Khaitan & Co

Shardul Amarchand Mangaldas (SAM) real estate partner Avnish Sharma is to join Khaitan & Co next month, boosting its real estate practice in Delhi that it’s long been looking to fill.

Shardul Amarchand Mangaldas (SAM) real estate partner Avnish Sharma is to join Khaitan & Co next month, boosting its real estate practice in Delhi that it’s long been looking to fill.

The Indian capital markets have a new international king, at least going by law firms and volumes of initial public offerings (IPO), and it’s Sidley Austin, in a league table dominated by a completely new list of firm names after a swathe of some big-name partner moves in the past years.

The Indian capital markets have a new international king, at least going by law firms and volumes of initial public offerings (IPO), and it’s Sidley Austin, in a league table dominated by a completely new list of firm names after a swathe of some big-name partner moves in the past years.

Khaitan & Co has filed more IPO drafts than any other firm in 2017 just ahead of Cyril Amarchand Mangaldas, in a market where downward pricing pressures have made it tough across the board.

Khaitan & Co has filed more IPO drafts than any other firm in 2017 just ahead of Cyril Amarchand Mangaldas, in a market where downward pricing pressures have made it tough across the board.

Cyril Amarchand Mangaldas (CAM) Bangalore-based partner Reeba Chacko led for BigBasket, with partner Akshay Bhat and principal associate S Harish. The firm also acted for the existing investors.

Chennai-based NBFC Samunnati Financial Intermediation & Services has raised Rs 150 crores ($23.5m) in a Series-C funding round led by Swiss investment firm responsAbility with participation from existing investors Elevar Equity and Accel Partners, as reported by VCCircle and The Hindu. The investment was done by way of subscription to 100 equity shares and 317,423 compulsory convertible preference shares of Samunnati.

Khaitan & Co Delhi principal associate Arjun Rajgopal joined K Law in Bangalore as corporate partner last month.

Khaitan & Co Delhi principal associate Arjun Rajgopal joined K Law in Bangalore as corporate partner last month.

Khaitan & Co bested Economic Laws Practice (ELP) and won the ELP Masters Cup Cricket Tournament on 7 January after three days of competition with 15 other Indian law firms.

Khaitan & Co bested Economic Laws Practice (ELP) and won the ELP Masters Cup Cricket Tournament on 7 January after three days of competition with 15 other Indian law firms.

Itochu Petroleum Co, the Singapore-based subsidiary of Japanese trading company Itochu Corporation has announced the acquisition of 19.7% stake in Aegis Logistics' wholly-owned subsidiary, Hindustan Aegis LPG (HALPG), for INR 239 crores (apporximately $37.8m), as reported by Business Standard and VC Circle in May of last year. In addition to India, Itochu Corporation, the Japanese multinational trading group specialising in oil & gas, metals and other commodities, operates LPG import hubs in Japan and the Philippines.

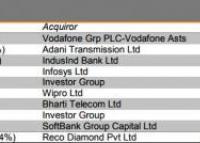

AZB & Partners was the busiest and fastest growing law firm in India this year according to year-end rankings released separately by Bloomberg and Thomson Reuters.

AZB & Partners was the busiest and fastest growing law firm in India this year according to year-end rankings released separately by Bloomberg and Thomson Reuters.

“Ola, operated by ANI Technologies Pvt. Ltd, has acquired online food delivery start-up Foodpanda India from its German parent Delivery Hero AG in an all-stock deal that will see the ride-hailing firm infuse $200m in Foodpanda India’s operations,” reported Mint.

Torrent Pharma, the flagship company of the Torrent Group, have announced their acquisition of the domestic formulations business of Unichem Laboratories, one of India's oldest and largest pharma companies, for about Rs 3,600 crores (around $556m), through a business transfer agreement, as reported by The Economic Times and Business Standard.