Experts & Views

By Madhulika Srikumar

Justice Rajiv Sahai Endlaw when hearing a petition in the Delhi High Court on the 23rd of September this year had this to say about ecommerce, “Prima facie, the Union of India/State Governments cannot, on the one hand, for the purpose of tax, treat such sales as retail and on the other hand, for the purposes of investment, not treat the same as retail sale”. This effectively sums up the confusion around ecommerce and Foreign Direct Investment (FDI) policy in India. Whether ecommerce should be considered as B2B (business to business) or B2C (business to consumer) under the FDI Policy is the question.

The above petition was filed by the Retailers Association of India (RAI) and the All India Footwear Manufacturers and Retailers Association (AIFMRA) seeking clarity on FDI in e-commerce, arguing that ecommerce companies have been acting like retailers which is in violation of the current FDI norms. In the beginning of this month, the Confederation of All India Traders (CAIT) had also raised similar objections in a complaint sent to the Secretary of Department of Industrial Policy & Promotion (DIPP) at the Ministry of Commerce and Industry. The letter in particular singled out Flipkart, Amazon and Snapdeal for flouting FDI regulations when offering huge discounts during the festive season sales. The commerce ministry in turn has requested the Enforcement Directorate (ED) and RBI to look into these companies and examine if they are indeed engaging in retailing activity.

This is not the first time that these ecommerce companies have been pulled up by the authorities. A similar probe was said to have been carried out by the ED placing Flipkart under the scanner back in late 2012. None of them to date have been found to be violating the FDI Policy to date. This could change with the Delhi High Court issuing a notice in the above case to the government (the matter is said to be heard by the High Court sometime soon) directing them to file their affidavit on the matter.

At this point there is no doubt about the increasing importance that ecommerce is going to play in India’s economy, with the industry said to cross the $100-billion mark over the next five years according to an Assocham-Pricewaterhouse Coopers study. Meanwhile the regulatory landscape for ecommerce looks quite shaky and that includes the FDI regulations.

Regulatory Framework for FDI

FDI in India is regulated under the Foreign Exchange Management Act, 1999 (FEMA). The Ministry of Commerce comes out with the investment policy and the amendments in consultation with the DIPP. This is then notified by the Reserve Bank of India (RBI) through press notes and circulars. It is the Directorate of Enforcement (ED) that carries out investigations when it comes to possible violations of FDI Policy. Penalty under the Act can go up to thrice the sum[1] involved for the guilty entity resulting in the possibility of Flipkart facing a whopping 1400 crore penalty had the earlier ED probe in 2014 found them guilty. This kind of penalty can reduce a company to bankruptcy quite easily.

This is what Amazon’s options look like currently

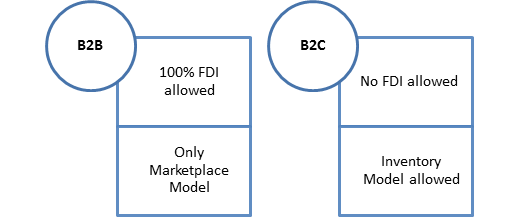

Now India‘s FDI Policy (Consolidated FDI Policy, 2015) permits FDI up to 100% in e-commerce activities.[2] This however applies only to B2B ecommerce (under the Automatic Route) and not to online retailers/e-retailers also known as B2C ecommerce[3]. B2B stands for Business to Business where the trading is between business entities such as manufacturers and wholesalers or between wholesalers and retailers. B2C on the other hand stands for Business to Consumers where online businesses sell directly to the customers.

In September 2012, the Indian government allowed 51% FDI in multi-brand retail, subject to certain conditions. Whereas retail trading in ecommerce for companies with FDI (single[4] or multi brand[5]) is not allowed under the FDI Policy. The 51% FDI limit in multi-brand retail is subject to some conditions where the states take the final call, which might be difficult to translate into ecommerce which has no geographical boundaries.

All this is not to say that Amazon and the rest haven’t found a way out under the existing FDI framework to attract foreign investment. Amazon follows what is known as the marketplace model that is compliant with the FDI Policy of India. A marketplace model in ecommerce, as a Snapdeal spokesperson explained, “(Snapdeal) is a technology platform that connects sellers with buyers to facilitate transactions”. In the marketplace model, the ecommerce company only engages in the activity of buying and selling which is considered B2B and not retail trading under the Policy (see footnote n.3). Therefore under this model the ecommerce company does not carry out any retail transactions and does not directly sell anything to the customer. Instead the ecommerce platform earns commission from sellers of goods/services for their services. This move to operate as a marketplace enables Amazon[6]and Flipkart which are both majority-owned by foreign investors to still function in the Indian market without running afoul of the FDI Policy.

What Amazon can’t do is run an inventory based model. In this model, ownership of goods and services and the marketplace vests with the same entity. As a comparison India is said to be the only one among a list of developed and developing economies that does not allow FDI in inventory based ecommerce. Keep in mind that in the marketplace model, ownership of the inventory vests with the enterprises who are the ultimate sellers of the goods/services.

Does Ecommerce fall under B2B or B2C?

This section looks at what CAIT, AIFMRA and other brick and mortar associations are complaining about when it comes to e-commerce companies like Amazon, Flipkart among others. Their primary concern is that e-commerce companies are acting like B2C retailers while enjoying foreign investment that is only legal for B2B enterprises.

One of the possible FDI Models as laid out in the paper by Arkay & Arkay and Medianama

The CAIT has pointed out that the intensive advertising campaigns carried by the marketplaces should not be considered B2B activity as these initiatives are directed towards the consumers to promote their sales. Further, the CAIT questions how these ecommerce platforms offer such massive discounts when they have no inventory at their disposal. AIFRMA in their Delhi HC petition argued that marketplaces in ecommerce in India operate as retailers since the payment, delivery, returns and refund are all handled by these companies.

The other accusation made against these companies is that they do in fact have inventories and do not perform as mere marketplaces. In September 2014, the ED was directed to look into Amazon and examine if they are making the sales instead of the vendors. The Karnataka Government also had suspicions about the “fulfillment centres” belonging to Amazon alleging that Amazon “owned” the products in such centres. Interestingly when Flipkart was incorporated in 2008, it started out as an inventory-based B2C model that had to be changed to the B2B marketplace model after raising foreign funds in 2012. The change however was made only in April 2013 leading to an investigation by the ED on Flipkart functioning as a B2C with FDI during 2012-2013. Again, none of these ecommerce companies have ever been found to be violating FDI Policy.

While the marketplace model is practiced by Amazon, Flipkart and others, there are also other structures through which foreign investors can enter the Indian ecommerce market legally. One of the structures for instance can be found in the image above. The Delhi HC petition also addressed concerns that ecommerce companies have been creating complex business structures to evade the law. One such case study is that of Amazon Asia’s stake in Cloudtail (see image below), one of the largest sellers on Amazon India. Amazon through Cloudtail can therefore dictate pricing among other things and in effect acts like a retailer. This of course pales in comparison when it comes to Flipkart and their dominant seller WS Retail that accounts for 85% of the total products sold on the portal over the past three years. Flipkart does have operational control over WS Retail even now. This, after the famous corporate restructuring that Flipkart carried out in 2012 which included the divesting of WS Retail. Ecommerce companies are doing all this to make sure that the companies are an arm’s length from directly selling to the consumers.

Amazon being clever: image from ISID paper by Rahul Nath Choudhury

Way Forward

Which brings us to the next question of whether companies should be penalized for creating such business structures or is it time to allow for FDI in B2C ecommerce instead? The DIPP considered the pros and cons of doing so in their Discussion Paper that came out in January 2014 and sought out public opinion. The government has held discussions with several stakeholders including ecommerce companies and bodies such as FICCI, NASSCOM and CII this year. There have also been several reports of foreign retailers like Amazon and Ebay lobbying with the Indian government to permit FDI in online retail in India. It is clear that there are valid arguments both for allowing FDI in e-retail and not. It is crucial however that the government decides on this soon to ensure that the current FDI framework is not manipulated and its purpose defeated. It is also worth exploring how the government can impose conditions (and what conditions) on companies with FDI in online retail, if it were to be allowed.

Fundamentally more clarity is required with respect to the definition of the term marketplace and the difference between retail and wholesale trading[7] on online platforms. With FDI not being the only regulatory concern for ecommerce in India, seeing as concerns regarding taxation of these goods/services and anti-competitive behavior by these companies have also been brought out, maybe it is not a bad idea to go back to the drawing board to figure out the definition of ecommerce in India. A better understanding of what ecommerce in India entails will help characterize it either as B2B or online retail which in turn can bring the “violations of FDI Policy” debate to an end. Answers are expected soon from the government after the commerce and industry ministry received responses from various states on this matter a few days ago. The Vidhi Centre for Legal Policy in a report has proposed for a law to be passed by the Parliament under Entry 42 of the Union List[8] to govern goods/services of online marketplaces and those sold directly on the Internet. Moving forward a uniform policy on ecommerce across states will provide much-needed clarity albeit it has to be done in the near future.

[1] As per S.13 of FEMA, 1999, penalty imposed can be thrice the sum involved in the contravention where such amount is quantifiable.

[2] DIPP Press Note No. 8 of 2015, Annexure 1, paragraph 6.2.16.2.1 allows 100% FDI in B2B Ecommerce activities.

[3] Under paragraph 6.2.16.2.1 of the Consolidated FDI Policy of 2015 (effective from May 12, 2015), 100% FDI is permitted only in B2B ecommerce activities, “E-commerce activities refer to the activity of buying and selling by a company through the e-commerce platform. Such companies would engage only in Business to Business (B2B) e-commerce and not in retail trading, inter-alia implying that existing restrictions on FDI in domestic trading would be applicable to ecommerce as well.”

[4] Under paragraph 6.2.16.3 of the Consolidated FDI Policy of 2015, “Retail trading, in any form, by means of e-commerce, would not be permissible, for companies with FDI, engaged in the activity of single-brand retail trading.”

[5] Paragraph 6.2.16.4 of the Policy provides, “Retail trading, in any form, by means of e-commerce, would not be permissible, for companies with FDI, engaged in the activity of multi-brand retail trading.”

[6] Amazon India (Amazon Sellers Services Private Limited) for instance was set up as a wholly owned subsidiary by Amazon Asia-Pacific Resources Pvt. Ltd., Singapore in 2012, incorporated in Bangalore. They had entered the Indian ecommerce market before through the acquisition of Junglee.com way back in 1998 which came into operation in 2012. Junglee.com, a price comparison website, was also set up under the marketplace model.

[7] Currently under paragraph 6.2.16 of the Consolidated FDI Policy of 2015, B2B ecommerce is considered as wholesale trading.

[8] Entry 42 of the Union List covers inter-state trade and commerce.

(Madhulika Srikumar is a Research Assistant at CCG and a final year student at GNLU)