Deals

Private equity / VC

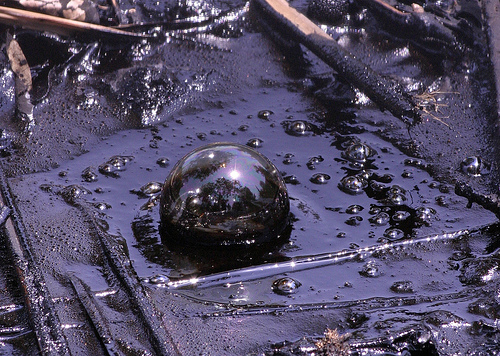

Kolkata Amarchand spin-off Argus Partners and AZB & Partners have scooped roles on the $124m private equity placement and open offer by Bain Capital in coal tar manufacturer Himadri Chemicals & Industries.

Kolkata Amarchand spin-off Argus Partners and AZB & Partners have scooped roles on the $124m private equity placement and open offer by Bain Capital in coal tar manufacturer Himadri Chemicals & Industries.

Corporate M&A

Crawford Bayley and Khaitan & Co have advised on the $400m (Rs 1,900 crore) takeover of listed Chennai pharmaceutical company Orchid Chemical & Pharmaceutical by US pharma major Hospira.

Crawford Bayley and Khaitan & Co have advised on the $400m (Rs 1,900 crore) takeover of listed Chennai pharmaceutical company Orchid Chemical & Pharmaceutical by US pharma major Hospira.

Capital Markets

In November Amarchand Mangaldas' Bangalore office bagged a role in four out of six initial public offerings (IPOs), and together with one instruction from Delhi has extended its lead in the top spot of the IPO league tables over Khaitan & Co, Luthra & Luthra and AZB & Partners.

In November Amarchand Mangaldas' Bangalore office bagged a role in four out of six initial public offerings (IPOs), and together with one instruction from Delhi has extended its lead in the top spot of the IPO league tables over Khaitan & Co, Luthra & Luthra and AZB & Partners.

Corporate M&A

J Sagar Associates (JSA) and Trilegal have represented Asia Pacific Breweries (APB) and Heineken International respectively on brokering the agreement to allow United Breweries (UB) to make Heineken brand beer in India.

J Sagar Associates (JSA) and Trilegal have represented Asia Pacific Breweries (APB) and Heineken International respectively on brokering the agreement to allow United Breweries (UB) to make Heineken brand beer in India.

Corporate M&A

Khaitan & Co Bangalore and local boutique Menon Associates have advised on the MindTree acquisition of US handset maker Kyocera Wireless' Indian arm for Rs 29 crores ($6m) and further consideration linked to future revenues.

Khaitan & Co Bangalore and local boutique Menon Associates have advised on the MindTree acquisition of US handset maker Kyocera Wireless' Indian arm for Rs 29 crores ($6m) and further consideration linked to future revenues.

Capital Markets

Amarchand Mangaldas and AZB & Partners capital markets teams have sewn up Tata Steel's $493m (Rs 2,550 crore) convertible bond swap, marking the third joint instruction for the firms on similar deals in the past half-year.

Amarchand Mangaldas and AZB & Partners capital markets teams have sewn up Tata Steel's $493m (Rs 2,550 crore) convertible bond swap, marking the third joint instruction for the firms on similar deals in the past half-year.

Capital Markets

The Delhi offices of Amarchand Mangaldas and Luthra & Luthra have advised Dish TV in issuing GDRs (Global Depository Receipts) worth Rs. 465 crores ($100m) to Apollo Management for an 11 per cent stake in the company.

The Delhi offices of Amarchand Mangaldas and Luthra & Luthra have advised Dish TV in issuing GDRs (Global Depository Receipts) worth Rs. 465 crores ($100m) to Apollo Management for an 11 per cent stake in the company.

Corporate M&A

Luthra & Luthra's and Kochhar & Co's Delhi offices have advised on the 69 per cent acquisition of NDTV Lifestyle by US company Scripps Networks Interactive for Rs 254.5 crores ($55m).

Luthra & Luthra's and Kochhar & Co's Delhi offices have advised on the 69 per cent acquisition of NDTV Lifestyle by US company Scripps Networks Interactive for Rs 254.5 crores ($55m).

Corporate M&A

Amarchand Mangaldas Mumbai has advised Aditya Birla Group in the series of mergers between Grasim Industries, Samruddhi Cements and UltraTech Cements, creating India's largest and the world's tenth largest cement manufacturer.

Amarchand Mangaldas Mumbai has advised Aditya Birla Group in the series of mergers between Grasim Industries, Samruddhi Cements and UltraTech Cements, creating India's largest and the world's tenth largest cement manufacturer.

Corporate M&A

J Sagar Associates (JSA) and Luthra & Luthra co-ordinated the Rs 62.2 crore ($13.5m) cash and equity acquisition of DLF-owned DT Cinemas chain by entertainment chain PVR.

J Sagar Associates (JSA) and Luthra & Luthra co-ordinated the Rs 62.2 crore ($13.5m) cash and equity acquisition of DLF-owned DT Cinemas chain by entertainment chain PVR.

Private equity / VC

Bharucha & Partners and Khaitan & Co have led on The Blackstone Group's Rs 300 crore ($64m) investment in logistics company Gateway Rail Freight.

Bharucha & Partners and Khaitan & Co have led on The Blackstone Group's Rs 300 crore ($64m) investment in logistics company Gateway Rail Freight.

Litigation

A Supreme Court judge on the Ambani brothers' gas supply dispute has stepped down, fearing a conflict of interest because of his daughter recently joining AZB & Partners in Bangalore as a partner.

A Supreme Court judge on the Ambani brothers' gas supply dispute has stepped down, fearing a conflict of interest because of his daughter recently joining AZB & Partners in Bangalore as a partner.

Private equity / VC

Desai & Diwanji, DSK Legal and Wadia Ghandy have triple-teamed on the $100m private equity investment into Hyderabad power company Ind-Barath Power Infra.

Desai & Diwanji, DSK Legal and Wadia Ghandy have triple-teamed on the $100m private equity investment into Hyderabad power company Ind-Barath Power Infra.

Capital Markets

Luthra & Luthra, AZB & Partners and S&R Associates have pushed up the IPO league tables this October, as J Sagar Associates (JSA) and capital markets specialist firm JurisPrudent Consulting Partners make their entry into the rankings.

Luthra & Luthra, AZB & Partners and S&R Associates have pushed up the IPO league tables this October, as J Sagar Associates (JSA) and capital markets specialist firm JurisPrudent Consulting Partners make their entry into the rankings.

Private equity / VC

SN Gupta & Co and one-year-old start-up India Legal have advised on Duet India Hotels' Rs 120 crore ($26m) fund investment in a Hyderabad hotel project with L&T Phoenix Infoparks.

SN Gupta & Co and one-year-old start-up India Legal have advised on Duet India Hotels' Rs 120 crore ($26m) fund investment in a Hyderabad hotel project with L&T Phoenix Infoparks.

Private equity / VC

Thakker & Thakker and venture capital (VC) boutique law firms Sand Hill Counsel and Menon Associates have advised on the series A investment into a Hyderabad mobile TV start-up, giving several angel investors a partial exit.

Thakker & Thakker and venture capital (VC) boutique law firms Sand Hill Counsel and Menon Associates have advised on the series A investment into a Hyderabad mobile TV start-up, giving several angel investors a partial exit.