Cyril Amarchand Mangaldas

The CLIENT:: State Bank of India (SBI);; is planning to raise Rs 15,000 crore in capital through a qualified institutional placement (QIP) of 54.4 crore equity shares, reported Bloomberg Quint.

Cyril Amarchand Mangaldas (CAM) is closing its transaction support group (TSG), which was set up 2013 in Mumbai to explore providing volume-focused transactional support at lower rates on work such as due diligence and other commoditised advice, with its TSG head Ami Parikh joining AZB & Partners to start a TSG there.

Cyril Amarchand Mangaldas (CAM) is closing its transaction support group (TSG), which was set up 2013 in Mumbai to explore providing volume-focused transactional support at lower rates on work such as due diligence and other commoditised advice, with its TSG head Ami Parikh joining AZB & Partners to start a TSG there.

Cyril Amarchand Mangaldas principal associate Tirthankar Datta will join J Sagar Associates (JSA) some time next month as a retained partner in its banking team, we understand from sources.

Cyril Amarchand Mangaldas principal associate Tirthankar Datta will join J Sagar Associates (JSA) some time next month as a retained partner in its banking team, we understand from sources.

“In the largest private equity deal in the logistics space, the Canadian pension fund manager Canada Pension Plan Investment Board (CPPIB) and IndoSpace, promoted by PE firm Everstone and US-based Realterm, have entered into a three-step deal which would entail an investment of $1.3 billion (Rs 8,320 crore), most of which will come from the CPPIB,” reported Business Standard

Former Cyril Amarchand Mangaldas (CAM) Delhi partner Raghuram Raju, who left the firm to set up his own finance and M&A practice in October 2016, has rebranded it as Mandalā Law Offices after former CAM Delhi partner Srinivas Kilambi joined Raju as a partner on 1 April.

Former Cyril Amarchand Mangaldas (CAM) Delhi partner Raghuram Raju, who left the firm to set up his own finance and M&A practice in October 2016, has rebranded it as Mandalā Law Offices after former CAM Delhi partner Srinivas Kilambi joined Raju as a partner on 1 April.

Gaurav Singhi, who had resigned from Shardul Amarchand Mangaldas’ partnership last month, will be joining Cyril Amarchand Mangaldas in early June as a corporate partner, according to two sources.

Gaurav Singhi, who had resigned from Shardul Amarchand Mangaldas’ partnership last month, will be joining Cyril Amarchand Mangaldas in early June as a corporate partner, according to two sources.

Under Taj Hotels current general counsel Rajendra Misra, the iconic Taj Mahal Palace hotel in Mumbai is set to join the rare registered trademark category of what are known as “image marks”. The Louvre in Paris is another one.

Under Taj Hotels current general counsel Rajendra Misra, the iconic Taj Mahal Palace hotel in Mumbai is set to join the rare registered trademark category of what are known as “image marks”. The Louvre in Paris is another one.

“Arms dealer Abhishek Verma, his wife and others were discharged by special court on Wednesday in a CBI case involving alleged payments to some officials to influence the defence ministry to keep a German firm out of the government’s blacklist. Special CBI Judge Anju Bajaj Chandna also discharged Verma and his Romanian wife Anca Verma in a money laundering case filed by Enforcement Directorate (ED) in the matter.” reported the Times of India.

Cyril Amarchand Mangaldas Mumbai banking partner Niloufer Lam has resigned the firm, as first reported by Bar & Bench.

Cyril Amarchand Mangaldas Mumbai banking partner Niloufer Lam has resigned the firm, as first reported by Bar & Bench.

Cyril Amarchand Mangaldas has fully funded a chair in “everyday ethics for the legal profession” at GNLU Gandhinagar for at least the next three years, which, if it succeeds, would become a template for the law firm contributing financially to other universities’ courses.

Cyril Amarchand Mangaldas has fully funded a chair in “everyday ethics for the legal profession” at GNLU Gandhinagar for at least the next three years, which, if it succeeds, would become a template for the law firm contributing financially to other universities’ courses.

Cyril Amarchand Mangaldas acted for Avenue Supermarts on one of the largest (Rs 1800 crore) and most oversubscribed (106 times) initial public offerings (IPOs) ever, alongside Luthra & Luthra and Herbert Smith Freehills Singapore for the banks, listing with a valuation of Rs 39,998 crore - the 67th largest Bombay Stock Exchange-listed company.

Cyril Amarchand Mangaldas has promoted 20 lawyers to partner, with the majority in the corporate practice, in addition to formally inducting AZB & Partner partner Rishi Gautam as a partner from 1 April.

Cyril Amarchand Mangaldas (CAM) is understood to be hiring AZB & Partners corporate partner Rishi Gautam, who had joined the firm in 2014 from Clifford Chance and a short stint at Amazon, as first reported by Bar & Bench.

Cyril Amarchand Mangaldas (CAM) is understood to be hiring AZB & Partners corporate partner Rishi Gautam, who had joined the firm in 2014 from Clifford Chance and a short stint at Amazon, as first reported by Bar & Bench.

Infosys, beleaguered by speculation over boardroom disagreements, internal governance surrounding CEO compensation, severance pay, appointments of independent directors, visas and a difficult business environment, has appointed Cyril Amarchand Mangaldas to help it settle ongoing disputes and disagreements between the company’s bosses and various shareholders, as reported by The Hindu Business Line and others.

Infosys, beleaguered by speculation over boardroom disagreements, internal governance surrounding CEO compensation, severance pay, appointments of independent directors, visas and a difficult business environment, has appointed Cyril Amarchand Mangaldas to help it settle ongoing disputes and disagreements between the company’s bosses and various shareholders, as reported by The Hindu Business Line and others.

According to a Cyril Amarchand Mangaldas press release, it will be India's first law firm to deploy such a technology, hence enhancing its delivery model to provide certain legal services more efficiently, quickly and accurately to its clients, having signed up with a Canada-based machine learning legal software company.

According to a Cyril Amarchand Mangaldas press release, it will be India's first law firm to deploy such a technology, hence enhancing its delivery model to provide certain legal services more efficiently, quickly and accurately to its clients, having signed up with a Canada-based machine learning legal software company.

Lakshmikumaran & Sridharan (LKS) has snapped up former Cyril Amarchand Mangaldas director for “strategy & special projects” Anish Tripathi as director of “GST and supply chain advisory services.

Lakshmikumaran & Sridharan (LKS) has snapped up former Cyril Amarchand Mangaldas director for “strategy & special projects” Anish Tripathi as director of “GST and supply chain advisory services.

Anish Tripathi, Cyril Amarchand Mangaldas director “strategy & special projects” in Mumbai, has resigned with today being his last day at the firm.

Anish Tripathi, Cyril Amarchand Mangaldas director “strategy & special projects” in Mumbai, has resigned with today being his last day at the firm.

Cyril Amarchand Mangaldas partner Srinivas Kilambi, who had joined the Delhi office of the firm from MNK Partners, where he was co-founding partner, is set to resign according to two authoritative sources.

Cyril Amarchand Mangaldas partner Srinivas Kilambi, who had joined the Delhi office of the firm from MNK Partners, where he was co-founding partner, is set to resign according to two authoritative sources.

Cyril Amarchand Mangaldas has hired AZB & Partners’ Mumbai HR head Kiran Patheja for its HR function, as head of talent acquisition, reported Bar & Bench.

Cyril Amarchand Mangaldas has hired AZB & Partners’ Mumbai HR head Kiran Patheja for its HR function, as head of talent acquisition, reported Bar & Bench.

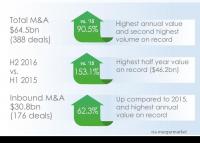

Cyril Amarchand Mangaldas has acted on $40.4bn worth of mergers and acquisition in the 2016 calendar year, according to researcher mergermarket, with AZB & Partners having recorded $30.1bn of M&A deals in the same period.

Cyril Amarchand Mangaldas has acted on $40.4bn worth of mergers and acquisition in the 2016 calendar year, according to researcher mergermarket, with AZB & Partners having recorded $30.1bn of M&A deals in the same period.