Trilegal

AZB & Partners Mumbai-based partner and competition practice co-head Nisha Kaur Uberoi is likely to be joining Trilegal as an equity partner and to head its competition practice.

AZB & Partners Mumbai-based partner and competition practice co-head Nisha Kaur Uberoi is likely to be joining Trilegal as an equity partner and to head its competition practice.

The President of India recently sold 10.19% of shares in HUDCO for Rs 1,209 crores ($188m) in an IPO in India and concurrent private placements outside the country (including a Rule 144A offering in the United States), as reported by The Times of India.

“Domestic air-conditioning major Voltas today said it has formed an equal joint venture with Turkish company Ardutch BV to introduce the Beko brand of home appliances in the Indian market. The joint venture will have an equity capital of USD 100 million and will set up a manufacturing plant in the country, it said in a statement,” reported DNA.

“Paytm has raised $1.4 billion from SoftBank Group Corp. in the largest funding round by a single investor in India, making the digital payments firm the Japanese company’s biggest bet in India’s start-up ecosystem. The deal includes $400 million worth of shares that SoftBank will buy largely from Paytm’s early investor SAIF Partners in a secondary transaction, and a minor stake from founder Vijay Shekhar Sharma, according to two persons close to the development,” reported Mint.

“Mumbai-based non-banking financial company (NBFC) InCred Finance, founded by former Deutsche Bank senior executive Bhupinder Singh, has secured $75 million in a funding round led by Deutsche Bank’s former co-CEO Anshu Jain. The latest investment is one of the largest fintech deals in India this year. The startup focusses on providing SME loans, home loans and education loans,” reported In Shorts.

Trilegal has promoted Delhi disputes counsel Jafar Alam and Ashish Bhan into its all-equity partnership, which now numbers 37.

Trilegal has promoted Delhi disputes counsel Jafar Alam and Ashish Bhan into its all-equity partnership, which now numbers 37.

Trilegal partner Anand Prasad has four days left until he stops being a Trilegal partner, giving up all his equity, all “financial arrangements”, not even “a consulting arrangement” with the firm he co-founded in 2000.

Trilegal partner Anand Prasad has four days left until he stops being a Trilegal partner, giving up all his equity, all “financial arrangements”, not even “a consulting arrangement” with the firm he co-founded in 2000.

“Bangalore-based Catbus Infolabs Pvt. Ltd, which operates intra-city logistics startup Blowhorn, has raised Rs 25 crore ($3.65 million) in Series A funding from IDG Ventures India, Michael & Susan Dell Foundation, and existing investors Draper Associates and Unitus Seed Fund, it said in a statement,” reported Techcircle. “Blowhorn, whose tech-enabled platform connects customers with mini truck owners for intra-city, sub 2-tonne deliveries, will use the funds to expand operations to eight cities over the next two years.”

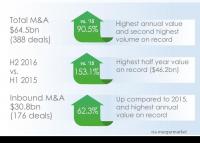

Cyril Amarchand Mangaldas has acted on $40.4bn worth of mergers and acquisition in the 2016 calendar year, according to researcher mergermarket, with AZB & Partners having recorded $30.1bn of M&A deals in the same period.

Cyril Amarchand Mangaldas has acted on $40.4bn worth of mergers and acquisition in the 2016 calendar year, according to researcher mergermarket, with AZB & Partners having recorded $30.1bn of M&A deals in the same period.

"International Finance Corp (IFC), the private sector investment arm of World Bank, on Thursday said it has invested $125m in Hero Future Energies, the renewable energy arm of the Hero Group, for an undisclosed equity stake.

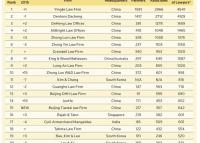

Asian Legal Business (ALB) magazine last month released a listing of Asia’s biggest law firms, including a round-up of the 25 largest Indian firms by total headcounts.

Asian Legal Business (ALB) magazine last month released a listing of Asia’s biggest law firms, including a round-up of the 25 largest Indian firms by total headcounts.

Ostro Energy general counsel (GC) Rachika Sahay, who just closed her seventh power deal in less than two years said that in house roles are no less “grilling and consuming” than law firm life.

Ostro Energy general counsel (GC) Rachika Sahay, who just closed her seventh power deal in less than two years said that in house roles are no less “grilling and consuming” than law firm life.

"American Express Ventures, the corporate venture investment arm of American Express Co, has led a $4m (Rs 26.6 crore) funding round in fintech startup IndiaLends, its second transaction in the country in as many months,” reported the Economic Times.

"Square Yards Consulting Pvt. Ltd, a real estate listings and advisory firm, has raised $12 million from the private equity arm of Anil Ambani-led Reliance Group,” reported Mint.

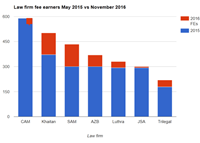

The seven largest law firms in India have grown their headcounts by an average of around 20% in the last one-and-a-half years. Of those, the fastest-growing such as Shardul Amarchand Mangaldas and Khaitan & Co, had expanded fee-earner headcounts by 45% and 35% respectively, while others such as AZB & partners’ partnership ballooned by 75%.

The seven largest law firms in India have grown their headcounts by an average of around 20% in the last one-and-a-half years. Of those, the fastest-growing such as Shardul Amarchand Mangaldas and Khaitan & Co, had expanded fee-earner headcounts by 45% and 35% respectively, while others such as AZB & partners’ partnership ballooned by 75%.

"Online travel firm MakeMyTrip Ltd has agreed to buy Ibibo Group’s travel business in India in an all-stock deal, creating the country’s largest online travel firm which, according to a note by Morgan Stanley, is worth $1.8 billion. The deal value wasn’t announced, but the $1.8 billion valuation and the fact that Ibibo’s owners, Naspers and Tencent, end up with a 40% stake in the merged entity, translate into a transaction worth $720 million. Naspers owns a third of Tencent, its most valuable investment.” reported Mint.

VC firm DSG Consumer Partners has made a partial exit in food processing industry company Veeba Fine Foods (founded in 1983, making sauces, dips, emulsions and dessert toppings) to Brussels-headquartered Verlinvest Asia, which was created by several families of the Anheuser-Busch InBev empire to make investments in the food and beverage space.

Khaitan & Co topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $18.7bn worth of transactions, followed by AZB & Partners which topped the list of deals by value, with 43 transactions worth $15.4bn.

Khaitan & Co topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $18.7bn worth of transactions, followed by AZB & Partners which topped the list of deals by value, with 43 transactions worth $15.4bn.

Trilegal has hired J Sagar Associates (JSA) Delhi principal associate Gautam Shahi as a counsel to specialise in competition and litigation, reported VCCircle, relying on two unnamed sources.

Trilegal has hired J Sagar Associates (JSA) Delhi principal associate Gautam Shahi as a counsel to specialise in competition and litigation, reported VCCircle, relying on two unnamed sources.

Japanese healthcare media giant M3 has acquired a stake in Health Impetus Private Limited - which offers disease management services - from its existing shareholder, Health Care at Home India Private Limited, and by subscribing to equity shares in the target for an undisclosed amount.