Linklaters

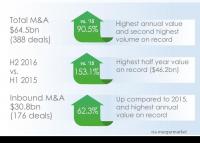

Freshfields Bruckhaus Deringer has topped the mergermarket value league table of international law firms that advised on M&A deals in the record 2016 calendar year.

Freshfields Bruckhaus Deringer has topped the mergermarket value league table of international law firms that advised on M&A deals in the record 2016 calendar year.

"The acquisition is the biggest foreign acquisition ever in India and Russia’s largest outbound deal. Billionaire brothers Shashi and Ravi Ruia have agreed to sell 98 per cent of Essar Group flagship firm Essar Oil to Russian oil major Rosneft and a consortium of oil trading firm Trafigura with private investment group United Capital Partners for $13 billion, making it the largest foreign direct investment in India.” reported The Hindu and others.

Shearman & Sterling, DLA Piper, White & Case and Allen & Overy had the largest number of recorded Indian M&A deals in the first six months of 2016, according to data intelligence provider mergermarket, each with five or four transactions.

Linklaters advised Banca Regionale Europea and 14 other Italian banks on Tech Mahindra and Mahindra & Mahindra’s buy of majority stake in Italian automotive brand Pinifarina. Gianni, Origoni, Grippo, Cappelli & Partners advised the Mahindra Group entities and Pavesio and Associates advised Pinifarina’s owner Pincar.

Linklaters Italy partner Francesco Faldi, managing associate Ettore Consalvi and associate Valentina Armaroli acted for the banks: Banca Regionale Europea, Intesa Sanpaolo, Banca Nazionale del Lavoro, UniCredit, Banca Monte dei Paschi di Siena, Banco Popolare Società Cooperativa, UBI Leasing, Monte dei Paschi di Siena Leasing & Factoring, Banca per i Servizi Finanziari alle Imprese, Selmabipiemme Leasing, UniCredit Leasing, BNP Paribas Leasing Solution, Release, Mediocredito Italiano and Banca IM

Gianni senior partner Francesco Gianni acted for IT, Networks and Engineering solutions and BPO services provider Tech Mahindra and Mahindra & Mahindra.

Pavesio founder Carlo Pavesio acted for Pincar on the sale of its automotive and industrial design brand which will continue to remain an independent company, listed on the Milan Stock Exchange, according to Linklaters’ press release.

As part of the agreement, Tech Mahindra and M&M will form a joint venture (JV), with 60 per cent stake held by Tech Mahindra. This JV will purchase 76.06 per cent stake in Pininfarina at a price of Euro 1.1 per share, followed by an open offer for all the remaining ordinary shares of Pininfarina, also at Euro 1.1 per share. A rights issue to infuse funds into Pinifarina will also be executed before the end of 2016, added the release.

The 85-year-old Pinifarina is an iconic design brand and has relationships with the best in the automobile industry including with Ferrari, Alfa Romeo, Maserati and Peugeot. But it has remained unprofitable for 10 of the last 11 years, with a consolidated revenue of 86.6 million Euros in 2014, reported The Hindu.

Former Linklaters Singapore managing associate Pallavi Gopinath Aney is set to join Baker & McKenzie as a partner, an authoritative source has confirmed to Legally India.

Former Linklaters Singapore managing associate Pallavi Gopinath Aney is set to join Baker & McKenzie as a partner, an authoritative source has confirmed to Legally India.

Linklaters, Clifford Chance, Allen & Overy and Baker & McKenzie are the highest profile foreign law firms operating in India, according to the latest analysis of foreign law firms’ India businesses.

Linklaters, Clifford Chance, Allen & Overy and Baker & McKenzie are the highest profile foreign law firms operating in India, according to the latest analysis of foreign law firms’ India businesses.

White & Case has hired Linklaters managing associate Pradyumna Mysoor as a local partner in its Hong Kong office.

Narayan Iyer, who had left Linklaters Singapore in 2009 to join the magic circle firm’s best friend Talwar Thakore & Associates, has been appointed as head of the India practice.

Narayan Iyer, who had left Linklaters Singapore in 2009 to join the magic circle firm’s best friend Talwar Thakore & Associates, has been appointed as head of the India practice.

Linklaters and Talwar Thakore Associates (TTA) advised the lending and underwriting banks on Tata Steel UK Holdings, which took a term loan and revolving credit facilities of $3.05bn to refinance its bank debt.

Linklaters London partner Narayan Iyer, who had rejoined Linklaters a year ago from TTA, and Singapore partner Philip Badge, and capital markets partner Kevin Wong and TTA partner Rahul Gulati acted for the banks.

JSA and Slaughter & May advised Tata.

The new financing structure consists of a five-year loan of a €370 million, a six-year revolving credit facility for working capital of £700 million and a seven-year loan of €1.8 billion, with more favourable terms and pricing relative to the earlier debt, reported Mint.

Read on for the hottest M&As, fundraisings and financings of the fortnight.

Read on for the hottest M&As, fundraisings and financings of the fortnight.

One of the most important things when creating a technology company is “to think about what could go right”, says Ankur Singla, in stark contrast to the typical lawyers’ mindset.

One of the most important things when creating a technology company is “to think about what could go right”, says Ankur Singla, in stark contrast to the typical lawyers’ mindset.

Magic circle firm Clifford Chance has promoted four women and three men to its partnership in London after Linklaters did the same earlier this month for the first time.

Women still make up a minority of partners in UK firms but some firms, such as Herbert Smith Freehills, have recently introduced a 30 per cent female partner target by 2019 in a bid to address the imbalance (63 per cent of fresh recruits to UK law firms are women). [RollOnFriday] [HSF quota story: The Lawyer]

SC wants life sentence for milk-tampering

The SC has asked state governments to make laws that punish with life in prison the selling and production of adulterated milk injurious to humans [TOI]

Kalam faces faulty voting machine

Former president APJ Abdul Kalam was yesterday temporarily among the large number of Delhi voters who could not exercise their right to vote locally due to malfunctioning electronic voting machines (EVM). Kalam waited, went back home without voting, then came back to vote once the fault was corrected [Outlook]

Linklaters breaks strict associate lockstep

UK magic circle law firm Linklaters has introduced a merit-based discretionary pay element to its associate lockstep for the first time, to reward associates above two years of PQE, departing from the previous system of “strict ladder according to PQE” plus year-end bonus [The Lawyer]

Tejpal should pay Rs 25 lakh for wasteful Delhi bail application

Tehelka founding editor and rape accused Tarun Tejpal should be awarded exemplary costs of Rs 25 lakh – which should then be donated to the legal aid cell – for wasting the Delhi HC’s time with his anticipatory bail application, argues senior advocate and former additional solicitor general of India KN Bhat. Bhat says that Rs 25 lakh is equivalent to the amount of funds the court ended up wasting on the two days it entertained the application [Asian Age]

Sexual violence in India higher than US or under-reported?

Global statistics state that a woman is sexually abused in India every twenty minutes and that one in every six women experiences sexual violence in the US is an example of under-reporting, say experts [TOI]

AZB, Luthra, Links & Slaughters sell off Indian RBS assets to Ratnakar bank.

AZB, Luthra, Links & Slaughters sell off Indian RBS assets to Ratnakar bank.

Linklaters India partner set to join Magic Circle rival.

Linklaters India partner set to join Magic Circle rival.