Capital Markets

Capital Markets

Vaish Associates advised auto-parts maker Amtek India in raising Rs 375 crore ($70mn) through issue of 2.5 per cent foreign currency convertible bonds (FCCB). Linklaters and Trilegal advised the Singapore-incorporated DBS bank which was the guarantor, and the bank’s Indian branch which was the lead manager in the issue.

Vaish Associates Delhi partner Satwinder Singh with principal associates Manish Tully and Sushma Mathur and associate Sougata Kundu acted for Amtek India, which issued FCCB convertible at Rs 103.005 per equity share of the company according to Post Jagran.

Trilegal Mumbai partner Srinivas Parthasarthy with senior associate Anil Choudhary and associates Priyanka Kumar and Smriti Bahety, and Linklaters Singapore counsel Aditya Shroff acted for DBS Bank India and Singapore.

The issue, raised on the Bombay Stock Exchange (BSE), is Amtek’s second round of FCCB-fund raising in less than six months. Vaish Associates also advised the company in the first round in April 2012, when funds worth Rs 650 crore ($130m) were raised on the Singapore Stock Exchange.

Capital Markets

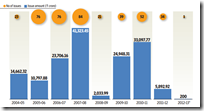

LI-Mint exclusive: Law firms saw a slump in earnings from their capital markets business in the year that ended March. Many that had invested heavily in the practice during the boom years adopted various strategies to cope with the decline.

LI-Mint exclusive: Law firms saw a slump in earnings from their capital markets business in the year that ended March. Many that had invested heavily in the practice during the boom years adopted various strategies to cope with the decline.

Capital Markets

S&R Associates and Jones Day advised the book running lead managers (LMs) Kotak Mahindra Capital and UBS Securities India on the first ever Institutional Placement Programme (IPP) in India. Indian realty major Godrej Properties’ (GPL) issued a private placement of Rs 4.9 bn ($95m) of equity shares worth Rs 575 each. GPL was advised by Amarchand & Mangaldas & Suresh A Shroff & Co.

S&R Associates and Jones Day advised the book running lead managers (LMs) Kotak Mahindra Capital and UBS Securities India on the first ever Institutional Placement Programme (IPP) in India. Indian realty major Godrej Properties’ (GPL) issued a private placement of Rs 4.9 bn ($95m) of equity shares worth Rs 575 each. GPL was advised by Amarchand & Mangaldas & Suresh A Shroff & Co.

Capital Markets

MV Kini & Co took advantage of the government go-ahead to four major PSUs to issue tax-free bonds, advising National Highway Authority of India (NHAI) on its Rs 10,000 crore ($1.93bn) issue of 28 December 2011.

MV Kini & Co took advantage of the government go-ahead to four major PSUs to issue tax-free bonds, advising National Highway Authority of India (NHAI) on its Rs 10,000 crore ($1.93bn) issue of 28 December 2011.

Capital Markets

Amarchand Mangaldas, Latham & Watkins and Middle East law firm Al Tamimi & Company have advised India’s largest private sector bank ICICI Bank on issuing $1bn (Rs 4,470 crore) of international bonds through five-and-a-half year fixed rate notes.

Amarchand Mangaldas, Latham & Watkins and Middle East law firm Al Tamimi & Company have advised India’s largest private sector bank ICICI Bank on issuing $1bn (Rs 4,470 crore) of international bonds through five-and-a-half year fixed rate notes.

Capital Markets

The winner doesn’t take it all anymore in the capital markets field. Read Legally India’s full analysis of the main players and contenders in the equity and debt capital markets.

The winner doesn’t take it all anymore in the capital markets field. Read Legally India’s full analysis of the main players and contenders in the equity and debt capital markets.

Capital Markets

ALMT Legal, Khaitan & Co and Crawford Bayley have grabbed the maximum number of rights issue mandates in the financial year (FY) 2010-2011.

Capital Markets

Exclusive: Amarchand Mangaldas has lost ground in its lead over Luthra & Luthra and surprise performer AZB & Partners in the initial public offering (IPO) league tables for the 2010-11 financial year, while DLA Piper came from nowhere to top the rankings of foreign firms ahead of Dorsey & Whitney and Jones Day.

Exclusive: Amarchand Mangaldas has lost ground in its lead over Luthra & Luthra and surprise performer AZB & Partners in the initial public offering (IPO) league tables for the 2010-11 financial year, while DLA Piper came from nowhere to top the rankings of foreign firms ahead of Dorsey & Whitney and Jones Day.

Capital Markets

Exclusive: Against a background of slowing markets in qualified institutional placements (QIPs), Amarchand Mangaldas has retained a strong lead in Legally India’s QIP league table for the 2010-2011 fiscal despite its deal volume dropping by half, while Luthra & Luthra and Crawford Bayley scaled ahead of Khaitan & Co and AZB & Partners.

Exclusive: Against a background of slowing markets in qualified institutional placements (QIPs), Amarchand Mangaldas has retained a strong lead in Legally India’s QIP league table for the 2010-2011 fiscal despite its deal volume dropping by half, while Luthra & Luthra and Crawford Bayley scaled ahead of Khaitan & Co and AZB & Partners.

Capital Markets

Luthra & Luthra and DLA Piper have bagged the 12,500 crore ($2.75bn) follow-on share sale of ONGC, beating five other law firms in a competitive tender, with Amarchand Mangaldas Delhi winning the mandate for the bankers.

Capital Markets

Exclusive: AZB & Partners has topped Legally India’s 2010-2011 quarterly initial public offering (IPO) league table taking it to second place in the financial year IPO rankings to date behind Amarchand Mangaldas and overtaking Luthra & Luthra, which did not file any IPOs in the last quarter.

Exclusive: AZB & Partners has topped Legally India’s 2010-2011 quarterly initial public offering (IPO) league table taking it to second place in the financial year IPO rankings to date behind Amarchand Mangaldas and overtaking Luthra & Luthra, which did not file any IPOs in the last quarter.

Capital Markets

Khaitan & Co and UK firm Berwin Leighton Paisner (BLP) have advised on the Global Depository Receipt (GDR) issue of Indian coal-bed methane producer Great Eastern Energy Corporation Limited (GEECL) on the London Stock Exchange (LSE) after its listing on London's Alternative Investments Market (AIM) earlier in 2005.

Capital Markets

Crawford Bayley and Dorsey & Whitney have won the mandate to advise public sector undertaking SAIL on its follow-on public offer (FPO) to raise Rs 8,000 crore.

Capital Markets

Exclusive: Amarchand Mangaldas has reclaimed the top rank in Legally India’s 2010-11 first-half-year initial public offering (IPO) league table ahead of Luthra & Luthra, with AZB & Partners winning third place after doubling its IPO mandates compared to the same period last year as Khaitan & Co dropped four ranks.

Exclusive: Amarchand Mangaldas has reclaimed the top rank in Legally India’s 2010-11 first-half-year initial public offering (IPO) league table ahead of Luthra & Luthra, with AZB & Partners winning third place after doubling its IPO mandates compared to the same period last year as Khaitan & Co dropped four ranks.