Cyril Amarchand Mangaldas (CAM) has said it had appointed three former banking industry regulators to its financial institutions group (FIG) and an initiative it has dubbed a “regulatory bench”, according to a press release by the firm last week.

The initiative was a “critical piece” of CAM’s advice to the financial services industry and was part of the newly-created FIG. The bench’s members have “had the benefit or living through the evolution of laws and business changes affecting the policy development of and delivery of services in the financial services universe, and also having overseen technological and business developments involved therein”, according to CAM.

Joining the CAM bench as senior advisers will be:

- Lily Vadera, former executive director, Reserve Bank of India (RBI),

- PK Nagpal, former executive director, Securities and Exchange Board of India (SEBI), and

- Nilesh Sathe, former whole time member of the Insurance Regulatory and Development Authority of India (IRDAI).

Managing partner Cyril Shroff said: “They are deeply respected individuals in the industry and their joining will further support firm’s FIG team and the regulatory bench.”

The “regulatory advisors bench” would bring “substance and experience” in order to “provide comprehensive and innovative advice and give depth to our offering”, he added.

Vadera had served at the RBI for more than 30 years and most recently headed the department of regulation, dealing with the financial sector regulatory frameworks, including on fintech.

Vadera said she was “looking forward to work with their [CAM’s] lawyers”.

Nagpal has around 40 years of experience and at SEBI had formulated policies and “reforms in various segments of securities markets and enforcement of regulations”. He commented in the press release that he would assist in the “financial institution group’s development initiatives”.

Sathe had been chief executive officer (CEO) at LIC Nomura Mutual Fund Asset Management Company and Executive Director at the Life Insurance Corporation of India (LIC) before joining IRDAI. He commented: “I am hoping to contribute extensively in the financial services regulatory space.”

According to CAM’s press release, with the latest three senior advisers, the firm now had an “integrated regulatory and policy advisors’ bench, a first of its kind in India which will offer complete business, sectoral and regulatory advice to its clients”.

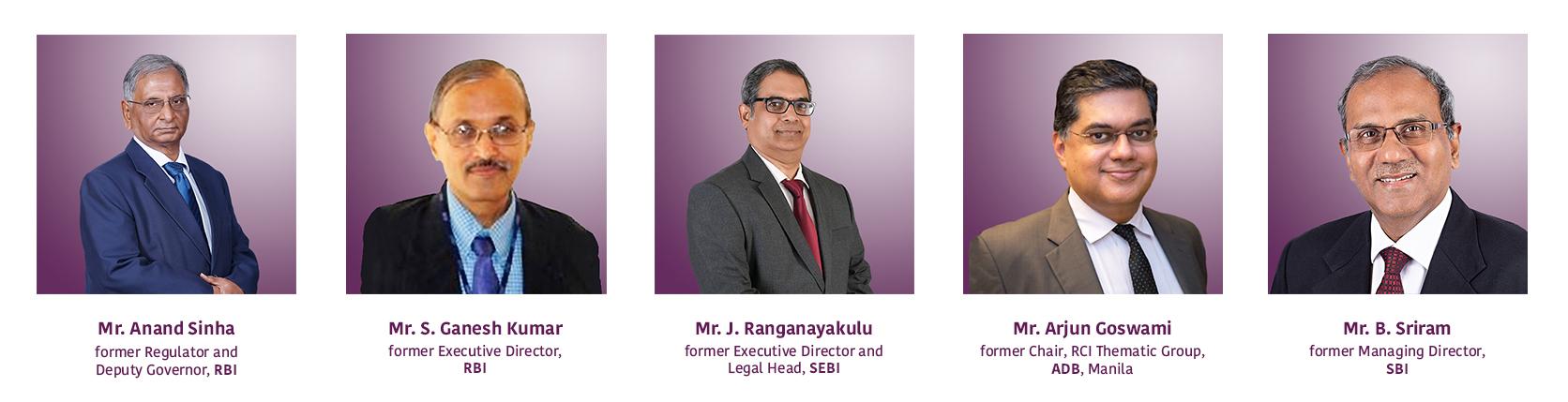

The other members on the regulatory bench are:

(i) Mr. Anand Sinha, widely respected former regulator and Deputy Governor, RBI, with 37 years overseeing Banking, Non-banking, Information Technology and Risk Monitoring.

(ii) Mr. S. Ganesh Kumar, former Executive Director, RBI, with over 36 years supervising Information Technology, Payment and Settlement Systems and External Investments and Operations. Most recently he has been at the forefront of integrating (and oversight over) technology and banking/ financial services.

(iii) Mr. J. Ranganayakulu, former Executive Director and Legal Head, SEBI, who oversaw framing of key regulations, investigations and enforcement and has deep insights into the regulatory mindset of SEBI.

(iv) Mr. Arjun Goswami, former Chair, Regional Cooperation & Integration (RCI) Thematic Group, Asian Development Bank (ADB), Manila, which integrated the government and policy cooperation aspects of the ADB; he brings rich experience in understanding each aspect of government cooperation and understanding the regulatory and policy mindset from a holistic perspective.

(v) Mr. B. Sriram, former Managing Director of the State Bank of India (SBI) and State Bank of Bikaner & Jaipur, and former Chairperson IDBI Bank. He has over 37 years of experience in all areas of Banking and Finance. He has held Board positions in various financial subsidiaries of SBI and Nominee Director representing SBI on the Boards of invested companies.

threads most popular

thread most upvoted

comment newest

first oldest

first

threads most popular

thread most upvoted

comment newest

first oldest

first