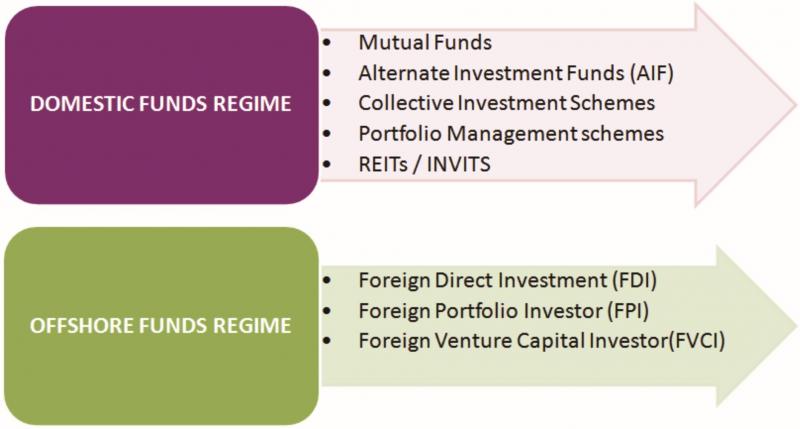

The mandate of Securities and Exchange Board of India (SEBI) in the asset management space, has translated into various regulations, through which SEBI regulates funds (domestic and offshore) as well as certain managers/advisers.

The domestic funds (investment funds set up in India) are regulated as mutual funds under the SEBI (Mutual Funds) Regulations, 1996 (MF Regulations), alternative investment funds (AIFs) under the SEBI (AIF) Regulations, 2012 (AIF Regulations), real estate investment trusts (REITs) under the SEBI (REIT) Regulations, 2014 (REIT Regulations), infrastructure investment trusts (INVITs) under the SEBI (INVIT) Regulations, 2014 (INVIT Regulations) and collective investment schemes (CIS) under the SEBI (CIS) Regulations, 1999 (CIS Regulations).

Offshore funds (investment funds set up outside India that invest in Indian securities or domestic funds) are regulated under SEBI (Foreign Portfolio Investors) Regulations, 2014 (FPI Regulations), SEBI (Foreign Venture Capital Investor) Regulations, 2000 (FVCI Regulations). The Reserve Bank of India also regulates offshore funds through the exchange control regulations, viz. FEMA (Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) Regulations, 2000 (FEMA 20).

Portfolio Managers who manage funds or securities of their clients are regulated under the SEBI (Portfolio Managers) Regulations, 1993 (PMS Regulations). Investment advisors (IA) are regulated under the SEBI (Investment Advisers) Regulations, 2013 (IA Regulations) and research analysts under SEBI (Research Analysts) Regulations, 2014 (RA Regulations).

With the above background, below is a brief write up on each of the regimes.

AIFs

India has witnessed a steady growth in the number of AIFs being registered with SEBI and the commitments raised by such funds growing year on year. As on January 31, 2017, SEBI had 2881 AIFs registered across categories. As on December 31, 2016, AIFs across all categories, raised commitments of ~ INR 700,000 million out of which ~INR 280,000 million has been invested2.

AIFs are investment funds that mobilise pools of capital from sophisticated investors with minimum investment ticket size of INR 10 million. AIFs can be registered under any of the following three categories:

-

Category I includes social venture funds, small and medium-sized enterprises (SME) funds, infrastructure funds, venture capital funds and angel funds;

-

Category II includes those AIFs that do not fall in Category I or III – these include private equity and debt funds; and

-

Category III includes those AIFs that employ diverse or complex trading strategies and may employ leverage – these are primarily for hedge funds. However, Indian funds proposing to use fund level leverage or invest primarily in listed equity investments (including long only funds) also need to seek registration as Category III AIFs.

AIFs are becoming the vehicles of choice in the alternate assets space as the structure can be customised to suit diverse investment strategies, sector exposure or target asset classes. AIFs also enjoy a special taxation regime thereby adding a sense of certainty and clarity for the tax implications for AIF investors, albeit, several tax issues remain to be addressed.

SEBI’s commitment to support the AIF industry in its growth strategy led to constitution of the Alternative Investment Policy Advisory Committee (AIPAC) under the chairmanship of Mr. N.R. Narayana Murthy.

AIPAC has submitted its reports in January 2016 and December 2016.

The recommendations made under the AIPAC reports can be classified under the following themes:

Unlocking domestic pools of capital: The AIPAC seeks reforms to permit wider participation by domestic banks, insurance companies, pension funds and high networth individuals.

Promoting onshore management: The AIPAC recommends amendments to the domestic regulatory and tax regime to encourage onshoring of management of offshore funds and thereby deepening the domestic fund management industry.

Tax recommendations: The key tax recommendation of AIPAC include:

losses on investments to be available to investors for set off, allowing proportionate exemption for service tax on management fees in unified structures, extending pass-through status to Category III AIFs, exempting foreign investors investing directly into an AIF from the rigors of obtaining a permanent account number and making tax filings, permitting AIF investors to capitalize the management fee as a cost of improvement thereby enhancing their post tax returns; to name a few.

Mutual funds

Mutual funds operate in the retail segment (with limited exceptions for private placement for specified types of schemes) by raising monies from the public through the sale of units under schemes set up from time to time. Such solicitation is required to be conducted through the issue of an offer document, which is scrutinised by SEBI. As would be expected from a retail product, the offer document is required to be detailed with extensive disclosures. All mutual funds are required to be established as trusts. The MF Regulations set out the eligibility criteria and also codify the rights and obligations of the sponsor, trustee (in addition to trust law), manager and custodian, including as to the contents of the trust deed and the investment management agreement. The MF Regulations stipulate broad basing requirement at each scheme level as well as prescribe the investment conditions, including cap on exposure to investee companies for investments by way of equity and debt. The MF Regulations also govern the economics of a mutual fund, including payment of dividends, redemptions and valuation, and mandate norms and caps on fees, expenses and commissions payable to intermediaries.

REITs and INVITs

REITS and INVITs are regulated by the REIT Regulations and the INVIT Regulations respectively and the two regulations, barring a few exceptions, are similar. REITs / INVITS are required to invest primarily in completed, revenue generating real estate assets and distribute ninety percent of the earnings to investors.

Units of REITs / INVITs are to be issued by way of a public offer through an offer document which is scrutinised by SEBI. INVIT Regulations do envisage private placement, subject to certain conditions. REITs and INVITs are not permitted to have multiple classes of units or schemes. The units of the trust (including where privately placed) mandatorily need to be listed on a stock exchange in India, with a minimum trading lot of INR 0.1 million for REITs and for INVITs it is INR 10 million (private placement); and INR 0.5 million otherwise.

The regulations also specify minimum offer size, minimum public shareholding and minimum number of investors. Detailed investment conditions and restrictions have also been prescribed in the regulations.

Both regulations specify minimum standards of net worth, qualifications and experience for, and rights and responsibilities of sponsors, manager and trustee, as well as rights and responsibilities of valuers and auditors. Additionally, INVIT Regulations require a project manager to be appointed who will undertake operations and management of the INVIT’s assets.

Thus far, SEBI has granted registration to three INVITs, viz. IRB INVIT Fund, GMR Infrastructure Investment Trust, MEP Infrastructure Investment Trust, Reliance Infrastructure Investment Trust, India Grid Trust, and IL&FS Transportation Investment Trust. No REIT has been registered with the SEBI yet, thought there are newspaper reports of a few players considering a REITs structure.

CIS

Pursuant to recommendations of Dr S.A. Dave Committee, regulatory regime for CIS was introduced. CIS are regulated under the CIS Regulations read with Section 11AA of the SEBI Act. A CIS is a pooling arrangement for making investments in assets other than securities and units of a CIS have to be mandatorily listed on a stock exchange. Through 1990s several agricultural / plantations schemes mushroomed and investors lost their monies on account of ponzi schemes or vanishing promoters thereby leading to clamp down on unregulated private schemes. Given the stringent norms under the CIS Regulations and its history, there is only one CIS manager registered under the CIS Regulations.

Portfolio Managers

Portfolio Managers are permitted to engage in the management (whether on discretionary or non-discretionary basis) or administration of a portfolio of securities or funds of the client. As of December 2016, portfolio managers had 72,477 clients and Rs. 11.7 trillion of assets under management across discretionary, non-discretionary and advisory services3.

The PMS Regulations prescribe qualification, experience and capital adequacy conditions for registration as a portfolio manager. They also provide for a code of conduct, including in respect of avoidance of conflicts and disclosures, general responsibilities, reporting and compliance items. To minimum investment amount for an investor under the PMS Regulations is INR 2.5 million.

In January 2017, SEBI amended the PMS Regulations laying down an enabling framework for the registration of Eligible Fund Managers (EFM) to manage Eligible Investment Funds (EIF) pursuant to Safe Harbour Regime under Section 9A in the Income Tax Act, 1961 (IT Act (read with applicable rules)) whereby an EIF would not be liable to tax in India merely on account of having an EFM in India, subject to satisfaction of several conditions, a few of them being:

-

the EIF shall be a resident of a country notified by the central government;

-

the aggregate participation or investment in an EIF, directly or indirectly, by persons resident in India shall not exceed 5 per cent of the corpus of the EIF;

-

the EIF shall have a minimum of 25 members who are, directly or indirectly, not connected persons (look-through permitted only for the direct investor);

-

the EIF shall not invest more than 25 per cent of its corpus in any entity;

-

the EIF shall not carry on or control and manage, directly or indirectly, any business in India.

Investment Advisors

The IA Regulations seek to regulate entities providing investment advice to specific clients. Registration with SEBI is not mandatory for entities regulated under other regulations or those who provide advice incidental to their main activity or for AIF managers. The IA Regulations stipulate capital adequacy norms and other eligibility criteria, including qualification and certification requirements from the National Institute of Securities Market (NISM).

Research Analysts

To regulate dissemination of research analysis and reports (and recommendations) relating to listed or to-be-listed securities, SEBI introduced regulations for governing RAs in September 2014, thus closing the loop on all forms of investment management and advisory activities in India. Notably, the obligations under the RA Regulations are applicable to proxy advisers as well. The RA Regulations also stipulate eligibility criteria, including qualification and certification requirements such as NISM certification.

Offshore funds

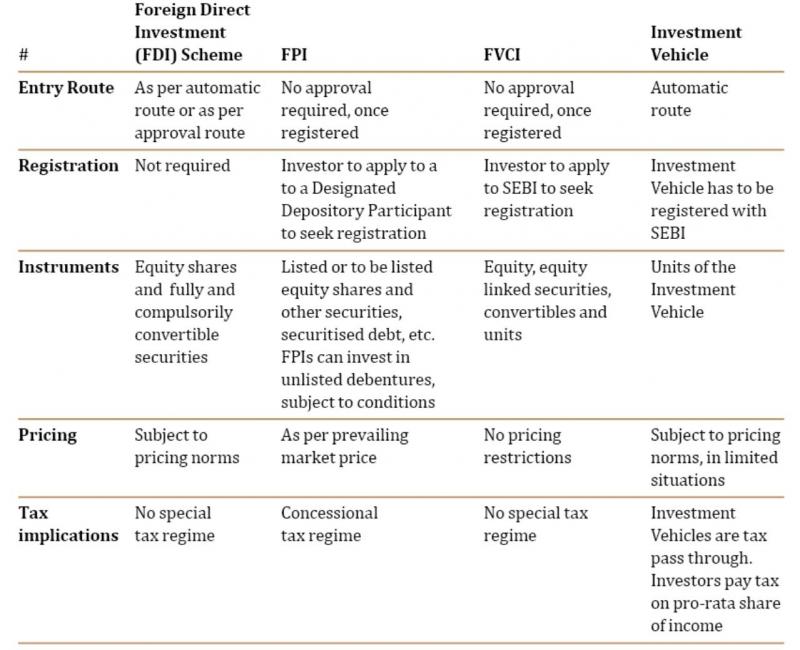

Foreign investment in India is required to comply with the Foreign Exchange Management Act, 1999 and the subordinate regulations, including FEMA 20. Below table encapsulates key routes for investing into Indian funds / Indian securities as per FEMA 20:

India’s tax treaty amendments play a vital role in structuring, documentation and implementation of fund structures.

In addition to the above, non-resident Indians (NRIs), or entities owned and controlled by NRIs are permitted to invest on a non-repatriation basis which investments are treated at par with residents. NRIs can also invest in Indian securities on a repatriation basis.

The typical jurisdictions for setting up the offshore fund/investment SPV for making investments into India are Mauritius, Singapore, Cyprus, Luxembourg, Netherlands, Ireland. In 2016, India has amended its tax treaties with Mauritius, Singapore and Cyprus and moved to source based taxation for capital gains on sale of shares. Recent tax treaty amendments together with coming in force of general anti avoidance rules (GAAR), place of effective management (POEM) rules, limited thin capitalisation (thin-cap) norms and other tax implications under domestic law for funds and downstream investments play a vital role in structuring, documentation and implementation of fund structures.

Conclusion

As India moves steadfastly on its growth trajectory, funding requirements for core and key sectors continue to rise. The Finance Minister of India has estimated that funding requirement for infrastructure sector to be over US$1.5 trillion. Government of India has, by making a commitment of Rs 200,000 million for 49% stake, set up the National Investment and Infrastructure Fund (NIIF), under the AIF regime, as a fund for enhancing infrastructure financing in India. Further, the total stressed assets in the Indian banking sector is estimated to be US$130 billion. There is renewed interest amongst offshore and domestic investors in debt funds and debt investments – be it mezzanine debt, mid-market lending, structured credit, participation in stressed or distressed opportunities through an asset reconstruction company (ARC) route, non-banking finance company (NBFC) route or combination structures. A buoyant stock market, strong FDI inflows, significant participation by funds industry and structural reforms backed by a progressive and collaborative government makes India an appealing investment destination.

About the author

Shagoofa Rashid Khan

Partner and Head - Funds, Investments and Advisory Shagoofa Rashid Khan has 18 years of post-qualification experience across structuring funds, managed accounts, fund documentation, acquisitions / exits / restructuring / joint ventures and strategic initiatives, international taxation and planning, corporate and commercial laws, business advisory, compliance and ethics advisory, audit and finance.

She has extensively worked as an in-house counsel of leading players in the Indian financial services industry. She was Senior Vice President & Head – Legal at Kotak Investment Advisors Limited, a subsidiary of Kotak Bank, which is the investment manager and advisor for alternate assets across real estate, private equity and infrastructure verticals, and was part of the core team that built the alternate assets management platform of Kotak Group. Prior to joining Cyril Amarchand Mangaldas, Shagoofa was Senior Director and Head of Legal & Compliance with IDFC Alternatives Limited, alternate assets manager of IDFC group.

She is also experienced in corporate law & transactional advisory on account of her role as Vice President – Group Legal Team where she reported into the Group General Counsel of Tata Sons and advised Tata companies from diverse industrial sectors.

About Cyril Amarchand Mangaldas

Cyril Amarchand Mangaldas (“The Firm”) was founded on May, 2015 and takes forward the legacy of the erstwhile 100-year old Amarchand &

Mangaldas & Suresh A. Shroff & Co., whose pre-eminence, experience and reputation of almost a century has been unparalleled in the Indian legal fraternity. Tracing its professional lineage to 1917, the Firm of Cyril Amarchand Mangaldas is the largest full-service law firm in India, with over 625 lawyers, including 100 partners, and offices in India’s key business centres at Mumbai, New Delhi, Bengaluru, Hyderabad, Chennai and Ahmedabad. The Firm advises a large and varied client base that includes domestic and foreign commercial enterprises, financial institutions, private equity funds, venture capital funds, start-ups and governmental and regulatory bodies.

The Firm prides itself in having a strong value system that keeps its clients as the central focus. Building on the strength of this value system, the Firm has fostered a collaborative work culture and adopts a pragmatic and solution-oriented approach to problem solving. Today, the Firm is recognised globally as a trusted adviser which consistently delivers quality, capability and commitment to its clients.

The firm was recently awarded “National Law Firm of the Year” by IFLR Asia Awards 2017 & “India Deal Firm of the Year” by ALB SE Asia Law Awards, 2016 & 2015. Ranked no. 1 amongst India’s top 40 law firms in 2015 as per RSG India report as well as ALB on Asia’s Top 50 Largest Law Firm report in 2015 and topped recent league tables namely Bloomberg, Merger Market, Dealogic, Thomson Reuters.

Several of our lawyers are cited as leading practitioners by global publications like Chambers and Partners, International Financial Law Review, Asia Legal 500 and Euromoney.

Our partners routinely advise and collaborate with governments and regulators on policy matters. Many partners of the Firm are also members of various government committees on legal and regulatory reform.

Our Practice Groups

-

Corporate

-

Projects

-

Disputes

-

Banking & Finance

-

Capital Markets

-

Competition

-

Employment

-

Financial Regulatory

-

Real Estate

-

Intellectual Property

-

Private Client

-

Tax

-

TMT

-

Investment Funds

-

Bankruptcy

-

Investigations

Global Approach

Through its “Best Friends’ Networks”, the Firm has established relationships with leading international law firms including those in the USA, UK, Japan, South Korea, Singapore, Hong Kong, China, Germany, and France. These cross-border relationships allow the Firm to provide local advice to its clients with a global outlook.

MUMBAI OFFICE

5th Floor, Peninsula Chambers, Peninsula Corporate Park, Ganpatrao Kadam Marg, Lower Parel, Mumbai 400 013

OTHER OFFICES

New Delhi, Bengaluru, Hyderabad, Chennai, Ahmedabad.

This article is brought to you by India Unleashed

India Unleashed is a print and online publication by Global Legal Media and Legally India, providing country-by-country insights and sector-specific analysis from leading law firms and writers around the world.

threads most popular

thread most upvoted

comment newest

first oldest

first

I am urgently in need of a Livestock Farm-house Supervisor and Manager who is willing to work and relocate to UNITED KINGDOM

The contract duration is 3 years renewable with a good salary and other incentives. This job is open for both male and female candidate.

Serious and interested candidate should forward their updated resume CV via email;( )

for review and kindly note that you must have a valid International passport before you apply.

Best Regards,

HON.LAWRENCE MACAULAl

Supervisor,

chief security officer,

Cooks,

Drivers,

House

Manager,

Cleaner,

Accountant,

Store Keeper,

Warehouse Supervisor

,

Real Estate Manager. etc.

contact whats-app ...+447482851693

threads most popular

thread most upvoted

comment newest

first oldest

first