Slaughter and May

Sunil Mittal-led mobile infrastructure major Bharti Infratel has announced the merger with Indus Towers to create a combined entity with an equity value of Rs 96,500 crores ($14.6bn), making it the world’s second largest telecom tower company after Beijing-owned China Tower, with more than 163,000 towers and having presence in all the 22 circles in India, reported Business Standard and Mint.

Slaughter and May has topped the mergermarket value league table of international law firms that advised on M&A deals in the 2017 calendar year.

Slaughter and May has topped the mergermarket value league table of international law firms that advised on M&A deals in the 2017 calendar year.

"Global private equity (PE) firm Carlyle Group has emerged as the front runner for GE Capital Corp’s stake in SBI Card, the credit card joint venture between the US-based company and India’s largest lender State Bank of India (SBI). Carlyle has emerged as the front runner for GE Capital’s stake in SBI Cards for somewhere around $325 million. The board of SBI settled upon the final bidder in a meeting. Carlyle has pipped Warburg Pincus and Credit Saison and emerged as the final bidder though the deal is not closed yet,” reported Mint.

According to several sources, S&R Associates partner Rajat Sethi and UK firm Slaughter and May partner Susannah Macknay have been advising Vodafone on its long-awaited Rs 80,000 crore ($12.2bn) merger with Idea, which was formally announced today.

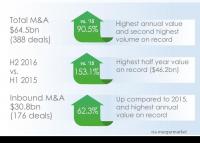

Freshfields Bruckhaus Deringer has topped the mergermarket value league table of international law firms that advised on M&A deals in the record 2016 calendar year.

Freshfields Bruckhaus Deringer has topped the mergermarket value league table of international law firms that advised on M&A deals in the record 2016 calendar year.

"The acquisition is the biggest foreign acquisition ever in India and Russia’s largest outbound deal. Billionaire brothers Shashi and Ravi Ruia have agreed to sell 98 per cent of Essar Group flagship firm Essar Oil to Russian oil major Rosneft and a consortium of oil trading firm Trafigura with private investment group United Capital Partners for $13 billion, making it the largest foreign direct investment in India.” reported The Hindu and others.

Kirkland & Ellis and Slaughter & May acted on the biggest Indian M&A transactions among 14 foreign law firms that each advised on more than $1bn worth of Indian M&A deals this quarter.

Kirkland & Ellis and Slaughter & May acted on the biggest Indian M&A transactions among 14 foreign law firms that each advised on more than $1bn worth of Indian M&A deals this quarter.

"Anil Ambani-controlled Reliance Communications Ltd (R-Com) has signed a definitive agreement to merge its wireless business with smaller rival Aircel Ltd to create India’s third largest telecom operator by users,” reported Mint.

Obhan & Associates acted for publisher Penguin Random House in its purchase of Ananda Publishers’ stake in Penguin Books India.

Obhan & Associates acted for publisher Penguin Random House in its purchase of Ananda Publishers’ stake in Penguin Books India.

AZB, Luthra, Links & Slaughters sell off Indian RBS assets to Ratnakar bank.

AZB, Luthra, Links & Slaughters sell off Indian RBS assets to Ratnakar bank.

Breaking: Herbert Smith Freehills (HSF) and DSK Legal advised old-client Strides Arcolab in the $1.6bn+ sale of its injectables subsidiary Agila Specialties to Nasdaq-listed generic drugs-maker Mylan Inc.

Breaking: Platinum Partners and Slaughter and May advised London-based drinks giant Diageo on its overall complete £1.28bn (Rs 11,166 crore) acquisition of Vijay Mallya-promoted United Spirits, which was advised by Amarchand Mangaldas Mumbai office, as well as Kanga & Co and Herbert Smith Freehills.

Breaking: Platinum Partners and Slaughter and May advised London-based drinks giant Diageo on its overall complete £1.28bn (Rs 11,166 crore) acquisition of Vijay Mallya-promoted United Spirits, which was advised by Amarchand Mangaldas Mumbai office, as well as Kanga & Co and Herbert Smith Freehills.

Exclusive: S&R Associates is advising Vodafone Group on its disposal of 5.5 per cent of the shares in Vodafone Essar for $640m to Piramal Healthcare, which is relying on Amarchand Mangaldas as lead adviser with Linklaters and Slaughter and May, as well as Crawford Bayley and Stephenson Harwood.

Exclusive: S&R Associates is advising Vodafone Group on its disposal of 5.5 per cent of the shares in Vodafone Essar for $640m to Piramal Healthcare, which is relying on Amarchand Mangaldas as lead adviser with Linklaters and Slaughter and May, as well as Crawford Bayley and Stephenson Harwood.