The capital markets are exceptionally quiet at the moment, lawyers said.

“It’s generally following everything else in the market. Every day you look at the papers it’s kind of scaring you. One or two deals scrape through, one gets cancelled—maybe there are one or two successful ones,” said Sandip Bhagat, managing partner of law firm S&R Associates, which was set up in 2005. The firm was a specialist in the capital markets and has now diversified.

“On the equity side it’s been very quiet,” said Manan Lahoty, Mumbai-based capital markets partner at Luthra and Luthra. “Specifically the market is not doing very well. The primary market must compete with the secondary market, and until the secondary market is stable, I don’t expect the primary markets to pick up.”

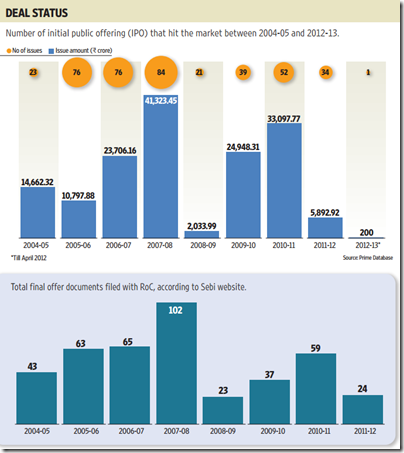

From September to April there has only been one filing, draft or otherwise, with the Securities and Exchange Board of India (Sebi) or the Registrar of Companies (RoC)—MT Educare Ltd’s initial public offering (IPO) in March on which Amarchand Mangaldas Suresh A. Shroff & Co. advised.

Amarchand ended up leading Legally India’s 2011-12 financial year IPO league table for the third year in a row. The firm had six new IPO mandates, compared with 32 in the previous year.

The offers for sale (OFS) of Oil and Natural Gas Corp. Ltd (ONGC) and Wipro Ltd meanwhile didn’t enthuse the market too much.

The picture is similar for other firms. The volume-oriented IPO practice of Crawford Bayley dropped to five mandates from 15, while Luthra and Luthra saw a drop to three from 18. AZB and Partners dropped to one from 10 and Khaitan & Co. to zero from 11.

Other major law firms that were active in the IPO markets a year ago such as ALMT Legal, Link Legal, Rajani Associates and Trilegal were similarly hit.

Mumbai-based Kanga and Co., whose capital markets practice is led by partners Chetan Thakkar and Dhaval Vussonji, managed to hold on to its numbers, getting four new IPO instructions against five the previous year.

The majority of IPOs didn’t make it beyond the draft stage. While a law firm can typically negotiate to be paid 50% or more of its fees when the draft —the lion’s share of work—is submitted, the remainder is usually only paid if the company lists.

Qualified institutional placements (QIP), unlike in previous financial years, provided little respite, with only nine compared with 35 in the previous year.

Amarchand handled two, while firms such as Axon Partners, AZB and Partners, J Sagar Associates (JSA), Krishnamurthy and Co., Luthra & Luthra, Rajani and S&R worked on one successful QIP each, according to the National Stock Exchange (NSE) website.

While international firm Dorsey and Whitney LLP, which runs its capital markets practice out of Australia, managed five QIP mandates, it did not score a single IPO in 2011-12 after having acted on eight the previous year.

| Rank FY '11-12 ('10-11) | Firm name | Total mandates FY '11-12 ('10-11) | Company mandates FY '11-12 ('10-11) | Bank mandates FY '11-12 ('10-11) |

| 1 (1) | Amarchand Mangaldas | 6 (32) | 6 (22) | - (9) |

| 2 (4) | Crawford Bayley | 5 (14) | 5 (13) | - (1) |

| 3 (9) | Kanga & Co | 4 (5) | 4 (5) | - (0) |

| 4 (6) | JSA | 3 (6) | 3 (3) | - (3) |

| 5 (2) | Luthra & Luthra | 3 (18) | - (11) | 3 (7) |

| 6 (8) | S&R Associates | 2 (6) | - (2) | 2 (4) |

Similarly, only nine rights offers took place, down from over 40 in the previous year, while only five public debt instruments made it to the market, according to Sebi listings.

Some of this sharp decline was unexpected, in light of the Sebi norms on public holding limits that companies need to meet. Non-state companies should have a minimum 25% stake held by the public by June 2013. For state-owned companies, the holding should be 10% by August 2013.

“One thought there would be a lot more activity on this front, but even there the general view would be that the markets are bad and this would not be the right time to float,” said Bhagat, adding that even new mechanisms such as the institutional placement programme (IPP) or OFS have not bridged the gap. (Bhagat, along with Amarchand and Jones Day acted in the successful Godrej Properties Ltd IPP.)

Listed companies had the option of going in for an IPO or an OFS or go through the “difficult and onerous process” of delisting, said Bhagat.

Amarchand’s Bangalore-based partner Arjun Lall said some companies have been seeking a relaxation in the deadline for raising the public holding. “Where is the market to buy large stocks of shares right now?”

With many capital markets lawyers idle, fees are being hit, particularly at the bottom end.

| Closed debenture issues 2011-12 | Adviser |

| Religare | JSA |

| Muthoot | AZB |

| Manappuram Finance | Amarchand |

| India Infoline | Khaitan |

| Shriram Transprot Finance | JSA |

For example, Link Legal, the sole issuer in the PG Electroplast Ltd IPO that listed in September 2011, charged a legal bill of Rs. 4.57 lakh—0.04% of the issue size or 0.51% of total issue expenses, according to the final prospectus.

On two other issues, Rushil Décor Ltd and Timbor Home Ltd, local Ahmedabad advocates, charged Rs. 3.6 lakh and Rs. 2.1 lakh respectively—both equivalent to 0.09% of the issue size.

“IPOs are extremely labour intensive: you can spend anywhere from 600 hours to 900 to 1,000 hours on a deal,” said a partner at a large firm. “If firms are willing to charge Rs. 2 lakh, Rs. 10 lakh or Rs. 15 lakh for it, from our perspective (as a more expensive top-tier firm), we don’t care about that.”

This also marks an evolution of the market.

“Most of the deals are very, very small transactions and you won’t see the international or big banks on the deals,” said another capital markets partner. “The fees are very little because the deals are very small. But the good thing is that the market is getting deeper. A few years ago, for small deals you had to go to a few big players. Now there are law firms that are happy to cut the cost.”

In most larger IPOs, which usually do not itemize legal costs but sometimes state total adviser expenses, the fees charged by law firms are higher but still greatly discounted compared with previous years. “I would say everyone across the band has reduced their fee.”

The lack of business can lead to such a trend.

“When the activity will go down people will get more desperate to get deals, and everybody has bandwidth these days,” said one partner. “Legal services is much like a hotel: if you don’t give the room out at night, you get nothing, so you are happy to give out the room at whatever price at night, because otherwise you are not going to get the room out at all.”

But some firms also have to consider the opportunity cost in farming out capital market lawyers cheaply.

“As capital markets lawyers you have your finger in many pies,” said one lawyer about the practice of re-branding lawyers who were earlier presented as hardcore capital markets specialists. In the quiet times, many of those capital markets lawyers have been assisting in corporate or private equity transactions, or other areas where business is still forthcoming.

All those interviewed said that no retrenchment of lawyers in capital markets teams had taken place, despite the decreased work volumes and heavy expansion in the practice area during the boom years, although “natural attrition” and a reduction in hiring has caused team sizes to shrink slightly.

But stepping away from the capital markets plate is not an option for law firms that want to stay in contention when, or if, the markets ever pick up again. “Being in touch with the market is very, very essential,” said one capital markets partner, who hoped to head home before 6pm that day.

This article first appeared in Mint. Legally India has an exclusive content partnership with Mint, which will feature the latest legal news and analysis every fortnight on Fridays in its print and web editions.

threads most popular

thread most upvoted

comment newest

first oldest

first

"For the purpose of rankings, counted only mandates where draft prospectus was filed with SEBI, or draft red herring prospectus was filed with ROC in 2011-12 financial year. Deal counts below two are excluded. Source: Legally India research, SEBI website"

A Draft Red Herring Prospectus is filed with SEBI, and not RoC.

Again, quoting:

"From September to April there has only been one filing, draft or otherwise, with the Securities and Exchange Board of India (Sebi) or the Registrar of Companies (RoC)—MT Educare Ltd’s initial public offering (IPO) in March on which Amarchand Mangaldas Suresh A. Shroff & Co. advised."

There have been several filings since September with SEBI other than MT Educare: MCX, Goodwill, NBCC, BHEL, SMFL among others.

Please correct these facts ...poorly researched article otherwise.

WHAT A SAD STATE OF AFFAIRS THIS PAINTS

TOO BAD FOR THE PEOPLE SITTING FOR RECRUITMENT RIGHT NOW!

One more indifferent year, and cost pressures will start to tell for capital markets teams.

#Hmmm....Are you a Khaitan insider? Teams have also reduced size at AMSS and Luthra. Some of capital markets lawyers working on M&A or General Corporate advisory from capital markets team.

Some were not included as a consequence but we wanted to keep the methodology the same as in the previous years.

As for the filing of red herrings and drafts with ROC and SEBI respectively, the wording was taken from the SEBI page to indicate the sections that were considered:

www.sebi.gov.in/Section.jsp?sec_id=5

Will look into adding a clarification to the text to make this methodology clear.

Best regards

Kian

There were several deals where (i) to (ii) were in fact reached in the FY 2011-2012, but are not listed here, whereas your methodology indicates that these have been considered. Suggest running this article through someone who practices capital markets law ...it appears to be inherently flawed, factually.

It is understood the reference is being made to someone into "capital markets practice".

Tell us the difference between a broking account, custodian account and a demat account.

I understand your point but as explained in my earlier comment, some of the IPOs were ignored because they weren't listed on the SEBI website.

We aimed to follow the same methodology as in previous years to allow ready comparison, and stuck to the prospectuses that were uploaded on the SEBI website.

I would be interested why some IPO prospectuses are not uploaded to the SEBI website - does anyone know?

Best wishes,

Kian

HIGH FIVE!! GOOD LUCK!!

threads most popular

thread most upvoted

comment newest

first oldest

first