Contrary to the actual legal position, the notice asserted that restaurants should levy ST only on “service charges” added to the bill, and urged “members, their family, friends and clients” to “rightly refuse to pay the extra tax and see the difference”.

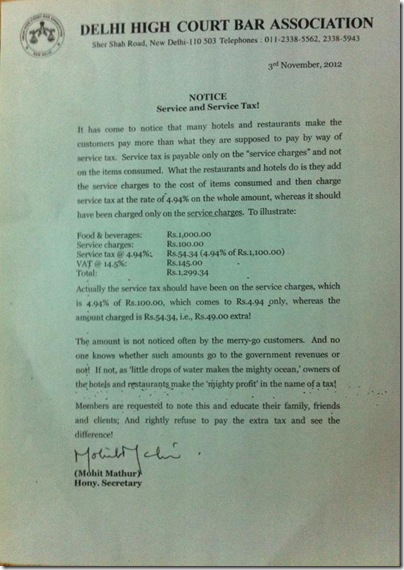

The notice printed on DHCBA letterhead and published on its noticeboard wrongly stated:

“It has come to notice that many hotels and restaurants make the customers pay more than what they are supposed to pay by way of service tax. Service tax is payable only on the ‘service charges’ and not on the items consumed.

“What the restaurants and hotels do is they add the service charges to the cost of items consumed and then charge service tax at the rate of 4.94% on the whole amount, whereas it should have been charged only on the service charges.”

However, the law actually provides for the levy of ST on the sum of the food and beverage charges and the service charges, according to several sources.

The Department of Revenue’s service tax guidebook on page 115 and 116 (via @gautham1016 on Twitter) states that service tax on supply of food and beverage by restaurants is governed by Rule 2C in the Service Tax (Determination of Value) Rules, 2006.

For restaurants with air-conditioning facilities, 40 per cent of the total billed amount is subject to service tax, notes the guidebook.

According to an explanation by chartered accountancy firm Arkay & Arkay (via @ThePallav), the Tax Research Unit (TRU) of the Department of Revenue has also clarified that “the gross price charged by the restaurant for the taxable service, [includes] any portion shown separately e.g. service charge”.

Therefore, the total price for food, beverages and any service charges added on the invoice, are taxable at 4.94 per cent (equivalent to 40 per cent of the current service tax rate of 12.36 per cent). However, any discretionary service charge left by a patron, is not service taxable, explains Akosha.

DHCBA secretary Mohit Mathur told Legally India that after the “anomaly” came to the notice of the executive members of the DHCBA, they consulted a lawyer specialising in taxation and proceeded to issue the notice in the public interest.

“We will again consult them and if the position is indeed contrary we will issue a clarification,” he said.

Hat tip also goes out to Twitter users @gkjohn, @madmanweb, and others for clarifying

Update: The error in the notice was first blogged about on Friday by Dushyant K Mahant.

Letter via Vineet Soni

threads most popular

thread most upvoted

comment newest

first oldest

first

Perhaps the IT department can retroactively change the law til at least the early 19th century so electricity can be taxed an extravegance. I'm tired of these foreigners hiding their electrical charges abroad.

This gives a clearer picture.

Even by basic logic:

Food is subject to VAT

Beverages are subject to a higher Beverage VAT @ 20%

and Service tax accordingly is to be levied ON SERVICE and not on the product which is already subject to the taxes listed above.

As per set supreme court precents and guidelines, no "rule" can be interpreted in a manner that is contrary to the intention of any statute or public policy or in a way that renders it's execution illogical. Hope this clarifies the stand.

Plz ensure correct dissemination of information of public interest in the future. Thank you.

threads most popular

thread most upvoted

comment newest

first oldest

first