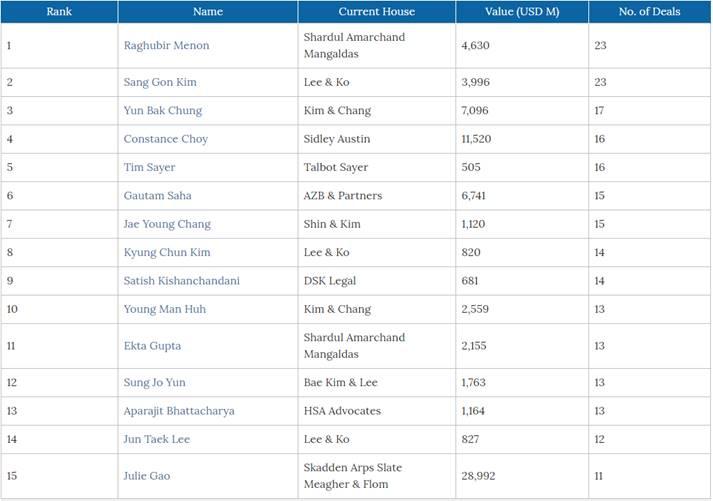

Five Indian lawyers have made it into a top 15 list of partners across Asia, ranked by the number of deals they completed in 2017 according to database mergermarket, with two Shardul Amarchand Mangaldas partners making what nearly literally translates to a list of hardest working corporate partners in Asia.

The list was topped by Shardul Amarchand Mumbai partner Raghubir Menon, who is recorded by mergermarket as having been involved in a whopping 23 deals in 2017, with values of $4.6bn (see list of largest deals of Menon and the other three partners below).

As regional corporate head at the firm that came first in mergermarket’s volume league table for 2017, that’s not necessarily a surprise. Menon had joined Amarchand Mangaldas Delhi, as it then was, in 2011 from White & Case, moving to Mumbai only in July 2017, after the departure of partner Shuva Mandal to head up Tata Sons' legal function.

It's also a function of a little bit of luck, requiring clients and deals that move quickly, rather than meandering for months before they die.

Nevertheless, that output is incredible, especially since it's understood that all of those 23 deals are ones that Menon has put significant time in on, assisted by two salaried partners (and a team of around 18 lawyers).

Which brings us to Shardul Amarchand Mumbai salaried partner Ekta Gupta (who became partner only in 2016 and had moved to Mumbai from Delhi at the same time as Menon), and who also made the top 15 in 11th position with 13 deals worth $2.2bn (of which at least one big one, One97 Communications acquisition by Softbank for $1.4bn, also had Menon working on it). Salaried partner Natashaa Shroff is also understood to regularly be involved in Menon's deals.

AZB & Partners' Gautam Saha, in Delhi, was not far behind in sixth position; or arguably, he is ahead, having advised on a greater value of deals than even Menon: $6.7bn (though a slightly smaller number at 15 - a listing of the largest below).

Again, that's not necessarily surprising: Saha has been M&A-happy Airtel's favourite go-to legal adviser for years now, alongside a steady roster of other major corporates. His team in Delhi includes five other partners, making it an M&A force to be reckoned with.

Update 13:10: Saha confirmed as much, saying (somewhat modestly): “To be honest, it's all thanks to the fantastic team that I have.”

Coming in ninth, is DSK Legal co-founding partner Satish Kishanchandani, with 14 deals with values of $681m.

The final Indian partner to make it to the Asian top 15 is senior partner Aparajit Bhattacharya, from HSA Advocates. Bhattacharya had joined HSA way back in 2004 from Trilegal, having started his career in 2001 as an articled clerk at Crawford Bayley in Mumbai, and has been particularly active in the energy and private equity space.

Update 14:04: Bhattacharya commented: “This recognition goes to each one of the M&A partners in the firm - and I personally thank each one of them and the entire team - for the never ending support and hard work. Congratulations to the entire corporate team at HSA - I am only the gate keeper.”

Notwithstanding the above, the trophy for the largest value of deals advised on in Asia by single partners in the list, went to Hong Kong's Julie Gao of Skadden Arps (with 11 deals worth nearly $29bn), followed by Constance Choy of Sidley Austin, with over $11.5bn in 16 deals.

23 deals of $4.63bn: Raghubir Menon, Shardul Amarchand Mangaldas

- Aon plc (benefits outsourcing division) acquired by Blackstone Group LP from Aon plc (10 Feb 2017) - Buy Side - $4.3bn

- One97 Communications Limited acquired by SoftBank Group Corp (18 May 2017) - Sell Side - $1.4bn

- Axis Bank Ltd acquired by The Capital Group Companies, Inc. (10 Nov 2017) - Sell Side - $1.144bn

15 deals of $6.741bn: Gautam Saha, AZB & Partners

- Bharat Financial Inclusion acquired by IndusInd Bank Limited (14 Oct 2017) - Sell Side - $2.385bn

- Bharti Airtel Limited acquired by Bharti Telecom Limited from Indian Continent Investment Limited (2 Nov 2017) - Sell Side - $1.246bn

- Bharti Infratel Limited, acquired by Canada Pension Plan Investment Board (+1) from Bharti Airtel Limited (28 Mar 2017) - Sell Side - $953.9m

13 deals of $2.16bn: Ekta Gupta, Shardul Amarchand Mangaldas

- One97 Communications Limited (see above)- Acquired by SoftBank Group Corp (18 May 2017) - Sell Side - $1.4bn

- One97 Communications Limited acquired by Alibaba Group Holding Ltd from Saama Capital India Advisors, LLP (+2) (7 Mar 2017) - Sell Side - $251.86m

- Sembcorp Green Infra Limited, acquired by Sembcorp Utilities Pte Ltd. from IDFC Private Equity Co Ltd. (31 Aug 2017) - Sell Side - $219.99m

13 deals of $1.164bn: Aparajit Bhattacharya, HSA Advocates

- A $600m power project acquisition

- A $200m malt deal

- A $138m deal in the cinema space

threads most popular

thread most upvoted

comment newest

first oldest

first

Wow for Raghubir ... he has a reputation for being detail oriented - so i doubt that his name has just been tagged onto deals without any active participation (disclaimer: i haven't worked with him myself).

Kudos to the lawyers on this list !

That's freaking incredible !!!!

By the way, we've had a similar partner-wise league table in mind for M&A for a while now, and are hoping to launch this soon. Any suggestions, please let us know.

Cheers

Kian

threads most popular

thread most upvoted

comment newest

first oldest

first