Shardul Amarchand Mangaldas

Shardul Amarchand Mangaldas has promoted 16 to its partnership, and internally announced the promotion of ex-Cognizant Anand Bhushan that was first reported by us on 4 July.

Shardul Amarchand Mangaldas has promoted 16 to its partnership, and internally announced the promotion of ex-Cognizant Anand Bhushan that was first reported by us on 4 July.

"Canadian billionaire Prem Watsa’s Fairfax India Holdings Corp. ... said it had agreed to acquire a 51% stake in Privi Organics Ltd for about Rs 370 crore. Privi Organics is a supplier of aroma chemicals to many large fragrance and consumer goods companies globally.” reported Mint.

Cyril Amarchand Mangaldas has topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $6.2bn worth of transactions, followed by AZB & Partners and Vaish Associates, with stronger performances across the board than at the same time last year.

Cyril Amarchand Mangaldas has topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $6.2bn worth of transactions, followed by AZB & Partners and Vaish Associates, with stronger performances across the board than at the same time last year.

Shardul Amarchand Mangaldas has scooped Cognizant Technology Solutions India & APAC region general counsel (GC) Anand Bhushan to set and head up its new Chennai office after he fully leaves a little later this month, according to three authoritative sources.

Shardul Amarchand Mangaldas has scooped Cognizant Technology Solutions India & APAC region general counsel (GC) Anand Bhushan to set and head up its new Chennai office after he fully leaves a little later this month, according to three authoritative sources.

Taxi aggregator Uber started a joint venture with Tata Motors, which envisages Uber drivers buying Tata cars financed via Tata Capital Financial Services and Tata Motors Finance loans with insurance from Tata.

Taxi aggregator Uber started a joint venture with Tata Motors, which envisages Uber drivers buying Tata cars financed via Tata Capital Financial Services and Tata Motors Finance loans with insurance from Tata.

Economic Laws Practice (ELP) advised thermal power company BLA Power on Prism Cement’s acquisition of 15.23 per cent stake in it for 21 crore ($3m). Prism was advised by Shardul Amarchand Mangaldas (SAM).

HDFC Standard Life Insurance, a joint venture between HDFC and Standard Life, will be absorbing Max Life Insurance and Max Financial Services, according to reports, in what is billed as the biggest ever consolidation in the private insurance space in India.

Shardul Amarchand Mangaldas (SAM) advised Japanese conglomerate Sumitomo Corp on its Rs 623.44 crore ($93m) buy of 44.98 per cent stake in Excel Crop Care which was advised by AZB & Partners.

Welcome to Legally India's first ever premium-subscribers-only newsletter and also a massive thank you for being one of that special breed of human being who will support journalism online. We are truly blessed to have you as our reader and supporter.

Link Legal advised digital healthcare platform 1MG Technologies on raising Rs 100 crore ($15m) from Maverick Capital Ventures which was advised by Shardul Amarchand Mangaldas (SAM) and Jones Day. Existing investors also participating in the round were Sequoia Capital which was advised by Themis Associates, Omidyar Network which was advised by Trilegal, and Dumac.

Phoenix Legal counsel Mukul Baveja has joined Shardul Amarchand Mangaldas as a salaried partner, according to his Linked-in profile as first reported by Bar & Bench.

Phoenix Legal counsel Mukul Baveja has joined Shardul Amarchand Mangaldas as a salaried partner, according to his Linked-in profile as first reported by Bar & Bench.

J Sagar Associates (JSA) has promoted Manvinder Singh, Trisheet Chatterjee and Poonam Verma to its equity partnership, while partner Akshay Nagpal will joined Indigo as associate general counsel.

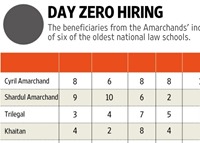

Both sides of the now divided Amarchand Mangaldas family empire have considerably increased their recruitments for 2017 from top law schools, many top firms have filled up their quota from recruits from top law schools already.

Both sides of the now divided Amarchand Mangaldas family empire have considerably increased their recruitments for 2017 from top law schools, many top firms have filled up their quota from recruits from top law schools already.

Shardul Amarchand Mangaldas has started a Bangalore office with ex-Omidyar Network India general counsel (GC) Karthik Krishnan Mahalingam as office head and national venture capital practice head.

Shardul Amarchand Mangaldas has started a Bangalore office with ex-Omidyar Network India general counsel (GC) Karthik Krishnan Mahalingam as office head and national venture capital practice head.

NLSIU Bangalore’s 2017-graduating batch placed 33 out of 53 participating recruitment coordination committee (RCC) members, out of a total batch of 81, on 2 April.

NLSIU Bangalore’s 2017-graduating batch placed 33 out of 53 participating recruitment coordination committee (RCC) members, out of a total batch of 81, on 2 April.

Cyril Amarchand Mangaldas (CAM) beat 2015’s top three firms, and flew past Shardul Amarchand Mangaldas as well, to lead Mergermarket’s M&A value rankings this quarter (Q1).