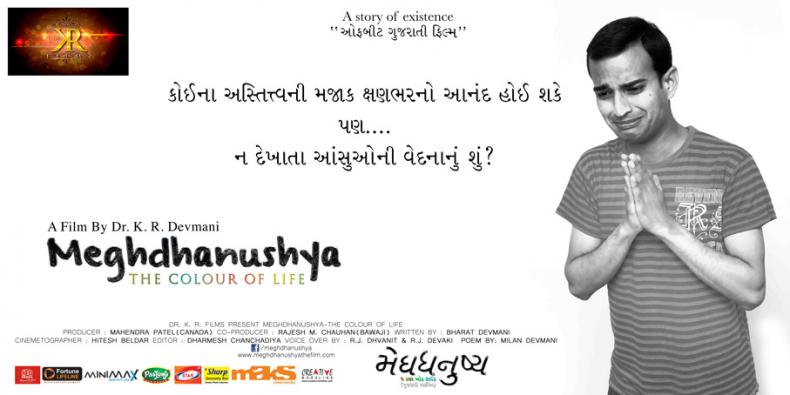

On September 15, the Supreme Court bench of justices Anil Dave and Adarsh Kumar Goel expedited a pending hearing on admission of SLP, and granted leave thus converting it into a civil appeal, even while continuing the ad-interim relief granted earlier. In the normal course, it would not have raised eyebrows. But when it became known that the subject of the SLP is about the Government’s denial of tax exemption to a film on gay sex, Meghdhanushya, (meaning a spectrum or a rainbow) it made news and rightly so. The film centers around a young boy who finds himself attracted to persons of his own sex.

The SLP filed by the Gujarat Government was heard twice earlier.

On April 15, 2014, a bench comprising justices Dave and Shiva Kirti Singh stayed the High Court’s judgment directing the state Government to exempt the film from paying entertainment tax, and issued notices to the parties.

On October 17, 2014, the bench comprising justices Dave and Kurian Joseph, wanted it to be listed on a non-miscellaneous day in the 2nd week of January, 2015, and allowed the interim order staying the High Court verdict to continue. But the matter got listed before Justice Dave’s bench only on September 15.

The grant of leave by the Supreme Court effectively converts the SLP into a Civil Appeal, which will be heard in due course, and if the present queue of civil appeals is any indication, it may take about three to four years. The filmmaker, Kiran Kumar Rameshbhai Devmani, is naturally disappointed with the outcome.

The 45-page Gujarat high court judgment makes a fascinating reading on the merits of the state Government’s contentions against the grant of entertainment tax exemption to the film. Delivered by Justice Akil Kureshi, on behalf of himself and Justice Ms.Sonia Gokani, on February 28, 2014,

The high court noted that the grounds of exceptions to grant of exemption from entertainment tax to a film are that the film is based on evil customs, blind faith, sati, dowry, and such other social evils or is against the national unity.

But the high court found that the film does not fall under any of these exceptions. “Merely because the subject of the film is thought provoking, forces the viewer to come out of the comfort zone and face the subject which is often sought to be swept under the carpet would not mean that the film is either controversial or objectionable”, the high court held.

The high court also found that another contention of the government that the film cannot be watched by an entire family together because it received ‘A’ certificate, is an impermissible ground for rejecting the application for tax exemption.

The high court also noted that the offending words ‘eunuch’ and ‘impotent’ have already been deleted at the instance of the Censor Board.

The government then had objected to two scenes in the film.

In one, a teacher is shown patting girl students on their back; and in another, a character admonishes a woman for getting an abortion in her desire to bear a male child.

The high court found that mere mention of a teacher’s habit, even if undesirable does not make the film objectionable, and the reference to abortion is in no way encouraging but seems to be discouraging the person.

The high court also concluded that the one sentence or an utterance cannot be picked in isolation to project that a character is either encouraging or propagating a gay lifestyle or sexual preference.

In essence, the high court said, the character in question asserts the right of a gay person to lead life with human dignity. Even a person with homosexual preference as human being has right to life and liberty guaranteed under Article 21 of the Constitution, the high court held.

The denial of tax exemption on the ground that the film would lead to friction was also found to be inconsistent by the high Court. Firstly, the Commissioner who has the power to grant such excemption from tax, is not controlling exhibition of the film, and secondly, there was no material which would suggest that friction was imminent, if the film was granted tax exemption, the high court had clarified.

Merely because in some cases the society is still not prepared to watch a film in presence of people of different genrations or age groups, would by itself not mean that it relates to any of the exceptions mentioned in the Government policy, the high court held.

To suggest that the topic of a gay youth going through all the confusions and dilemmas on his discovery of a rare unusual side of his personality is one of the exceptions is simply not possible to accept, the high court held.

To deny tax exemption to a film which does not fall in the category of exceptions would be hostile discrimination violative of Article 14, the high court held. When all other Gujarati films of various kinds receive full exemption from payment of entertainment tax and whose tickets therefore would be that much cheaper, to subject the present film to compete with such films at a much higher ticket rate (inclusive of entertainment tax) would be unfair competition, the high court observed.

threads most popular

thread most upvoted

comment newest

first oldest

first

indiankanoon.org/doc/85458084/

It is truly disappointing of the Supreme Court to grant an interim stay like this. It is a film and it should not be told to wait for years together like this - a mess, I think, at the Supreme Court. A film is a perishable commodity and the Supreme Court's treatment of it is unthinkable.

I cannot find any fault with the judgment of the Gujarat High Court at all. All that you will see in display in it is the State Government's homophobia and nothing else. Surprising that the Supreme Court got readily sold on the State Government's homophobia.

threads most popular

thread most upvoted

comment newest

first oldest

first