Veritas Legal

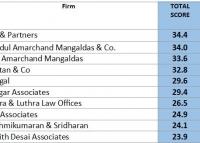

In the latest bi-annual rankings compiled by consultancy RSG India, AZB & Partners has topped the table ahead of Shardul Amarchand Mangaldas (SAM) and Cyril Amarchand Mangaldas (CAM), which had topped the table in 2015 when still united in one firm as Amarchand Mangaldas before their break-up (see full table below).

In the latest bi-annual rankings compiled by consultancy RSG India, AZB & Partners has topped the table ahead of Shardul Amarchand Mangaldas (SAM) and Cyril Amarchand Mangaldas (CAM), which had topped the table in 2015 when still united in one firm as Amarchand Mangaldas before their break-up (see full table below).

Otsuka Pharmaceutical Factory, Inc, a leading Japanese pharmaceuticals manufacturing company, has announced a proposal to acquire an additional 20% stake from its joint venture partner, Claris Lifesciences Limited for a consideration of about Rs 128.9 crores (US$20 million) in its existing Indian joint venture, Otsuka Pharmaceutical India Private Limited, as reported by Business Standard.

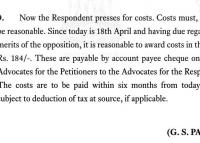

Bombay high court Justice Gautam Patel has awarded a “reasonable” Rs 184 in costs on a petitioner because the date was 18 April (18.4) on the day of the order, after he was unconvinced by a lawyer’s counterarguments against a permission to refile a case.

Bombay high court Justice Gautam Patel has awarded a “reasonable” Rs 184 in costs on a petitioner because the date was 18 April (18.4) on the day of the order, after he was unconvinced by a lawyer’s counterarguments against a permission to refile a case.

Khaitan & Co topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $18.7bn worth of transactions, followed by AZB & Partners which topped the list of deals by value, with 43 transactions worth $15.4bn.

Khaitan & Co topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $18.7bn worth of transactions, followed by AZB & Partners which topped the list of deals by value, with 43 transactions worth $15.4bn.

"PayU Global, the digital payments provider owned by South Africa’s Naspers Group, will buy rival Citrus Pay for $130 million in an all-cash deal. PayU India will have more than 30 million customers post the acquisition of Citrus Pay. The company forecast it will process an estimated 150 million transactions, worth $4.2 billion, in 2016. The deal, once concluded, is expected to provide an attractive exit to Citrus Pay’s investors—Ascent Capital, Beenos and Sequoia Capital. PayU confirmed that the early investors will exit but declined to disclose details,” reported Mint.

CX Partners (a PE firm focused on the Indian mid-market) and Capital Square Partners sold for $420m its stake in Minacs to Concentrix Global Holdings Inc., a subsidiary of Synnex Corporation, as reported by the Economic Times as one of the largest in the business process outsourcing (BPO) sector, and Concentrix’ second largest deal.

Cyril Amarchand Mangaldas has topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $6.2bn worth of transactions, followed by AZB & Partners and Vaish Associates, with stronger performances across the board than at the same time last year.

Cyril Amarchand Mangaldas has topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $6.2bn worth of transactions, followed by AZB & Partners and Vaish Associates, with stronger performances across the board than at the same time last year.

Veritas Legal, the firm started by ex-AZB & Partners senior partner Abhijit Joshi in 2014, has made its first two internal promotions, according to a press release from the firm.

Veritas Legal, the firm started by ex-AZB & Partners senior partner Abhijit Joshi in 2014, has made its first two internal promotions, according to a press release from the firm.

Veritas Legal advised Recipharm AB, a Swedish pharmaceutical company on investing $103m (Rs 671.2 crore) in Nitin Lifesciences, an Indian pharma company which was advised by Khaitan & Co.

Veritas partner Partner Nandish Vyas and Associates Natasha Sethna and Tejasvi Saxena acted for Recipharm.

Khaitan Mumbai partner Kalpana Unadkat, senior associate Shweta Dwivedi and associate Bidya Mohanty acted for Nitin Lifesciences.

Recipharm, will buy 74 per cent in Nitin Lifesciences, reported Livemint

The firm of former AZB & Partners CEO Abhijit Joshi, Veritas Legal, has advised German specialty chemicals company Evonik on its acquisition of Mumbai-based catalyst supplier Monarch Catalyst, which was advised by J Sagar Associates (JSA) partner Sandeep Mehta.

The value of the purchase of the family owned company founded in 1973 was not disclosed. It is expected to close in the first half of 2015, reported Mint.

Rahul Dwarkadas, who had resigned from Wadia Ghandy’s partnership on 4 March, will be joining the Mumbai-based firm of ex-AZB & Partners CEO Abhijit Joshi, Veritas Legal.

Rahul Dwarkadas, who had resigned from Wadia Ghandy’s partnership on 4 March, will be joining the Mumbai-based firm of ex-AZB & Partners CEO Abhijit Joshi, Veritas Legal.