service tax

Senior advocates are now temporarily outside the service tax net, as the Delhi high court today stayed the imposition of this tax on them, reported Mint.

Justices S Muralidhar and RK Gauba ordered the stay on the Delhi High Court Bar Association’s (DHCBA) plea that charging senior advocates on the services they provide to their clients, as well as charging the clients on the services they take from senior advocates, amounts to double taxation and is unconstitutional.

The stay order was passed in order to maintain consistency with a similar stay order by the Guajarat high court on 30 March, according to Mint.

The DHCBA had also contended that the function of senior advocates – aiding the court in administration of justice – is not a “taxable service”, according to Live Law which published a copy of the DHCBA’s petition in the Delhi high court.

The union budget 2016 had withdrawn the exemption provided to senior advocates from service tax, effectively increasing the cost of instructing them by 14 per cent, as reported by [legallyindia.com/news/budget-catches-senior-advocates-tribunals-with-wider-service-tax-net

Legally India*].The budget provisions which had taken away the senior advocates’ exemption were to be effective from today. Previous unsuccessful attempts of the government to levy service tax on lawyers came in 2011 and 2012.

Advaita Legal won relief from service tax for lottery distributors, in Future Gaming’s Sikkim high court writ challenging the imposition of service tax on them.

Advaita senior attorney AR Madhav Rao and associates Rajat Mittal and Nandita Narayan acted for Future Gaming which had challenged Finance Act 2015 amendments putting lottery distributors in the category of service providers and hence liable to pay service tax.

Justices Sonam Wangdi and Meenakshi Rai observed that explanations inserted in clauses of the latest Finance Act cannot override the law laid down in judgments which have already held that Future Gaming is not a service provider.

The bench stated in its order:

“As noted earlier, the amendments in question have been carried out by the Parliament in order to overcome the decisions of this Court in the Future Gaming Case 2015 (supra) and Future Gaming Case 2014 (supra) which we have alluded to in detail. We agree with Mr. Rao that it is trite that when a Legislature sets out to validate a tax declared by a Court to be illegally collected under an ineffective or an invalid law, the cause for ineffectiveness or invalidity must be removed before the validation can be said to take place effectively. “

Mumbai lawyer Abhishek Nakashe lodged a police complaint under Section 504 (intentional insult with intent to provoke breach of peace) against local restaurant Secret Spice, after the restaurant entered a heated argument with Nakashe over an allegedly illegally levied service charge in Nakashe’s food bill, reported Midday. Section 504 attracts two years in jail, or a fine, or both.

Under Indian consumer protection laws restaurants have to mandatorily print on their menu all their charges, including the service charge, but Secret Spice, in Mulund, Mumbai had omitted to do so on mention that a service charge was "applicable". Consequently Nakashe objected to the 8 per cent service charge levied on his Rs 525 bill.

“Service charge is a deceptive nomenclature, and rarely do restaurants clarify the per cent levied in their menus, although it is mandated that they do. While I usually pay up when eating out, I decided to take up the issue this time because there was ambiguity in the menu and the management wasn’t forthcoming with an explanation,” Nakashe told Midday.

Service charge is separate from service tax the proceeds from which go to the government. The proceeds from the service charge are distributed between the hotel or restaurant staff after deducting the damages. Consumers argue that menu items are priced to make profits and remunerate staff and the service charge is an unnecessary burden over and above this. Hoteliers argue that the service charge has replaced the generous tips that customers used to offer but have now dried up.

Economic Laws Practice (ELP) won for Bharti Airtel, PDS Legal for Ernst & Young (E&Y), Lakshmikumaran & Sridharan (LKS) for Ultratech Concrete, and Global Legal Associates for ITC Welcome Group in the Delhi high court on Tuesday against the Service Tax Department.

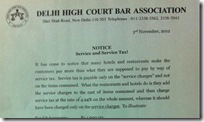

The Delhi High Court Bar Association (DHCBA) published a notice on Saturday that appears to have incorrectly explained the service tax (ST) rules on restaurant bills, urging its members, families, friends and clients to refuse to pay the correct amounts.

The Delhi High Court Bar Association (DHCBA) published a notice on Saturday that appears to have incorrectly explained the service tax (ST) rules on restaurant bills, urging its members, families, friends and clients to refuse to pay the correct amounts.

In today’s edition of Mint: The finance ministry’s latest concession on service tax imposed on lawyers that was notified in June has been welcomed by some; others continue to say it wasn’t enough and many remained unaware of the current law and how, or if at all, they had to pay this tax.

In today’s edition of Mint: The finance ministry’s latest concession on service tax imposed on lawyers that was notified in June has been welcomed by some; others continue to say it wasn’t enough and many remained unaware of the current law and how, or if at all, they had to pay this tax.

Breaking: Fees earned by lawyers in courts or tribunals will not be subject to service tax under the Union Budget, which expanded the overall scope of service tax to everything except for a few exceptions.

Breaking: Fees earned by lawyers in courts or tribunals will not be subject to service tax under the Union Budget, which expanded the overall scope of service tax to everything except for a few exceptions.

Naik Naik & Co-led Retailers Association of India (RAI) has lost the immovable property rentals’ service tax matter in the Bombay High Court, which upheld the union government’s power to enact laws to impose service tax on such rentals as constitutionally valid.

The Andhra Pradesh High Court has become the third high court after the Delhi and Gauhati High Courts to stay the imposition of service tax on lawyers practicing in courts made applicable during this year’s budget under the Finance Act 2011.

The Andhra Pradesh High Court has become the third high court after the Delhi and Gauhati High Courts to stay the imposition of service tax on lawyers practicing in courts made applicable during this year’s budget under the Finance Act 2011.

Breaking Exclusive: The Delhi High Court has stayed the imposition of service tax on individual advocates under the Finance Act 2011, according to two lawyers with knowledge of the case.

The Finance Ministry has reversed its earlier budget proposal that would make service tax payable by professionals such as lawyers when bills are issued rather than when they are paid, after protests and representations from lawyers that this would be unduly onerous.

The Finance Ministry has reversed its earlier budget proposal that would make service tax payable by professionals such as lawyers when bills are issued rather than when they are paid, after protests and representations from lawyers that this would be unduly onerous.

Advocates at courts throughout India are today observing a protest day, wearing black ribbons in opposition to the Legal Services Bill, coinciding with a Delhi High Court Bar Association strike against the service tax.

The Government is reportedly re-examining the 2011 Finance Bill’s proposal to charge service tax on an accruals basis, which would force law firms to pay service tax as soon as they bill a client rather than when the cash is actually received.

Either the Indian Government is short of cash, is in full GST mode or it just does not like lawyers very much.

Exclusive: Law firms’ litigation associates could find themselves liable to have to charge service tax to their law firms and account for it to the Revenue under the Budget’s new service tax rules that apply to individuals representing businesses in courts or tribunals.

Exclusive: Law firms’ litigation associates could find themselves liable to have to charge service tax to their law firms and account for it to the Revenue under the Budget’s new service tax rules that apply to individuals representing businesses in courts or tribunals.

Exclusive: Society of Indian Law Firms (SILF) chairman Lalit Bhasin has condemned the expanded service tax rules on law firms, saying that SILF and other law firms would file a new writ petition against the changes while the existing writ petition remained pending in the Bombay High Court.

Exclusive: Society of Indian Law Firms (SILF) chairman Lalit Bhasin has condemned the expanded service tax rules on law firms, saying that SILF and other law firms would file a new writ petition against the changes while the existing writ petition remained pending in the Bombay High Court.

Breaking: The Union Budget has widened contentious law firm service tax to apply to court-based, tribunal and arbitration advice by lawyers and has been further expanded to include advice by law firms to individuals too.

Breaking: The Union Budget has widened contentious law firm service tax to apply to court-based, tribunal and arbitration advice by lawyers and has been further expanded to include advice by law firms to individuals too.

Economic Laws Practice (ELP) has won a Rs 257 crore service tax reprieve for clients Jetlite before the Custom Excise & Service Tax Appellate Tribunal (CESTAT) which held that brand promotion without reference to services offered under business auxiliary services (BAS) category is not taxable.

Exclusive: The Delhi High Court has again stayed the imposition of service tax imposition on immovable property rentals in one of the Home Solutions cases, reaffirming its earlier stance. The order contradicted a Punjab & Haryana High Court order and put the ball back into the Supreme Court, which had asked for the Delhi High Court to adjudicate.