IndusLaw’s new capital markets team has completed its first deal with deal credit in the prospectus, in the RBL Bank Limited qualified institutional placement (

The QIP had raised Rs 2,205 crores, according to The Hindu.

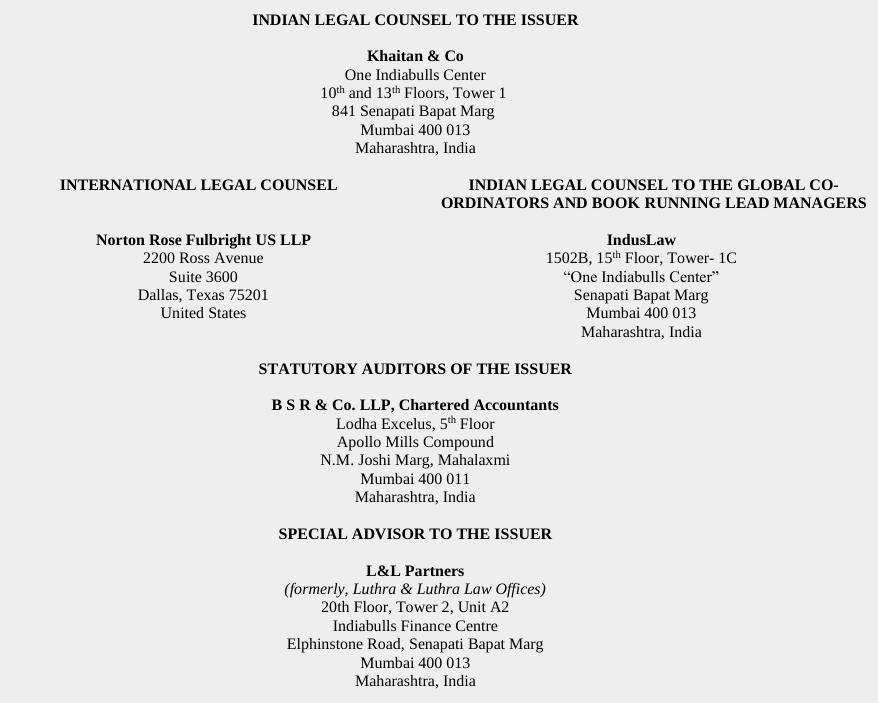

Khaitan & Co Mumbai acted for the issuer,

IndusLaw acted for the global co-ordinators and book running lead

Norton Rose Fulbright acted as international legal counsel to the issue.

L&L Partners, formerly known as Luthra & Luthra, acted as special advisor to the issuer,

The deal is significant since its the first prospectus deal credit for the Indus capital markets team, which had left Luthras and joined IndusLaw in October with a team 18 lawyers (and five partners led by Lahoty).

Both firms had agreed in their contentious settlement over the departure (that had ended up in the Bombay high court) for L&L to get deal credit (both in prospectuses and effectively league tables, perhaps) for any ongoing deals, although the Indus team would continue working and billing on those.

Luthra, meanwhile, had acted on the $56m Catholic Syrian Bank initial public offering (IPO), which we had reported last week. That IPO had taken place without billings from the team at Indus.

Besides

threads most popular

thread most upvoted

comment newest

first oldest

first

Plus, you have already reported CSB, there was no need to toot their horn again.

threads most popular

thread most upvoted

comment newest

first oldest

first