreet Law Advisors, Mumbai

4. Tomu Francis, Partner, Khaitan & Co., Mumbai

The live-blogging team will be bringing you thrilling updates about the progress of the teams, so keep checking here for more.

SEMI FINAL ROUNDS

COURT ROOM 1

13:03 The first speaker for appellant briefly exaplines the facts and lays out a structure for his speech.

13:06 Mr. Sumit Agarwal asks for a legal clarification

13:07 Speaker One has satisifed the judge with his answer.

13:10 The judges start posing questions to the Speaker. However, he tackles them deftly.

13:13 Mr. Sumit Agarwal wants a very straightforward answer to his questions.

13:18 Mr. Tomu Francis asks the Speaker to refer to the Act.

13:21 The speaker concedes to a point brought up by Mr. Tomu Francis.

13:23 The bench asks the speaker for specific case law, but he is unable to provide one.

13:24 Time laspses for the speaker and he requests an extension.

13: 25 The second speaker for appellants has commenced speaking and lays down a roadmap for his arguments.

13:26 The bench questions him on the Prayer.

13:27 Mr. Sumit Agarwal poses several questions.

13:33 Mr. Tomu Francis asks the speaker to proceed to the next point.

13:36 The speaker seeks some time to refer some documents in his compendium but fails to locate them.

13:40 The judges and the speaker delve into the technicalities of the facutal matrix.

13:41 The speaker directs the bench to his written submissions to substantiate his argument, but Mr. Sumit Agarwal does not seem to be accepting it.

13:43 The Speaker seeks an extension of 3 minutes and it is granted.

13:44 Mr. Tomu Francis asks for some factual clarifications.

13:45 As the speaker begins to conclude his arguments, Mr. Tomu Francis asks him more questions.

13:47 Mr. Tomu Francis points out certain loophoels and the speaker is ready with replies.

13:48 The Appellants read out their prayer.

13:49 Mr. Sumit Agarwal mentions that he wants appellants to asnwer two particular questions during their rebuttals.

13:50 Speaker 1 for the Respondents has commenced speaking.

13:51 Mr. Sumit Agarwal gives the speaker 10 seconds to find some clarity before proceeding.

13:52 The Speaker fumbles a little.

13:54 The Speaker is back on track and confidently puts forth more contentions.

13:56 Mr. Sumit Agarwal seeks clarifications on the facts of the case.

13:57 The Bench seems to be unsatisfied with the arguments.

14:01 The Bench ceases questioning and the Speaker is allowed to conclude.

14:05 The second speaker for respondent has commenced speaking.

14:06 Mr. Sumit Agarwal interjects with some questions.

14:08 The Bench points out contradictions in the submissions.

14:10 The Speaker attempts to explain how there are none.

14:14 Mr. Sumit AAgarwal expresses disappointment with the arguments.

14:17 The Speaker hesitates to agree with Mr. Tomu's interpretation of facts.

14:19 The Speaker struggles to provide adequate arguments in some respects.

14:27 The Bench asks for case law to substantiate a point but the Speaker is unable to provide one.

14:28 The Speaker concludes.

14:29 The Bench is hesitant to allow for rebuttals.

COURT ROOM 2

13:05 The judges are seated and the participants anxiously wait to begin their arguments.

13:06 The Judges strictly advice the participants to stick to their time limits.

13:07 The 1st speaker on the appellant side begins and seems to be in a hurry to ensure that he finishes in time.

13:09 The Judge asks the speaker technical questions regarding the statutes referred to by the speaker.

13: 11 The speaker enlists the several sections and elucidates vividly the relevance of the same.

13:14 The Judges continue to pose technical questions to the speaker.

13:16 The speaker shuffles his notes, looking for an answer to the questions.

13:17 The judges point out that the appellant's compendium are flagged inaccurately.

13:19 The judges seem to be in agreement with the arguments of the speaker.

13: 20 The first speaker on the appellant side commences the last leg of his arguments.

13: 24 The speaker pauses as the judges read the sections to which he made reference.

13:25 Mr. Anil Choudhary questions the applicability of the sections.

13:27 Mr. Anil Choudhary asks the speaker to wrap up his arguments and he seems to be racing to conclude his arguments.

13:31 The second speaker for appellant has begun to present his case.

13:33 Mr. Robin asks the Speaker about the Prayer.

13:37 Mr. Anil asks the Speaker for an explanation of the issue he is addressing.

13:43 The Speaker is well-versed with the technical aspects of the moot problem and is able to answer all the questions from the bench.

13:46 Mr. Robin asks the Speaker to wrap up due to a paucity of time.

13:47 With two minutes left, the speaker delves into the crux of the issues.

13:52 The appellants rest their case.

13:53 The judges are deliberating.

13:55 First speaker for the Respondent has recieved permission to proceed with his arguments.

13:56 The Speaker draws the judges' attention to a Supreme Court judgement.

14:00 Mr. Anil poses several questions to the Speaker and is assured they will be addressed in due course.

14:01 Mr. Robin seeks clarifications on the moot proposition from the Speaker.

14:06 The Speaker fumbles a little while drawing on relevant precedents.

14:09 The Speaker brings up crucial legal principles essential to the case at hand.

14:10 The judges listen patiently to the contentions.

14:13 Mr. Anil does not appear to be satisfied with the answer to a query.

14:14 The Speaker has exceeded the time limit while answering questions from the bench.

14:17 The second Speaker for the respondent commences submissions with an outline of her argumentation.

14:22 The Speaker details facts relevant to the issue.

14:27 The judges question the speaker on the acts of the Respondent.

14:28 The Speaker struggles to defend those actions and is questioned further by the judges.

14:39 The judges ask the Speaker to conclude.

14:42 The Respondents rest their case.

14:43 The Appellants raise thier rebuttals.

14:46 The round ends with responses from the Respondents.

FINALS

And the results are out! The two teams making it to finals are:

School of Excellence in Law, Tamil Nadu Dr Ambedkar Law University as Appellants and Rajiv Gandhi School of Intellectual Property Law, IIT, Kharagpur as Respondents.

The judges for the final round are as follows:

1. Justice Tarun Agarwala, Presiding Officer, Securities Appellate Tribunal, Mumbai

2. Mr. Murali Neelakantan, Principal, amicus

3. Mr. Sandeep Parekh, Founder and Managing Partner, Finsec Law Advisors, Mumbai

4. Mr. Sanjay Asher, Senior Partner, Crawford Bayley & Co..

5. Mr. Somasekhar Sundaresan, Advocate, High Court of Bombay

Appellant

15:35 Speaker 1 for the appellant has commenced speaking.

15:36 He proceeds to give a brief outline of the pertinent facts.

15:37 The speaker is dealing with a general jurisdictional issue and mentions that the Electricity Act is an exhaustive code. He mentions that he will rely on the Statement of Objects and Reasons in the Act. He further clarifies that the Act has three important points to note – one, concerning private sector participation; two, concerning trading in electricity as a distinct activity (since before the Act, there were 3 or 4 enactments, this Act is a comprehensive enactment); and three, that this distances regulation from the purview of the government and places it in the hands of the regulatory commission.

15:39 The Speaker quotes definition of commodity derivative and ready delivery contracts. He also mentions that his arguments will revolve around contracts for delivery and contract for difference in prices. He further goes on to say that sections 2(7) and 2(71) have to be taken into account. Section 2(70) pertains to what is ‘supply’ of electricity and section 2(71) concerns what is ‘trade’- being the purchase of electricity for resale thereof.

15:40 He says he won’t be relying only on the provision of ‘trade’ and his contention is that supply and trade have to be taken together.

15:41 He mentions that a major fact to be noted is that these two sections are not exhaustive in nature and therefore it is clear that all contracts concerning electricity come under the ambit of the regulator.

15:42 The speaker says that a person can buy and sell a commodity even through forward contracts so the fact that this possible means that the definition should not be restricted. He further contends that in every case where there is delivery, it has to go through a licensee certified by the appellant. Further, if the court holds commodity derivatives to go under the jurisdiction of the respondent, there would be a disconnect in the mechanism under the Act.

15:44 Mr. Somasekhar Sundaresan, asks if the answer would vary if the person is purely someone who has a financial interest in the price of electricity and seeks to trade on it. What is the role of the appellant there? The appellant responds that section 66 of the Electricity Act has to be given due importance here. He refers to Waverly Jute Mills Case to say that trading include forward contracts as well.

15:46 Mr. Murali Neelakantan asks if trading means purchase for resale. If so, then if SEBI regulated them there would be be non-licensed parties trading in power, why not let them trade, since it would not affect the appellant’s role?

15:46 Mr. Murali Neelakantan asks if there are people trading in electricity who are not reselling, would they be brought under the ambit of the appellant’s regulation? how does 2(71) help the appellant in that context?

15:47 Appellant speaker contends that section 2(71) has two limbs- purchase and resale.

15:48 Mr. Murali Neelakantan clarifies that his question pertains to non-licensees.

Mr. Somasekhar Sundaresan asks whether the appellant would you find it undesirable that anyone who is not licensed should not trade - so there should not be a market for anyone outside of buying for resale or buying for consumption? He questions if that is the argument of the appellant.

15:49 Appellant speaker replies that under the Act, there are distinct activities - so any one dealing in electricity comes under the ambit of it.

15:50 The appellant speaker then moved on to differences in prices. The intent is that everything dealing with electricity should come under the purview of the Act.

15:51 Appellant relied on a case to state that the nature behind forward or future markets is with respect to the commodity market itself.

15:52 Mr. Murali Neelakantan states that the important word in the excerpt the appellant speaker read from the case is "traders". Under section 2(71) ‘trading’ has a very limited meaning. Does not refer to other markets.

15:52 The appellant asked if he could revert to these arguments later, and moved on to other submissions.

15:53 Electricity is a movable property but in State of Andhra Pradesh v National Thermo Power Corp, the Court referred to the fact that electricity cannot be stored. He also referred to the Indian Aluminium Company Case.

15:54 Since the enactment of the Electricity Act, the Central Government has lost its power to notify a commodity under FCRA or SCRA. He calls the Electricity Act a ragbag legislation stating that it may pertain to many entries under the lists at the same time.

15:56 Appellant relies on Section 174 of the Electricity Act – which states that the Electricity Act prevails in case of conflict with other statutes. This conflict can be express or implied conflict.

15:57 Appellant contends that with respect to the Electricity Act and the SCRA, commodity of electricity is the issue which forms the principal subject matter. According to Section 174, this Act has to be taken into account as lex specialias.

15:58 Appellant contends that the intention of the Act is to avoid regulation by the Central Government and place it solely in the hands of the regulators. Mr. Somasekhar Sundaresan, asked if there is a positive provisions that no one shall regulate this commodity or anything express?

15:59 Justice Tarun Agarwala asks the Speaker to read section 174 again when talking about the special act. Justice Tarun Agarwala says that something has to be inconsistent because there is such a word used. you need to show an inconsistency.

16:00 Mr. Somasekhar Sundaresan asks if the appellant’s contention pertains to a contract in electricity or trading in electricity.

16:00 Second speaker for the appellant has commenced. The Speaker contends that section 18 of the FCRA has a proviso. This section is an exemption to the FCRA. The two distinguishing factors are the recognised and unrecognised association.

16:02 The Speaker contends that the entire jurisdiction assumed by SEBI is not valid in law and there is a breach of principles of natural justice.

16:03 The speaker says that chapter IIIA applies only to individual applications of registrants.

16:03 The Speaker mentions that if the Central Government wanted to control such commodity derivatives, there should have been a notification.

16:03 The speaker calls into question the validity of show cause notice sent to the commodity brokers and specifies this is the second leg of her argument. s

16:04 The speaker outlines facts in this regard.

16:04 The Speaker introduces an argument under article 14 of the Constitution on grounds of unreasonableness and arbitrary nature of the notice and proceeding to explain why.

16:05 The Speaker states that if the statute prescribes for an act to be done in a certain way it should be done in that way.

16:06 Justice Tarun Agarwala asks if the Speaker is conceding jurisdiction against the rest of the brokers? Mr. Murali Neelakantan asks how the act violates principles of natural justice because a show cause notice is supposed to give you an opportunity to be heard.

16:06 The Speaker clarifies that she made a mistake, she meant that it was the Wednesbury principle that was applicable here.

16:07 Justice Tarun Agarwala asks if her argument is that appellants were not given an opportunity to be heard? The Speaker clarifies that while they were given an opportunity to be heard, it was done by assuming a jurisdiction they did not have. Mr. Somasekhar Sundaresan interjects and asks, if there is no juris, why did the rest of the commodity brokers apply?

16:08 Mr. Murali Neelakantan clarifies the question and asks the counsel if SEBI did not have jurisdiction, why 200 of the appellant clients went to SEBI seeking registration.

16:09 Mr. Somasekhar Sundaresan asks how the first 10 are different from the 190 and in which respect. The speaker answers by saying they are raising the same question.

16:10 Mr. Somasekhar Sundaresan says that if SEBI did not even consider the 10 for reg, do they stand on a different footing from the 190?

16:11 The Speaker explains the facts and tries to show how the Wednesbury principle applies here.

16:13 She reiterates that SEBI has initiated an action that is not sound in law.

16:13 She says that there are two proceedings being parallel proceedings. One is quasi judicial which is ultra vires and which should be quashed, and the second is criminal proceedings. These two have a direct bearing on the right of applicants.

16:14 She argues that if the parallel proceeding has a direct bearing on the rights in a quasi judicial proceeding, the effect of the conclusive finding of the court will also have an impact.

16:18 Mr. Sandeep Parekh asks if parallel civil and criminal proceedings can go on, in the present case?

16:18 The judges are in agreement that it seems the appellant is saying that if they were to get acquitted in the criminal case, only then they would want SEBI to continue with its proceedings.

16:19 With two minutes left on the clock, the appellants read out their prayer.

Respondent

16:21 First speaker for the respondent has commenced speaking.

16:21 He outlines the two issues that he would be covering.

16:22 He refers the judges to his written submissions.

16:22 He says that the CERC gets exclusive regulatory oversight from the National Electricity Policy.

16:23 He refers to para 5.7.1 to state that the policy deals with consumer protection and envisages an intra-day market. If the CERC wanted to envisage forwards and futures markets for electricity it would be in the policy itself.

16:23 He argues that the definition of trading under section 2(71) requires purchase for resale. Therefore. purchase and resale cannot be read disjunctively. Supreme Court Cases in this regard have also said that it is for tax matters or matters of that nature and are not applied it to forwards or futures.

16:24 The respondent says that the Electricity Appellate Tribunal has interpreted the phrase purchasing for resale.

16:25 The first attempt at jurisdictional overreach by CERC was in their first order. The second attempt at overreach was int he approval to EXIL to trade in NTSDs

16:26 respondent speaker says that the CERC asked the Central Government to amend the FCRA to bring NTSDs outside of their jurisdiction.

16:27 Respondent speaker refers to a Bombay Hight Court judgement that pertained to legislative intent.

16:27 Mr. Somasekhar Sundaresan asks if the respondent counsel is saying that they have exclusive jurisdiction over electricity forward contracts or whether they are saying CERC does not?

16:27 The respondent counsel answers that they are not contending exclusive jurisdiction on forward contracts.

16:28 Mr. Somasekhar Sundaresan asks why resale should be read in the manner they were contending?

16:28 Mr. Murali Neelakantan asks if the respondent counsel is talking about shorting a position or short-selling?

16:29 The respondent speaker says that the whole forwards and future markets cannot be limited inside the definition of purchase and resale.

16:30 Mr. Murali Neelakantan asks a procedural question - how did the respondent file a writ petition in the Bombay High Court.

16:31 Mr. Somasekhar Sundaresan asks why the respondent did not seek the quashing of this case when they were added as respondent. Does that not amount to submitting to jurisdiction?

16:32 Mr. Murali Neelakantan says that if two regulators have a disagreement, how does that give you a right under art. 226?

16:33 Mr. Murali Neelakantan asks where the locus standi is?

16:34 The speaker says that the FCRA and FMC are dealing with several products. The role of CERC is limited to delivery and not financing matters dealing with forward contracts.

16:34 Mr. Murali Neelakantan asks if the price not relevant and if it is not affected by trading?

16:35 Respondent answers that the appellant has jurisdiction with regard to spots and forwards.

16:35 Mr. Murali Neelakantan asks where that is provided for.

16:37 Mr. Somasekhar Sundaresan says that NTSD is a specific delivery contract and questions why the respondent would have jurisdiction over that.

16:38 The respondent answers that he will keep his arguments under the FCRA because that is the framework under which allegations were made.

16:39 Mr. Somasekhar Sundaresan asks if the respondent is implying that the jurisdictional fact is violative conduct?

16:40 Mr. Somasekhar Sundaresan asks the respondent speaker to read the proviso out loud.

16:41 The judges ask if there is a facility to perform NTSDs without actual delivery?

16:42 Mr. Somasekhar Sundaresan asks if the respondent is claiming jurisdiction after having sensed the violation?

16:43 respondent speaker replies by saying section 18(1) proviso explains how jurisdiction falls under the purview of the FMCA. Mr. Somasekhar Sundaresan, asks in terms of the CERC law, would the respondent counsel say that they have jurisdiction in so far as it constitutes a violation under section 18, but that the Appellant has jurisdiction under the Electricity Act.

16:44 Second speaker for the Respondent commences his speech by saying that the Appellant had contended that brokers did not fall under the FCRA. He points the judges to facts to rebut this.

16:45 He says that he has a two-fold argument – the ascertainment of fit and proper criteria, and the criminal proceedings initiated by SEBI under FCRA regime

16:46 He specifies that to operate in the commodity derivative space they had a registration window for 3 months .

16:47 He mentions where and how the ‘fit and proper’ criteria – are found in legislation.

16:48 Mr. Murali Neelakantan asks if he is assuming that if there is a report, that suffices to tarnish a reputation.

16:49 Mr. Somasekhar Sundaresan asks if the absence of convictions throw light on how to read a provision with wide ambit

16:50 Mr. Murali Neelakantan says that the respondent could have lodged a complaint based on their own investigations.

16:51 Mr. Murali Neelakantan tells the respondent speaker that deciding to prosecute and whether you have enough evidence to prosecute is a different question. Here the question is one of being fit and proper.

16:52 Mr. Murali Neelakantan questions respondent speaker about a report he alluded to and how it tarnishes reputation

16:53 Mr. Sanjay Asher and Mr. Somasekhar Sundaresan continue a line of questioning.

16:53 Mr. Murali Neelakantan asks why, when they knew there was fraud, the respondent did not investigate.

16:54 Mr. Somasekhar Sundaresan clarified facts with the respondent.

16:58 the respondent speaker reiterates his argument that NTSD contracts are forward contracts and because they did not have registration under the FCRA they were acting in contravention of the Proviso.

17:01 Respondent speaker proceeds to the prayer.

Rebuttals:

17:02 To clarify on the point of trading, if one solely relies on trading under EA there is no case. Therefore, he relies on supply and trading. He further poses 3 questions to the Respondent and Mr. Somasekhar Sundaresan questions him on sunset clauses.

17:05 The round ends with the responses from the Respondent.

Valedictory Ceremony

All the teams have gathered in the Orientation Hall, waiting anxiously for the results.

17:40 The dias today is honored with the presence of our finale Judges, Justice Tarun Agarwala, Presiding Officer, Securities Appellate Tribunal, Mumbai, Mr. Murali Neelakantan, Principal, Amicus and Mr. Somasekhar Sundaresan, Advocate, High Court of Bombay along with the Honorable Director of GNLU, Dr. Prof. Shantha Kumar.

17:43 Short video on journey of GMSIL over the years followed by a welcome speech by the Honorable Director.

17:45 Justice Tarun Agarwala addresses the gathering with an insight into the importance of securities law and mooting. He shares interesting stories about his experiences in the court of law. He commends the performance of the participants and congratulated the participating teams and the Organising Committee for the success of the moot.

18:10 School of Excellence in Law, Tamil Nadu Dr. Ambedkar Law University and Rajiv Gandhi School of Intellectual Property Law, IIT Kharagpur battled it out in the finals today. The winner of the GNLUMSIL 2019 is Rajiv Gandhi School of Intellectual Property Law, IIT Kharagpur.

The detailed results are:

|

Title |

Team Code and Name |

Prize |

|

Winners |

141 Rajiv Gandhi School of Intellectual Property Law, IIT Kharagpur |

Trophy Rs. 50,000 cash prize Internship by Shardul Amarchand Mangaldas & Co. Books sponsored by Corporate Law Adviser Subscription to Manupatra for 6 months Merit Certificates |

|

Runners Up |

148 School of Excellence in Law, Tamil Nadu Dr. Ambedkar Law University |

Trophy Rs. 25,000 cash prize Books sponsored by Corporate Law Adviser Subscription to Manupatra for 3 months Merit certificates |

|

Best Written Submission |

124 Symbiosis Law School, Pune |

Trophy Rs. 10,000 cash prize Merit certificates. |

|

Best Speaker Finals |

141 Aniruddha Bhatnagar Rajiv Gandhi School of Intellectual Property Law, IIT Kharagpur |

Trophy Rs. 5,000 cash prize Merit certificate |

|

Best Speaker- Preliminary Rounds |

115 Sahil Malhotra National Law University ,Delhi |

Trophy Rs. 5,000 cash prize Merit certificate |

|

Best Researcher |

126 Urmil Shah Auro University |

Trophy Rs. 5,000 cash prize Merit certificate |

|

Semi Finalists |

115 National Law University, Delhi 136 SASTRA Deemed University, Thanjaavoor |

Merit certificates |

|

Quarter Finalists |

109 NALSAR 146 UPES, Dehradun 130 Lloyd Law College 131 NLU, Jodhpur |

Merit Certificates |

18:18 The Student Convenors the GNLUMSIL OC 2019 Ms. Yashi Saraswat and Mr. Rohan Merchant address the gathering expressing their gratitutde to all their co-coordinators and fellow OC members.

18:25 Vote of Thanks was delivered by Ms. Garima Goswami, the Facult Co-convenor.

With this, GNLUMSIL 2019 officially comes to a close.This is the live blog team signing off. See you next year!