Traditionally, Indian companies have been a family run affair, with the promoter (founder) shareholders hesitant to lose control over the family business. As a corollary, private equity investments were also conventionally minority investments. But the growth of the Indian economy has given birth to a new generation of entrepreneurs - the executive-turned-entrepreneur as well as those joining the start-up band wagon.

This new class of promoters (or founders) is receptive to ceding control for both growth and expansion of the business. Further, many family businesses are being run by the second or third generation of promoter shareholders and some are also facing succession issues, and these promoters are often open to the idea of selling out. Coinciding with this development is the fact that PE players in India are at a stage where they have gained significant experience in India and have the wherewithal to deal with governance and regulatory risks and exposure, which in some instances may be unique to India. This has placed PE funds in a favourable position, where they are able to apply their expertise from running businesses globally to the Indian context.

This is a phenomenon which could be beneficial to new age Indian promoters as well as PE funds. As a cumulative result, control deals have been on the rise in India. A recent survey conducted by Alvarez and Marsal1 shows that over the last three years, control deals constituted nearly 30% of the overall deal value for over 20 PE firms as compared to only about 8% in 2014.

Some of the notable control deals in 2016 were Blackstone Group’s acquisition in Mphasis; Kedaara Capital and Partners Group acquisition in AU Housing Finance and Abraaj Group’s acquisition in Care Hospitals.

Ability to Exit

Easier exits: The primary advantage, amongst various others, that make control deals attractive to PE investors is the ability to drive their exit from the investment. In a typical minority investment, PE investors look to exit by selling their stake to the promoters by way of a put option, creating liquidity through an IPO, or by a sale to third parties. Each of these actions requires the promoter’s participation and willingness to abide by the promises made at the time of the investment, with the only recourse in the event of any default by the promoter being a long-drawn dispute resolution process. Conversely, in majority control situations, exit lies solely in the control of the PE firms and they can exit at an opportune time, without being subject to or even requiring the promoter to act. The year 2016 saw several exits by controlling investors. An example is the exit by share sale at a substantial return by CX Partners and Capital Square Partners from Minacs Ltd. to US-based Synnex Corp. The acquisition of a majority stake in Care Hospitals by Advent International and subsequent sale to the Abraaj Group at a significant premium is also a notable success story.

Challenges to controlled exits: The ability to control exit, however, is not without its pitfalls. Though a PE investor may have the ability to drive the exit and set the terms for the exit, where the exit is by way of an IPO on the Indian stock exchanges, the controlling investor is likely to be classified as a ‘promoter’ under applicable regulations. This will lead to the investor being subject to the obligations and restrictions traditionally imposed on a promoter in a public offering (including post-IPO lock in), as well as obligations applicable to ‘promoters’ on an ongoing basis. Recent SEBI regulations2 have, for the first time, formulated provisions for re-classification and de-classification of promoters, which may come to the aid of existing investors to declassify themselves as promoters, but this option will be available only after the public offering. Interestingly, despite the higher obligations imposed in case of listed companies, control deals are also happening in the listed space.

Even where the exit is by way of a secondary sale to a financial or strategic investor, the potential purchaser is likely to seek business warranties and indemnities from the controlling investor. While in some cases, a strategic investor may agree to a sale on an ‘as is where is’ basis, financial investors are more likely to insist on business warranties and indemnities. If the original promoters remain in a minority position, they would be reluctant to take on these obligations and the burden would fall on the investor. Investors should discuss this upfront with the promoters at the time of the investment, and also consider indemnity insurance, which is offered in ‘buy side’ and ‘sell side’ formats. However, these come with their own set of limitations, and India being considered a high risk jurisdiction, there are a limited number of insurers who offer indemnity insurance.

Promoters holding a minority stake may also seek exit rights from the controlling investor. Investors need to carefully evaluate whether they can take on the obligation to provide an exit to the promoters, or merely offer them an opportunity to participate in exit along with the investors.

Management and Governance

Ability to control management: Another attraction of control transactions is that the investor has a greater say in the governance of the company. The investor can bring in professional management, implement new ideas based on its global experience, and ensure that the company is run in the best possible manner. Irrespective of whether the investor brings in new management or retains the promoter, in a control transaction, the investor will be able to link the tenure of the management of the company to the performance standards laid down by the investor.

Another factor aiding the growing comfort between promoters who wish to stay on in their company, and investors who plan on acquiring majority stakes, is the fact that both parties are aware of the limited lifespan of their relationship. A financial investor typically has a definitive exit horizon, and consequently has no option but to chart an aggressive growth course to achieve the expected returns, including by bringing in the best possible strategic, operational and execution expertise into the investee company. A failure to do so would negatively impact its investment. Therefore, in any control transaction, a financial investor arguably has a greater interest at stake than a promoter, allowing the promoter to take reassurance in the fact that the best possible decisions will be taken for his company.

Challenges of being in the driver’s seat: In control transactions, the investor will either require strong operational ability and market expertise to run the business, or must bring in a new management team with appropriate expertise or rely on the promoters for this purpose. The dual facts of being in a controlling position without deep operational / management involvement and the investor’s dependence on professionals or promoters to run the business, could give rise to their own set of challenges. To address this, the investor should involve its operation teams fairly early during the investment negotiations. Identification of the right management team, charting a transition plan and aligning the objectives of the investor with the management team are critical. Formulating an initial 100 day plan and organizing training sessions with the management may also help in aligning the goals and vision of the management and the investor.

A key concern is also ensuring that the management team has skin in the game and contributes to the growth of the company. Stock options are a good tool to ensure this, but where the promoters of a company continue to play a key role, alternative incentive structures will have to be formulated owing to legal restrictions on issuance of stock options to promoters. These could include good leaver / bad leaver provisions and other retention structures to offset limited ownership interests. Further, where promoters are not bought out and will continue in their management role in the target company after investment, a balance will need to be struck between the investor’s role as the majority stakeholder and operational freedom to the minority promoters for day to day activities. In some cases, such minority promoters may also seek affirmative rights and this may involve protracted negotiations.

Another issue for PE investors to watch out for is the liability of their nominee directors, who will no longer be mere non-executive directors representing a minority interest. A key concern is classification as ‘officer in default’, ‘employer’ or ‘person in charge’ under various laws, leading to liabilities. Fiduciary duty versus allegiance to the investor is a recurring concern for nominee directors and contractual remedies will need to be found for this. While these concerns are to some extent applicable to all transactions, the issue is more pronounced in a control transaction.

Other Considerations

Co-invest to diversify risk: In minority investments, diligence, affirmative rights and board representation are the key constituents of the arsenal for protection of investor rights, with the investor being, for the large part, an onlooker. However, control deals demand greater participation and involvement of the investor, even in situations where the promoters continue to hold shares in the company. Control deals require a greater investment in pure monetary terms, which in turn increases the risk associated with each investment. In this background, in addition to a high level of due diligence as well as business expertise which are prerequisites for any control deal, it may also be prudent for PE firms to diversify their risk in such transactions. One option available to PE firms is to co-invest with another financial investor or strategic investor, especially in the case of high value transactions. The advantage of such co-investment is that both monetary and management risk would be shared; and a strategic investor may also bring in sufficient business expertise to run the operations of the company and provide the financial investor with an exit in the future. However, a co-investment structure would imply dilution of governance and exit rights as between the co-investors as these rights will have to be shared with each other. Co-investment structures also need to be approached carefully as multiple co-investors may end up tipping de facto control and de facto majority in favour of the promoters, as the promoters may be the only shareholders with a significant consolidated stake.

Synergies: An added advantage of control transactions is that they give investors the option to use the controlled entities to make further acquisitions in India, or enhance efficiencies by having one or more investee companies work with each other or consolidate. In this connection, it may be noted that minority investment documentation typically provides a right to an investor to conduct its business and invest in other entities without any restrictions. However, in a control transaction, if any investor group entity is engaged in the same or similar business as a portfolio company in which there are shareholders apart from the investor, the investors and promoters / other shareholders should consider formulating basic conflict avoidance principles in the interests of good governance.

Conclusion

Recent years have seen a significant portion of the total PE investments in India being directed towards acquiring controlling stakes in companies. Some large PE exits from control deals have also been struck. Based on current evidence, the landscape for such transactions is maturing and it appears that control deals are here to stay. The volume of these deals is also likely to increase on account of stressed asset sales by banks. If the challenges posed by such investments are tackled effectively, and good governance approaches to management are adopted, control deals by PE firms may well spike in the near future.

Notes

The authors would like to acknowledge the contribution of Trayosha Darapuneni, Senior Associate at Cyril Amarchand Mangaldas.

1 “The Operating Paradigm : Indian Private Equity Changes Gears”; available at Alvarez and Marsal; last visited on April 11, 2017

2 SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (in force since December 2015)

About the authors

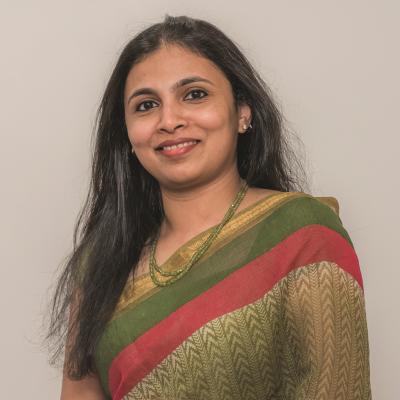

Maheshwari Sundaresh, Partner

Maheshwari Sundaresh is part of the general corporate practice of the firm. Her advisory and transaction experience extends to foreign and domestic private equity and venture capital investments, inbound and outbound mergers and acquisitions, joint ventures and corporate restructuring. She also has extensive experience advising on securities market laws. Her sectors of expertise include e-commerce, consumer healthcare and technology enabled services.

In the private equity and venture capital fields, Maheshwari has been involved in a wide range of transactions, including early-stage to mid-stage investments, PIPE transactions and exits from investments, and has advised both investee companies as well as funds.

She has also advised prominent business houses in India on the restructuring of their Indian and overseas assets, and has advised established businesses as well as mid-stage companies and start-ups on fund-raising initiatives and general corporate matters, including business model analyses for foreign investment eligibility and compliance.

Having graduated from NALSAR University of Law, Hyderabad in 2007, Maheshwari joined the firm in July, 2007. She also has an LL.M. from Columbia University.

Reeba Chacko, Partner and Head – General Corporate

Reeba specializes in private equity and venture capital investments, mergers & acquisitions, joint ventures and corporate restructuring.

She brings to the table her vast experience of working with foreign clients as well as international counsel in structuring complex private equity deals, mergers and acquisitions spanning several jurisdictions, and in advising clients on Indian acquisition strategies, foreign exchange control regulations, structured investments and other regulatory aspects. She has represented several leading global private equity funds, as well as large Indian corporates in connection with private equity investments. She advices both buy side and sell side in strategic sale transactions in India as well as financial investor stake sales and exit transactions. Her experience ranges across various sectors including pharmaceuticals & healthcare, real estate and infrastructure, technology, retail and ecommerce, financial services and education.

Reeba was ranked in Band I for Corporate M&A, Bangalore by Chambers Asia 2011 and Chambers Asia 2012. She was named for corporate M&A in Chambers Asia 2013 and 2014; and was recommended PE lawyer by Chambers Asia 2012, 2013 & 2014 for Private Equity. Chambers Asia 2015 has named her in the Corporate/M&A – India practice and says Reeba Chacko is praised for her sound expertise and “exceptional client management skills” and has also named her in the Private Equity – India practice and says she “is exceptional at client management and making sure that the resources of the firm are involved in the deal.” Reeba was recently also recognised for Corporate M&A, Bangalore by Chambers Asia 2016, for her experience advising international private equity groups and venture capital firms in large-scale, complex transactions, and her peers have endorsed that she “handles impressive transactions for clients.” Reeba has also been named in “Who’s Who Legal – The International Who’s Who of Business Lawyers - Mergers & Acquisitions 2012” as one of the thirteen named lawyers from India and continues to be named in the Who’s Who Legal directory for India including in their latest edition in 2016.

She has graduated from National Law School of India University, Bangalore and has completed her LL.M from London School of Economics & Political Science (LSE).

About Cyril Amarchand Mangaldas

Cyril Amarchand Mangaldas (“The Firm”) was founded on May, 2015 and takes forward the legacy of the erstwhile 100-year old Amarchand &

Mangaldas & Suresh A. Shroff & Co., whose pre-eminence, experience and reputation of almost a century has been unparalleled in the Indian legal fraternity. Tracing its professional lineage to 1917, the Firm of Cyril Amarchand Mangaldas is the largest full-service law firm in India, with over 625 lawyers, including 100 partners, and offices in India’s key business centres at Mumbai, New Delhi, Bengaluru, Hyderabad, Chennai and Ahmedabad. The Firm advises a large and varied client base that includes domestic and foreign commercial enterprises, financial institutions, private equity funds, venture capital funds, start-ups and governmental and regulatory bodies.

The Firm prides itself in having a strong value system that keeps its clients as the central focus. Building on the strength of this value system, the Firm has fostered a collaborative work culture and adopts a pragmatic and solution-oriented approach to problem solving. Today, the Firm is recognised globally as a trusted adviser which consistently delivers quality, capability and commitment to its clients.

The firm was recently awarded “National Law Firm of the Year” by IFLR Asia Awards 2017 & “India Deal Firm of the Year” by ALB SE Asia Law Awards, 2016 & 2015. Ranked no. 1 amongst India’s top 40 law firms in 2015 as per RSG India report as well as ALB on Asia’s Top 50 Largest Law Firm report in 2015 and topped recent league tables namely Bloomberg, Merger Market, Dealogic, Thomson Reuters.

Several of our lawyers are cited as leading practitioners by global publications like Chambers and Partners, International Financial Law Review, Asia Legal 500 and Euromoney.

Our partners routinely advise and collaborate with governments and regulators on policy matters. Many partners of the Firm are also members of various government committees on legal and regulatory reform.

Our Practice Groups

-

Corporate

-

Projects

-

Disputes

-

Banking & Finance

-

Capital Markets

-

Competition

-

Employment

-

Financial Regulatory

-

Real Estate

-

Intellectual Property

-

Private Client

-

Tax

-

TMT

-

Investment Funds

-

Bankruptcy

-

Investigations

Global Approach

Through its “Best Friends’ Networks”, the Firm has established relationships with leading international law firms including those in the USA, UK, Japan, South Korea, Singapore, Hong Kong, China, Germany, and France. These cross-border relationships allow the Firm to provide local advice to its clients with a global outlook.

MUMBAI OFFICE

5th Floor, Peninsula Chambers, Peninsula Corporate Park, Ganpatrao Kadam Marg, Lower Parel, Mumbai 400 013

OTHER OFFICES

New Delhi, Bengaluru, Hyderabad, Chennai, Ahmedabad.

This article is brought to you by India Unleashed

India Unleashed is a print and online publication by Global Legal Media and Legally India, providing country-by-country insights and sector-specific analysis from leading law firms and writers around the world.

threads most popular

thread most upvoted

comment newest

first oldest

first

threads most popular

thread most upvoted

comment newest

first oldest

first