General blogging

The incidents of war happened in the real world is mirrored in cyber space, given the recent incidents of hacking of government websites by state or non state group of hackers for political, military, espionage purposes. As the world becomes increasingly dependent on the internet and increasingly connected through it, another threat is beginning to loom large – Hacking and defacement of Government website and other cyber infrastructure. Recently, a hacker group from Pakistan calling itself as ‘Pakistan Cyber Army’ made a mockery of the country’s cyber security by infiltrating into the CBI website supposed to be one of the most secure websites as it is maintained by National Informatics Centre, reported to be employing strict cyber security measures.

Today the CBI’s website, connected to the command centre of world police organisation — Interpol — 24x7 has been hacked, but what about tomorrow? What is the guarantee that next cyber attack may take place on something more critical, like the power grid?

The hacking of Government websites is not new and in past too the hackers group with patronage of government establishment successfully penetrated the highly secure websites belonging to Government of India. However, it is not a one sided affair as there are hacker group from either side who in retaliation or out of political or strategic compulsion hack each other websites. It is no more a secret that our neighbors with whom we have troubled relations find it politically and strategically useful to have arms-length relationship with hackers. One blogger has written that the hackers claim that they are sometimes paid secretly by the Chinese government -- a claim the Beijing government denies. There is a number that circulates the web (not confirmed data) that the Chinese government pays to up to 50,000 highly skilled military hackers to use the Internet for specific purposes that are defined by the government officials (cyber expert James Mulvenon told a congressional commission in 2008). The hacker community is diverse with different purposes, for example; (a) Script-kiddies – people, teenagers who are doing it for fun or to show off or to see what they can actually accomplish (b) Criminal Hackers-criminals who are just hacking for financial gains, (c) Patriotic hackers – people that hack websites out of a kind of nationalistic feeling (d) Government backed hackers; There are hackers that are probably employed by the government, probably by the military and the security agencies that are used to attack specific targets for political reasons and last but not the least there are hackers in the military that are thinking about how cyber would be used in an actual military conflict.

The category to which the Pakistani Hackers group who hacked the CBI website is not difficult to imagine. The Pakistan Cyber Army, claim that the Indian Cyber Army had allegedly hacked into the oil and gas regulatory website in Pakistan. The Pakistan Cyber army in retaliation has therefore also hacked the website of CBI. So, the group clearly fall under point (c) mentioned above i.e. patriotic hackers, however it is equally true that they have the government sponsorship too.

As far as the law is concerned, we have Information Technology Act, 2000 on statute book which deals with hacking, particularly the government owned website, say Section 66 (punishing the offence of hacking) read with Section 70 Information Technology Act (punishing access or attempt to access the protected systems). However, these sections are not effective as far as cross border cyber crimes are concerned, more so if one traces the digital footprints of hacking to hostile countries with which we have troubled relations and do not have bilateral treaty. The only solution seems to be is to first identify the critical and vulnerable cyber infrastructure, upgrade their security, setting up of a cyber command structure with experts in cyber security and warfare to continuously look at the cyber security aspects and suggest measures to upgrade the security, make preemptive cyber attacks against enemy cyber infrastructure and last but not the least thwart any similar cyber attacks emanating from foreign land.

The need for international cooperation on these critical issues and the role that international law can play in containing the threat cannot be undermined. As far as the cyber espionage is concerned, there is no known international treaty on this issue, however, on the criminal front there is a convention on cyber-crime drawn up by Council of Europe which is the first international treaty seeking to address Computer crime and Internet crimes by harmonizing national laws, improving investigative techniques and increasing cooperation among nations. However, the problem with this convention or treaty is that most of the major players including India itself have not signed it which could have gone a long way consistent legal enforcement standards across national borders about dealing with instances of cross border cyber crimes. As an alternative to the aforesaid convention, as a short time security measure we can enter into treaty with the Pakistan and China like the one we have with Pakistan to not attack each other nuclear installations, in similar manner we can agree to not launch cyber attacks on each other identified critical cyber installations.

General blogging

This blog is off-shoot of a BIFR Order dated 30.09.2010 in the case of India Foils Limited. The BIFR sanctioned and approved the merger of M/s India Foils Limited (IFL Transferor Company) with M/s Ess Dee Aluminium Limited (EDAL Transferee Company).

The strange & absurd exchange ratio of the scheme is- the shareholders of India Foils will get 1 share of Ess Dee Aluminium Ltd for every 1285 shares held of India Foils Ltd.

I have recorded a letter to SEBI. I have questioned the legal possibility of the Merger and not of the exchange ratio. It is quite interesting, I think.

Complaint / Notice

27.11.2010

From,

Sandeep Jalan, Advocate

C/o Janhit Manch,

Kuber Bhuvan,

Bajaj Road, Vile Parle West,

Mumbai – 400056.

To,

Shri C. B. Bhave,

Chairman, SEBI,

SEBI Bhavan, Bandra Kurla Complex,

Bandra (E), Mumbai - 400051.

Subject of the Complaint

The Order passed by Hon'ble Board dated 30.09.2010 in the case of India foils limited, is illegal, inasmuch as, the said Amalgamation is beyond the contemplation of Sick Industrial Companies (Special Provision) Act 1985 [For short SIC Act 1985]

There is a “Legal Impossibility” of the Amalgamation of M/s India Foils Limited (IFL Transferor Company) with M/s Ess Dee Aluminium Limited (EDAL Transferee Company), in the light of section 17(1) of SIC Act 1985 & Regulation 30 of BIFR Regulations 1987.

INDEX

Particulars Page No.

1. Facts of the case

2. Relevant provisions of law

3. Application of law to facts of the case

4. Provisions of law under which the public authority is obliged under the law

5. Legal Expectation

6.The consequences that may follow

7. SC Judgment in Salem Advocate Bar Association, Tamil Nadu Vs. Union of India

8. Important Points Revisited

9. Attachments

10. Post Script:

Dear Sir

In continuation of my earlier communiqué in this regard, received by your above office on 23.11.2010, again I am writing to you, under instructions and on behalf of my Client Mrs Laxmi Girish Jalan, residing at 56 C Amba Jyoti Apartment, flat no.303, near SBI, Trimurti Nagar, Nagpur.

1. Facts of the case-

A. My Client is holding about 17,300 shares of India Foils Limited.

B. On date: 19-05-2006 India Foils Ltd has informed the Exchange that the Company has been registered as Sick Company with The Board for Industrial and Financial Reconstruction under Case no.08/2006 and after hearing, the Bench of BIFR was satisfied that the Company fulfilled the various criteria for sickness under the ACT and have become a sick industrial company in terms of section 3(1)(o) of the Act and accordingly declared it to be sick company. The Bench of BIFR has further appointed ICICI as the Operating Agency with directions to prepare a viability study report and revival scheme for Company.

C. On date: 20-11-2008 India Foils Ltd has informed the Exchange that: "In terms of the rehabilitation scheme ("Scheme") sanctioned by Hon'ble BIFR dated August 18,2008, the Board of Directors of India Foils Limited in their meeting held on November 19, 2008, has altered its Authorized Equity Share Capital by splitting the unissued equity shares of Rs.10/- each into equity shares of Re.1/-each. (i) Pursuant to Scheme mentioned herein above the Board of Directors has issued and allotted the following equity and equity linked instruments. 13,60,00,000 equity shares of face value Rs.1/- each fully paid up to Ess Dee Aluminium Limited and 1250000, 0.01% optionally convertible redeemable non-cumulative preference shares of face value Rs.100/- each fully paid up to Sterlite Industries (India) Limited, an affiliate of Madras Aluminium Company Limited. (ii) Further the Board has also issued and allotted 13953423, 0.01% redeemable non-cumulative non-convertible preference shares of face value Rs.100/- each fully paid up and 9628115, 0.01% redeemable non-cumulative non-convertible preference shares of face value Rs.100/- each fully paid up to Sterlite Industries (India) Limited and Ess Dee Aluminium Limited respectively. (iii) With the issue of above shares, Ess Dee Aluminium Limited has become the majority stakeholder in the India Foils Limited and thereby it has became the subsidiary of Ess Dee Aluminium Limited".

D. The Hon'ble Board / BIFR, vide its Order dated 30.09.2010, inter alia, sanctioned and approved the merger of M/s India Foils Limited (IFL Transferor Company) with M/s Ess Dee Aluminium Limited (EDAL Transferee Company) in terms of the modified Rehabilitation Scheme. The above BIFR or Board Merger Order could not be located on the website of the BIFR. Therefore, the Appellant relies on the communiqué issued by Ess Dee Aluminium Ltd in this regard. The undated communiqué of Ess Dee Aluminium Ltd underlines the salient features of BIFR or Board Merger Order. Pls find Attachment 'A', the copy of this communiqué.

2. Relevant provisions of law: The Role of BIFR or Board comes into play once a reference is made to it or a information is received by it under section 15 of the SIC Act 1985.

Section 16 contemplates, among other things, Inquiry into the working of the Sick Industrial Company by the BIFR or Board. When a reference is made to a BIFR or Board, the BIFR or Board makes such inquiry or appoint any operating agency to determine whether the referred Industrial Company has really become a Sick Industrial Company within the meaning of this Act of 1985.

Section 16(4) stipulates the appointment of a Special Director by BIFR or Board. This sub section 4 of section 16 is pressed into by the Parliament to safeguard the interest of the Company from the likely ill-doings of the present management, the incompetent management / Board of Directors who have made the Company Sick and were forced to refer the Company to the Board. According to information available, Shri K. Raghuraman has been appointed as the Special Director under Section 16(4) of the Sick Industrial Companies ( Special Provisions ) Act, 1985 on the Board of India Foils Limited.

Section 17 outlines the Powers of the BIFR or Board to make suitable order on the completion of the inquiry. The section says- after making an inquiry under section 16, if the BIFR or Board is satisfied that the referred Company has become the Sick Industrial Company within the meaning of this Act of 1985, then, after taking into consideration all relevant facts and circumstances of the referred Sick Industrial Company, the BIFR or Board proceeds to decide whether or not the said Sick Industrial Company can make its net worth exceed the accumulated losses within a reasonable time.

Here the section makes it obligatory on the part of BIFR or Board to take into consideration all relevant facts and circumstances of the referred sick industrial company before reaching to the decision as whether the said Sick Industrial Company can make its net worth exceed the accumulated losses within a reasonable time.

When the BIFR or Board considers all relevant facts & existing circumstances of the referred Sick Industrial company and decides that the said Sick Industrial company cannot make its net worth exceed the accumulated losses within a reasonable time, it may undertake to adopt all or any measures specified in section 18 of the SIC Act 1985.

The measures under section 18 broadly enumerate (i) financial reconstruction of the sick industrial company, (ii) take over or change in the management of the Company, (iii) the amalgamation of the sick Industrial company with any other company or amalgamation of any other company with the said sick industrial company; and such other preventive, ameliorative and remedial measures as may be appropriate. Section 18 is a elaborate section comprising various measures that can be undertaken to revive the referred Sick Industrial Company.

The Regulation 30 of the of BIFR Regulations 1987 is under Chapter VI of-- Procedure & Preparation And Sanction of Scheme under section 18. Regulation 30 contemplates the consideration by the Board / BIFR of the suggestions and objections that it may receive from the Sick Industrial Company or from the Transferee company or from the Operating Agency or from any other company concerned in the proposed amalgamation.

3. Application of law to facts of the present case-

At this point, I will be primarily agitating on the “Legal Impossibility” of the Amalgamation of M/s India Foils Limited (IFL Transferor Company) with M/s Ess Dee Aluminium Limited (EDAL Transferee Company) provided vide BIFR or Board Order dated 30.09.2010.

I am advancing argument on the presumption that the Order of BIFR or Board dated 30.09.2010 was made under section 18(1)(c) of the SIC Act 1985.

(A) It is my grand argument that a measure stipulated under Section 18(1)(c) contemplates a new management for the sick industrial company. Amalgamation under section 18(1)(c) of SIC Act 1985 presupposes the change of Managament. The words in the statute “any other company” contemplates other company, a different managament.

(B) And, therefore, it is imperative to understand how this section 18(1)(c) has evolved.

(i) Section 18(1)(c) comes in the backdrop of section 17(3). Section 17(3) is the off-shoot of section 17(1).

(ii) Section 17(1) speaks about consideration of all relevant facts and circumstances by the Board before adopting the course of measures contemplated under section 18.

(C) Thus, it can safely be submitted that all measures sought to be undertaken by the BIFR or Board under section 18 is based on its consideration under section 17(1) of relevant facts and circumstances of the case.

(D) To illustrate this--

(i) I say that, when the BIFR or Board under section 17(1) considers “all relevant facts and circumstances” of the Sick Industrial company, can we take a pause to ponder for a while as what could be the relevant facts & circumstances which the Board may be considering to reach to the decision that the said Sick Industrial company can or cannot make its net worth exceed the accumulated losses within a reasonable time.

(ii) In this respect, I can safely argue that the Board of Directors of a Company are the most important people of the Company. In fact they are the people who are the driving force behind the success or failure of the Company. They are the people who make the Company Sick and take the Company to BIFR.

(iii) Again, I can safely argue that-- “Who are the persons in the Board of Directors of a sick industrial Company” is the principal & paramount fact of consideration of the BIFR or Board in reaching to the decision that whether the said Sick Industrial company can or cannot make its net worth exceed the accumulated losses within a reasonable time. (iv) Therefore, when the Board decides that the said Sick Industrial company cannot make its net worth exceed the accumulated losses within a reasonable time, it actively takes into account the worth or the competence of the present Board of Directors of the sick industrial company.

(E) If for a moment, it is presumed that section 18(1)(c) can be invoked for the amalgamation of companies which are run by same management, then we reach to this absurd proposition, i.e. --

“The BIFR or Board while looking at the present management of the sick industrial company comes to the conclusion that the said Sick Industrial company cannot make its net worth exceed the accumulated losses within a reasonable time and therefore decides that the sick industrial company, under section 18(1)(c) should be amalgamated with another company. The Management of the new amalgamated company will be the same old management of that sick industrial company.”

(F) Without prejudice to my right to rely on earlier submissions--

(i) If the amalgamating companies relying on the words “any one or more of the following measures”, contained in section 18(1) to say that amalgamation of this sort is permissible under the Act of 1985; Then it may also be noted that this measure of amalgamation contained in clause (c) was not existent in the original Act of 1985, when the words “any one or more of the following measures” were there. This clause (c) came into effect from 01.02.1994 by virtue of Act 12 of 1994.

(G) Without prejudice to my right to rely on earlier submissions-- I say that- conflict of interest of litigating parties forms the basic feature of our adversary style of litigation. I invite the attention of SEBI to Regulation 30 of BIFR Regulations 1987. The Regulation 30 of the of BIFR Regulations 1987 is under Chapter VI of-- Procedure & Preparation And Sanction of Scheme under section 18. Regulation 30 contemplates the consideration by the Board / BIFR of the suggestions and objections that it may receive from the Sick Industrial Company or from the Transferee company or from the Operating Agency or from any other company concerned in the proposed amalgamation.

Tell me, if the Management of both - Sick Industrial Company and of Transferee company are same, then, the rights of the Sick Industrial Company to forward any objection to the Board or BIFR with regard to proposed amalgamation with the transferee company becomes meaningless.

And, therefore, it can again be safely argued that measure contemplated under section 18(1)(c) of Amalgamation pre-supposes two entirely distinct entities, being run by different management.

(H) While looking at the rehabilitation scheme ("Scheme") sanctioned by Hon'ble BIFR or Board dated August 18, 2008 wherein, among other things, Ess Dee Aluminium has become the majority stakeholder in the India Foils Limited and thereby the India Foils Limited has became the subsidiary of Ess Dee Aluminium Limited". At present, India Foils is already under the active management of Ess Dee Aluminium Limited.

4. Provisions of law under which the recipient Public Authority is obliged under the law to attend the nature of the Complaint narrated hereinbefore and to take needed action in this regard..

I invite attention of the Chairman to Section 11(1) of SEBI Act 1992 which reads as -- “Subject to the provisions of this Act, it shall be the duty of the Board to protect the interests of investors in securities and to promote the development of, and to regulate the securities market, by such measures as it thinks fit.”

I invite attention of the Chairman to Section 14 of General Clauses Act 1897. Powers conferred to be exercisable from time to time.- (1) Where, By any (Central Act) or Regulation made after the commencement of this Act, any power is conferred then (unless a different intention appears) that power may be exercised from time to time as occasions requires. This section applies also to all (Central Acts) and Regulations made on or after the fourteenth day of January, 1887.

5. Legal Expectation:

Therefore, in this whole background, I humbly request you to, in the exercise of powers vested upon you under section 11(1) of the SEBI Act 1992, and in all seriousness, look into the matter of this amalgamation / Merger, and make suitable representation before the BIFR or before the Appellate Authority to quash its said Order dated 30.09.2010.

However, if you are satisfied that there is no anomaly in the said BIFR or Board Order of 30.09.2010 and my submissions are merit less OR if, SEBI argues that it has no powers to approach BIFR or AAIFR to make suitable representation on behalf of the Retail investors--

then, SEBI may please record its such satisfaction OR lack of powers, as the case may be, and please make a reply to us of SEBI's such satisfaction or lack of powers, as the case may be, within 30 days of receipt of this Complaint / Notice.

6. The consequences that may follow: This is to inform you that your failure to comply to legal expectation as stated hereinbefore may compel us to institute legal Proceedings under Writ Jurisdiction, at your personal cost, as settled by Hon'ble Supreme Court of India in below Salem Advocate Bar Association, Tamil Nadu Vs. Union of India case.

7. SC Judgment in Salem Advocate Bar Association, Tamilnadu Vs. Union of India: I wish to inform you that in Salem Advocate Bar Association, Tamilnadu Vs. Union of India (UOI), (2005) 6 SCC 344, the Hon'ble Supreme Court has, among others, observed and directed “…

The Governments, government departments or statutory authorities are defendants in a large number of Cases pending in various courts in the country. Judicial notice can be taken of the fact that in a large number of cases either the notice is not replied to or in the few cases where a reply is sent, it is generally vague and evasive. It not only gives rise to avoidable litigation but also results in heavy expenses and costs to the exchequer as well.

A proper reply can result in reduction of litigation between the State and the citizens. In case a proper reply is sent, either the claim in the notice may be admitted or the area of controversy curtailed, or the citizen may be satisfied on knowing the stand of the State.

Having regard to the existing state of affairs, we direct all Governments, Central or State or other authorities concerned, whenever any statute requires service of notice as a condition precedent for filing of suit or other proceedings against it, to nominate, within a period of three months, an officer who shall be made responsible to ensure that replies to notices under Section 80 or similar provisions are sent within the period stipulated in a particular legislation.

The replies shall be sent after due application of mind. Despite, if the court finds that either the notice has not been replied to or the reply is evasive and vague and has been sent without proper application of mind, the court shall ordinarily award heavy costs against the Government and direct it to take appropriate action against the officer concerned including recovery of costs from him.”.

It may happen that the High Court, like the Supreme Court had questioned the Prime Minister Manmohan Singh's silence on application received from Subramanium Swamy on 2G Scam, may question – why you have remained silent -EXPLAIN.

8. Important Points Revisited

(i) On 19-05-2006 India Foils Ltd has informed the Exchange that the Company has been registered as Sick Company with The Board for Industrial and Financial Reconstruction under Case no.08/2006

(ii) On 20-11-2008 India Foils Ltd has informed the Exchange that: "In terms of the rehabilitation scheme ("Scheme") sanctioned by Hon'ble BIFR dated August 18,2008, among other things, Ess Dee Aluminium Limited has become the majority stakeholder in the India Foils Limited and thereby India Foils Limited has became the subsidiary of Ess Dee Aluminium Limited"..

(iii) The Hon'ble Board / BIFR, vide its Order dated 30.09.2010, inter alia, sanctioned and approved the merger of M/s India Foils Limited (IFL Transferor Company) with M/s Ess Dee Aluminium Limited (EDAL Transferee Company) in terms of the modified Rehabilitation Scheme.

(iv) It is legitimately presumed that the Order of BIFR or Board dated 30.09.2010 was made under section 18(1)(c) of the SIC Act 1985.

(v) It is my grand argument that a measure stipulated under Section 18(1)(c) contemplates a new management for the sick industrial company. Amalgamation under section 18(1)(c) of SIC Act 1985 presupposes the change of Management. The words in the statute “any other company” contemplates other company, a different management.

(vi) Section 18(1)(c) comes in the backdrop of section 17(3). Section 17(3) is the off-shoot of section 17(1).Section 17(1) speaks about consideration of all relevant facts and circumstances by the Board before adopting the course of measures contemplated under section 18.

(vii) All measures sought to be undertaken by the BIFR or Board under section 18 is based on its consideration under section 17(1) of relevant facts and circumstances of the case.

(viii) If for a moment, it is presumed that section 18(1)(c) can be invoked for the amalgamation of companies which are run by same management, then we reach to this absurd proposition, i.e. -- “The BIFR or Board while looking at the present management of the sick industrial company comes to the conclusion that the said Sick Industrial company cannot make its net worth exceed the accumulated losses within a reasonable time and therefore decides that the sick industrial company, under section 18(1)(c) should be amalgamated with another company. The Management of the new amalgamated company will be the same old management of that sick industrial company.”

(ix) The Regulation 30 of the of BIFR Regulations 1987 is under Chapter VI of-- Procedure & Preparation And Sanction of Scheme under section 18. Regulation 30 contemplates the consideration by the Board / BIFR of the suggestions and objections that it may receive from the Sick Industrial Company or from the Transferee company or from the Operating Agency or from any other company concerned in the proposed amalgamation. Tell me, if the Management of both - Sick Industrial Company and of Transferee company are same, then, the rights of the Sick Industrial Company to forward any objection to the Board or BIFR with regard to proposed amalgamation with the transferee company becomes meaningless.

(x) SEBI is the Principal & Solemn institution to safeguard the interest of retail investors. In fact SEBI came into being to safeguard the interest of retail investors. The retail investors are simply incapable of engaging themselves into the conventional expensive and time consuming court litigation. And, therefore, whenever the retail investors face unlawful loss to their investment, they turn to SEBI.

(xi) I submits that my Client has a very good case on merit and serious prejudice & irreparable loss will occasion to my Client and to many other shareholders of India Foils Limited. Moreover, by allowing this Amalgamation, a wrong precedent will set in, which may encourage such illegal mergers in future.

Thanking you in the anticipation of your effective action in this regard.

With Regards

Sandeep Jalan

Advocate

9. Attachment ' A'.

10. Post Script:

Discretionary powers of Public Servant: Discretion being an element in all powers, but the concept of discretion imports a duty to be fair, candid and unprejudiced; not arbitrary, capricious or biased; much less, warped by resentment or personal dislike. Discretion allowed by the statute to the holder of an office is intended to be exercise according to the rules of reason and not according to personal opinion.

Discretionary powers are never absolute. Even if a statutory pronouncement state explicitly that the discretion it grants is absolute, this discretion is interpreted as requiring the holder of the authority to act strictly according to some procedure such as granting a hearing and acting impartially and acting in such a way to achieve the goal of the legislation for which the authority has been granted.

If a decision on a matter is so unreasonable that no authority could ever have come to it, then the courts can interfere. The repository of discretion must be prepared to justify in court the reasonableness of his belief and in arriving at a decision in the exercise of his discretionary powers. It is not enough to say that the discretion was exercised honestly by the authority.

It is pertinent to note that any action, decision or order of any statutory or public authority bereft of reasoning would be arbitrary, unfair and unjust violating article 14 of the Constitution of India or would be deemed to have been taken or arrived at by adopting unfair procedure offending article 21 of Constitution of India. Krishna Swami Vs Union of India. AIR 1993 SC 1407

LORD GREENE, MR in Associated Provincial Picture House Ltd Vs Wednesbury Corp observed that it is a established law that a Person entrusted with a discretion must direct himself properly in law. He must call his own attention to the matters which he is bound to consider. He must exclude from his considerations matters which are irrelevant to the matter that he has to consider. If he does not obey those rules, he may truly be said, and often is said, to be acting unreasonably.

The abuse of discretionary power is like saying- “as an Authority of Public Power- I may decide but declines to let you know the reasons or grounds of my decisions or provide reasons without being reasonable.

Reasons disclose how the mind is applied to the subject matter for a decision whether it is purely administrative or quasi judicial; and reveal a rational nexus between the facts considered and conclusions reached. Union of India Vs Mohan Lal Capoor (1973) 2 SCC 836

The Apex Court in one case viewed that when statute confers discretion on a holder of public office that should be exercised reasonable and rationally. U.P. State Road Transport Corporation V Mohd Ismail (1991) 3 SCC 239.

In our humble view- The basis of every law or every rule OR EVERY EXERCISE OF DISCRETION or every decision govt or govt agencies take, is on the premise of greatest good of the greatest number of people. The forms of accountability may differ but the basic idea remains the same that the holders of High Public Office must be able to publicly justify their exercise of power not only as legally valid but also socially wise just and reasonable, chiefly designed to add something more to the quality of life of the people. Every exercise of Power depend on this ideal for its validity.

A note was struck by Apex Court in Superintending Engineer, Public health, U.T. Chandigarh V Kuldeep Singh when it observed: “Every Public servant is a trustee of the society; and in all facets of public administration, every public servant has to exhibit honesty, integrity, sincerity and faithfulness in the implementation of the political, social, economic and constitutional policies to integrate the nation, to achieve excellence & efficiency in public administration. ...”

End

General blogging

If you are a final year student reading this, you shall be indebted to me for writing this post. If you are a recruiter reading this, well…This is why I haven’t revealed my real, unemployed name on my blog. Final year students are looked upon by their faculties as people who know their responsibilities, won’t do anything to tarnish the reputation of their colleges, will grab hefty pay packages which add on to the glowing record of the placement committee.

Now, it’s not an easy job when the placement coordinator, your parents, your seniors, your friends, your neighbours (one going through a nasty divorce and one in jail for stabbing one of his colleagues....wow, if they had been nicer to me when I was a kid, maybe I could have fought their cases!!) throw free advice at you, even if you don’t want them. Like:

1) Smile, but don’t smile showing your teeth. Just stretch your lips slightly. But don’t beam. Or don’t grin. It should come from the eyes, not from your teeth.

2) Don’t fiddle with your hair. Don’t rub your nose. Body language experts say that means you are lying or you aren’t completely sure of what you are saying. Don’t shift in your chair. Don’t change your posture. Don’t nod a lot. Just shake your head slightly.

3) Don’t blink a lot. If they offer water, take it, but don’t gulp loudly. If you have a cold, don’t sniff.

4) Be polite. Greet everyone with a ‘Good Morning’. Check your watch, if it is good morning or afternoon.

5) If they ask you, your reading habits, don’t tell them you read Mills and Boons, the Twilight saga or Harry Potter. (Now, this is too much)

6) Don’t make fun of your faculty with them (???)

7) Don’t discuss what they asked inside, with your batchmates. Lie to them.

8) No need to take up a job outside your hometown. You can save the rent and food by staying at your hometown. (And who is going to earn and become independent? My father-in-law??)

9) Don’t message in front of them (WHY? WHY? WHY would I want to jeopardize my own career by forwarding Rajnikanth jokes to people during my interview ?)

10) Don’t tell them you blog and crack jokes (I have proudly said I blog, and even cracked jokes with the panel- Yes, if the panel looks strict, you must sober down- but both were well appreciated by them!!)

What do people think? You are just going to get in the room, jump on the table and do belly dancing? You becoming a lovesick, brainless loser if you read Twilight? Or you are a kid if you read Harry Potter? You are so stupid that you are going to rant about your college problems or your hostel toilet which leaks sometimes? The most rotten advice I’d gotten was to take the side of the company I am representing even if they are doing something which is very harmful to the public. My argument was that I can take their side, but I would also try to look for some other options which would not harm the public in anyway. India has a lot of population, but this is no excuse to harm people and mint money.

I’m one for becoming completely honest and being yourself when it comes to interviews. What’s your take?

General blogging

Hon'ble benches of the 'Supreme Court of India' took Judicial Notices of the unethical practices adopted by some of the 'Advocates on Record' , the Hon'ble benches of the Supreme Court shown its displeasure many times about the said prevalent practices time to time some are reported in; (2009)2 SCC 399 [State of Punjab Versus Ashok Singh Garcha], in (2010)1SCC 166 [Vijay Dhanji Chaudhary Versus Suhas Jayant Natawadkar ] and in 2010(3) SCALE 266 (Smt. Poonam Versus Sumit Tanwar) ultimately on 30.10.2009 the bench of Hon'ble Mr. Justice R.V. Raveendran and Hon'ble Mr. Justice G.S. Singhvi had sue moto issued notices to 'Supreme Court Bar Association' and 'Advocates on Record Association' to assist the Hon’ble Court to find appropriate solutions and to provide necessary checks and balances regarding the Practice and Procedure of Hon'ble Court.

After appearances the 'Advocates on Record Association' had filed its suggestion in this matter which cannot be said to be practical and feasible solutions because even all the Advocates on Record are not members of that association, at the relevant time the Board of Executive of SCBA had resigned and Interim Board Management was functional, such IBOM without calling the General Body of SCBA had made suggestion which was not acceptable to majority of the Advocates which causing dissatisfaction among the practicing members, ultimately the members of “THE SUPREME COURT ADVOCATES ASSOCIATION (NON-AOR)” had decided to file its intervention application in that case and assist the Hon'ble Court, according by a team work legal research was done and an application for impledment is being filed in the matter, and in the interest of justice and for finding solutions and providing necessary check and balances in the present situation, the applicant SCAA made following Suggestions:

(I) Pursuance to the SCBA resolution dated 4.3.2009 the exemption available to the “Attorneys” and “Solicitors” under Rule 5(i)[(aa)] and (ii)(a) respectively in “SCR 1966”, the similar exemption may kindly be granted to the Advocates-Members having ten years Standing at Bar (SCBA) and experience of conducting / incharge Advocates who draws the Cases etc. of 100 or above in all, be exempted from the passing of Exam./test as prescribed in the Order IV of “SCR 1966” for registering / enrolling themselves as A.O.R. of this Hon’ble Court; And/Or

(II) Pursuance to the SCBA resolution dated 4.3.2009 to amend the “SCR 1966” and make a provision therein that whenever a cases; like SLP/WP/Applications etc. are filed, in those cases the name of the conducting / incharge Advocates who draws the Cases etc. may be required to be mentioned in the petition and Registry also publish their names in the Cause Lists and Office Reports issued by this Hon’ble Court along with names of AORs. ; And/Or

(III) Just to protect the AORs, the Certificate of the conducting / incharge Advocates made to be filed mandatory mentioning therein Bar Council Enrolment nos. in support of cases; like SLP/WP/Applications etc. concerning the merit of the matter, as well as signature of the Translators be taken on the translated documents, so that no one should escape himself before the Hon’ble Court from the responsibility, so that litigants interest be fully protected in the dispensation of justice.

Now the case is adjourned for 7.12.2010 for hearing of the parties, and we hope by some solution the Public at large interest will be protected by the Hon'ble Court.

General blogging

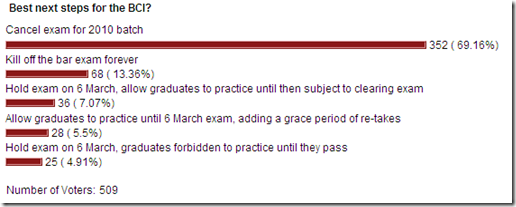

A total of 13 per cent want the exam to be scrapped forever, while roughly the same percentage were content with an exam in March, subject to them being allowed to practice until then.

Less than 5 per cent think the BCI should hold the exam on 6 March and not allow graduates to practice until after they pass it.

This is a fairly unexpected result, also judging by the regular comments left on Legally India by disgruntled students. And after all, most graduates can be expected to vote in their own interest and in favour of making their life easier by not having to study for and sit another exam.

Perhaps more interesting than the results, however, was a technical glitch.

Due to a technical error on Legally India, which was entirely my fault, multiple voting was possible on the poll in the first 24-odd hours.

Total votes rapidly climbed to more than 1,200. We fixed the error when we noticed it by consolidating all duplicate votes, reducing the total vote count to only 251 (don’t worry, no legitimate votes were lost, even of multiple voters!).

But on further analysis of the recorded voting data it became blatantly apparent that at least 15 voters had submitted between 50 and 120 votes each. Yes, 120!

And, of the worst offending duplicate voters every - yes every single one - voted to have the exam cancelled either completely or just for the exam for the 2010 batch. Over and over again.

For the most click-happy voters this process took an average of between 10 and 30 minutes of repeatedly clicking “Vote”, “Back” and “Vote” again, or refreshing the page over and over again.

Now again, let me raise my hands and say that the only reason that this was even possible is because of my own clear and admitted negligence, and you can not expect a poll which allows multiple voting to not get abused.

However, several questions can now be asked, employing some cod psychology.

- Do some 2010 grads hate the idea of the bar exam so much they are willing to ‘cheat’ slightly and spend considerable time and effort to try and skew the results?

- Why did only those 2010 grads opposing the bar exam from being held spend so much time trying to rig an online poll? Some of those who voted for the other options did vote more than once, but roughly 90% of all of the almost 1000 duplicate votes wanted to scrap the exam.

- Do those opposing the exam completely this year or forever have lower moral standards about what, although benign, must have been apparent at the time was ‘cheating’. I.e., is opposing the bar exam the preserve of the ‘bad’?

- Do ‘good’ students who do not ‘cheat’ do not oppose the bar exam as vehemently?

Food for thought or random correlation?

And for the avoidance of doubt, no offence intended to any ‘cheaters’, nor is this blog meant to address any of the relative merits of having a bar exam or not having one, nor am I saying that it is wrong or right to oppose or support the bar exam. Nor, just to be clear, do I mean that all bar exam opponents are ‘cheaters’ (clearly not, judging by the poll result). All I looked at here in this blog was the statistical correlation between ‘cheating’ and not ‘cheating’.

Call it an unintentional psychological experiment if you will.

Anyway, should we hold another poll to find out what you think?

General blogging

---------- Forwarded message ----------

Date: Fri, Nov 19, 2010 at 12:59 PM

Subject: Judgment of British nature.

To:

Judgment of British nature

Date: 19th November 2010.

To,

Hon'ble The Chief Justice of India and other Hon'ble Judges of Supreme Court

New Delhi.

India.

Your Lordship,

I am writing this in the background where the Supreme Court in SLP(C)No.32855/2009 & SLP(C)No.32856/2009 says that it is a bad idea to inform people of this Nation as how appointment and transfer of Supreme Court Judges takes place, saying that it would adversely impact the independence of the judiciary. http://www.zeenews.com/news668926.html

I have FOUR uncomplicated arguments to justify complete disclosure of the process of Appointments of Judges at Supreme Court of India.

The mail is slightly long. The issue too is quite serious.

Argument first-

No Indian will dispute, we the contemporary people of India breathe fresh air of freedom because of the countless bloodshed sacrifices of then brilliant people of India. Their sacrifices were selfless.

In our vast, beautiful, geographical landscape of Independent INDIA, i.e. Bhaarat, the Constitution of INDIA (Governing Volume), which came into existence on 26th January 1950, is the supreme & fundamental governing volume.

This epic governing volume makes a categorical announcement in the introductory passage that people of INDIA are the architect of this volume. The announcement assumes significance because by this announcement, the framers of our constitution propose to acknowledge and give tribute to selfless sacrifice of every men & women who devoted their life for the independence of INDIA.

Every letter & word of this governing volume represents the wishes and ambitions of the then people of India; and our law makers, the government, the judges and the bureaucracy owe their origin and discharge their all responsibilities while taking inspiration from this peoples' governing volume.

The Constitutional courts, while dealing with any constitutional or fundamental issue before it for adjudication, while looking at the relevant words of the constitution, also looks behind the words of the constitution, i.e. what is the history behind those words.

The court looks into historical national event relevant to the issue at hand. Like for example- Without turning the pages of history, it can very well be said that during colonial times of British, the people of India were not having any say nor they were knowing how appointment of judges were made. Those were the judges who has conducted farce trial of Balgangadhar Tilak and sentenced him for sedition and ordered the hanging of our Bhagat singh.

Therefore, while constitutional courts ventured to decide on issue of appointment of judges, should consider answering this question- Should it be presumed that the then people of India has decided that colonial opaque practice of appointment of judges be continued ? Should it be presumed that people have decided that they will have no right to know how judges will be appointed ?

Like a man write his WILL and wish that after his death his properties shall be given to these people, it appears to me that every letter of Constitution of India exhibits the Solemn WILL of our freedom fighters, wherein we the people of INDIA are made the beneficiary. Nevertheless, the bounden duty remains on our High Courts & Supreme Court to secure that WILL of the testators (read freedom fighters) being of transparency in the administration of the nation is followed.

Argument second-

This Nation has been an elective democracy where people "elect" their representatives, who in turn make laws for them. When people of India have power to elect who should make laws for them, it is quite prudent and reasonable to say, and no man should dispute, people too have power to know, how men (read judges) are "selected" at Higher Court in the country, who are nearly given "legislative powers" under the Constitution of India, for they are court of Record, and near absolute legislative powers under Article 141 of constitution of India are conferred upon Supreme Court of India.

And therefore it comes to my mind, that, judges of higher courts, every word they utter in the court, at times, shapes human lives for generations; and sometime allow women and men to sense deep breath of safety. And if we merely look at Article 21 of constitution, and see their utterance and we will only amaze the kind of concern the judges have displayed and the service this Judicial institution has done to Indian mankind. The mercies are numerous. The reverse of this is - A single corrupt at these high constitutional office is far more dangerous to a civil society than dreaded dawood ibrahim, Taliban and all militants put together.

Therefore, the people of India are the most interested party to know and check appointments at these constitutional offices, the High Courts and the Supreme court.

Argument third -

In fact it is my argument that the People of India has a right to know the process of Appointments of Supreme Court Judges to secure the independence of Judiciary.

Whereas it is argued that independence of Judiciary as envisaged in our Constitution will be immediate casualty, can the Supreme Court satisfy to the People of India, on THREE counts-

(1) That there is ZERO INFLUENCE of influential Government in the selection of Judges, i.e. there has been not a single case been brought or alleged as selection of Judges at Apex Court is influenced by the Government;In fact, the fascination of People of India to know the selection process of Judges at Apex Court, is to ensure the independence of Judiciary as envisaged in our Constitution.

(2) That no practice of Nepotism is followed in selection of Judges, i.e. there has been not a single case been brought or alleged as selection of Judges at Apex Court is influenced by the Nepotism;

(3) That there is no dissent ever heard of from any of the Judge of High Court alleging arbitrariness and non transparency in the selection process.

Argument fourth -

As I see, one of the most convincing argument for full disclosure of information about Judges appointments is -

"In the scheme of Justice, the voluntary display of profound transparency is unique characteristics hallmark of Judges as they discharge their solemn duties in open public court and NO independence of this worshipped institution is seen endangered if also profound transparency is solemnized by Judges in their administrative exercise of selection of Judges".

My Nation is not safe in the present Judgment of British nature.

In view of the importance of the issue, I have taken the liberty of circulating this letter to Media & other stakeholders of our democracy.

--

-- iN APPRECIATION,

Sandeep Jalan

Advocate

093 22 67 1212.

C/o Janhit Manch

Kuber Bhuvan, Bajaj Road, Vile Parle West,

Mumbai - 400056.

General blogging

What is your first reaction when you come across a Eunuch or transgender or in Indian context ‘kinnar’, ‘hingra’, or a ‘chakka’?, One runs away from them or at most gives them a handsome amount of money to get rid of them but the impression every citizen of this worthy country carries is that “they are a stigma on the society”. Why are they considered a stigma?,

As they are Unacceptable part of the society because they don’t live like a normal human being or to be precise they don’t have normal sexual orientation, is this impression correct?

A transgender is a normal Human being capable of fulfilling all his duties as a citizen of a country. A normal human baby male or female is always born with both male and female hormones, the exposure which they get lead to decide there feelings as a male or female. A person who has been exposed to more female domination from his tender age develops feelings as a female and starts feeling like one and in his adolescents age wants to fulfill his desire by dressing like a female, carrying the same attitude as a female does, which is very much unacceptable by the society at large. This ill attitude of people towards them forces them to test there gender identity.

General blogging

This blog specifically deals with property Agreements that are ordinarily executed between Developers, the Landlord, the Tenant and the members of the Co-operative Housing Societies.

This blog originated when one of my dear friend Kamal Ladia approached me for studying the Re-development (proposed) agreement that was given to him by the Developer. I said-yaar I am not aware of complex development & property laws. Kamal has already took opinion from one his friend who is a Developer.

Kamal pointed out to me some hidden technical legal meaning, quite different from plain meaning, of one clause in that proposed agreement, and I found myself in utter surprise.

And I thought if one goes by the plain meaning of the clause, he will certainly be cheated. It is impossible to understand the technical legal meaning of that clause unless the man or a lawyer is well versed with those specific laws.

And I thus advised my friend as this-

Set-up your mind what specifically and broadly you seek from the Developer. Consult with your Solicitor/Advocate to know what you are entitled to under the law.

Once this is done, record a brief and very to the point “Letter of Offer” to the Developer thru your Solicitor / Advocate. This letter must state in very clear / categorical / unambiguous terms and language what you want from the Developer. The terms may be in the form of Option 1, Option 2 and so on. This letter shall call upon the Developer to prepare the final Agreement in the context and backdrop of this “Letter of Offer”. This "Letter of Offer" may also be referred to as "Instrument of fundamental / core terms".

This “Letter of Offer” must be produced / manifested in verbatim in the final agreement.

The final agreement must specifically mention that this Agreement is made in pursuant to the “Letter of Offer”. The said Agreement shall also state as what Option, i.e. whether Option 1 or Option 2, the Developer has agreed to. If there is any negotiations with regard to Options, the same may be finalized and a fresh “Letter of Offer” may be prepared, without any options.

The final Agreement shall state that Parties to the Agreement have expressly agreed that all terms and conditions or any Clause of this Agreement which is found to be inconsistent or frustrating or varying or diluting the terms of “Option” so agreed in “Letter of Offer”, expressly or by necessary implication, shall be deemed to have been infected / suffering from / with “undue influence” or misrepresentation or both and not accepted by the Tenant notwithstanding he subscribe his signature to this final Agreement and the Agreement shall be voidable at the option of the tenant.

There must be a clause in the final Agreement to the effect that while interpreting the terms of this Agreement, if there appears to be conflicting meaning between the terms of the “Option” in the Letter of Offer and terms of this final Agreement, the terms of the Option shall prevail over the terms of agreement.

The terms of the “Option” in Letter of Offer” shall demise only in one situation and that is, if any of the term of the “Option” in “Letter of Offer” is held by competent authority to be manifestly / expressly going against the laws of the land and in that scene the Developer is at liberty not bind by that term.

The efficacy of this approach is uncertain to me and the learned people who routinely deals in these kind of agreements can only offer their views on the same. And I humbly request for the same.

Sandeep Jalan (advocate)

Mumbai.

General blogging

Can anyone please advise on sec 138, if a PDC cheque is bounced on account of EMI, signed by a director of a pvt limited company, the loan was a commercial loan by the bank, wherein due to business loss the company could not pay the EMI amount when due. the cars were repossessed and sold by the bank for a considerable amount, can the director be prosecuted for cheque bounce under sec 138 and what are the implications of sec 142 of N.I Act.

General blogging

This is on the recent order of the Delhi Government ordering closure of shops, establishments and cinema halls in the national capital on Oct 3rd & 14th on the sidelines of the Common Wealth Games - More of a security measure, this would paralyse normal life and result in loss of earnings to shop keeps, Cinema Hall Owners etc., Can this be construed as a 'Bandh'? A Bandh need not be necessarily be called by Political parties or activists. This is my view. Views and expressions invited for debate.

General blogging

I'm always surprised as to why non-judicial minds are given authority to decide litigations. I'm practicing at District Kathua (J&K) since last more than nine years. According to the J&K laws, the revenue appeals are heard by the revenue officers, who either are the IAS or KAS Officers. And to everyone's surprise only 5 to 10% of these Officers do possess the knowledge of law. To add the chaos, I must tell you, all of these Officers are entrusted with the primary job of Administration and they are so occupied in their Administrative jobs that they hardly find time to dispose off the litigations/appeals and concequently the judicial files are piling up in the Revenue Courts and the disposal is almost negligible. Most of the times, the litigants find that the Officer is busy in attending the meeting involving the agenda of administration, like to discuss the measures of any calamity, prepare for the Minister's visit, prepare for the Board Meeting, Issues involving tranquility, etc, etc...

My suggestion to the Government is that why not a special post be created at the District or Sub-District level, headed by the Presiding Officer having the knowledge of law and entrusted with the exclusive authority to dispose off the litigations only. In this way, the long pending matters would be easily disposed off and the litigants would also get speedy justice, afterall we have been grown up listening "Justice delayed is Justice denied".

I hope through this blog, the eminent and busy lawyers may get time to think on these notes.

Thanks for the patient reading. The comments of the readers are solicited.

General blogging

This blog originated in the felt need to ponder where it is found that Indian Public authorities are fascinated to interprete laws to their convenience and logic and issue notices as they deem fit, completely devoid of spirit of the enacted laws.

In modern democracies, wide powers vest with Legislators, Judges, with Govt, and with Bureaucrats. Each group, if it so wishes, may act quite fancy, in any or all the ways thus far specified hereinafter. Nevertheless, the authorities in charge may be disproportionately rude if you happen to be in even irrelevant shortcoming. The Scent of power is immense.

The Public Servants / Officials were deemed heard, saying, in the words of learned Professor Upendra Baxi-

(1)As an Authority of Public Power, I have this and that power. I exercise it in this or that manner because I so wish. The only good reason which I exercise my power this or that manner is that I wish to exercise it in this or that manner;

(2) As an Authority of Public Power- I may so act as to favour some and disfavour others;

(3) As an Authority of Public Power- I may so act as to give an impression that I am acting within my powers but in reality I may be acting outside it;

(4) As an Authority of Public Power- I may decide by myself what your rights and liabilities are without giving you any chance to be heard, Or I may make your opportunity to be heard a meaningless ritual;

(5) As an Authority of Public Power- I may decide but declines to let you know the reasons or grounds of my decisions or provide reasons without being reasonable;

(6) As an Authority of Public Power- I may use my power to help you only if I am gratified in cash or in kind;

(7) As an Authority of Public Power- I may choose to use my power only after a good deal of delay and inconvenience to people;

(8) As an Authority of Public Power- I may just refuse to exercise the powers I have regardless of my legal obligation to act and regardless of social impact of my inaction.

Also, I am given to understand that, all Writs that are filed before High Courts’, 70% of it constitutes the illegal notices that are challenged, so issued by army of public authorities in India, in the pretence of their implied and undefined discretionary powers.

The Supreme Court of India in Nawabkhan Abbaskhan v State of Gujrat allows every person the discretion to make his own decision and disobey the order of the government, if in his opinion, it is illegal. Of course he is answerable and liable, if he turns out to be wrong. (1974) 2 SCC 121; AIR 1974SC 1471.

This is how the above proposition came to establish in our land--

(1) An externment order was passed against one person. He refused to obey that order.

(2) He was prosecuted under section 142 of the Bombay Police Act 1951 because he had violated the externment order passed by the Police commissioner.

(3) He was acquitted by lower court.

(4) The State went into appeal to High court. The accused challenged the validity of the externment order itself. The High court raised a question to itself- “Whether a person can disobey the order with impunity which he thinks is illegal although the order subsequently may have been quashed for being illegal”.

(5) This is what High court said- “There is no principle in upholding the Respondent's (accused) claim that he has a right to violate an order passed by an authority having jurisdiction to pass it, although subsequently he can persuade the court that there was an inbuilt lacuna or latent defect in the said order. In other words he claims to have a right to judge for himself whether it is legal or illegal and in anticipation of court upholding his contention, the right to violate it with impunity.”

(6) The accused went into appeal to supreme court. The Supreme court reversed the order of the High court and said- “The individual decision making by private persons of public actions may be considered as a very radical approach. Grave consequences are involved in allowing discretion to disobey, someone may argue, may first lead to anarchy and then to tyranny. But what is the remedy available to a person who has been subjected to an illegal order. Our legal system does not recognize the right to compensation for damage suffered by a person in obeying an invalid order.

Thus the Supreme Court allows every person the discretion to make his own decision and disobey the order of the government, if in his opinion, it is illegal order. Of course he is answerable and liable, if he turns out to be wrong.

However, today any talk about discretion to disobey may sound seditious. In India where judicial process grinds dead slow and grievance procedures are feeble and inefficient, perhaps the discretion to disobey may provide an effective check on the operation of the government machinery in a reckless manner.

There can be many different legitimate ways of dealing with served illegal notices. In my limited knowledge as on today, there can be two ways to deal with those illegal notices.

ONE- The one who is served a notice, which he thinks as patently illegal, should in the first place, make a suitable representation before that issuing authority. If the authority refuses to relent / listen, then, should file a Writ Petition in the High Court concerned under Article 226, not for quashing of that notice, but for directing the public authority concerned to pass appropriate speaking Order on the basis of representation made to that authority. The Orders passed by Public authorities, generally termed as administrative Orders, though are not Court Orders, yet, the Public authorities are bound to listen to the affected persons where it seeks to interfere with the rights of the persons by way of their notices and they are bound to assign reasons for their decisions. Readers may pls refer this link: http://commonlaw-sandeep.blogspot.com/2009/07/litigants-must-fight-for-reasoned.html

TWO- The one who is served a notice, which he thinks as patently illegal, should file a Writ Petition in the High Court concerned under Article 226, asking the Hon'ble Court to dwell upon the limited issue of interpretation of that law, in the exercise of which the illegal notice was issued and asking the Hon'ble Court to settle the position of law, also, so that all litigation in respect of that law, that may arise in future, may be avoided. And once the Court ventures to settle the position of law, you win. The relief you get of quashing of that impugned notice is consequent and automatic of that settling of that law. Therefore, it is quite important to frame appropriate question of law that may be posed before the presiding Judge to dwell upon and adjudicate thus.

It is not desirable to seek directly the quashing of order, in my view. There can be two reasons for not directly asking this Relief before the Hon'ble Court. One- the High Court may refuse to exercise its extra-ordinary jurisdiction under Writ, saying you have alternate remedy and remedy under Writ is yet to crystallize. Second- it may exercise its extra-ordinary jurisdiction under Writ, but, it is quite likely, I feel that, unless the Advocate specifically ask the Hon’ble Court to decide the question of law involved, the Hon'ble High Court may venture to refuse to give you any relief, even without dwelling upon the letter & spirit of law under scrutiny.

There is, I think, fundamental difference between asking the High Court to quash the illegal notice or asking the High Court to settle the position of law. The High Court may refuse to exercise its jurisdiction in the former case, but it cannot refuse to exercise its jurisdiction in the latter, for it is the prerogative of the High Court to settle the law.

And I tell you, in Writ cases, in my strong view, if you succeed in satisfying the Court about jurisdiction, you have won half the battle.

How to file a Writ- may pls check below web link

http://commonlaw-sandeep.blogspot.com/2009/04/how-to-file-writ-petition-or-pil-writ.html

Sandeep Jalan (advocate)

Janhit Manch, Kuber Bhuvan, Bajaj Road, Vile Parle West, Mumbai- 400056.

General blogging

Like a man write his WILL and wish that after his death his properties shall be given to these people, it appears to me that the mandate of Constitution represents the WILL of our freedom fighters to which we the contemporary people of INDIA are enjoying the legacy of Independence and breathe fresh air of freedom. Nevertheless, the bounden duty remains on our High Courts & Supreme Court to secure that WILL of the testators is given effect to.

In our vast, beautiful, geographical landscape of Independent INDIA, i.e. Bhaarat, again, the Constitution of INDIA, which came into existence on 26th January 1950, is the supreme & fundamental governing volume. This epic governing volume makes a categorical announcement in the introductory passage that people of INDIA are the architect of this volume. The announcement assumes significance because by this announcement, the framers of our constitution propose to acknowledge and give tribute to selfless sacrifice of every men & women who devoted their life for the independence of INDIA.

The origin & the authority of the Indian legislatures, of the Indian govt, of the Indian judiciary and of the Indian bureaucracy flows from this “Peoples' Governing Volume”.

Every injunction of this governing volume represents the wishes and ambitions of our countless freedom fighters; and our law makers, the government, the Indian judges and the bureaucracy owe their origin & discharge their all responsibilities while taking inspiration from this “Peoples' Governing Volume”.

And therefore I will say that this fundamental governing volume should not be read and interpreted like any other statutes of legislatures. This fundamental governing volume is to be read and interpreted keeping in mind the aspirations & demands of people then who were instrumental to our national freedom movement, the aspirations which can be found in various injunctions of this fundamental governing volume.

And therefore, should this governing volume, i.e. constitution of INDIA and the legislations, laws, bye laws, rules, regulations, resolutions, policies, notifications that get sanctity or flows from the constitution itself, be read & interpreted overlooking the events that has characterized our national movement and which paved our way to Independence on 15th of august 1947 ? And, should the Constitution of INDIA and the legislations, laws, bye laws, rules, regulations, resolutions, policies, notifications that get sanctity and flows from the constitution itself, be read & interpreted while continuing the discriminatory behavior, non transparent & suppressive policies of governance that were existing at british times.

In my considered view, the Constitutional courts, while dealing with any issue of constitutional importance before it for adjudication, while looking at the relevant words of the constitution, should also look behind the words of the constitution, i.e. what is the history behind those words, i.e. the court may look into historical national event relevant to the issue at hand.

Like for example-

Without turning the pages of history, it can very well be said that during colonial times of British, the people of INDIA were not having any say nor they were knowing how appointment of judges were made. Those were the judges who has conducted farce trial of Balgangadhar Tilak and sentenced him for sedition and ordered the hanging of our young beloved Bhagat singh. Therefore, while constitutional courts ventured to decide on issue of appointment of judges, should consider answering this question- should it be presumed that the then people of INDIA has decided that colonial opaque practice of appointment of judges be continued ? should it be presumed that people have decided that they will have no right to know how judges will be appointed ?

Also, it comes to my mind that Bhagat singh, Bal gangadhar Tilak, Mahatma Gandhi, Subhash Chandra Bose, Maulana Azad and many countless brilliant laid down their entire life to seek freedom from British rule, not because for the sake that they were white Englishmen, but because these white Englishmen were practicing discrimination, inflicting merciless exploitation on Indian poor lot and devising suppressive penal laws towards Indians. The British govt decision making process were non transparent and Indians were not consulted. Britishers were told to go back not because merely we wanted our men at place of power but because it was seen that Britishers didn’t gave dignity of life to the Indians.

Our then national leaders thought that if INDIA will be ruled by its own people, there will not be any discrimination, there will be no exploitation and no suppression that is existing in British colony. It was thought that if Indians will rule, every policy of discrimination, exploitation & suppression will be repealed at the threshold.

It comes to my mind a stray thought that if our then leaders were short sighted to have thought that Indians will govern their fellow brothers & sisters with great care & respect. There is hardly any need to establish that people of INDIA are worse governed by their own counterpart.

It is painful and equally frustrating to see that we the Independent people of INDIA have in many respects continued with British system of ruling. The first thing that immediately comes to my mind is liberty of people vis a vis personality of Police. In British times, then people were so scared of then police for they have assumably and presumably given super powers to arrest and put any one in the lock-up. Freedom fighters and inconvenient persons were put behind bars on the pretext of non bailability of offences.

Nothing much has changed in modern Independent INDIA. We the people yet are so afraid of police for they have assumably and presumably continue to have super power to arrest and detain anyone in the lock up. In today Independent INDIA, a man is liable to be arrested merely on a complaint of non bailable offence if so registered with the police.

Today, we have forgotten that these were the issues of liberty for which our then leaders and countless people have fought with the British. Our govt still blindly follow bailability of offences and interfere with most cherished i.e. liberty of a individual. Whereas we are though gifted with shield of landmark Judgment given by Hon Supreme Court in Joginder Kumar case in 1994, yet arrests are effected with fascination of ignorance. In Joginder Kumar case Supreme Court has given clear guidelines for arresting any one. Readers may check this link. one has to copy and paste to get access to this link. http://commonlaw-sandeep.blogspot.com/2009/06/final-word-on-law-of-arrests.html

I will say that we the people, though enjoying fruits of Independence and also enjoying public holidays earmarked in the memory of our brilliant freedom fighters, but otherwise we have severed our ties with history of freedom struggle and we have merely moved forward and we have forgot the issues for which the freedom was sought from the Britishers.

It also feels that we the people of INDIA have not properly understood our freedom struggle or perhaps the history is not told to us in the right way. Moreover, it also comes in the mind that this “People's Governing Volume” is interpreted like any other act of legislature.

I will also add here that "a constant affair with thy nation" should become personal obligation of every Indian citizen.

Sandep Jalan(advocate)

Mumbai.

General blogging

<!-- @page { size: 21cm 29.7cm; margin: 2cm } P { margin-bottom: 0.21cm } -->

A Less interesting Case took nearly two hours of Bombay High Court (dated 24.09.2010) and the Division Bench at Court No.2 presided by Smt.Justice Ranjana Desai and Mr Justice R.V. More were constrained to observe and say to the arguing Counsel-- So should we discharge rest of the Board for the day ? I tell you, its the most learned Bench I have ever seen in my brief exposure to Bombay High Court. Both Judges were found shooting relevant questions to every arguing Counsels, that I have never seen so far.

The facts leading to the filing of above cases by Hindustan Coca Cola (5510 of 2010) & Pepsico India (5867 of 2010) are few and simple. Sangli Municipal Corporation issued Notice / Bills of Octroi to be paid on Re-usable Empty Glass Bottles of Beverages to above parties. It is the case of Sangli Municipal Corporation that above parties have imported within municipal limits, say about 100 filled Soft drink Glass bottles and therefore, they are liable to pay Octroi on 100 Re-usable Empty glass bottles.

And Parties, instead of making due representations before the Sangli Municipal Commissioner, preferred, though rightly, a Writ, challenging the notices / Bills. Interim relief were granted to parties and Municipal authorities were directed not to take any action till further order of this Hon'ble Court.

The Sangli Municipal Corporation were heavily relying on Judgment of Hon'ble SC in M/s Acqueous Victuals Pvt. Ltd. v. State of U.P. and Others, JT 1998 14 SC 195. Although the facts of the case in this case were quite different that from present case at hand, the above judgment, among other things, stated that Parties may claim refund of octroi after paying the same and also that principles of Sales Tax and Excise cannot be applied in cases of Octroi.

The Counsels of Pepsico (Sr.Advocate Janak Dwarkadas & Learned Advocate Rajeev Talasikar) were also in fact relying on above SC Judgment and also one unreported Judgment of SC in S.M. Ram Lal & Co. v. Secy. to Govt. of Punjab and were of the view that in the light of interpretation of relevant words "consumption, use or sale”, no liability to pay Octroi accrues.

The Counsels of Coca Cola (Learned Advocate Madhur Baya & the team of Economic Law Practice) were vehemently arguing that in fact they have already paid Octroi on the Glass Bottle, as they are already paying Octroi on the filled Bottles.

In a way, both Counsels were absolutely correct in their views. But in my humble view, learned Counsels there have failed to appreciate the spirit of Octroi Taxation. And, also, they have failed to appreciate that the Judgment on which Sangli Municipal Corporation were heavily relying upon is in fact in their favour.

The Hon'ble SC in M/s Acqueous Victuals Pvt. Ltd. v. State of U.P. and Others observed in para 21 of the Judgment that principles of Sales tax cannot be applied in Octroi. The Hon'ble Apex Court is very right when it says that principles of imposing Octroi cannot be equated with other taxing statutes. Let me try to illustrate this principle.

Every goods that is manufactured is subject to Excise duty, but the same goods is not subject to Octroi unless that goods is transported to another municipal limit. The short point I am making is that -- “A goods is not subject to Octroi unless it knocks the doors of a Municipal limit expressing its desire to enter into its limits, for consumption, sale or use." Therefore, a goods manufactured is certainly going to be Excised but that goods may or may not attract Octroi. Both taxes operate on different principles.

The sweeping spirit of Octroi Tax is that it becomes payable when the goods are imported within any municipal limit for the purposes of consumption, sale or use; In the present case, it is no case of the Municipality to say that the Parties have brought in Empty Bottles within the municipal limits; and therefore, when Octroi is demanded on empty bottles & empty crates, the taxing municipal authorities must be told to produce documents which show that the person has imported within that municipal limits empty bottles & empty crates.

It is a settled position of law that Taxing statutes are to be strictly construed and logic has little role to play and the persons’ liability to pay 'a tax' must be strictly brought within the four corners of the charging section. I take leave to repeat—“It is the case of Sangli Municipal Corporation that above parties have imported within municipal limits, say about 100 filled Soft drink Glass bottles and therefore, they are liable to pay Octroi on 100 Re-usable Empty glass bottles.”

In the last, I take liberty to take you to the observation of Justice CHINNAPPA REDDY in McDowell & Co Ltd versus Commercial Tax Officer (1985) 3 SCC 230-- “..... In our view, the proper way to construe a taxing staute, while considering a device to avoid tax, is not to ask whether the provision should be construed literally or liberally, nor whether the transaction is not unreal and not prohibited by the Statute, but whether the transaction is a device to avoid tax.”. In the above cases of Hindustan Coca Cola & Pepsico India, it is not the case of Sangli Municipal Corporation that they are evading to pay Octroi duty.

Therefore, the essential question (though not raised by Parties therein) before the Hon'ble Court is-- whether Octroi can be demanded on “Re-usable Empty glass bottles” on the premise that filled glass bottles were imported into municipal limits ?

Anyway, the case is reserved for Judgment. Let’s wait anxiously.

I have apprised Advocates of both parties to consider my this proposition of law and and they may consider to move appropriate Application before Bombay High Court in this regard.

Sandeep Jalan (advocate)

(Former employee at Rajeev & Associates)

Mumbai.

Unfolding "Commercial Purposes" as contemplated under the scheme of Consumer Protection Act of 1986.

General blogging

This blog is originated in the felt need to educate myself as what transactions constitutes “Commercial purposes” within the meaning of Consumer Protection (CP)Act of 1986. Section 2(1)(d) of CP Act 1986 stipulates who is a consumer within the meaning of this Act. Following all ingredients must be satisfied to show one is a Consumer of goods Services within the meaning of this Act to qualify as a Complainant-

(1) that he is a person, natural or body corporate;

(2) that person buys any goods / services for a consideration or at price;

(3) that person may have paid, or promised to pay, or have partly paid and partly promised for that purchased goods / services;

(4) He is also a consumer who consumes the goods / services purchased above, with the consent of the original buyer;

(5) The goods / services purchased must not be for reselling it;

(6) The goods / services purchased must not be purchased in the regular course of his/ her commercial or business activity.