Corporate / M&A

Corporate M&A

Chemicals company BASF India has sold its leather chemicals business to Stahl India Private Limited for Rs. 197.63 crores (USD 30.35 million) through a slump sale, as reported by Livemint and Business Standard.

Corporate M&A

Realty firm Embassy Group has entered into a joint-venture of about Rs 900 crores with US-based Taurus Investment Holdings in an SPV called Winterfell Realty Private Limited, to develop commercial projects, including an IT/ITES SEZ, encompassing 2.5 million square feet on a 10-acre land parcel as part of Phase III of the Technopark SEZ in Thiruvananthapuram, Kerala as reported by Livemint and The Economic Times.

Corporate M&A

Zee Entertainment Enterprises Limited (ZEEL) aquired 100% in 9X Media Private Limited (and its subsidiaries) from Rivendell PE LLC / New Silk Route Partners and other shareholders of 9x Media Private Limited. The deal was valued at Rs 160 crore, reported VC Circle and others.

Corporate M&A

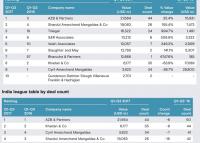

Massive Vodafone-IDEA merger continues causing quakes in league tables half a year after having been announced...

Massive Vodafone-IDEA merger continues causing quakes in league tables half a year after having been announced...

Corporate M&A

One does wonder whether all the Playboy publicity generated by Hefner’s death late last month would have positively affected valuations...

One does wonder whether all the Playboy publicity generated by Hefner’s death late last month would have positively affected valuations...

Corporate M&A

Hyderabad-based Itelligence India Software Solutions Private Limited, a subsidiary of Germany’s itelligence AG, acquired 100% of Hyderabad-based Vcentric Technologies Private Limited for an undisclosed amount. Vcentric had revenues of around Rs 72 crore and profits of Rs 1.59 crore in 2015-16, according to VCCircle.

Corporate M&A

Realty Major DLF Limited has entered into an agreement to sell a stake of 33.34% in its rental arm, DLF Cyber City Developers Limited (DCCDL) to Reco Diamond Private Limited, an affiliate of the Singapore sovereign wealth fund, GIC Group, in a multi-stage transaction for an aggregate value of US$ 1.9 billion, as reported by VCCircle and Business Standard.

Corporate M&A

"Monsanto is selling its branded cotton seeds business in India to Hyderabad-based Tierra Agrotech, although the US biotechnology major would remain invested in farming segments such as corn seeds, crop protection, vegetables and Bollgard II technologies," reported the Economic Times.

Corporate M&A

“A stake sale by DLF Ltd’s promoters to an affiliate of Singapore’s sovereign wealth fund GIC Pte Ltd will see capital infusion of nearly Rs 13,000 crore into India’s largest property developer,” reported Mint.

Corporate M&A

Smaaash Entertainment, a gaming and entertainment company co-owned by Sachin Tendulkar has entered into a definitive agreement to acquire a 100% stake in bluO entertainment, PVR's JV with Thailand-based Major Cineplex Group, B, through a cash acquisition deal for Rs 86 crores ($13.46 million), as reported by Livemint.

Corporate M&A

ASDA Media & Entertainment Private Limited (ASDA), an INDASDA Group entity, has acquired a significant stake in Moshe's Fine Foods Private Limited from South Asia Gastronomy (Mauritius) Enterprises LLC, a food and beverage portfolio company and platform of private equity firm, New Silk Route, as reported by The Economic Times and Deal Street Asia.

Corporate M&A

Engineering major, Larsen & Toubro (L&T) has entered into a definitive agreement for the divestment of its entire stake in its unlisted and wholly owned subsidiary L&T Cutting Tools, to IMC International Metalworking Companies BV, owned by the Warren Buffett-led Berkshire Hathaway Inc. for Rs. 174 cr ($27.18 million USD) as reported by Business Standard, Livemint and others

Corporate M&A

"International Finance Corp (IFC), the private-sector investment arm of the World Bank, will sell its entire 7.5% stake in Analjit Singh-led Max Group’s healthcare business for Rs 423 crore ($65.3 million)," reported VCCircle.

Corporate M&A

"Mars Food, part of Mars Inc said it has signed a definitive agreement to acquire Connecticut-based Preferred Brands International, known for its ready-to-heat Indian and Asian food products sold primarily under brand Tasty Bite," reported The Hindu Businessline.

Corporate M&A

"Dollar Industries Limited announced an equal joint venture with Pepe Jeans Europe BV. Pepe London would pump in ₹36 crore worth of equity as its contribution over four years," reported The Hindu.