Dorsey & Whitney

“State-owned NBCC’s share sale garnered 1.54 times subscription from institutional buyers, who put in bids totalling more than Rs 2,700 crore,” reported the Economic Times.

Luthra & Luthra is acting for fast-growing RBL Bank of 183 branches, formerly called Ratnakar Bank, which aims to raise Rs 1,100 crore ($173m) via initial public offering (IPO), with AZB & Partners and Dorsey & Whitney acting for the bankers, led by Kotak Mahindra Capital Company.

AZB Mumbai partner Varoon Chandra with senior associate Lionel D’Almeida acted for the lead managers. Dorsey Hong Kong partners John Chrisman and Kenneth Kwok advised on international laws.

Luthra & Luthra Mumbai partner Manan Lahoty acted for the issuers.

Khaitan & Co Mumbai associate partner Madhur Kohli was domestic counsel for two selling shareholders, Beacon and Gpe, that together sold 13 million shares according to the Business Standard.

Amarchand, AZB, Khaitan, Crawford Bayley and S&R Associates wrap up the last five deals of 2012..

Amarchand, AZB, Khaitan, Crawford Bayley and S&R Associates wrap up the last five deals of 2012..

Dorsey & Whitney London special counsel Jamie Benson, who has played a key role in several of the firm’s Indian capital markets transactions, has moved to the Singapore office of US law firm Duane Morris & Selvam to co-head its India practice.

Dorsey & Whitney London special counsel Jamie Benson, who has played a key role in several of the firm’s Indian capital markets transactions, has moved to the Singapore office of US law firm Duane Morris & Selvam to co-head its India practice.

Benson, who specialises in US securities and capital markets law, said: “It will be much easier to run my India practice from Singapore compared with London. Also, if you are serious about servicing Indian clients I think you need to be in Singapore.”

The India group at the 700-lawyer firm with more than 20 offices, the majority of which are in the US, is co-headed by funds and private equity partner Parikhit Sarma and M&A partner Krishna Ramachandra.

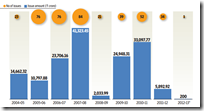

LI-Mint exclusive: Law firms saw a slump in earnings from their capital markets business in the year that ended March. Many that had invested heavily in the practice during the boom years adopted various strategies to cope with the decline.

LI-Mint exclusive: Law firms saw a slump in earnings from their capital markets business in the year that ended March. Many that had invested heavily in the practice during the boom years adopted various strategies to cope with the decline.

Exclusive: Against a background of slowing markets in qualified institutional placements (QIPs), Amarchand Mangaldas has retained a strong lead in Legally India’s QIP league table for the 2010-2011 fiscal despite its deal volume dropping by half, while Luthra & Luthra and Crawford Bayley scaled ahead of Khaitan & Co and AZB & Partners.

Exclusive: Against a background of slowing markets in qualified institutional placements (QIPs), Amarchand Mangaldas has retained a strong lead in Legally India’s QIP league table for the 2010-2011 fiscal despite its deal volume dropping by half, while Luthra & Luthra and Crawford Bayley scaled ahead of Khaitan & Co and AZB & Partners.

Crawford Bayley and Dorsey & Whitney have won the mandate to advise public sector undertaking SAIL on its follow-on public offer (FPO) to raise Rs 8,000 crore.

Amarchand Mangaldas and Dorsey & Whitney have won the government's mandate on the $1.8bn follow-on public offer (FPO) by Power Grid Corporation of India.

Amarchand Mangaldas and Dorsey & Whitney have won the government's mandate on the $1.8bn follow-on public offer (FPO) by Power Grid Corporation of India.

Amarchand Mangaldas' Delhi office and Dorsey & Whitney have won the bid on the Hindustan Copper divestment while Khaitan & Co bagged the underwriter's mandate.

Amarchand Mangaldas' Delhi office and Dorsey & Whitney have won the bid on the Hindustan Copper divestment while Khaitan & Co bagged the underwriter's mandate.

Amarchand also won the role for the underwriters on the mammoth Coal India stake sale with Ashurst as international counsel while Luthra had won the tender to advise the company.

Amarchand Mangaldas was the busiest IPO law firm in Legally India's 2009-10 financial year (FY) league table by far but the newer practices Luthra & Luthra, S&R Associates, AZB & Partners and Khaitan & Co have managed to keep pace in bank advisory work bagging nearly as many instructions.

Amarchand Mangaldas was the busiest IPO law firm in Legally India's 2009-10 financial year (FY) league table by far but the newer practices Luthra & Luthra, S&R Associates, AZB & Partners and Khaitan & Co have managed to keep pace in bank advisory work bagging nearly as many instructions.

Legally India research has revealed Amarchand Mangaldas as the top IPO dealmaker of this financial year so far, while Khaitan & Co and Luthra & Luthra are in close contest for the runner-up spot. International and domestic firms are competing in a tightly bunched mid-field of the ranking.

Legally India research has revealed Amarchand Mangaldas as the top IPO dealmaker of this financial year so far, while Khaitan & Co and Luthra & Luthra are in close contest for the runner-up spot. International and domestic firms are competing in a tightly bunched mid-field of the ranking.

Amarchand Mangaldas has acted on 70 per cent of qualified institutional placements (QIPs) in the first half of this financial year, with international firms, AZB & Partners, J Sagar Associates (JSA), Luthra & Luthra, S & R Associates and Crawford Bayley mopping up the rest.

Amarchand Mangaldas has acted on 70 per cent of qualified institutional placements (QIPs) in the first half of this financial year, with international firms, AZB & Partners, J Sagar Associates (JSA), Luthra & Luthra, S & R Associates and Crawford Bayley mopping up the rest.

A raft of law firms have picked up mandates on the four latest initial public offer (IPO) proposals to be filed with the Securities and Exchange Board of India (SEBI), with Amarchand Mangaldas taking two issuer mandates, Luthra & Luthra acting for one company and Rajani Associates for the fourth.

A raft of law firms have picked up mandates on the four latest initial public offer (IPO) proposals to be filed with the Securities and Exchange Board of India (SEBI), with Amarchand Mangaldas taking two issuer mandates, Luthra & Luthra acting for one company and Rajani Associates for the fourth.

Amarchand Mangaldas is moving on with its second Government divestment instruction, advising NHPC (National Hydroelectric Power Corporation) on raising around Rs 1,680 crore through an initial public offering (IPO).

Amarchand Mangaldas is moving on with its second Government divestment instruction, advising NHPC (National Hydroelectric Power Corporation) on raising around Rs 1,680 crore through an initial public offering (IPO).