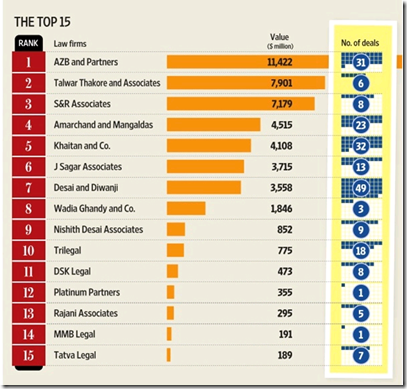

AZB & Partners was involved in at least 31 India-related M&A deals worth over $11.4bn in the 2011 calendar year but this was still 64 per cent less than the total value of deals it advised on last year ($31.4bn), according to data provider mergermarket.

Amarchand & Mangaldas & Suresh A Shroff & Co, Khaitan & Co, J Sagar Associates (JSA) and Desai & Diwanji, were the other law firms picking up most of the remaining M&A market share.

Wadia Ghandy, coming in at eighth position, was the only other firm where total deal values exceeded the billion dollar mark.

Nishith Desai Associates, Trilegal, DSK Legal, Platinum Partners, Rajani Associates, MMB Legal and Tatva Legal occupied the ranks from ninth to 15th in the league table with total deal values between $852m and $189m.

Desai & Diwanji came in top by the number of deals done at 49, followed by Khaitan with 32, and AZB with 31.

Middling deals

In 2010’s full year league table Amarchand had racked up 29 deals with a value of $9.5bn – more than double 2011’s figure.

“We’ve had our hands full but … I don’t think deal sizes were anything compared to last year,” said Ashwath Rau, corporate partner at Amarchand in Mumbai, adding that this did impact the revenue firms could generate with the deals. “Obviously the larger deals tend to generate larger billings and given that a lot of our clients are global players, the pain they were experiencing resulted in pressure in pricing.”

“I think that despite all the doom and gloom around we yet find there is quite a lot of activity,” commented Akshay Chudasama, Mumbai-based corporate partner at JSA, and profit margins of work continued to be good. “But of course, compared to the 2007-08 boom where people were just closing deals on any teams, most of our clients are far more cautious about the transactions,” he said.

“The effort it’s taken to get deals closed is signed is greater,” agreed Rau.

Trilegal in 2010 had a deal volume of 13 worth $11.4bn, which last year decreased to only $775m.

Describing 2011 as “more in the mid market” than previously, corporate partner and CEO at AZB Mumbai, Abhijit Joshi, said that billings were still good for the year because smaller deals could be as complex as larger deals. But he admitted that 2011 saw no mandates as complex as some of the previous year’s biggest deals.

The only Indian firms that added to their deal volume in 2011 were Khaitan & Co and JSA. Khaitan & Co increased its tally of recorded deals from 14 worth $3.4bn, to 32 worth $4.1bn in 2011.

JSA in 2010 had recorded only $322m of deals – in 2011 mergermarket picked up more than 10 times as many from the firm.

Foreign firms ranking (source mergermarket)

| Law firm | Value (US$m) | Deal Count | % Value Change against 2010 |

| Linklaters | 8,939 | 6 | -28.10% |

| Allen & Overy | 8,693 | 3 | -61.10% |

| Vinson & Elkins | 7,200 | 1 | 783.40% |

| Herbert Smith/Gleiss Lutz/Stibbe | 6,261 | 3 | -41.50% |

| Conyers Dill & Pearman | 5,460 | 1 | 1438.00% |

| Slaughter and May | 5,460 | 1 | - |

| Kirkland & Ellis | 2,411 | 3 | 1370.10% |

Early-year headstart, tailing off

“2011 saw 244 M&A deals in India, registering a total transaction value of US$ 29.2bn. This was significantly lower than 2010’s 294 deals with an aggregate value of US$ 51.8bn, with Q4 2011 representing the worst quarter in terms of M&A value since 2005,” said mergermarket in its press release.

In fact, all five of the largest deals with law firm advisers known, took place in the first quarter of 2011.

“2012,” said Joshi, “is anybody’s guess. But I don’t think it’s going to be as gloomy as people make it out today.”

The largest deal of 2011 was the $7.2bn joint venture between BP plc and Reliance Industries Limited (RIL), which bumped up a total of five Indian and foreign law firms in the deal values league tables. Talwar Thakore & Associates advised BP together with its London-headquartered relationship firm Linklaters LLP, while AZB that worked with Allen & Overy (A&O) for RIL.

Without that $7.2bn Reliance-BP bump AZB would have been just behind Amarchand in the league tables at $4.2bn, while Talwar Thakore Associates would have come in after Trilegal.

S&R Associates and Slaughter and May managed to snag a role on the second biggest deal: Vodafone Group’s $5.5bn buy of a 33 per cent stake in Vodafone Essar from the Essar Group, opposite Herbert Smith.

Amarchand acted on Siemens AG’s 19.8 per cent stake buy in Siemens Limited for $1.4bn.

On iGate Corporation’s buy of Patni Computer Systems for $1.2bn, S&R; AZB, JSA and Wadia Ghandy advised the exiting sellers with foreign firms Paul Weiss Rifkind Wharton & Garrison; Day Pitney; Hogan Lovells. iGate was represented by Khaitan & Co, with Ashurst and Kirkland & Ellis.

On the Government of Singapore Investment Corporation and Bain Capital LLC’s investment in Hero Investments, valued for the purpose of mergermarket’s league table at just under $1bn, AZB, Desai & Diwanji and JSA advised.

‘Horribly underreported’

Mergermarket stated: “All data is based on announced transactions over $5m. Deals with undisclosed deal values are included where the target’s turnover exceeds $10m. Deals where the stake acquired is less than 10 per cent will only be included if their value is greater than $100m. Activities excluded include property transactions and restructurings where the ultimate shareholders’ interests are not changed. All data excludes minority stake deals (10 to 30 per cent) where the dominant target geography is Asia-Pacific and the deal value is less than $100m.”

But two partners of top-seven-ranked M&A firms told Legally India that they estimated internally that their deal counts were actually around double the figure captured by mergermarket.

“We are horribly underreported,” he said, explaining that client confidentiality and other internal firm issues meant that some deals would never count the tally.

One partner estimated that the uncounted deals might have added around $1bn to the firm’s overall deal value tally.

A shorter version of this article was originally published in Mint today.

Previous mergermarket M&A law firm league tables:

threads most popular

thread most upvoted

comment newest

first oldest

first

threads most popular

thread most upvoted

comment newest

first oldest

first