The Indian legal services industry has never quite seen the turmoil that it has experienced in 2016. As generations shift, institutions mature and old alliances and allegiances crumble, the question is being asked: Could it be the end of days or a new beginning?

A version of this article was first published in Mint last week. If you’ve read it in Mint already, then we’ve highlighted new parts in yellow for you (please note the 10 all-new law firm charts at the end, in particular).

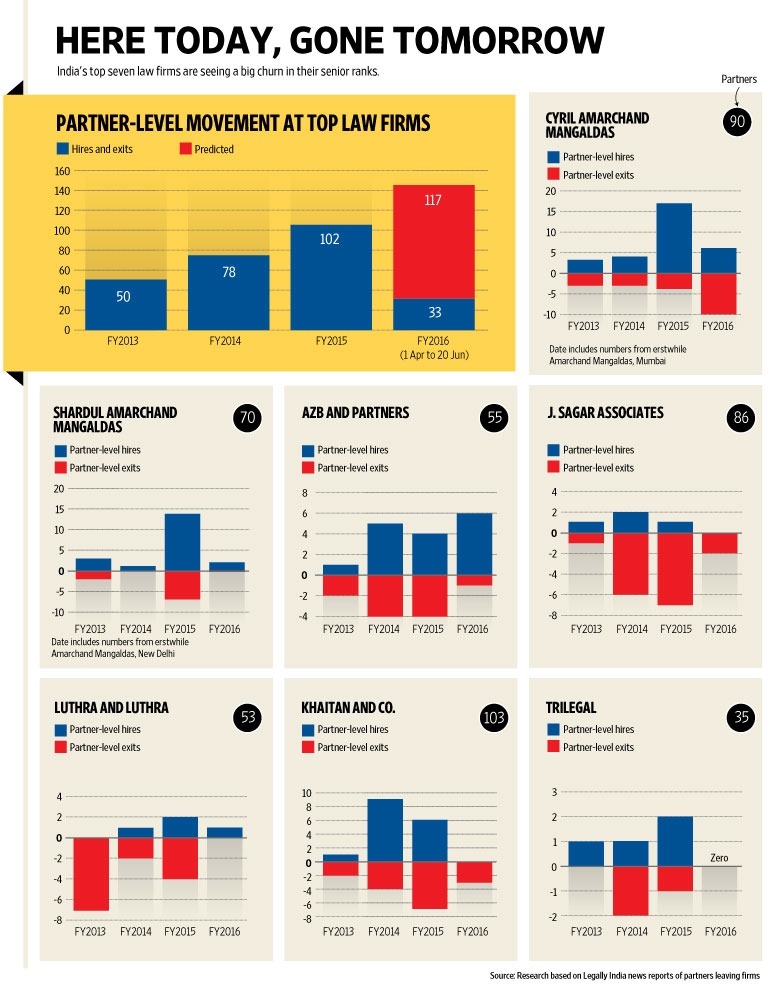

In less than three months to date, nearly as many law firm partner-level senior lawyers have moved as in the entire 2013-14 financial year. If it continues at the same pace—and a lot of observers are predicting that it will—the 2016-17 financial year could see 150 partners moving to rival law firms, going independent or in-house.

That would be 50% more lateral movement than the record-setting previous year, which infamously saw the break-up of India’s largest law firm—Amarchand Mangaldas Suresh A Shroff & Co.—into two entities, Cyril Amarchand Mangaldas (CAM) and Shardul Amarchand Mangaldas (SAM), and it’s triple of the 2013-14 tally.

But more has changed than just the extent of people movement or the overt aggression between competing firms. The dynamics of the market now seem fundamentally and irretrievably different.

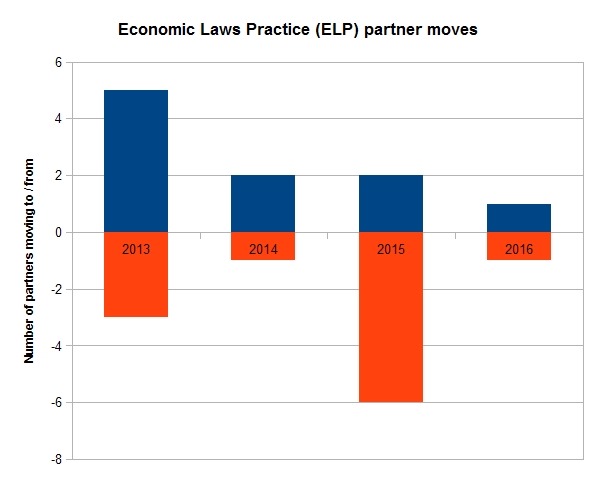

For instance, large law firms’ founding partners or major rainmakers seem to be retiring increasingly in order to pursue independent counsel practice. Economic Laws Practice’s Rohan Shah announced last week that he would join the bar. J. Sagar Associates’ star securities partner Somasekhar Sundaresan did so in March and Trilegal co-founder Anand Prasad in February.

Other than a sign of talented lawyers wanting to try out something new, these moves also give a sense of an increased maturity of the market, in which the youngest generation of larger law firms seem to be strong enough to stand on their own feet.

Another very possible explanation for the increased lateral moves is that the number of recruitment consultants working the Indian market has skyrocketed in recent years. Other than domestics, like Vahura, Legal League Consulting, FCL Search or independent recruiters, Hong Kong-headquartered Aquis Search recently opened a legal wing here and several other foreign legal recruiters have already set up here or are currently knocking.

There is historical precedent – mass law firm partner movements in the UK market around two decades ago were largely orchestrated by the boom in legal recruitment firms. Because if recruiters do their job right, they can encourage entrenched senior talent to move to places they had not even considered, sometimes with massive teams in tow.

Couple all that with the common but uncertainly-held belief of most lawyers that foreign law firms’ ambitions of setting up shop in India may finally actually happen this year or may be next, and we are faced with a perfect lateral storm.

Being a law firm managing partner doesn't look like it'll become any easier any time soon…

Relationships buried

Since the beginning of the 2016 financial year, CAM has been gutted by AZB and Partners, which has already poached six CAM partners or senior lawyers as partners. The most shocking to the market, including to quite a few outside the legal community, was AZB’s hiring of Amarchand stalwart of nearly two decades, Ashwath Rau, and his team of three partners and more than 20 lawyers. That was followed by AZB poaching CAM’s competition head Nisha Kaur Uberoi.

CAM retaliated quickly by poaching Percival Billimoria, who was practically a co-founding partner of AZB.

The informal long-standing, non-poaching pact between Amarchand and AZB, which was based on an understanding and friendship between Mumbai-based managing partners Cyril Shroff and Zia Mody, is well and truly buried now and this is unlikely to be the last partner move between the two firms this year.

Arguably, Mody did not start the fight though.

AZB Mumbai has through the years faced consistent attrition and poaching of senior- and mid-level corporate partners such as senior partner Abhijit Joshi, who set up his own firm Veritas, as well as younger generation partners such as Vaishali Sharma, Vishnu Jerome, Essaji Vahanvati, and, most recently, Shuva Mandal, who was hired into SAM’s new Mumbai office. While some of these wouldn’t have worried AZB excessively, as Mody still directly or indirectly pulls in most of the revenue, the gaps in AZB’s line-up were noticeable.

At that point, CAM must have begun looking like one of the few remaining alternative sources of Mumbai corporate bench strength that can also come with a significant book of business.

The innocent bystander

JSA, traditionally a more gentle firm than many others when it comes to aggressive lateral hirings, has easily suffered the most out of all Big 7 firms, losing partners at a much faster rate than it has been replenishing them from outside since its founder Jyoti Sagar retired in early 2013.

While JSA lost six partners in 2014, by the time the Shroff war kicked off in 2015, SAM took five partners out of JSA led by corporate rainmaker Akshay Chudasama, and in early 2016, CAM hired two partners from the team of the retiring Sundaresan.

JSA is at a delicate juncture right now with newly elected management facing the retirement of senior partner Berjis Desai in 2017, and consistent rumblings of low-level departures on the horizon.

That said, its egalitarian model of partnership should act as a buffer of sorts against anything too cataclysmic, if its internal democracy finds some way to incentivize its top rainmakers from leaving.

Khaitan & Co. has seen a lot of churn in the past few years, but it has generally been giving as good (or better) as it has been getting, having been the most aggressive lateral recruiter in the market in 2014 (when it hired nine).

But even when both CAM and SAM started strategically picking off younger Khaitan partners in 2015 (hiring one and four Khaitan lawyers as partners, respectively), external reinforcements kept the numbers steady (including two whom Khaitan hired from SAM, and one from CAM).

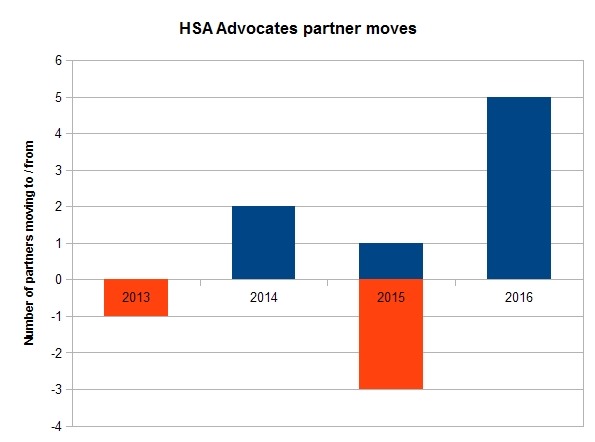

That said, Khaitan has faced pressure from outside the Big 7, having lost principal associates in its infrastructure practice to mid-sized infrastructure and projects-focused firm HSA Advocates as partners, where former Khaitan partner Amitabh Sharma has taken over as managing partner from founder Hemant Sahai with huge expansion ambitions.

Fallout of CAM-SAM split

The other two firms in the Big 7 have also managed to emerge relatively unscathed from the war of the Shroffs and its aftermath.

This year so far, Luthra is one of the few Big 7 firms that has poached someone but not seen anyone leave, having hired one partner from Tatva Legal to open up a Hyderabad office.

While Luthra was hit hard by attrition in the 2013 financial year, when seven partners left, it’s been picking up recently after spending a long time focusing on internal promotions and profitability. While a total of six partners had left in the 2014 and 2015 financial years, only three of those departed directly to one of its Big 7 rivals (CAM picked up two, and AZB picked up one).

Trilegal too hasn’t lost anyone this year (and is rumoured to be looking at a few partner hires very soon), and over the past three years, its aggregate tally of comers and goers stands basically at zero.

So, what’s going on?

There are several possible explanations.

“The SAM-CAM split catapulted a lot of these things. Had the split not happened, I don’t think any of these movements would have happened,” commented Premal Shah, founding partner of recruitment firm FCL Search.

Independent legal recruiter Leena Krishnan predicted that going forward, “there will be a lot of team movements” and that it is “very difficult for a managing partner to retain a lawyer”.

“It’s not only money people are moving for,” she said.

Ripple effect

Bithika Anand, founder and CEO of law firm management and recruitment consultancy Legal League Consulting, agrees on those counts, and also attributes the mass moves to a “rippling effect”.

“People who were very satisfied and happy for many years, when they saw their other peers moving, they thought why not them also,” she said. “Not just at large firms, (but) also in mid-tier firms.”

Firms are also more strategic than they used to be about their hiring: when a big name moves, bringing their own business, this can dislodge other partners at their old firm or entire teams. It also creates demand for more partners at the new firm, including those who will execute the partner’s work rather than bring in new work. And in turn, the firm that loses a partner will be looking for replacements, creating a hiring spiral.

“There’s a lot of consolidation that’s happening in this market,” said Balanand Menon, head of consulting at legal recruiter Vahura. Many big law firms want to increase their bench strength, while mid-size and regional firms are often looking at expanding towards new practice areas and clients or regions.

Firms looking towards inorganic growth and new client acquisition, according to Menon, would be looking for partners with an annual book of business of at least Rs.3-4 crore, although hiring firms will then also take into account a “portability rating”—how likely the client relationships are to transition with a partner and what kind of relationships they are.

Rishabh Chopra, associate director at Aquis Search’s legal private practice and in-house team in New Delhi, said that firms had become more strategic and flexible in their hiring, and won’t necessarily expect newly hired partners to recover all of their business immediately.

He explained that firms would ideally want a partner to bill and generate around three times the money that they are paid by the firm (a multiple of 3x), but in the first year, they may often make exceptions and might only expect a partner to recover their own pay (1x).

The foreign factor

Another factor is undoubtedly the feeling among law firm lawyers that foreign law firms may soon be allowed to set up shop in India, if the government’s plans end up becoming a reality.

A lot of firms are therefore currently reshaping themselves to be more attractive acquisition targets to larger foreign firms, while partners too are repositioning themselves in the market and proving their independence from long-time promoter bosses.

However, compared to a few years ago, start-up law firms seem to have lost their lustre. There are fewer senior lawyers who set up their own firms now than there were three and four years ago, and many more of them have been getting re-absorbed into larger firms.

“If a start-up is able to cross the three-year mark,” said Chopra, “they are able to do well, but some professionals within these set-ups tend to consider bigger platforms to focus more on execution and business development and do away with the administration bit.”

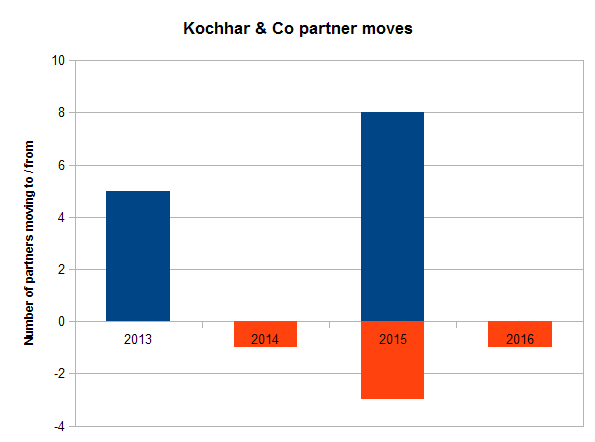

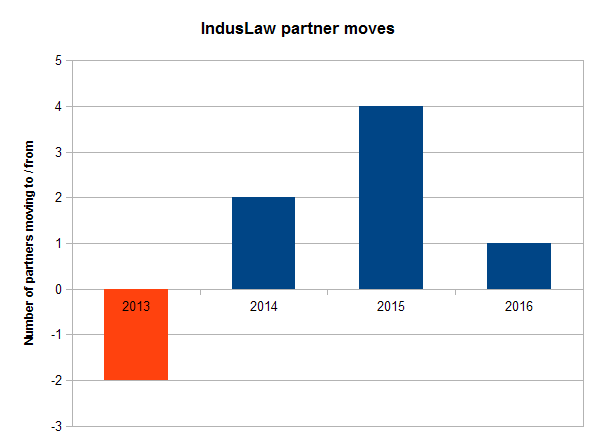

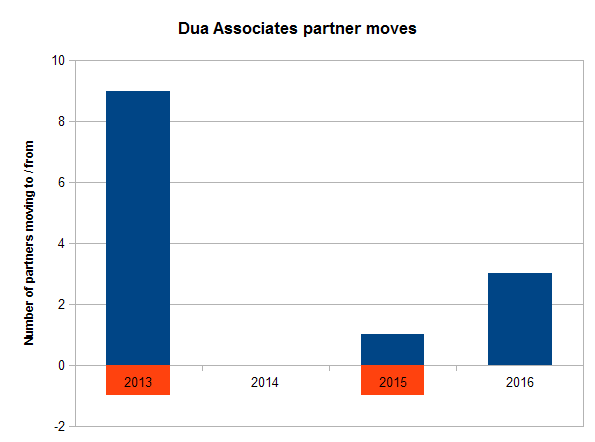

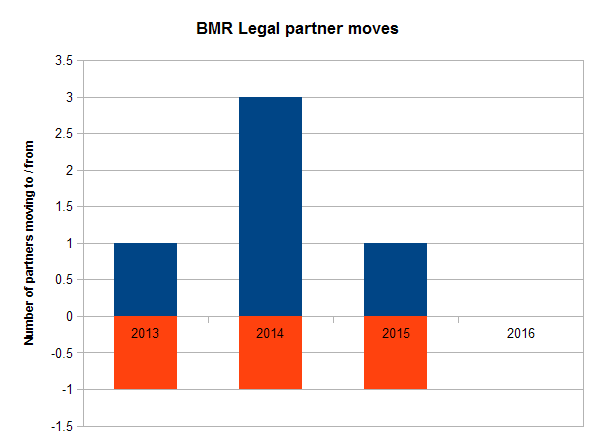

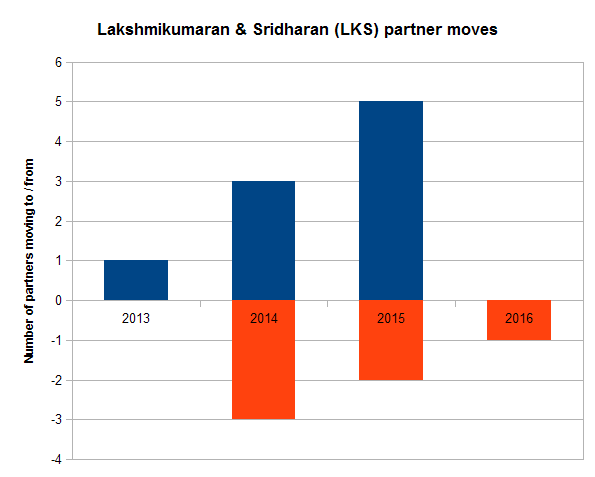

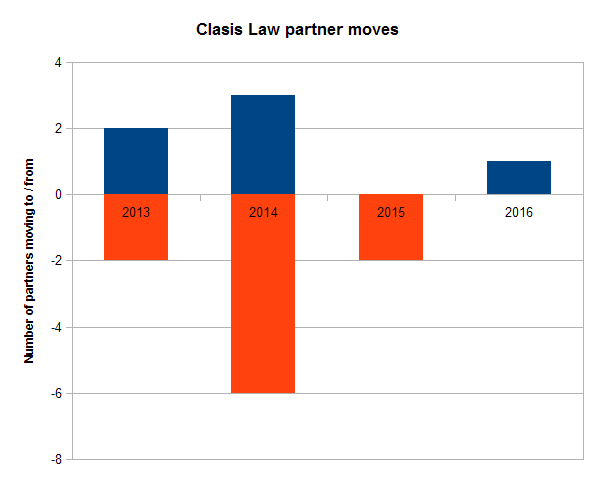

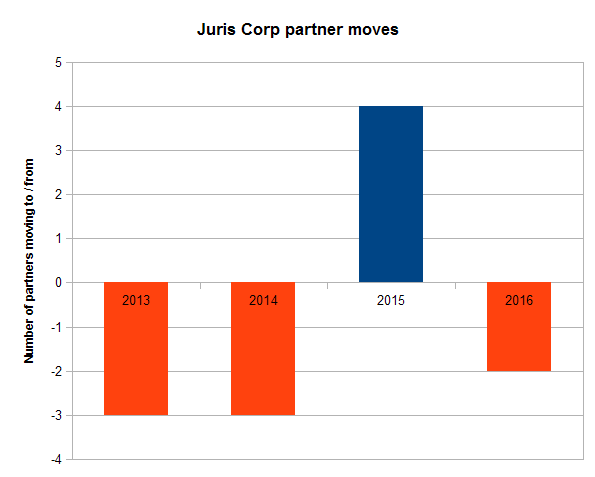

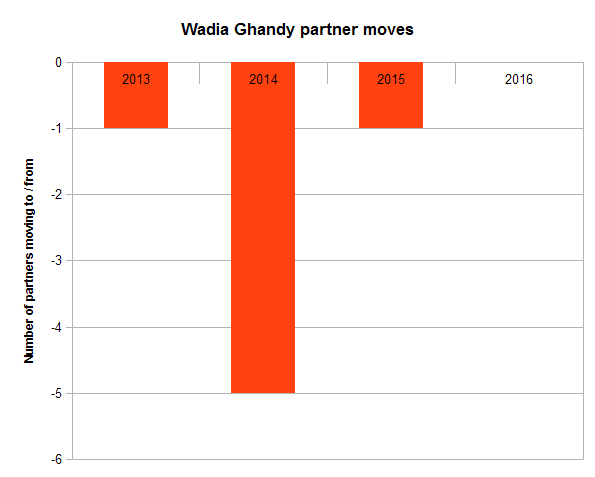

The 10 other law firms with the greatest number of partner-level hires / leavers per financial year

threads most popular

thread most upvoted

comment newest

first oldest

first

Quite insightful this!

If we added partner promotions into this analysis, it would become skewed all over the place...

if you look at WG, they have had a lot of exits but you have also reported that they also seem to have elevated quite a few people. Had they not elevated their own crop, they may have hired laterally.

But I agree, if your article is limited to the market movement, and not about the state of the firms, i suppose your method is better.

A message to you: The 'hires' might be including promotions which can skew the figures. CAM and SAM both promoted a ton of second and third string associates after the split and this should not be used to gloss over the losses. Maybe hires should include only lateral hires.

Of course, where third rate associates from other places were hired as partners by CAM and SAM, that will still skew things.

Also, I note that the article doesn't really discuss SAM, just the graph and a passing reference with CAM. No thoughts on the Shuva and Akshay moves, Kian?

However, I think LI can put its collective heads together and come up with graphs demonstrating quality of partner moves. Losing an Ashwath or an Akshay cannot be made up by picking up even 5 salaried partners.

Similarly this graph must un-bundle "partner". Ashwath, Akshay or Nisha had equity/ equity-like stakes. They don't belong on the same graph as a salaried "partner" hire.

barandbench.com/wadia-ghandy-hires-almt-partner-subashini-radhakrishnan/

As stated in the graphic, we only included moves that had been reported by LI, and as such these graphs are only ever approximations, I'm sure.

However, we generally capture around 90% of moves, even those reported by others, but sometimes we miss one...

threads most popular

thread most upvoted

comment newest

first oldest

first