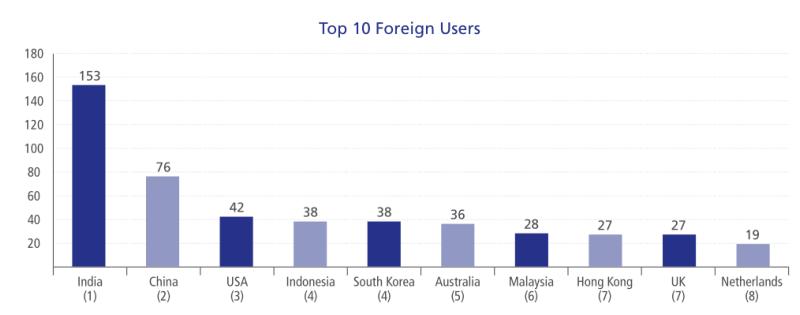

The Singapore International Arbitration Centre (SIAC) has seen a two-third increase in new cases filed in 2016 involving Indian parties, with India remaining the largest overseas jurisdiction to adjudicate in Singapore, way ahead of China.

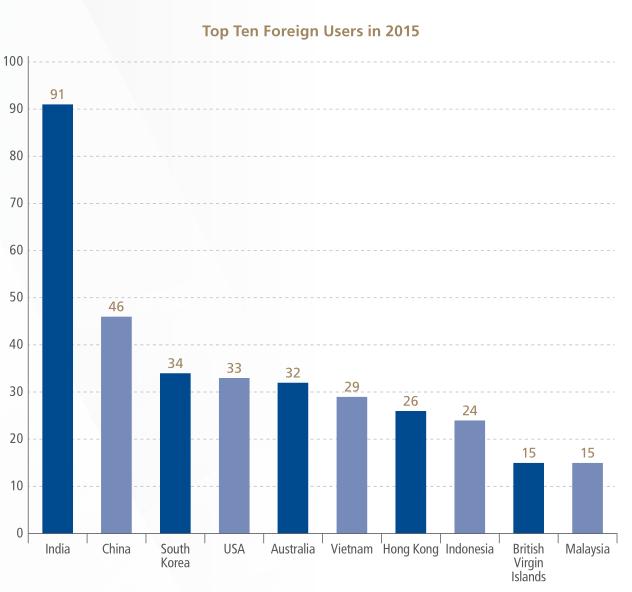

Indian parties (including non-India-based subsidiaries of Indian parent companies) were already the largest foreign contingent in 2015 with 91 parties. But in 2016, this grew by 68% to 153 Indian parties with disputes at the SIAC, according to SIAC’s 2016 annual report that was published last week (see full copy below).

Nearly exactly half of those 153 Indian parties were claimants, while the other half were respondents.

With Indian parties having made up around 16% of the roughly 960 total parties before SIAC in 2016, this translated to a massive 9% of total disputes governed by Indian law in 2016 before SIAC (or around 31 cases). That is fewer than the 49% of disputes governed by Singapore law and 19% governed by English law (English law in second position, despite only 27 UK parties having been before SIAC, is not surprising, it being the lingua franca of many international finance and other agreements).

And while 7.3% of arbitrators nominated at SIAC were Indian, Indian arbitrators made up only 2.8% of arbitrators who were eventually appointed (Singapore led the field in terms of appointed arbitrators with 34%, followed by 27% of arbitrators from the UK, 11% from Australia, and 8% from Malaysia).

According to its annual report, the SIAC also signed a memorandum of understanding (MOU) with the Gujarat International Finance Tec-City (GIFT) to open an office there, to “work closely with SIAC’s existing Mumbai office to promote SIAC’s services to businesses and investors in GIFT City and throughout India”. According to the Business Standard, that GIFT office would have begun operations by January 2017.

(As an aside, it’s worth referencing here the speculation that foreign law firms might first enter India via special economic zones (SEZs) such as the GIFT).

What of India Disputes LLP?

The increase in SIAC arbitrations, other than a testament to Singapore’s long and heavy marketing of SIAC as a disputes destinations for Indians, would not come as a huge surprise to anyone in the arbitration space, but it does suggest the continuing inability of successive Indian governments to make good on their pledges to transform India a disputes hub in Asia.

It also underlines India’s inability to have provided viable domestic alternatives to keeping settlements of disputes at home (including the lack of improvement in the overstretched Indian courts system, and notwithstanding the 2016 launch of the Mumbai Centre for International Arbitration (MCIA), which still remains mostly theoretical).

And although disputes being settled outside of India is not a bad thing, per se, flying parties to Singapore does translate into money spent by parties in Singapore that could have stayed in India (though Indian lawyers are likely to earn their fees, irrespective of whether the arbitrations happens in Singapore or India).

By the numbers: India remains biggest growth driver for SIAC ahead of China

Indian parties before SIAC were double the number of parties from China, which too grew considerably from 2015 to 2016 (by 65%, from 46 Chinese parties in 2015, to 76 last year).

Both of those far outstripped the 27% growth in the total number of cases (343) handled by SIAC from 2015 to 2016.

That said, the 323 Singaporean parties in 2016 still made up the lion’s share of all SIAC users.

Total disputes handled by SIAC skyrocketed by 2.75 times from 2015’s $4.41bn, to $11.85bn in 2016 (though a large $3.47bn chunk was made up by a single record case).

The average size of new SIAC disputes in 2016 was $38.5m.

Other countries’ use of SIAC grew more conservatively, in line with the average: the number of US parties at SIAC increased by only 27% to 42, overtaking South Korea, which had been ranked third in 2015, but whose representation at SIAC increased by only 4 to 38 parties.

Another big increase was in Indonesian parties, which at 38 parties in 2016 grew by 58% year-on-year.

threads most popular

thread most upvoted

comment newest

first oldest

first

Indian Police are readily available for use by any NRI companies abroad which have home connections in India.

How an NRI company used Indian Police www.lexmeridian.com/nri-company-files-criminal-complaint-against-baring-asia/ to good benefit while engaged in a civil dispute in Singapore.

You should also be tracking Stayzilla case in Bengaluru and Chennai in which Police were put to good use to settle some civil disputes.

Sorry lawyers, the Police should get the Golden Peacock award.

threads most popular

thread most upvoted

comment newest

first oldest

first