Cyril Amarchand Mangaldas

As first reported by us in October when battle lines were first being drawn, Desai & Diwanji is continuing to represent ousted Tata Sons chairman Cyrus Mistry, who has now, via his company Cyrus Investments, filed in the National Company Law Tribunal (NCLT) against Tata Sons, with Cyril Amarchand Mangaldas also having been roped in to advise the Tatas.

As first reported by us in October when battle lines were first being drawn, Desai & Diwanji is continuing to represent ousted Tata Sons chairman Cyrus Mistry, who has now, via his company Cyrus Investments, filed in the National Company Law Tribunal (NCLT) against Tata Sons, with Cyril Amarchand Mangaldas also having been roped in to advise the Tatas.

Cyril Amarchand Mangaldas’ Mumbai partner Ashish Jejurkar, who was hired in 2009 from Luthra & Luthra, will be leaving the firm and moving to Japan, as first reported by Bar & Bench.

Cyril Amarchand Mangaldas’ Mumbai partner Ashish Jejurkar, who was hired in 2009 from Luthra & Luthra, will be leaving the firm and moving to Japan, as first reported by Bar & Bench.

Cyril Amarchand Mangaldas Hyderabad partner Anshuman Jaiswal is going in-house to join Indian renewables giant Greenko Group in a senior position.

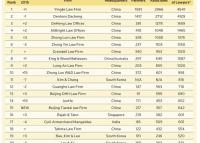

Asian Legal Business (ALB) magazine last month released a listing of Asia’s biggest law firms, including a round-up of the 25 largest Indian firms by total headcounts.

Asian Legal Business (ALB) magazine last month released a listing of Asia’s biggest law firms, including a round-up of the 25 largest Indian firms by total headcounts.

Cyril Amarchand Mangaldas Delhi partners and husband and wife team Harry Chawla and Niti Paul, who were first reported to be leaving in September, are “in the process of setting up our new firm” under the name Atlas Law Partners, Chawla told Bar & Bench.

JPMorgan India has hired Cyril Amarchand Mangaldas consultant Shubhra Tewari as assistant general counsel and vice president legal, taking its total legal team to eight lawyers and three company secretaries.

“The Competition Appellate Tribunal (Compat) on Thursday set aside an order of fair trade regulator Competition Commission of India (CCI) in a case of alleged abuse of dominant position and anti-competitive practices by the International Air Transport Association (IATA) and its Indian arm. Dismissing the CCI findings, Compat ordered a fresh probe in the matter,” reported Mint.

“The Competition Appellate Tribunal (Compat) on Thursday set aside an order of fair trade regulator Competition Commission of India (CCI) in a case of alleged abuse of dominant position and anti-competitive practices by the International Air Transport Association (IATA) and its Indian arm. Dismissing the CCI findings, Compat ordered a fresh probe in the matter,” reported Mint.

"[Quess Corp] entered into a definitive agreement to acquire a 49 per cent stake in Terrier Security Services (India) (Terrier), marking its entry into the manned guarding and security solutions business. With a track record of over 27 years, Terrier is among the leading providers of manned guarding services in India. In addition, Terrier also provides training services for security personnel and electronic security solutions to clients,” reported the Financial Express.

"A week after the Essar group signed a mega $12.9bn deal to sell Essar Oil and Vadinar Port to Rosneft of Russia, three banks — ICICI Bank, Axis Bank and Standard Chartered Bank — have received over $2.5bn (around Rs 16,750 crore) from the Essar group towards repayment of loans to Essar Global,” reported the Indian Express.

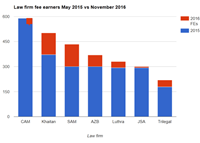

The seven largest law firms in India have grown their headcounts by an average of around 20% in the last one-and-a-half years. Of those, the fastest-growing such as Shardul Amarchand Mangaldas and Khaitan & Co, had expanded fee-earner headcounts by 45% and 35% respectively, while others such as AZB & partners’ partnership ballooned by 75%.

The seven largest law firms in India have grown their headcounts by an average of around 20% in the last one-and-a-half years. Of those, the fastest-growing such as Shardul Amarchand Mangaldas and Khaitan & Co, had expanded fee-earner headcounts by 45% and 35% respectively, while others such as AZB & partners’ partnership ballooned by 75%.

"The Rs 1,112.50-crore IPO of Varun Beverages was subscribed 1.86 times at a price band of Rs 440-445. The public issue was open during October 26-28.” reported the Economic Times.

“Wind turbine maker Suzlon Energy on Wednesday said it will sell a 49 per cent stake in its 50 megawatt (MW) solar project in Telangana to wind energy company Ostro Energy, months after selling a project to CLP India,” reported Mint.

The settlement of arbitration between Cyril Amarchand Mangaldas (CAM) and former Chennai partner Dorothy Thomas have completed today, with the Bombay high court bench of Justice Kathawalla today recording the filing of consent terms.

The settlement of arbitration between Cyril Amarchand Mangaldas (CAM) and former Chennai partner Dorothy Thomas have completed today, with the Bombay high court bench of Justice Kathawalla today recording the filing of consent terms.

"Canadian Solar Inc. and China’s Unisun Energy Group bought 49 per cent stakes in solar projects being developed by Suzlon Energy,” reported Mint.

According to the allegations in the Bombay high court section 9 petition against former Cyril Amarchand Mangaldas (CAM) Chennai partner Dorothy Thomas, Thomas “in direct collusion with” Shardul Amarchand Mangaldas instructed associates to “extract confidential files” of CAM’s “in a systematic and pre-planned manner” from 26 September before she and her team had resigned from the firm.

According to the allegations in the Bombay high court section 9 petition against former Cyril Amarchand Mangaldas (CAM) Chennai partner Dorothy Thomas, Thomas “in direct collusion with” Shardul Amarchand Mangaldas instructed associates to “extract confidential files” of CAM’s “in a systematic and pre-planned manner” from 26 September before she and her team had resigned from the firm.

"The acquisition is the biggest foreign acquisition ever in India and Russia’s largest outbound deal. Billionaire brothers Shashi and Ravi Ruia have agreed to sell 98 per cent of Essar Group flagship firm Essar Oil to Russian oil major Rosneft and a consortium of oil trading firm Trafigura with private investment group United Capital Partners for $13 billion, making it the largest foreign direct investment in India.” reported The Hindu and others.

Cyril Amarchand Mangaldas (CAM) had alleged in the Bombay high court application for interim relief in arbitration proceedings that team members of departing Chennai partner Dorothy Thomas had taken boxes of CAM client files from the office.

Cyril Amarchand Mangaldas (CAM) had alleged in the Bombay high court application for interim relief in arbitration proceedings that team members of departing Chennai partner Dorothy Thomas had taken boxes of CAM client files from the office.

Cyril Amarchand Mangaldas has started arbitration proceedings against Chennai partner Dorothy Thomas, who is due to join Shardul Amarchand Mangaldas, filing in the Bombay high court yesterday for interim measures.

Cyril Amarchand Mangaldas has started arbitration proceedings against Chennai partner Dorothy Thomas, who is due to join Shardul Amarchand Mangaldas, filing in the Bombay high court yesterday for interim measures.

Khaitan & Co topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $18.7bn worth of transactions, followed by AZB & Partners which topped the list of deals by value, with 43 transactions worth $15.4bn.

Khaitan & Co topped the list of 13 domestic law firms’ M&A mandates by value of deals done with $18.7bn worth of transactions, followed by AZB & Partners which topped the list of deals by value, with 43 transactions worth $15.4bn.