There finally appeared to be light at the end of the tunnel. A rocky insolvency process seemed to be ending.

The insolvency process for Chennai-based Orchid Chemicals and Pharmaceuticals has had so many unexpected twists that it could have been written by an alter ego of George RR Martin with a passion for insolvency law.

Orchid Pharma was a leading player in a critical industry of injectables and Active Pharmaceutical Ingredients (APIs). However due to a series of unfortunate market exigencies (read cheaper Chinese products) Orchid Pharma found itself unable to repay its debt, triggering insolvency proceedings under Section 7 of the IB Code.

Things appeared to be going smoothly for the lenders, with the petition being admitted by the Madras Bench of the NCLT on August 23, 2018.

Things were looking up.

Orchid Pharma was an enticing prospect for competitors. A resolution plan by US-based Ingen Capital was quickly approved by the CoC. Things were rosy. The NCLT approved Ingen Capital’s plan. All that was left was payment by Ingen.

The First Twist

This is where the first twist happens.

Ingen didn’t pay.

In an order dated 28 February 2019, the NCLT annulled Ingen’s plan and the Committee of Creditors was back to square one: squared with a bad debt and no end in sight.

Fortunately, the NCLT had permitted a re-do of the Insolvency Resolution Process. This was completed with relative ease and the Committee of Creditors approved the Insolvency Resolution Plan of Gurgaon based Dhanuka Enterprises.

Things were rosy again.

The CoC was happy.

The Second Twist

The next twist will be familiar to all who practice before our insolvency courts.

Unsuccessful Resolution Applicant, Accord Life Spec, challenged the Plan before the NCLT claiming an underpar valuation.

The NCLT rejected Accord’s contentions. Accord went to the NCLAT – with the same contentions. The NCLAT set aside the NCLT’s order and allowed Accord’s contentions.

Supreme Court Intervention

The Committee of Creditors’ having already seen the lure of a successful plan snatched away, persisted and took the matter to the Supreme Court.

The Supreme Court ruled in favour of the CoC and upheld the NCLT order, permitting Dhanuka’s plan to be implemented.

The highest court in the land had now ruled in favour of Dhanuka’s plan.

Things were definitely rosy this time. There finally appeared to be light at the end of the tunnel.

Pandemic and lockdown

Then disaster (a literal one) struck. The COVID-19 disease – rapidly spreading around the world – had finally turned its eye on India. To mitigate the spread of the disease and flatten the curve, India imposed a 21-day lockdown.

An 1,100 crore Resolution plan – with a set of 22 Creditors – a combination of Indian public sector banks, private banks and foreign banks now stood in jeopardy.

Further delay could have led to further twists – all too likely in a choppy proceedings. Missing the target date of March 31 (the end of the financial year) would have wrecked the balance sheet of several creditors (including Dhanuka – the Resolution applicant itself).

However, due to the lockdown – the logistics of signing the documentation related to the plan seemed impossible. How would parties scattered across locations meet to sign? How would paper travel to their locations?

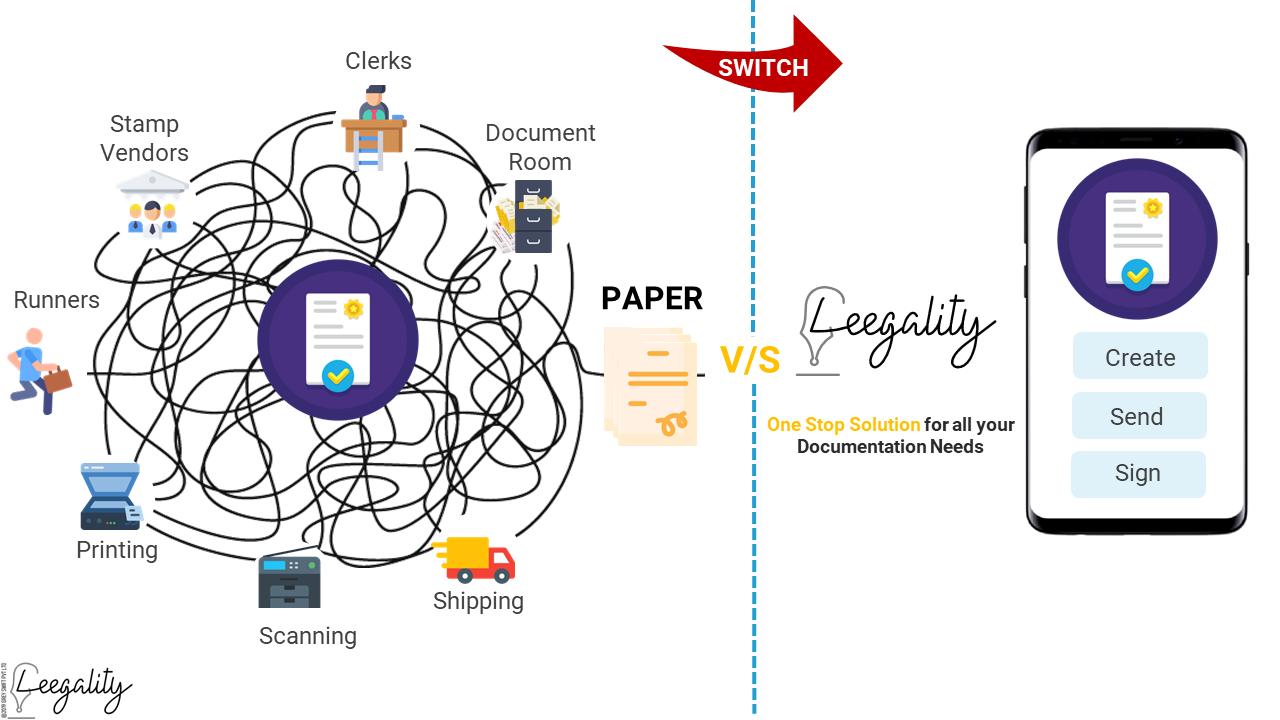

Enter Leegality.

Leegality Transaction Management

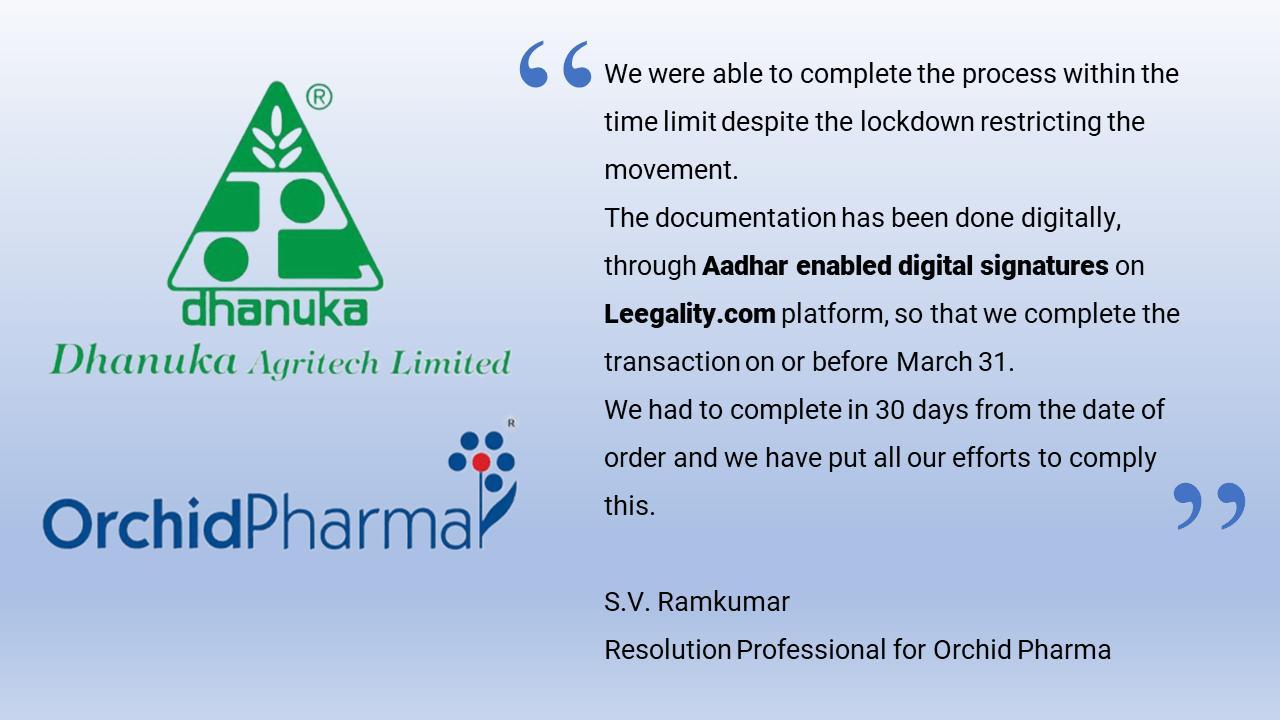

The Resolution Professional enlisted Leegality’s Transaction Management Services.

A resolution plan worth 1100 Crores – with a set of 22 Creditors – a combination of Indian public sector banks, private banks and foreign banks was executed through Leegality’s Aadhaar eSign gateway in under 12 hours

An electronic copy, bearing the digital signatures of each signatory was immediately sent to each party for safekeeping, mere seconds after execution.

The money was received by the Banks – and Dhanuka’s plan implemented – all before March 31st.

How did this happen?

Leegality allows businesses to execute documents remotely through a wide variety of signing options – from Aadhaar eSign, DSC Token based signing, Server based sign certificate and Secure Virtual Authentication.

All documents executed through the platform are rendered as secure electronic records– making them easier to enforce under the Evidence Act.

The powerful signing platform is bolstered by Digital Stamping support – allowing digital affixture of stamp paper – to enable businesses to comply with stamping laws while closing transactions.

Find out more

Leegality’s Transaction Management Services provide mission-critical support in execution of critical transactions on an urgent basis.

All parties need to do is provide the documentation that requires signing and the parties that need to sign it. Leegality handles the rest – with rapid quick turnaround of less than a day.

Businesses like Airtel Payments Bank, HDB Financial Services, L&T Finance, IndusInd Financial Inclusion, Siemens Finance, Razorpay, WeWork, goDigit among 200 others rely on Leegality to execute their transactions in a seamlessly digital and secure manner.

What are you waiting for?

Contact us here for a quick 10-minute product demo to see how it works!

threads most popular

thread most upvoted

comment newest

first oldest

first

Yes, Leegality's founding team consists of two lawyers. The overall team as well consists of 5 lawyers with prior experience at SAM, AZB, Trilegal and Keystone. The product is geared specifically to meet the needs of the Indian contracting environment :)

On a side note, it is encouraging to see lawyers starting tech companies - kudos!

threads most popular

thread most upvoted

comment newest

first oldest

first